Home>Finance>How Trade Finance Allows Multinational Firms To Operate Across Country Boarders

Finance

How Trade Finance Allows Multinational Firms To Operate Across Country Boarders

Published: January 21, 2024

Discover how trade finance enables multinational firms to operate seamlessly across country borders, leveraging the power of finance to drive global success.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Importance of Trade Finance for Multinational Firms

- Overview of Trade Finance

- Types of Trade Finance Instruments

- Benefits of Trade Finance for Multinational Firms

- Challenges and Risks in Trade Finance

- Case Studies of Multinational Firms Utilizing Trade Finance

- Best Practices for Utilizing Trade Finance in Cross-Border Operations

- Conclusion

Introduction

In today’s global economy, multinational firms face numerous challenges when it comes to conducting business across international borders. One of the most significant hurdles they encounter is navigating the complex world of international trade. The ability to import and export goods and services efficiently and effectively is crucial for the success and growth of these companies. This is where trade finance plays a vital role.

Trade finance refers to the financial instruments and products that facilitate international trade transactions. It provides funding and risk mitigation solutions to help companies manage the uncertainties and complexities associated with cross-border trading.

For multinational firms, trade finance is not just a tool for financial support; it is a strategic enabler that allows them to optimize their supply chains, expand their customer base, and explore new market opportunities. Through various trade finance instruments such as letters of credit, export credit insurance, and factoring, these firms can mitigate payment risks, ensure timely delivery of goods, and enhance their overall trade efficiency.

In this article, we will explore the importance of trade finance for multinational firms and delve into the various types of trade finance instruments available. We will also discuss the benefits and challenges associated with trade finance and examine case studies of multinational firms that have successfully utilized trade finance in their cross-border operations. Lastly, we will provide best practices for effectively utilizing trade finance and maximizing its potential for multinational firms.

Importance of Trade Finance for Multinational Firms

Trade finance plays a crucial role in the success of multinational firms by providing them with the necessary financial support and risk mitigation tools to navigate the complex landscape of international trade. Let’s explore the key reasons why trade finance is important for these companies:

1. Mitigating Payment Risks: When engaging in cross-border trade, multinational firms face the risk of non-payment or delayed payment from their buyers or importers. Trade finance instruments such as letters of credit provide assurance to both parties involved in the transaction. The exporter receives a guarantee of payment from the importer’s bank, while the importer gains confidence that the goods will be delivered as per the agreed terms before making the payment.

