Finance

How To Write A Letter To The IRS Sample

Published: October 31, 2023

Learn how to write a well-crafted letter to the IRS with our comprehensive sample guide. Gain valuable tips and insights on navigating finance-related communication challenges.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Step 1: Gather Necessary Information

- Step 2: Format Your Letter

- Step 3: Include Your Contact Information

- Step 4: Address the IRS Properly

- Step 5: Provide a Clear and Concise Explanation

- Step 6: Attach Relevant Documents

- Step 7: Request a Response

- Step 8: Sign and Date Your Letter

- Step 9: Make Copies for Your Records

- Conclusion

Introduction

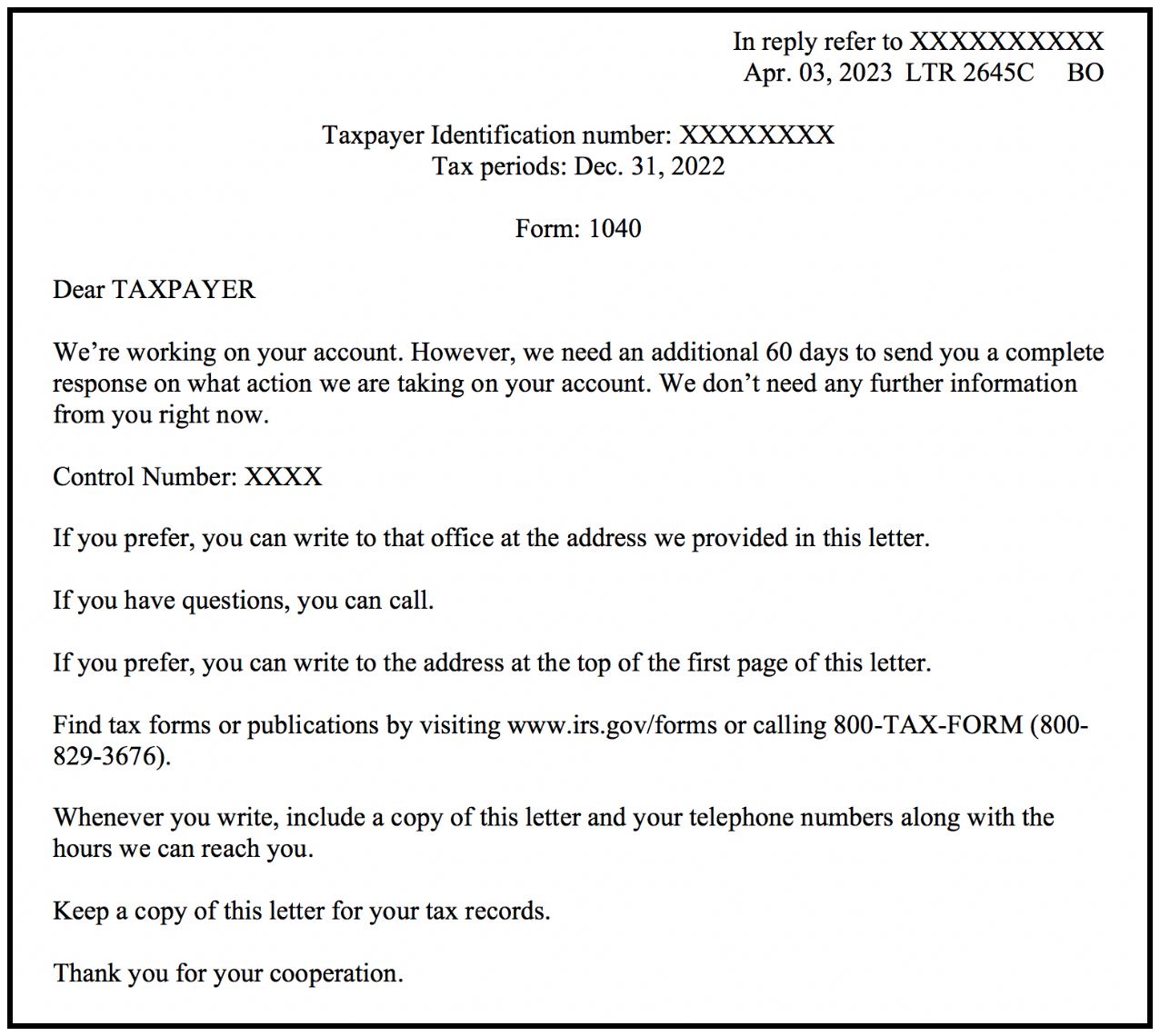

Dealing with the Internal Revenue Service (IRS) can be a challenging and intimidating task. Whether you’re addressing a tax-related issue, seeking clarification on a specific matter, or requesting assistance, writing a letter to the IRS can help you effectively communicate your needs and concerns. However, it’s important to approach the task strategically to ensure your letter is clear, professional, and engaging.

In this article, we will guide you through the process of writing a letter to the IRS. From gathering the necessary information to formatting the letter correctly and addressing the IRS appropriately, we will cover each step in detail. By following this guide, you can maximize the impact of your letter and improve your chances of a prompt and satisfactory response from the IRS.

Before you begin, it’s crucial to understand the purpose of your letter. Whether you’re seeking clarification, disputing a tax assessment, or requesting a payment plan, clearly defining your objective will help you structure and articulate your message effectively. Remember, the goal is to communicate your situation clearly and courteously, providing the necessary information for the IRS to take appropriate action.

Writing a letter to the IRS can be a complex process, but with the right approach, it can yield positive results. In the next few sections, we will break down each step, providing tips and guidelines to help you craft a well-written and persuasive letter. So, let’s get started with the first step: gathering the necessary information.

Step 1: Gather Necessary Information

Before you start drafting your letter, it’s essential to gather all the necessary information related to your tax issue. This will ensure that your letter is comprehensive and accurate, providing the IRS with all the relevant details they need to address your concerns.

Here are a few key pieces of information you should gather:

- Your personal information: Include your full name, address, and contact information. This will help the IRS identify you and respond to your letter promptly.

