Finance

How To Manage Risk In Banking

Published: October 14, 2023

Learn how to effectively manage financial risks in banking with our comprehensive guide. Gain actionable insights on risk assessment, mitigation strategies, and compliance protocols to ensure a secure financial future.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Risk in Banking

- Types of Risks in Banking

- Credit Risk

- Market Risk

- Operational Risk

- Liquidity Risk

- Interest Rate Risk

- Foreign Exchange Risk

- Regulatory and Compliance Risk

- Risk Management Framework in Banking

- Establishing Risk Appetite

- Identifying and Assessing Risks

- Risk Mitigation Strategies

- Risk Monitoring and Reporting

- Key Challenges in Risk Management

- Conclusion

Introduction

In the dynamic world of banking, managing risk is a crucial task that directly impacts the stability, profitability, and reputation of financial institutions. Whether it’s credit risk, market risk, operational risk, or regulatory risk, banks need to have a comprehensive understanding of the potential risks they face and implement effective risk management strategies.

Risk management in banking refers to the process of identifying, assessing, and mitigating risks to protect the bank’s assets, ensure compliance with regulations, and maintain the trust of stakeholders. With the ever-increasing complexity of financial markets, banks face a wide range of risks that can arise from economic factors, operational inefficiencies, compliance failures, or external events.

Effective risk management serves as a safeguard against potential losses, helps banks make informed decisions, and ensures the overall stability of the banking system. It involves establishing a risk management framework, setting risk appetite, identifying and assessing risks, implementing risk mitigation strategies, and monitoring and reporting on risks.

In this article, we will explore the different types of risks in banking, delve into the risk management framework, and discuss the key challenges involved in managing risk in the banking industry.

Understanding Risk in Banking

Risk is an inherent part of the banking industry. Banks are exposed to various risks that can potentially impact their financial stability and operations. Understanding these risks is crucial for effective risk management in the banking sector.

At its core, risk in banking refers to the potential of financial loss or negative consequences arising from uncertain events or circumstances. These risks can arise from a multitude of sources, including economic fluctuations, market volatility, operational failures, regulatory changes, and even natural disasters.

One key aspect of risk in banking is its interconnectivity. Risks in one area of a bank’s operations can have cascading effects on other areas. For example, a credit risk default can lead to not only financial losses but also reputational damage and liquidity concerns.

To effectively manage risk in banking, it is important to categorize and understand different types of risks that banks face. This allows banks to develop tailored risk management strategies and allocate resources accordingly.

The next section will discuss the various types of risks in banking and highlight their distinctive characteristics and implications for banks.

Types of Risks in Banking

Risks in banking can be categorized into several types, each with its own unique characteristics and potential impact on a financial institution. Understanding these risks is essential for developing a comprehensive risk management framework. Here are some of the key types of risks in banking:

- Credit Risk: This is the risk of financial loss arising from the failure of borrowers or counterparties to fulfill their financial obligations. Banks face credit risk when they lend money, issue loans, or engage in other credit-related activities. The key factors contributing to credit risk include borrower default, credit rating downgrades, and changes in economic conditions.

- Market Risk: Market risk arises from adverse movements in financial markets such as interest rates, foreign exchange rates, commodity prices, and equity prices. Banks are exposed to market risk through their trading activities, investments, and other market-sensitive positions. Managing market risk requires monitoring market fluctuations, implementing hedging strategies, and maintaining a diversified portfolio.

- Operational Risk: Operational risk refers to the risk of loss resulting from inadequate or failed internal processes, systems, or human factors. It encompasses a wide range of risks, including technology failures, fraud, errors, disruptions in business continuity, and regulatory compliance failures. Managing operational risk involves implementing robust internal controls, conducting regular audits, and training employees on risk awareness.

- Liquidity Risk: Liquidity risk is the risk of being unable to meet financial obligations when they become due. It arises from a mismatch between a bank’s assets and liabilities, as well as from market conditions that affect a bank’s ability to access funding or liquidate assets. Managing liquidity risk requires maintaining sufficient liquidity buffers, diversifying funding sources, and stress testing liquidity positions.

- Interest Rate Risk: Interest rate risk refers to the potential impact of changes in interest rates on a bank’s financial position. Banks face interest rate risk when there is a mismatch between their interest-sensitive assets and liabilities. Fluctuations in interest rates can affect a bank’s net interest income, asset valuations, and capital adequacy. Managing interest rate risk involves using interest rate derivatives, setting appropriate loan pricing strategies, and maintaining a balanced asset-liability structure.

- Foreign Exchange Risk: Foreign exchange risk arises from exposure to fluctuations in foreign exchange rates. Banks that engage in cross-border transactions, international trade finance, or foreign currency-denominated investments face foreign exchange risk. This risk can impact a bank’s profitability, capital adequacy, and balance sheet. Managing foreign exchange risk involves hedging currency exposures, closely monitoring exchange rate movements, and diversifying currency holdings.

- Regulatory and Compliance Risk: Regulatory and compliance risk refers to the risk of non-compliance with laws, regulations, and industry standards. Banks operate in a heavily regulated environment and are subject to strict requirements related to risk management, capital adequacy, customer protection, and anti-money laundering. Effective management of regulatory and compliance risk involves implementing robust internal controls, conducting regular compliance audits, and staying updated with evolving regulatory requirements.

By understanding these different types of risks in banking, financial institutions can develop strategies and frameworks to manage and mitigate these risks effectively. In the next sections, we will delve deeper into the risk management framework in banking and explore how banks can establish risk appetite, identify and assess risks, implement risk mitigation strategies, and monitor and report on risks.

Credit Risk

Credit risk is one of the most significant risks faced by banks and arises from the potential default of borrowers or counterparties in fulfilling their financial obligations. When banks extend loans, issue credit cards, or engage in other lending activities, there is always a risk that the borrower may be unable to repay the borrowed funds. This risk can adversely impact a bank’s financial stability, profitability, and liquidity.

Credit risk can originate from various sources, including individual borrowers, corporate entities, governments, and even financial institutions. It can be categorized into two main types:

- Individual Credit Risk: This type of credit risk arises from the default or non-payment by individual borrowers. Factors that contribute to individual credit risk include a borrower’s creditworthiness, financial stability, repayment history, and the purpose of the loan. Banks assess individual credit risk through credit scoring models, credit reports, and analyzing financial statements.