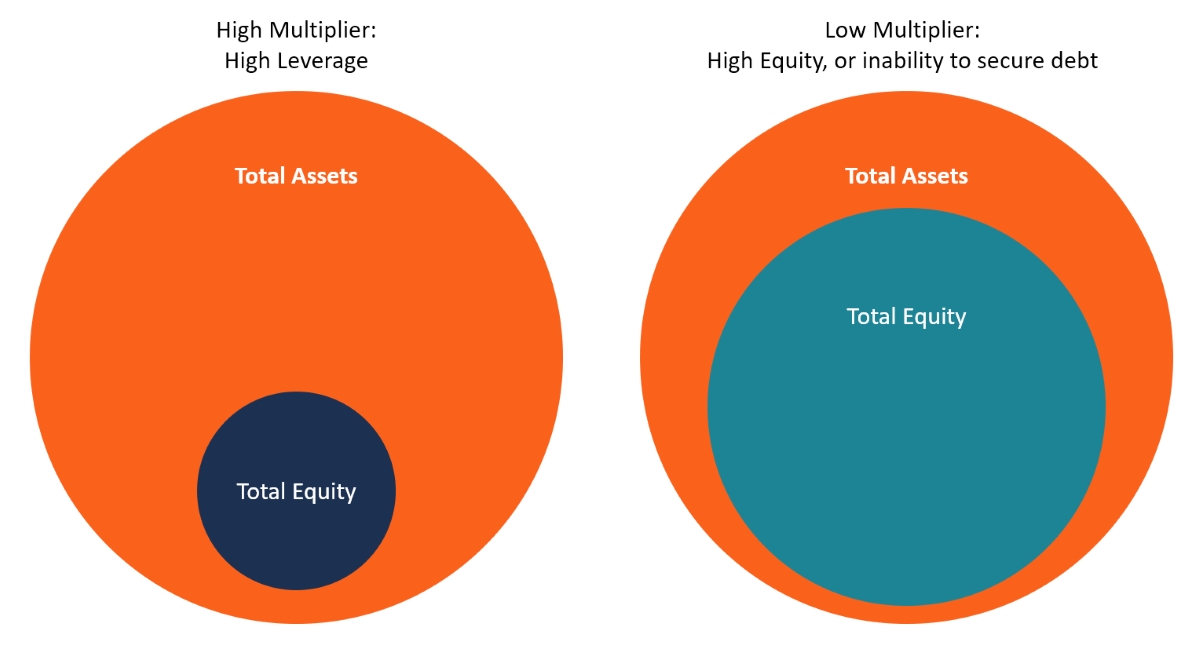

2. Optimizing Cash Flow: International trade transactions often involve lengthy payment cycles, which can strain a firm’s cash flow. Trade finance solutions, such as factoring or invoice discounting, allow multinational firms to access immediate cash by selling their receivables to a financial institution. This helps to improve liquidity and enables the company to manage its working capital more efficiently.

3. Expanding Market Opportunities: Trade finance enables multinational firms to explore new market opportunities and expand their customer base. By providing financial support and risk mitigation, trade finance instruments allow companies to enter new markets with confidence, even in regions where there may be perceived political or economic risks.

4. Enhancing Supply Chain Efficiency: Trade finance helps to streamline and optimize the supply chain operations of multinational firms. Through instruments like export credit insurance, which provides protection against buyer default or country risks, firms can ensure the smooth flow of goods and services across borders. This minimizes the disruptions caused by unforeseen events and allows for better inventory management and planning.

5. Leveraging Competitive Advantage: Trade finance provides multinational firms with a competitive edge in the global marketplace. By utilizing trade finance solutions, companies can offer favorable terms of trade to their customers, such as deferred payment options or access to trade credit. This enhances their market position and increases their chances of winning contracts over competitors.

In summary, trade finance is of paramount importance for multinational firms as it enables them to mitigate payment risks, optimize cash flow, expand market opportunities, enhance supply chain efficiency, and leverage their competitive advantage. By utilizing trade finance instruments effectively, these companies can navigate the complexities of international trade and maximize their growth potential in the global market.

Overview of Trade Finance

Trade finance encompasses a wide range of financial products and services designed to facilitate international trade transactions for multinational firms. It involves the financing, insurance, and guaranteeing of payment and delivery of goods and services between importers and exporters. Let’s take a closer look at the key components of trade finance:

1. Letters of Credit (LC): Letters of credit are a popular trade finance instrument that provides a guarantee of payment from a buyer’s bank to an exporter. In a typical LC transaction, the importer’s bank issues a letter of credit in favor of the exporter, assuring them timely payment if certain conditions (such as presenting required documents) are met. This mitigates the payment risks for both parties and ensures the smooth flow of trade.

2. Trade Loans: Trade loans are a form of financing provided to facilitate international trade. They can be short-term or medium-term loans tailored to the specific trade transaction’s needs. These loans help bridge the gap between the exporter’s need for working capital to produce and ship goods and the importer’s payment timeline.

3. Export Credit Insurance: Export credit insurance protects exporters against non-payment or delays in payment by their foreign buyers. It provides coverage for political risks (such as war, insolvency of the buyer’s country) and commercial risks (such as buyer default). This helps exporters safeguard their cash flow and reduces the risk of loss due to non-payment.

4. Factoring and Invoice Discounting: Factoring and invoice discounting involve selling accounts receivables (invoices) at a discount to a financial institution to access immediate cash. This helps to improve the exporter’s cash flow by converting their receivables into cash, eliminating the need to wait for the buyer to make the payment.

5. Bank Guarantees: Bank guarantees are financial instruments issued by a bank to provide assurance of payment or performance in a trade transaction. They act as a commitment from the bank to pay the recipient in case the buyer does not fulfill their obligations or defaults on the payment.

These are just a few examples of the trade finance instruments available to multinational firms. The choice of trade finance solutions depends on various factors such as the type of trade transaction, the level of risk involved, and the specific requirements of the parties involved.

Trade finance not only benefits the importing and exporting parties but also plays a vital role for banks and financial institutions. They generate revenue through fees and interest charges associated with trade finance products and services, while also minimizing their risk exposure by establishing stringent compliance measures and credit assessments.

In summary, trade finance provides the necessary financial tools and services to facilitate international trade, ensuring the timely payment and delivery of goods and services. It helps mitigate risks for both importers and exporters, improves cash flow, and promotes international trade growth for multinational firms.