- Tax-related details: Gather all relevant tax information, including your Social Security Number (SSN) or Employer Identification Number (EIN), tax year(s) in question, and any applicable tax return forms (such as Form 1040).

- Specific issue or inquiry: Clearly define the purpose of your letter. Whether you’re disputing a tax assessment, seeking clarification on a particular matter, or requesting a payment plan, make sure to gather all the necessary details and supporting documents related to your specific issue.

- Prior communication: If you have had any previous communication with the IRS regarding the issue, gather copies of all relevant correspondence, notices, or documentation. This will help provide a context for your letter and demonstrate any efforts you have made to resolve the matter.

Once you have gathered all the necessary information, take the time to review and organize it. Having everything ready will make the writing process smoother and allow you to address all the relevant points in your letter.

Remember, accuracy and completeness are crucial when dealing with the IRS. Double-check your information to ensure there are no mistakes or missing details that could potentially delay the resolution of your issue.

Now that you have gathered all the necessary information, it’s time to move on to the next step: formatting your letter. Creating a well-structured and professional letter is essential for catching the IRS’s attention and making a strong case for your concerns.

Step 2: Format Your Letter

When writing a letter to the IRS, it’s important to adhere to certain formatting guidelines to ensure your message is clear and professional. The proper formatting will not only make your letter more readable but also convey a sense of respect and seriousness to the recipient.

Here are some key formatting tips to follow:

- Use a professional tone: Maintain a formal and respectful tone throughout your letter. Avoid using slang or casual language, as it may undermine the credibility of your message.

- Choose an appropriate font and font size: Select a clear and legible font, such as Arial or Times New Roman, and use a font size between 10 and 12 points. This ensures that your letter is easy to read.

- Include clear headings and subheadings: Use headings and subheadings to organize your letter and make it easier for the reader to navigate. This also helps the IRS representatives to understand the structure and content of your letter.

- Keep paragraphs short: Use concise and focused paragraphs to present your points. This enhances readability and makes it easier for the reader to follow your arguments.