- Portfolio Credit Risk: Portfolio credit risk refers to the risk of default within a bank’s overall loan portfolio. This type of risk considers the diversification and concentration of loans, the quality and distribution of borrowers, and the potential impact of economic factors on the performance of the portfolio. Banks manage portfolio credit risk by maintaining a well-diversified loan portfolio, conducting stress tests, and implementing loan loss provisioning.

Effective management of credit risk involves several key strategies:

- Credit Underwriting: Banks need to establish rigorous credit underwriting processes to assess the creditworthiness of borrowers and determine an appropriate risk rating for each loan. This includes analyzing the borrower’s financial statements, credit history, repayment capacity, and collateral value.

- Credit Monitoring: Once loans are approved and disbursed, banks must continuously monitor the creditworthiness of borrowers, their financial health, and the overall performance of the loan portfolio. Regular credit reviews, financial analysis, and monitoring of payment patterns are essential for early detection of potential credit issues.

- Credit Risk Mitigation: Banks implement risk mitigation techniques to reduce credit risk exposure. This may include requiring collateral or guarantees, obtaining credit insurance, using credit derivatives for hedging purposes, and diversifying the loan portfolio across different sectors and geographies.

- Credit Loss Provisioning: Banks set aside provisions for expected credit losses to account for potential loan defaults. This ensures that they have adequate reserves to absorb losses that may arise from non-performing loans. Provisions are based on historical loss experience, economic forecasts, and regulatory requirements.

Overall, effective management of credit risk requires a robust credit risk management framework, clear lending policies, accurate risk assessment, continuous monitoring, and proactive risk mitigation strategies. Through prudent credit risk management, banks can minimize losses, maintain a healthy loan portfolio, and safeguard their financial stability.

Market Risk

Market risk is a significant risk faced by banks, arising from adverse movements in financial markets. It refers to the potential for losses due to fluctuations in interest rates, foreign exchange rates, equity prices, commodity prices, and other market factors. Banks are exposed to market risk through their trading activities, investments in securities, and other market-sensitive positions.

Market risk can be categorized into several types:

- Interest Rate Risk: This type of market risk arises from changes in interest rates. Banks with imbalances in interest-sensitive assets and liabilities are vulnerable to interest rate risk. When interest rates rise, the value of fixed-rate assets can decline, while the cost of funding increases. Conversely, declining interest rates can erode interest income and reduce the value of variable-rate loans.

- Foreign Exchange Risk: Foreign exchange risk arises from exposure to changes in foreign exchange rates. Banks engaging in cross-border transactions, foreign currency-denominated investments, or international trade finance are susceptible to this risk. Fluctuations in exchange rates can impact a bank’s financial performance, asset valuations, and capital adequacy.

- Equity Risk: Equity risk stems from changes in equity prices. Banks with investments in equities or equity indexes are exposed to this risk. Price fluctuations in stocks can affect a bank’s investment portfolio and overall financial performance.

- Commodity Risk: Commodity risk is associated with changes in commodity prices, such as oil, gas, metals, and agricultural products. Banks involved in commodities trading or have exposure to commodity-related businesses face this risk. Fluctuations in commodity prices can impact a bank’s loan portfolio, derivative contracts, and investments in commodity-related companies.

Managing market risk requires the implementation of various strategies:

- Risk Measurement: Banks need to accurately measure market risk exposure by utilizing risk models, simulations, and stress tests. This helps assess the potential impact of adverse market movements on the bank’s financial position.

- Risk Diversification: Maintaining a diversified investment portfolio helps mitigate market risk. By spreading investments across different asset classes, sectors, geographies, and currencies, banks can reduce their exposure to a particular market or asset.

- Hedging: Banks can use hedging techniques to offset market risk by entering into derivative contracts or other risk management tools. For example, interest rate swaps or currency futures can be used to protect against interest rate or foreign exchange rate fluctuations.

- Monitoring and Reporting: Regular monitoring of market conditions and promptly reporting the impact of market risk to management and regulators are crucial. This enables timely decision-making and ensures compliance with regulatory requirements.

By effectively managing market risk, banks can protect their financial stability, optimize investment returns, and maintain a resilient position in volatile market conditions. Implementing robust risk measurement techniques, diversification strategies, hedging mechanisms, and proactive monitoring are essential for successful market risk management.

Operational Risk

Operational risk is a critical risk faced by banks, arising from inadequate or failed internal processes, systems, or human factors. It encompasses a wide range of risks, including technology failures, fraud, errors, disruptions in business continuity, and regulatory compliance failures. Operational risk can potentially lead to financial losses, reputational damage, and legal and regulatory penalties for banks.

The nature of operational risk makes it inherently challenging to quantify and manage. It can originate from both internal and external events, such as employee misconduct, system failures, natural disasters, cyber-attacks, or changes in regulations. Managing operational risk requires a proactive and comprehensive approach to identify, assess, mitigate, and monitor potential risks.

Key aspects of operational risk in banking include:

- People Risk: This refers to the risk arising from human factors, including employee misconduct, negligence, lack of training, and inadequate supervision. Banks need to ensure they have proper human resources management practices, conduct background checks, provide adequate training, and promote a strong risk-aware culture to mitigate people risk.

- Technology Risk: Rapid advancements in technology expose banks to various technology-related risks. These include cyber threats, system failures, data breaches, and unauthorized access to sensitive customer information. Banks must have robust cybersecurity measures, disaster recovery plans, and regular system audits to manage technology risk effectively.

- Process Risk: Inefficient or flawed internal processes can expose banks to operational risk. This includes errors in transaction processing, inadequate record-keeping, lack of proper controls, and weaknesses in operational procedures. Banks need to continuously review and improve their processes, implement internal controls, conduct regular audits, and ensure compliance with industry best practices.

- Legal and Compliance Risk: Banks operate in a highly regulated environment and face the risk of non-compliance with laws, regulations, and industry standards. Failure to adhere to compliance requirements can result in fines, legal actions, and reputational damage. Banks need to establish robust compliance frameworks, conduct regular compliance assessments, and stay updated with evolving regulatory requirements.