Types of Trade Finance Instruments

Trade finance encompasses a wide range of instruments that help facilitate international trade transactions for multinational firms. These instruments provide financial support, risk mitigation, and assurance to both importers and exporters. Let’s explore some of the key types of trade finance instruments:

- Letters of Credit (LC): Letters of credit are one of the most widely used trade finance instruments. They provide a guarantee of payment from the buyer’s bank to the exporter. In an LC transaction, the buyer’s bank issues a letter of credit to the exporter, stating that payment will be made upon presentation of specified documents and compliance with the terms and conditions of the letter of credit.

- Documentary Collections: Documentary collections involve the payment and transfer of documents through banks. The exporter presents the shipping documents to their bank, which then forwards them to the importer’s bank. The importer can obtain the documents upon making payment or accepting a time draft. This type of trade finance instrument reduces payment risks but does not provide the same level of payment guarantee as letters of credit.

- Trade Loans: Trade loans are short-term or medium-term financing options provided to facilitate international trade transactions. They help bridge the financing gap between the exporter’s need for working capital and the importer’s payment timeline. These loans can be structured based on the specific needs of the trade transaction and can be used for various purposes, such as purchasing raw materials or funding production.

- Export Credit Insurance: Export credit insurance provides protection to exporters against non-payment or delays in payment by their foreign buyers. It covers both political risks (such as war, insolvency of the buyer’s country) and commercial risks (such as buyer default). Export credit insurance helps exporters safeguard their cash flow and minimize the risk of loss due to non-payment.

- Factoring and Invoice Discounting: Factoring and invoice discounting involve selling accounts receivables (invoices) at a discount to a financial institution. This provides immediate cash to the exporter, eliminating the need to wait for the buyer to make the payment. Factoring is when the financial institution takes over the collection of receivables, while invoice discounting allows the exporter to retain control over the collection process.

- Bank Guarantees: Bank guarantees are commitments issued by a bank to pay a specified amount to the recipient in case the buyer fails to fulfill their obligations or defaults on payment. These guarantees provide assurance to the parties involved that their interests are protected and payment will be made in the event of non-performance by the buyer.

These are just a few examples of the trade finance instruments available to multinational firms. The choice of instrument depends on factors such as the type of trade transaction, the level of risk involved, and the specific requirements of the parties involved. It’s crucial for multinational firms to thoroughly assess their trade finance needs and consult with financial experts to determine the most suitable instruments for their cross-border operations.

Benefits of Trade Finance for Multinational Firms

Trade finance offers numerous benefits to multinational firms, enabling them to optimize their international trade operations and expand their global footprint. Let’s explore some of the key benefits of trade finance:

- Risk Mitigation: Trade finance instruments like letters of credit, export credit insurance, and bank guarantees provide risk mitigation for both importers and exporters. These instruments mitigate payment risks, ensuring that sellers receive payment and buyers receive goods as per the agreed terms. This minimizes the financial and operational risks associated with cross-border trade transactions.

- Working Capital Optimization: Trade finance helps multinational firms optimize their working capital. By offering options such as factoring or invoice discounting, companies can convert their accounts receivables into immediate cash, improving liquidity and allowing for better management of day-to-day operations.

- International Market Expansion: Trade finance provides the necessary financial support for multinational firms to explore new market opportunities. By mitigating risks and providing funding options, trade finance enables companies to enter new markets and expand their customer base. This enhances their competitiveness and drives business growth.

- Enhanced Cash Flow: International trade transactions often involve lengthy payment cycles, which can create cash flow challenges for multinational firms. Trade finance solutions bridge the gap between the exporter’s need for immediate cash and the importer’s payment timeline. This results in improved cash flow, allowing companies to meet their financial obligations and reinvest in their business.

- Optimized Supply Chain: Trade finance instruments, such as export credit insurance, help multinational firms optimize their supply chain operations. By minimizing the risks associated with non-payment or delays in payment, firms can ensure the timely delivery of goods and services. This leads to improved inventory management, reduced operational disruptions, and increased customer satisfaction.

- Competitive Advantage: Utilizing trade finance instruments can give multinational firms a competitive edge in the global marketplace. By offering favorable trade terms, such as deferred payment options or access to trade credit, companies can attract more customers and secure business contracts over their competitors. This strengthens their market position and drives revenue growth.

In summary, trade finance provides a range of benefits to multinational firms. It mitigates payment risks, optimizes working capital, facilitates international market expansion, improves cash flow, optimizes supply chain operations, and enhances their competitive advantage. By leveraging trade finance effectively, multinational firms can navigate the complexities of international trade and achieve sustainable growth in the global market.