- Use bullet points or numbered lists: When presenting a list of items or key points, consider using bullet points or numbered lists. This helps break up the text and makes your information easier to digest.

- Leave white space: Allow for sufficient white space between paragraphs and sections. This improves the overall readability and prevents your letter from appearing cluttered or overwhelming.

By following these formatting guidelines, you can create a well-organized and visually appealing letter that effectively communicates your concerns to the IRS. Remember, clarity and professionalism are essential when dealing with any formal correspondence.

Now that you have formatted your letter properly, it’s time to move on to the next step: including your contact information. This ensures that the IRS can easily reach you for any further communication or clarification.

Step 3: Include Your Contact Information

When writing a letter to the IRS, it is crucial to include your contact information so that they can easily reach you for any necessary communication or clarification. Your contact information should be clearly stated at the beginning or end of the letter to ensure it is easily accessible to the recipient.

Here’s what you should include in your contact information:

- Your full name: Provide your complete legal name as it appears on official documents.

- Your address: Include your current mailing address. Make sure it is accurate and up to date to avoid any confusion or miscommunication.

- Your phone number: Provide a phone number where the IRS can reach you during business hours. Ensure that the number is active and regularly monitored.

- Your email address: If you prefer to communicate via email, include a valid email address where the IRS can contact you. Double-check for any typos or errors in your email address to prevent any potential delivery issues.

Including your contact information is essential for establishing clear communication channels with the IRS. It ensures that they can reach out to you promptly if they have any questions, need additional information, or are ready to offer a resolution to your issue.

In addition to providing your contact information, it may also be beneficial to express your willingness to cooperate and assist them further if needed. This demonstrates your commitment to resolving the matter and fosters open communication between you and the IRS.

Now that you have included your contact information, it’s time to move on to the next step: addressing the IRS properly. Understanding the appropriate way to address the IRS is crucial in ensuring your letter reaches the correct department or individual within the organization.

Step 4: Address the IRS Properly

Addressing your letter to the correct department or individual within the IRS is essential to ensure that it reaches the intended recipient and receives prompt attention. Using the proper format and addressing conventions will help your letter get to the right place and increase the likelihood of a timely response.

Here’s how to address the IRS properly:

- Include the correct IRS address: Start your letter by including the appropriate address for the IRS. The specific address you should use depends on the purpose of your letter, such as tax return filing, payment, or inquiry. Ensure that you have the most up-to-date address by visiting the official IRS website or checking the instructions provided with the related tax form.

- Use the appropriate salutation: Begin your letter with a professional salutation, such as “Dear Sir or Madam” or “To Whom It May Concern.” If you have identified a specific individual or department within the IRS to address your letter, use their name or title along with the appropriate salutation.

- Include any applicable identifiers: If you have a specific IRS case or reference number related to your inquiry or issue, include it in your letter. This will help the IRS identify your case quickly and streamline the handling of your letter.

By following these addressing guidelines, you ensure that your letter reaches the appropriate department or individual within the IRS and facilitates efficient handling. Remember, accuracy and attention to detail are crucial when addressing formal correspondence.

Now that you have addressed the IRS properly, it’s time to move on to the next step: providing a clear and concise explanation of the issue in your letter. This is where you will articulate your concerns or inquiries and provide the necessary details for the IRS to understand your situation.

Step 5: Provide a Clear and Concise Explanation

When writing a letter to the IRS, it’s crucial to provide a clear and concise explanation of the issue you are addressing. This will help the IRS understand your concerns or inquiries and enable them to take appropriate action. Here are some key tips for providing a clear and concise explanation in your letter:

- State the purpose of your letter: Clearly and briefly state the reason for your letter at the beginning. Whether you are disputing a tax assessment, seeking clarification on a specific matter, or requesting a payment plan, clearly identify the purpose of your communication.

- Provide relevant details: Include all the necessary information related to your issue. Be specific and provide details such as dates, amounts, and any relevant supporting documentation to support your claims or questions. The more information you provide, the better the IRS can understand and address your concerns.