- Business Continuity Risk: Disruptions to normal business operations, whether due to natural disasters, system failures, or external events, can have a significant impact on banks. Establishing comprehensive business continuity plans, implementing backup systems, and regularly testing disaster recovery procedures are crucial for managing business continuity risk.

Effective management of operational risk involves several strategies:

- Risk Assessment: Banks need to conduct comprehensive risk assessments to identify potential operational risks and assess their potential impacts. This includes evaluating the likelihood and severity of risks and prioritizing them based on their significance to the bank.

- Internal Controls: Implementing robust internal controls is essential for mitigating operational risk. This includes segregation of duties, approval processes, regular reconciliation, and monitoring of key processes to prevent errors and detect fraudulent activities.

- Training and Awareness: Educating employees about operational risks and promoting a strong risk-aware culture is essential. Banks should provide regular training sessions and awareness programs to enhance employees’ understanding of operational risk and their role in mitigating it.

- Incident Management: Developing an effective incident management framework helps banks respond swiftly to operational incidents. This includes incident reporting, investigation, resolution, and remediation to minimize the impact of operational risk events.

By proactively managing operational risk, banks can safeguard their financial stability, protect customer trust, and maintain regulatory compliance. Implementing robust risk management practices, enhancing internal controls, conducting regular risk assessments, and promoting a strong risk-aware culture are key to successful operational risk management in banking.

Liquidity Risk

Liquidity risk is a critical risk faced by banks, referring to the potential inability to meet their financial obligations when they become due. It arises from a mismatch between a bank’s assets and liabilities, as well as from market conditions that affect a bank’s ability to access funding or liquidate assets. Managing liquidity risk is crucial for maintaining the financial stability and solvency of banks.

Liquidity risk can manifest in different forms:

- Funding Liquidity Risk: This type of liquidity risk arises when a bank cannot obtain sufficient funds to meet its financial obligations. It can occur due to a loss of market confidence, limited access to funding sources, or disruptions in the interbank lending market. Funding liquidity risk affects a bank’s ability to repay debts, honor deposit withdrawals, and fund ongoing operations.

- Market Liquidity Risk: Market liquidity risk refers to the risk of not being able to sell assets or unwind positions at a reasonable price due to insufficient market depth or disruptions in financial markets. Banks with illiquid assets or significant exposure to illiquid markets face this risk. Market liquidity risk can result in losses, as banks may have to sell assets at unfavorable prices to meet their liquidity needs.

Managing liquidity risk requires a comprehensive approach that encompasses the following strategies:

- Liquidity Risk Measurement: Banks need to establish robust liquidity risk measurement frameworks to assess and monitor their liquidity positions. This involves tracking key liquidity metrics, such as liquidity coverage ratio (LCR) and net stable funding ratio (NSFR), as well as conducting stress tests to evaluate the bank’s ability to withstand severe liquidity shocks.

- Liquidity Risk Planning: Banks should develop contingency funding plans to address potential liquidity shortfalls in adverse scenarios. This includes establishing contingency funding sources, maintaining access to emergency liquidity facilities, and diversifying funding sources to reduce reliance on a single funding channel.

- Liquidity Risk Mitigation: Strategies to mitigate liquidity risk include maintaining appropriate levels of liquid assets, such as cash and highly marketable securities, to meet operational needs and withstand periods of market stress. Banks can also transfer liquidity risk through securitization, loan sales, or entering into liquidity risk transfer agreements.

- Liquidity Risk Stress Testing: Conducting regular stress tests helps banks assess their liquidity resilience under adverse scenarios. Stress testing evaluates the impact of severe liquidity shocks and enables banks to identify vulnerabilities, adjust their funding plans, and enhance liquidity risk management.

- Liquidity Risk Monitoring and Reporting: Maintaining an effective liquidity risk monitoring and reporting framework is crucial for timely identification and management of liquidity risk. Banks need to monitor liquidity metrics on an ongoing basis, assess liquidity gaps, and report to management and regulators as per regulatory requirements.

Proper management of liquidity risk is essential for banks to maintain financial stability, meet their obligations, and sustain their operations. By implementing robust liquidity risk measurement, planning, mitigation, stress testing, and monitoring practices, banks can mitigate the potential adverse impacts of liquidity risk and ensure their long-term viability.

Interest Rate Risk

Interest rate risk is a significant risk faced by banks, referring to the potential impact of changes in interest rates on a bank’s financial position. It arises from a mismatch between a bank’s interest-sensitive assets and liabilities, as well as from market conditions that affect interest rates. Managing interest rate risk is crucial for banks to maintain profitability, asset quality, and capital adequacy.

Interest rate risk can manifest in different ways:

- Price Risk: Price risk refers to the potential impact of changes in interest rates on the value of fixed-income securities held by banks. As interest rates rise, the value of existing fixed-rate securities tends to decline, which can result in capital losses. Conversely, falling interest rates can lead to increased values of fixed-rate securities.

- Reinvestment Risk: Reinvestment risk arises from the potential for lower returns on reinvesting interest income or principal repayments from loans or securities. When interest rates decline, banks face reinvestment risk as they may have to invest funds at lower interest rates, resulting in reduced income generation.

- Basis Risk: Basis risk occurs when there is a mismatch between the repricing characteristics of a bank’s assets and liabilities. For example, if a bank’s variable-rate loans reprice faster than its variable-rate deposits, it faces the risk of declining interest income when interest rates decrease.

- Yield Curve Risk: Yield curve risk refers to the potential impact of changes in the shape or slope of the yield curve on a bank’s financial position. Banks with assets and liabilities of different maturities may face yield curve risk if the changes in interest rates affect different maturity positions differently.

- Optionality Risk: Optionality risk arises from financial instruments with embedded options, such as callable bonds or mortgage-backed securities. Changes in interest rates can impact the likelihood of these options being exercised, leading to potential gains or losses for banks.

Managing interest rate risk requires the implementation of various strategies:

- Asset-Liability Management: Banks need to carefully manage the composition and maturity profiles of their assets and liabilities to reduce interest rate risk. This involves structuring the balance sheet to match the repricing characteristics, monitoring interest rate gaps, and employing hedging techniques.

- Hedging: Banks can use interest rate derivatives to hedge against interest rate risk. Interest rate swaps, futures, and options can be used to manage exposures to changes in rates, allowing banks to protect their net interest income and manage the impact of interest rate fluctuations.

- Loan Pricing Strategies: Banks can adjust the pricing of loans and deposits based on prevailing interest rate conditions. This allows banks to reflect changes in funding costs and mitigate the impact of interest rate fluctuations on their net interest margin.

- Stress Testing: Conducting regular stress tests helps banks assess the potential impact of severe interest rate shocks on their financial position. Stress testing assists in identifying vulnerabilities, adjusting risk management strategies, and ensuring an appropriate capital buffer to withstand adverse scenarios.

- Interest Rate Risk Modeling: Using sophisticated interest rate risk models can assist banks in measuring and forecasting the impact of interest rate changes on their balance sheet and earnings. This enables banks to better understand the potential risk exposure and make informed decisions.

Effectively managing interest rate risk is crucial for banks to maintain profitability, asset quality, and financial stability. By employing proactive asset-liability management, utilizing hedging techniques, implementing appropriate loan pricing strategies, conducting stress tests, and utilizing interest rate risk modeling, banks can navigate interest rate fluctuations and optimize their risk-return profile.

Foreign Exchange Risk

Foreign exchange risk is a significant risk faced by banks that arises from exposure to fluctuations in foreign exchange rates. It refers to the potential impact of changes in exchange rates on a bank’s financial position and performance. Banks engaged in cross-border transactions, foreign currency-denominated investments, or international trade finance are particularly exposed to foreign exchange risk.

Foreign exchange risk can manifest in various ways:

- Transaction Risk: Transaction risk arises from the potential loss due to changes in exchange rates between the initiation and settlement of a transaction. It affects banks engaged in international trade, where invoices or payments may be denominated in foreign currencies. Fluctuations in exchange rates can impact the profitability of such transactions.

- Translation Risk: Translation risk occurs when a bank has foreign subsidiaries or investments denominated in foreign currencies. Changes in exchange rates can affect the translation of these foreign assets or liabilities into the bank’s reporting currency. This can impact the bank’s financial statements and capital adequacy ratios.

- Economic Exposure: Economic exposure arises from the potential impact of changes in exchange rates on a bank’s future cash flows, revenues, and expenses. It can result from operations or investments in foreign markets, where revenue streams or costs are exposed to exchange rate fluctuations.

- Contingent Exposure: Contingent exposure refers to the potential impact of changes in exchange rates on unresolved future commitments or contingent liabilities. This includes guarantees, letters of credit, or trade finance instruments denominated in foreign currencies. Fluctuations in exchange rates can lead to changes in the value of these commitments.

Managing foreign exchange risk requires the implementation of various strategies:

- Hedging: Banks can use various hedging techniques to mitigate foreign exchange risk. This includes using forward contracts, futures, options, or currency swaps to lock in exchange rates and protect against adverse currency movements.

- Netting and Pooling: Netting foreign currency inflows and outflows within an organization can help offset exposures and reduce overall foreign exchange risk. Centralized pooling of foreign currency funds can also optimize liquidity management while reducing transaction costs.

- Asset and Liability Management: Banks can manage foreign exchange risk by matching foreign currency-denominated assets and liabilities to reduce the impact of exchange rate fluctuations. This involves careful selection and management of the currency composition of the bank’s balance sheet.

- Diversification: Diversifying operations and investments across different geographies and currencies can help mitigate foreign exchange risk. This can reduce reliance on a single currency and reduce the overall exposure to adverse exchange rate movements.

Regular monitoring of foreign exchange markets and developments is crucial for managing foreign exchange risk effectively. Banks need to stay informed about geopolitical events, economic indicators, and central bank actions that can influence exchange rates. Implementing comprehensive risk management frameworks, utilizing hedging strategies, diversifying currency exposures, and staying updated on market trends enable banks to manage foreign exchange risk and protect their financial positions.

Regulatory and Compliance Risk

Regulatory and compliance risk is a significant risk faced by banks, referring to the risk of non-compliance with laws, regulations, and industry standards. Banks operate in heavily regulated environments and face strict requirements related to risk management, capital adequacy, customer protection, anti-money laundering, and more. Failure to adhere to these regulations can result in financial penalties, legal actions, reputational damage, and loss of customers’ trust.

Regulatory and compliance risk can arise from several sources:

- Legal and Regulatory Changes: Banks need to stay updated with evolving regulatory requirements and changes in laws and regulations. Failure to adapt to new regulations in a timely manner can lead to compliance breaches and regulatory non-compliance.

- Operational Risk: Inadequate or failed internal processes, systems, or controls can contribute to regulatory and compliance risk. Banks need to establish robust internal control mechanisms, conduct regular audits, and implement appropriate compliance frameworks to mitigate operational risk.

- Customer Protection: Banks need to ensure they have procedures in place to protect the interests of their customers. Compliance with laws related to consumer protection, privacy, data security, and fair lending practices is crucial. Failure to meet these requirements can result in reputational damage and loss of customer trust.

- Anti-Money Laundering and Counter-Terrorism Financing: Banks are obligated to comply with regulations related to anti-money laundering (AML) and counter-terrorism financing (CTF) measures. They need to implement robust AML and CTF programs, conduct customer due diligence, and report suspicious transactions to regulatory authorities.

- Capital and Prudential Regulations: Banks must comply with capital adequacy requirements and prudential regulations set by regulatory bodies. These regulations aim to ensure the stability and soundness of the banking system. Non-compliance can lead to financial penalties and regulatory intervention.

Managing regulatory and compliance risk requires several strategies:

- Risk Assessment and Compliance Monitoring: Banks need to conduct ongoing risk assessments to identify potential regulatory and compliance risks. A robust compliance monitoring program helps banks track regulatory changes, assess their impact, and ensure timely compliance with new requirements.

- Internal Controls and Compliance Frameworks: Implementing strong internal controls and comprehensive compliance frameworks is essential. This includes establishing policies and procedures, conducting regular compliance audits, and providing training to employees on regulatory requirements.

- Regulatory Relationship Management: Building positive relationships with regulatory authorities is important for banks. This includes regular communication, proactive engagement, and timely reporting on compliance matters.