- Organize your thoughts logically: Present your explanation in a structured and logical manner. Use paragraphs or bullet points to break down different aspects of your issue, making it easier for the reader to follow your argument.

- Be concise and to the point: Avoid unnecessary details or tangents that may distract from your main message. Keep your explanation focused and relevant, providing only the information that is essential for the IRS to understand your situation.

- Use clear and simple language: Write in plain language that is easy to understand. Avoid complex jargon or technical terms, unless necessary. Use examples or analogies if they can help clarify your explanation.

Remember, the goal is to convey your concerns or inquiries clearly and efficiently. By providing a well-structured and concise explanation in your letter, you increase the chances of a timely and accurate response from the IRS.

Now that you have provided a clear and concise explanation in your letter, it’s time to move on to the next step: attaching relevant documents, if necessary. Supporting your claims with appropriate documentation can strengthen your case and provide the IRS with the necessary evidence to address your issue effectively.

Step 6: Attach Relevant Documents

Attaching relevant documents to your letter can provide crucial support for your claims or inquiries. These documents can help the IRS understand your situation more effectively and expedite the resolution process. Here are some guidelines for attaching relevant documents to your letter:

- Identify the necessary documents: Determine which documents are relevant to your issue. This may include copies of previous IRS correspondence, tax returns, receipts, invoices, or any other supporting evidence that can support your claims or inquiries. Be selective and include only the most pertinent documents.

- Organize and label your documents: Arrange your documents in a logical order and label them clearly to indicate their purpose. Use a cover sheet or index to provide an overview of the enclosed documents and their relevance to your letter.

- Make clear copies: Ensure that your attached documents are clear and legible. If needed, make copies or scans of the original documents and keep the originals for record-keeping purposes. Poor quality or illegible copies can hinder the IRS’s ability to review and understand the information.

- Refer to the attached documents: In your letter, refer to the attached documents when necessary. Provide a brief explanation of each document’s significance and how it relates to your issue. This helps the IRS connect the dots and understand the relevance of the provided evidence.

- Keep the original documents: Retain the original copies of the documents you attach to your letter. It’s important to keep a record of all documentation related to your tax matters for your own records.

By attaching relevant documents to your letter, you provide the IRS with supporting evidence and additional context for your claims or inquiries. This can facilitate a faster and more accurate resolution of your issue.

Now that you have attached relevant documents, it’s time to move on to the next step: requesting a response from the IRS. Clearly indicating your request for a response ensures that you receive feedback or clarification on your concerns or inquiries.