- Regulatory Reporting: Banks need to develop robust reporting systems to ensure timely and accurate regulatory reporting. They must provide regulators with the necessary information, disclosures, and reports as per regulatory requirements.

Effectively managing regulatory and compliance risk helps banks maintain trust with customers, regulators, and other stakeholders. By establishing strong internal controls, conducting regular compliance assessments, staying updated on regulatory changes, and fostering a culture of compliance, banks can mitigate regulatory and compliance risk and ensure long-term sustainability in the highly regulated banking industry.

Risk Management Framework in Banking

A robust risk management framework is essential for banks to proactively identify, assess, mitigate, and monitor the various risks they face. It provides structure and guidance for banks to effectively manage risks, safeguard their financial stability, and maintain regulatory compliance. A well-defined risk management framework in banking typically comprises several key components:

- Risk Governance: Risk governance sets the tone and establishes the overall framework for risk management. It includes defining the roles and responsibilities of the board of directors, senior management, and other stakeholders in managing risks. Risk governance ensures that risk management practices align with the bank’s overall objectives and risk appetite.

- Risk Appetite: Establishing risk appetite involves defining the level of risk a bank is willing to assume in pursuit of its strategic objectives. It sets the boundaries within which risk-taking activities are conducted and guides decision-making across the organization. Risk appetite is typically determined by considering the bank’s risk tolerance, business strategy, regulatory requirements, and stakeholder expectations.

- Risk Identification and Assessment: Banks need to have a systematic process for identifying and assessing risks. This involves conducting risk assessments, evaluating the likelihood and potential impact of risks, and prioritizing them based on their significance. Risk identification and assessment can be facilitated through risk registers, risk mapping exercises, scenario analyses, and expert judgment.

- Risk Mitigation Strategies: Risk mitigation strategies involve implementing measures and controls to reduce the likelihood and impact of identified risks. This may include diversification, hedging, internal controls, employee training, technological enhancements, and insurance coverage. Risk mitigation strategies should be aligned with the bank’s risk appetite and regulatory requirements.

- Risk Monitoring and Reporting: Banks need to establish monitoring mechanisms to track risks on an ongoing basis. Regular risk monitoring helps identify changes in risk profiles, detects emerging risks, and ensures compliance with risk limits and thresholds. It involves regular reporting on risk exposures, risk metrics, and the effectiveness of risk management activities to senior management, the board of directors, and regulatory authorities.

- Internal Controls and Compliance: Implementing robust internal controls is crucial for effective risk management. Internal controls ensure that policies, processes, and procedures are in place to mitigate risks and ensure compliance with regulatory requirements. Regular audits, internal reviews, and compliance assessments help assess the effectiveness of internal controls and identify areas for improvement.

A comprehensive risk management framework facilitates a proactive and integrated approach to managing risks in banking. It ensures that risks are identified, assessed, and mitigated in a structured manner, enabling banks to make informed decisions, protect their financial stability, and maintain regulatory compliance. Regular review and updates to the risk management framework are essential to keep pace with evolving risks and regulatory changes.

Establishing Risk Appetite

Establishing risk appetite is a critical component of a bank’s risk management framework. It involves defining the level of risk that a bank is willing to accept in pursuit of its strategic objectives. Risk appetite serves as a guidance system that helps senior management and the board of directors make informed decisions about risk-taking activities and sets boundaries within which the bank operates.

When establishing risk appetite, several factors need to be considered:

- Risk Tolerance: Risk tolerance reflects the bank’s ability to withstand potential losses and disruptions. It is influenced by factors such as capital adequacy, liquidity levels, and the bank’s financial strength. Risk tolerance helps determine the level of risk that the bank is willing and able to assume.

- Business Strategy: Risk appetite should align with the bank’s business strategy and objectives. It takes into account the bank’s growth aspirations, target markets, product offerings, and competitive positioning. Risk appetite ensures that risk-taking activities are consistent with the bank’s strategic direction.

- Regulatory Requirements: Regulatory guidelines and requirements play a significant role in shaping a bank’s risk appetite. Banks must consider the risk thresholds set by regulatory authorities to ensure compliance with capital adequacy ratios, liquidity requirements, and risk management standards. Regulatory input helps determine the acceptable level of risk for a bank.

- Stakeholder Expectations: Stakeholder expectations, including those of shareholders, customers, and regulators, should be taken into account when defining risk appetite. It helps maintain trust and confidence in the bank by incorporating their perspectives into risk decision-making.

- Risk Culture: Risk appetite is closely tied to the bank’s risk culture and appetite for risk-taking within the organization. A strong risk culture promotes awareness, openness, and accountability for managing risks. It fosters a risk-aware environment where risk appetite is effectively communicated and embraced by all levels of the organization.

Establishing risk appetite involves a structured process that includes:

- Risk Identification: Identifying and assessing the various risks the bank faces is crucial in understanding the potential impact on the bank’s objectives. This involves conducting a comprehensive risk assessment exercise to capture and analyze risks across various business lines and functions.

- Risk Quantification: Once risks are identified, they need to be quantified to determine their potential impact on the bank’s financial position and performance. This can be achieved through the use of risk metrics, stress testing, scenario analyses, and other quantitative methods.

- Scenario Development: Developing hypothetical scenarios helps in evaluating the bank’s risk tolerance under different circumstances. Scenarios can include economic downturns, interest rate changes, regulatory developments, and geopolitical events. Assessing how different scenarios impact the bank’s risk profile aids in defining risk appetite more effectively.

- Consultation and Input: Obtaining input from senior management, the board of directors, and other stakeholders is vital in defining risk appetite. Collaboration helps incorporate different perspectives, align expectations, and ensure widespread buy-in and support for the risk appetite statement.

- Communication and Implementation: Risk appetite needs to be effectively communicated across the organization to ensure widespread understanding and adherence. It should be embedded in the bank’s decision-making processes, risk management policies, and performance measures. Ongoing monitoring and reporting on risk appetite enable senior management and the board to assess compliance and make necessary adjustments.

By establishing clear risk appetite statements, banks can set boundaries, guide decision-making, and ensure that risk-taking aligns with their strategic objectives. A well-defined risk appetite supports effective risk management, enhances stakeholder confidence, and promotes the long-term sustainability of the bank.