Step 7: Request a Response

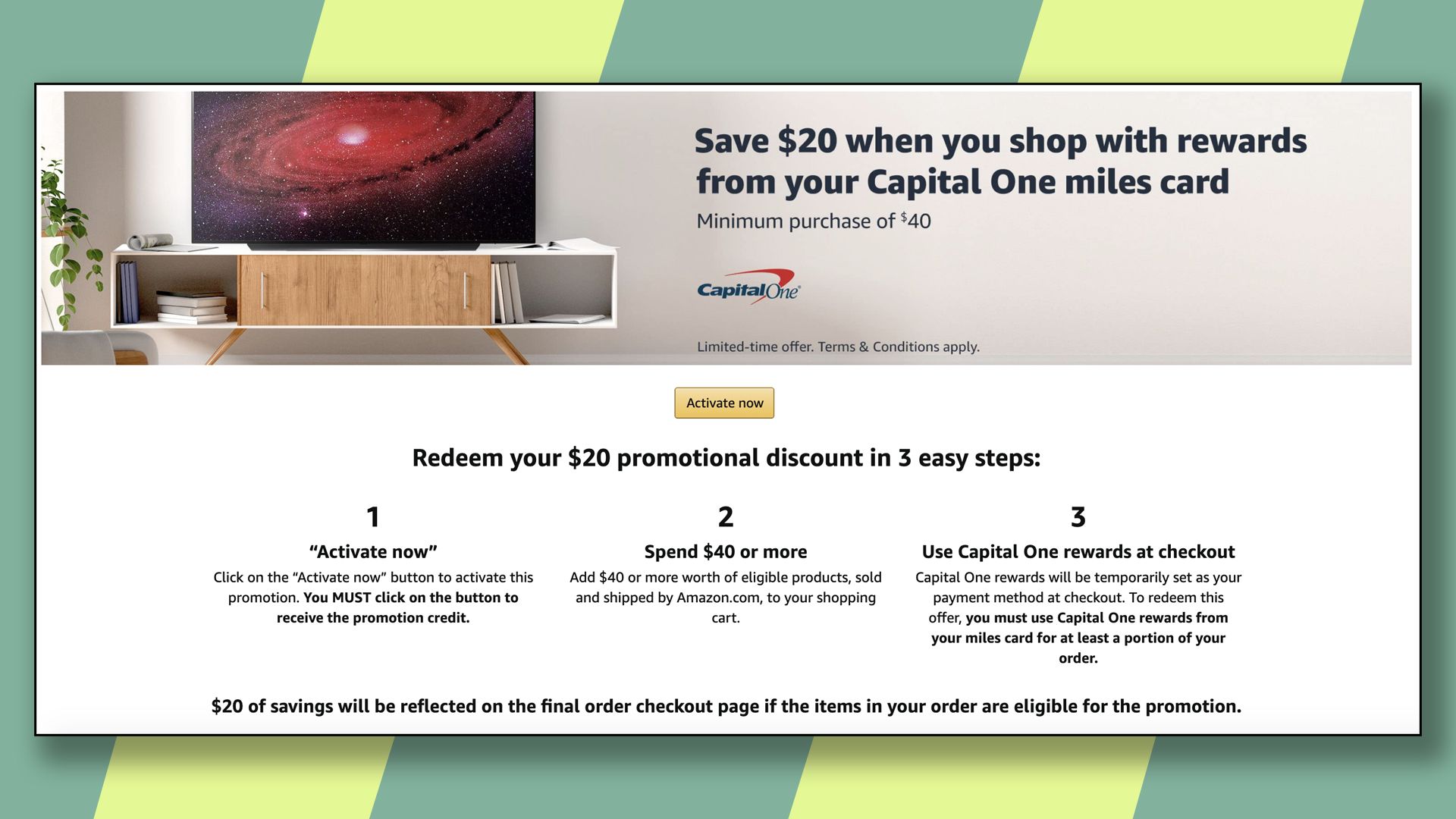

When writing a letter to the IRS, it’s important to clearly request a response to ensure that your concerns or inquiries are addressed in a timely manner. By requesting a response, you indicate your expectation for the IRS to provide feedback, clarification, or resolution to your issue. Here are some tips for requesting a response in your letter:

- State your request explicitly: Clearly indicate that you are requesting a response from the IRS. Use a direct and polite language to convey your expectation for feedback or resolution. For example, you can use phrases like “I kindly request a prompt response” or “I look forward to hearing from you regarding this matter.”

- Specify the preferred method of response: If you have a preference for how you would like to receive the IRS’s response, such as via mail or email, mention it in your letter. However, keep in mind that the IRS may have its own protocols for communication, so be open to alternative methods of response.

- Provide your contact information again: Reiterate and double-check that your contact information is accurate and up-to-date. This ensures that the IRS can reach you easily if they need to follow up or provide a response.

- Express your appreciation: Conclude your letter by expressing your gratitude for the IRS’s attention to your concerns or inquiries. A polite and thankful tone can help establish a positive and cooperative atmosphere for further communication.

By requesting a response in your letter, you set clear expectations for the IRS to address your issue promptly. It also demonstrates your proactive approach and commitment towards resolving the matter.

Now that you have requested a response from the IRS, it’s important to finalize your letter. This involves signing and dating your letter to authenticate your communication and make it legally valid.