Identifying and Assessing Risks

Identifying and assessing risks is a crucial step in the risk management process for banks. It enables banks to proactively understand and evaluate potential risks, ensuring that appropriate risk mitigation strategies can be implemented. The process involves a systematic approach to identify, analyze, and prioritize risks based on their likelihood and impact on the bank’s objectives.

The process of identifying and assessing risks requires considering various sources of risk across different areas of the bank’s operations:

- Operational Risks: These risks arise from internal processes, systems, and human factors. It includes risks associated with technology, fraud, compliance, business continuity, and internal control failures.

- Credit Risks: Credit risks stem from the potential default or non-payment of borrowers or counterparties. Banks must assess the creditworthiness of borrowers, evaluate the quality of loan portfolios, and analyze exposure to specific industries or regions.

- Market Risks: Market risks result from fluctuations in interest rates, foreign exchange rates, equity prices, and commodity prices. Banks need to evaluate their exposure to changes in financial markets and assess the potential impact on their assets, liabilities, and investments.

- Liquidity Risks: Liquidity risks arise from a bank’s inability to meet its financial obligations. Banks must assess the availability of liquid assets, potential funding gaps, and the ability to access financial markets in times of stress.

- Compliance Risks: Compliance risks pertain to the risk of non-compliance with laws, regulations, and industry standards. Banks need to assess their adherence to various regulatory requirements, such as anti-money laundering, consumer protection, and data privacy regulations.

The process of identifying and assessing risks generally follows a structured approach:

- Risk Identification: Banks need to identify potential risks through analyzing historical data, conducting risk assessments, and utilizing risk registers. This involves seeking input from relevant stakeholders across different departments and business lines.

- Risk Analysis: Once risks are identified, they must be analyzed to understand their characteristics, drivers, and potential impact on the bank. This may involve quantitative analysis, such as stress testing and scenario analysis, as well as qualitative analysis through expert judgment and industry benchmarking.

- Risk Prioritization: Prioritizing risks is essential to allocate appropriate resources and focus on managing the most significant risks. This can be achieved by evaluating the likelihood and potential impact of each risk, considering strategic objectives, regulatory requirements, and stakeholder expectations.

- Risk Reporting: Communicating risk assessment findings is crucial to ensure awareness and understanding across the organization. Risk reports should present the identified risks, their assessment results, and recommendations for risk mitigation strategies. Regular reporting to senior management and the board of directors aids in informed decision-making.

By systematically identifying and assessing risks, banks can proactively manage their risk exposures. This process enables them to develop appropriate risk management strategies, implement mitigation measures, and make informed decisions to safeguard their financial stability and protect the interests of stakeholders.

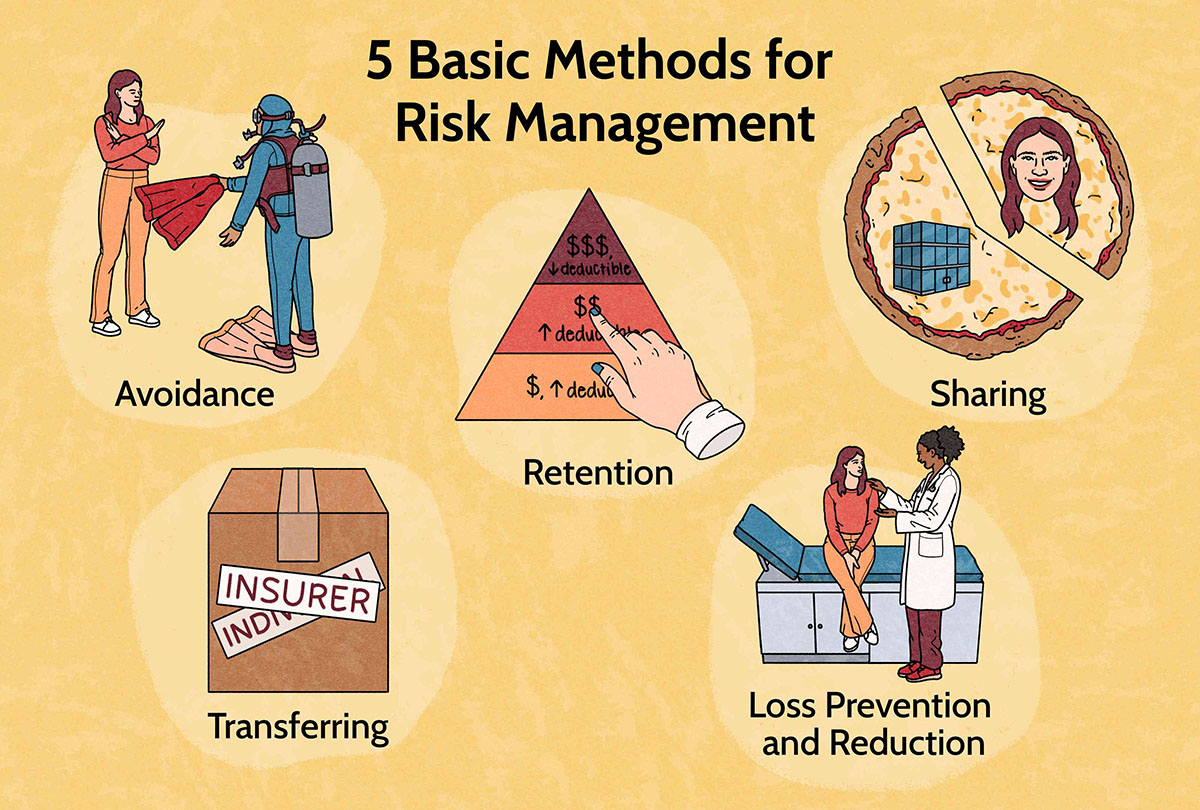

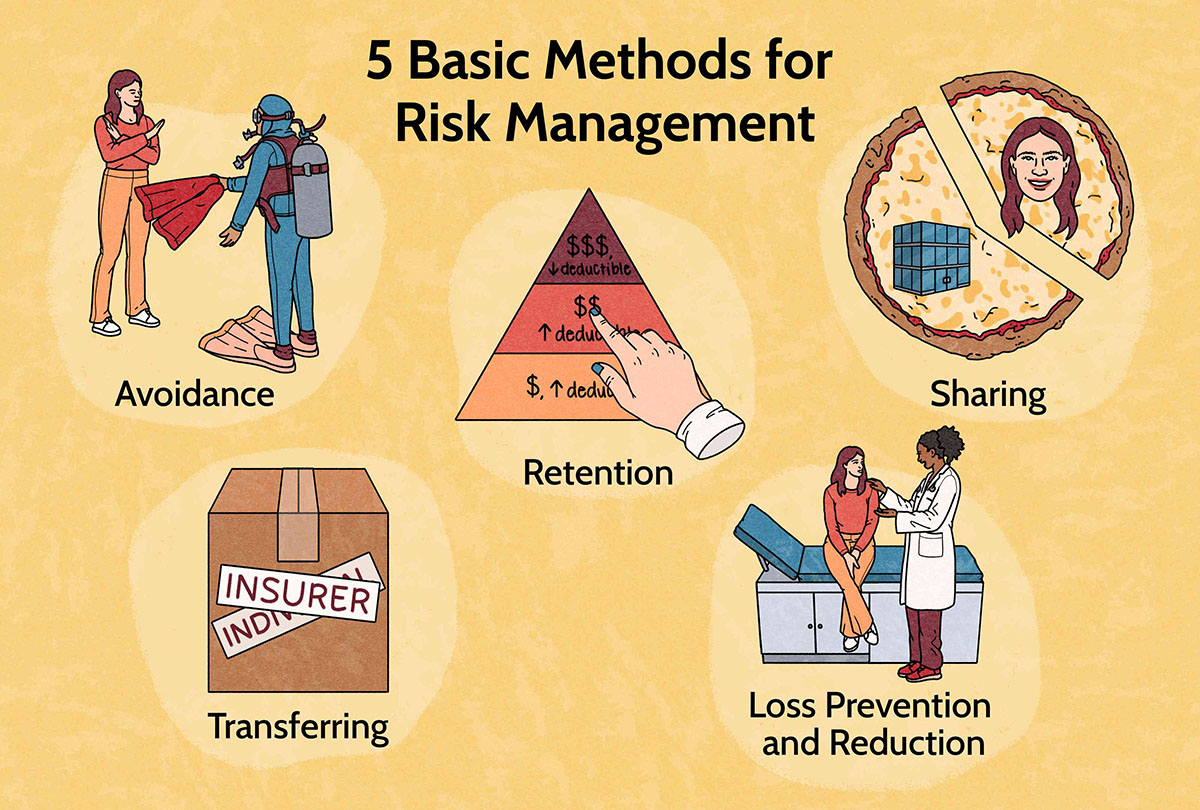

Risk Mitigation Strategies

Risk mitigation strategies are essential for banks to reduce the likelihood and impact of identified risks. These strategies involve implementing measures and controls to manage risks effectively and protect the bank’s financial stability. By employing appropriate risk mitigation strategies, banks can enhance their resilience and protect themselves from potential losses. Some common risk mitigation strategies employed by banks include:

- Diversification: Diversifying risks is a fundamental strategy used by banks. By spreading their assets, liabilities, and investments across different sectors, geographic regions, and types of borrowers, banks reduce their exposure to any single risk factor. Diversification helps mitigate the impact of individual risk events by ensuring that losses in one area can be offset by gains in other areas.

- Hedging: Hedging is widely used to mitigate risks associated with market fluctuations. Banks can enter into derivative contracts such as futures, options, swaps, or forwards to offset their exposure to adverse movements in interest rates, foreign exchange rates, commodity prices, or other market factors. Hedging serves to reduce the potential losses associated with these risks and provides a level of protection for the bank’s positions.

- Insurance Coverage: Banks often opt for insurance coverage to transfer certain risks to an insurance provider. This includes obtaining coverage for risks such as property damage, liability, professional indemnity, cyber risks, and other insurable risks. Insurance policies provide financial protection in the event of an unforeseen loss or adverse event, allowing banks to transfer the risk to the insurer.

- Internal Controls: Implementing robust internal controls is crucial for mitigating operational risks. Banks establish control mechanisms and procedures to ensure that process flows are efficient, responsibilities are clearly defined, and risks are adequately managed. Internal controls cover areas such as segregation of duties, reconciliation processes, approval frameworks, and access controls. These controls help detect and prevent errors, fraud, or other operational failures.

- Risk Transfer: Risk transfer involves transferring risks to third parties through various arrangements. Banks can engage in securitization to transfer credit risk, engage in trade credit insurance to transfer trade finance risks, or enter into risk transfer agreements with other financial institutions. Risk transfer allows banks to reduce their exposure to specific risks by shifting them to other parties willing to accept them.

- Employee Training and Awareness: Banks invest in training programs and awareness initiatives to ensure that employees are equipped with the necessary skills and knowledge to identify and manage risks effectively. By promoting a strong risk-aware culture and providing ongoing training, banks can enhance risk identification, risk assessment, and risk mitigation capabilities across the organization.

- Continuity Planning and Disaster Recovery: Banks develop comprehensive business continuity and disaster recovery plans to mitigate the impact of unforeseen events, such as natural disasters, cyber-attacks, or system failures. These plans include measures to ensure the uninterrupted provision of critical services, the backup of data and systems, and the ability to restore operations swiftly following a disruptive event.

The selection and implementation of risk mitigation strategies depend on the specific risks faced by the bank, their potential impact, and the bank’s risk appetite. A holistic approach, considering a combination of different strategies, is often necessary to effectively address risks across various dimensions of bank operations. Through the application of robust risk mitigation strategies, banks can safeguard their financial stability, protect against potential losses, and enhance their overall risk management capabilities.

Risk Monitoring and Reporting

Risk monitoring and reporting are critical components of effective risk management in banks. They involve the ongoing assessment and reporting of risks to senior management, the board of directors, and regulatory authorities. Regular monitoring and reporting help ensure that risks are tracked, evaluated, and managed in a systematic and transparent manner.

Key aspects of risk monitoring and reporting in banks include:

- Establishing Key Risk Indicators (KRIs): KRIs are specific metrics or indicators used to monitor and measure the levels of different risks faced by the bank. These indicators are typically derived from risk assessments, stress tests, historical data, and analysis. KRIs serve as warning signals, enabling banks to detect and respond promptly to changes in risk profiles.