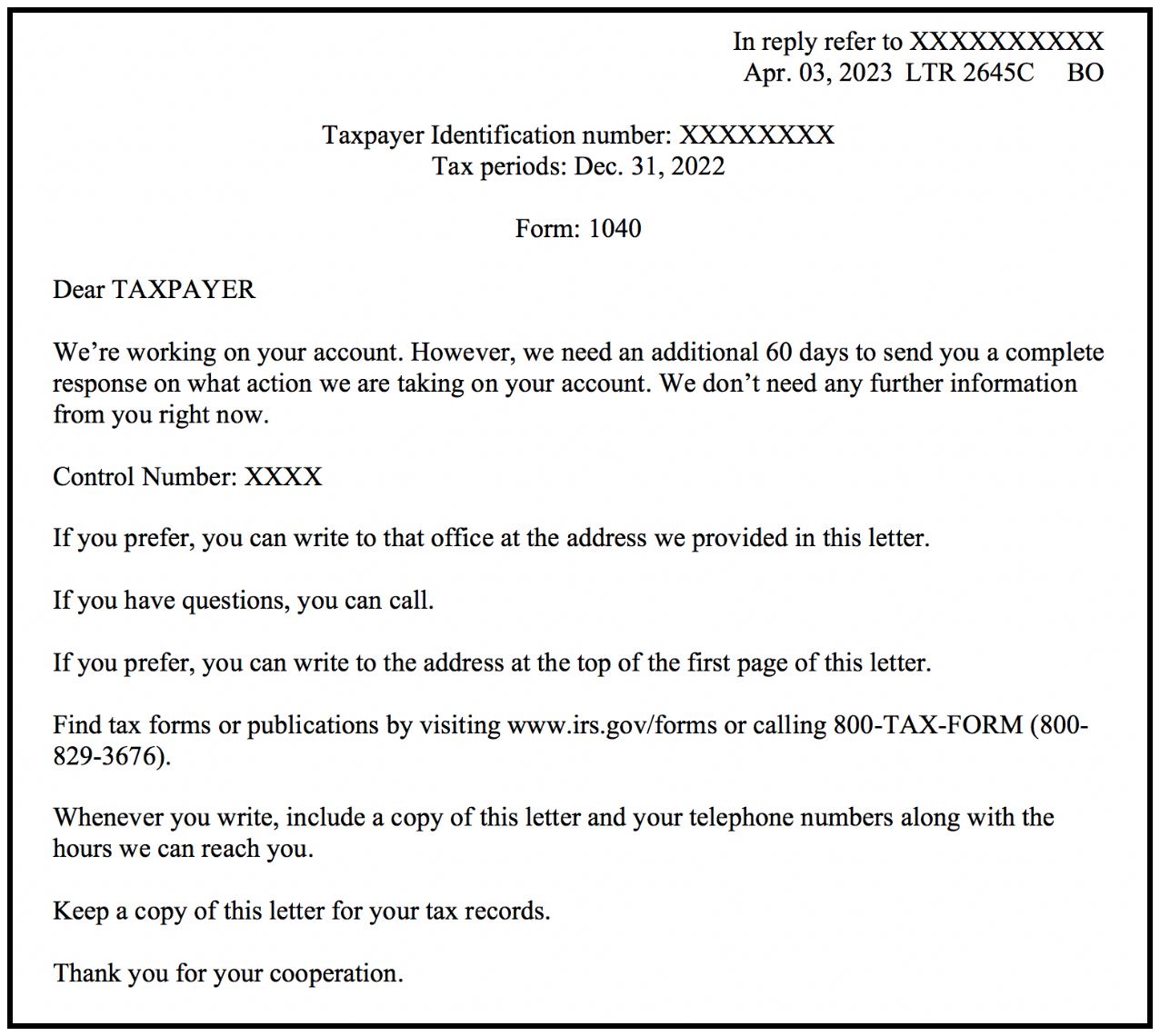

Step 8: Sign and Date Your Letter

Signing and dating your letter is a crucial step when communicating with the IRS. It serves as a way to authenticate your communication and demonstrate your agreement and commitment to the content of the letter. Here’s what you need to keep in mind when signing and dating your letter:

- Sign your full name: Sign the letter using your full legal name as it appears on official documents. This adds a personal touch and ensures that your identity is clearly established.

- Use a consistent signature: Aim to use a consistent signature across all documents to avoid any confusion or discrepancies. It’s important to sign your name in a way that is legible and matches previous signatures.

- Date the letter: Include the date of writing the letter. This serves as a reference point for both you and the IRS and helps maintain a chronological record of communication.

- Consider using a formal closing: After signing your name, you may include a formal closing such as “Sincerely” or “Best regards.” This adds a courteous and professional touch to your letter.

Signing and dating your letter is a simple yet crucial step to ensure the authenticity and validity of your communication. It signifies your commitment to the content of the letter and signifies that you are the one responsible for its contents.

Now that you have signed and dated your letter, it’s important to make copies for your records. Keeping copies of all correspondence with the IRS helps you maintain an organized documentation trail and enables you to refer back to it if needed.

Step 9: Make Copies for Your Records

Making copies of your letter and all relevant documents is a critical step to maintain a comprehensive record of your communication with the IRS. By keeping copies for your records, you have a reference to refer back to, track the progress of your case, and ensure that all necessary documentation is readily available if needed. Here’s what you should do when making copies for your records:

- Make copies of the complete letter: Copy the entire letter, including all pages, attachments, and enclosures. This ensures that you have an exact replica of the original letter and all supporting documents.

- Label and organize your copies: Clearly label and organize your copies in a systematic manner. Consider using a filing system that works for you, such as organizing by date or by different tax-related categories.

- Create a digital backup: In addition to physical copies, it’s recommended to create a digital backup of your letter and documents. This can be done by scanning or photographing them and saving them on your computer or a secure cloud storage service.

- Keep a record of important dates: Make note of the dates when you sent the letter and any subsequent correspondence or responses from the IRS. This helps maintain a timeline of events and aids in tracking the progress of your case.

- Store copies securely: Store your copies in a safe and secure place to protect them from being lost, damaged, or accessed by unauthorized individuals. Consider using a locked filing cabinet or a password-protected digital storage system.

By making copies for your records, you create a well-organized and easily accessible documentation trail of your communication with the IRS. This can prove invaluable if you need to refer back to specific details, provide additional information, or resolve any potential discrepancies in the future.

Congratulations! You have now completed all the necessary steps to write and submit your letter to the IRS. By following this comprehensive guide, you have increased your chances of receiving a prompt and satisfactory response to your concerns or inquiries. Remember to keep copies of all your correspondence for your records, and should you need further assistance, do not hesitate to reach out to the appropriate IRS department or seek professional advice.

Conclusion

Crafting a well-written and effective letter to the IRS requires careful thought, attention to detail, and a strategic approach. By following the step-by-step guide outlined in this article, you can enhance your chances of effectively communicating your concerns or inquiries and receiving a prompt response from the IRS.

From gathering the necessary information to formatting your letter correctly, addressing the IRS properly, and providing a clear and concise explanation, each step plays a crucial role in ensuring your letter is impactful and informative. Attaching relevant documents, requesting a response, and signing and dating your letter add further credibility and professionalism to your communication.

Remember, accuracy, professionalism, and courtesy are paramount when dealing with the IRS. Be thorough in organizing your information, follow the proper formatting guidelines, and be concise and specific in your explanation. Always maintain a respectful tone, clearly articulate your expectations, and provide the necessary supporting documents to strengthen your case.

Making copies for your records is not only a practical step but also a necessary one. Retaining copies of your letter and all relevant documents will serve as an invaluable resource, allowing you to track the progress of your case and access important information when needed.

By adhering to these guidelines, you can navigate the process of writing a letter to the IRS with confidence and increase the likelihood of a satisfactory outcome to your tax-related matters.

Remember that the IRS receives a large volume of correspondence, so it’s important to exercise patience while awaiting a response. If you do not receive a timely reply, it may be appropriate to follow up or seek further assistance from the appropriate IRS department or a tax professional.

Writing a letter to the IRS can feel daunting, but with the right preparation and approach, you can effectively convey your concerns and engage in a productive dialogue with the IRS. Stay organized, be clear and concise, and maintain a professional and respectful tone throughout the process. Your efforts will help ensure that your tax-related issues are addressed in a timely and satisfactory manner.