- Regular Risk Assessments: Banks should conduct regular risk assessments to evaluate the evolving nature of risks, taking into account changes in the internal and external environment. This may involve quantitative analysis, scenario testing, and expert judgment to assess the potential impact of risks on the bank’s financial position, operations, and strategic objectives.

- Monitoring Risk Limits and Thresholds: Banks establish risk limits and thresholds to ensure that risks are managed within acceptable levels. Regular monitoring of risk exposures against these limits helps identify breaches and triggers appropriate actions. This includes tracking credit concentrations, liquidity positions, market exposures, and compliance with regulatory requirements.

- Reporting to Senior Management and the Board of Directors: Comprehensive risk reports should be provided to senior management and the board of directors on a regular basis. These reports summarize the bank’s risk profile, highlight key risks and their potential impact, and provide recommendations for risk management strategies. Transparent and informative risk reporting enables informed decision-making and ensures the board’s oversight of risk management practices.

- Regulatory Reporting: Banks are required to submit various risk-related reports to regulatory authorities, complying with regulatory guidelines and requirements. These reports provide information on risk exposures, capital adequacy, liquidity positions, and compliance with regulatory standards. Regulatory reporting ensures transparency and enables regulatory supervisors to assess the bank’s risk management practices.

- Effective Communication: Communication is a vital aspect of risk monitoring and reporting. Banks need to foster robust communication channels within the organization to ensure that risks are effectively communicated across all levels. This includes promoting risk awareness, encouraging reporting of emerging risks, and creating an environment where employees are comfortable discussing and escalating risks.

Risk monitoring and reporting allow banks to stay informed about their risk exposures, identify emerging risks, and take timely actions to mitigate potential adverse impacts. By implementing robust risk monitoring mechanisms, reporting on risk profiles, and complying with regulatory reporting requirements, banks can strengthen their risk management practices, enhance stakeholder confidence, and maintain regulatory compliance.

Key Challenges in Risk Management

Risk management in the banking industry is a complex and ever-evolving process. Banks face several key challenges in effectively identifying, assessing, and mitigating risks. Understanding and addressing these challenges is essential for banks to enhance their risk management practices and safeguard their financial stability.

Some of the key challenges in risk management for banks include:

- Emerging Risks: Banks must constantly stay ahead of emerging risks, such as technological advancements, cybersecurity threats, climate change, and regulatory changes. Identifying and assessing new and evolving risks require continuous monitoring, research, and adaptation to newer risk management techniques.

- Data Quality and Availability: One significant challenge for banks is ensuring the quality, accuracy, and availability of risk-related data. Incomplete or inconsistent data can affect the accuracy of risk assessments and decision-making processes. Establishing robust data governance frameworks and investing in data analytics capabilities are crucial to overcome this challenge.

- Increased Regulatory Complexity: The banking industry operates in a highly regulated environment, with constantly evolving regulatory requirements. Banks must navigate complex regulatory frameworks and stay updated with changes in regulations related to risk management, capital adequacy, liquidity, consumer protection, and compliance. Adapting to new regulations and implementing compliance measures pose challenges for banks in terms of resources, expertise, and cost.

- Risk Integration: Banks often face challenges in integrating risk management across different business lines and functions. Siloed risk management practices can hinder the identification and assessment of risks holistically. Achieving an integrated approach to risk management requires establishing effective communication channels, shared risk frameworks, and coordination among various departments and stakeholders.

- Increasing Complexity of Financial Products: The development of complex financial products and derivatives poses challenges for risk management. Understanding the inherent risks associated with complex products, modeling their behavior, and assessing their impact on the bank’s overall risk profile require specialized knowledge and advanced risk management tools.

- Managing Cybersecurity Risks: The growth of technology and digitization in banking has exposed banks to cybersecurity risks. Banks face challenges in protecting customer data, preventing data breaches, and safeguarding against cyber threats. Managing cybersecurity risks requires continuous investment in robust cybersecurity infrastructure, employee training, threat intelligence, and proactive monitoring.

- Cultural and Organizational Challenges: Establishing a risk-aware culture and ensuring risk management is embedded throughout the organization can pose challenges. Banks need to overcome resistance to change, foster accountability for risk management, and create an environment where employees are encouraged to report risks and openly discuss risk-related issues.

Overcoming these challenges requires a proactive and agile approach to risk management. Banks must invest in technology, data analytics, and risk management expertise to effectively tackle emerging risks, adapt to regulatory changes, and strengthen risk management practices. Establishing effective communication channels, integrated risk frameworks, and an organizational culture that embraces risk management as a fundamental part of operations are also vital in addressing these challenges.

Conclusion

In conclusion, effective risk management is a critical aspect of success in the ever-evolving banking industry. Banks face various types of risks, including credit risk, market risk, operational risk, liquidity risk, interest rate risk, foreign exchange risk, and regulatory and compliance risk. To navigate these risks, banks must establish comprehensive risk management frameworks, enabling them to identify, assess, mitigate, and monitor risks effectively.

Establishing risk appetite is crucial in guiding risk-taking activities and aligning them with the bank’s strategic objectives. Identifying and assessing risks accurately is a fundamental step in risk management, allowing banks to prioritize and allocate resources appropriately. Risk mitigation strategies, such as diversification, hedging, internal controls, employee training, and continuity planning, help banks reduce the likelihood and impact of risks.

Risk monitoring and reporting play a pivotal role in ensuring ongoing awareness and oversight of risks. Regular risk assessments, monitoring of risk limits and thresholds, and transparent reporting to senior management, the board of directors, and regulatory authorities enhance risk management practices and enable informed decision-making.

However, banks also face several key challenges in risk management, including emerging risks, data quality, regulatory complexity, risk integration, complex financial products, cybersecurity, and cultural and organizational challenges. Overcoming these challenges requires a proactive and agile approach, investment in technology, data analytics capabilities, employee training, and establishing a risk-aware culture across the organization.

Overall, effective risk management enables banks to protect their financial stability, optimize their risk-return profile, maintain regulatory compliance, and build trust with stakeholders. By proactively identifying, assessing, mitigating, and monitoring risks, banks can navigate the ever-changing landscape of the banking industry and enhance their ability to adapt and thrive in a dynamic and challenging environment.