Challenges and Risks in Trade Finance

While trade finance offers numerous benefits to multinational firms, it is important to note that there are also various challenges and risks associated with utilizing trade finance. Understanding these challenges is crucial for companies to effectively manage and mitigate potential risks. Let’s explore some of the key challenges and risks in trade finance:

- Complex Documentation: Trade finance transactions often involve intricate documentation requirements. The process of preparing and validating documents, such as letters of credit or export documentation, can be time-consuming and prone to errors. Failure to comply with the required documentation can lead to delays in payment or even non-payment.

- Credit and Counterparty Risks: There is inherent credit risk in trade finance, particularly when dealing with new or unfamiliar trading partners. The risk of non-payment or default by the buyer or exporter can have significant financial implications. Thorough due diligence and credit assessment are essential to mitigate these risks and ensure the financial stability of the parties involved.

- Political and Economic Risks: Trade finance transactions can be exposed to political and economic risks associated with operating in different countries. Political instability, changes in government regulations, currency fluctuations, and economic downturns can impact trade finance operations and increase the risk of non-payment or delays in payment.

- Compliance and Regulatory Requirements: Trade finance is subject to various international trade regulations and compliance requirements, such as sanctions, anti-money laundering (AML), and know-your-customer (KYC) regulations. Non-compliance with these regulations can lead to penalties, reputational damage, and disruption of trade finance activities.

- Operational and Logistics Challenges: International trade involves complex logistics, including transportation, customs clearance, and delivery of goods. Delays or disruptions in these processes can impact the timely execution of trade finance transactions, leading to financial and operational challenges.

- Fraud and Cybersecurity Risks: Trade finance transactions are susceptible to fraud, including document forgery, double financing, and identity theft. The increasing reliance on digital platforms and online communication in trade finance also introduces cybersecurity risks. Strong risk management practices and robust cybersecurity measures are necessary to mitigate these risks.

To effectively mitigate the challenges and risks in trade finance, multinational firms should adopt comprehensive risk management strategies. This includes conducting thorough due diligence on trading partners, implementing robust compliance procedures, maintaining strong internal controls, and utilizing trade finance instruments with appropriate risk mitigation features. Working closely with experienced trade finance professionals and leveraging technology solutions can further enhance risk management and ensure smoother trade finance operations.

By proactively addressing these challenges and risks, multinational firms can navigate the complexities of trade finance and maximize the benefits of international trade while minimizing potential disruptions and financial losses.

Case Studies of Multinational Firms Utilizing Trade Finance

Several multinational firms have successfully utilized trade finance to optimize their international trade operations and achieve business growth. Let’s explore a few case studies that highlight the benefits of trade finance:

Case Study 1: Company X

Company X is a global electronics manufacturer based in country A, with a large customer base in country B. To meet the growing demand for their products, Company X had to import raw materials from suppliers in country C. However, long payment cycles posed a challenge for their cash flow. To address this, they decided to utilize trade finance solutions, specifically letters of credit and trade loans. By leveraging letters of credit, Company X gained assurance of payment from their buyers, ensuring smooth cash flow upon delivery of goods. Additionally, the trade loans allowed them to bridge the financing gap and maintain sufficient working capital to fulfill their production needs. As a result, Company X was able to fulfill orders promptly, expand their market share, and strengthen their position as a reliable electronics manufacturer in multiple countries.

Case Study 2: Company Y

Company Y is a multinational clothing retailer that sources garments from various suppliers around the world and sells them in their stores across different countries. With a high volume of trade transactions and a need for efficient working capital management, Company Y utilized trade finance instruments such as factoring and credit insurance. By factoring their accounts receivables, they gained immediate cash flow to purchase new inventory and expand their product offerings. Moreover, they mitigated the risk of buyer non-payment by obtaining export credit insurance, ensuring that their cash flow was protected even in the event of buyer default. These trade finance strategies allowed Company Y to maintain steady growth, optimize their supply chain, and explore new sourcing opportunities while minimizing payment risks.

Case Study 3: Company Z

Company Z is a multinational energy firm involved in large-scale infrastructure projects globally. To successfully execute their projects, Company Z relied on trade finance instruments such as performance guarantees and project finance loans. These instruments provided assurance to their clients that Company Z would fulfill their contractual obligations, ensuring successful project completion. Additionally, project finance loans allowed Company Z to access the necessary funding for their construction and development activities. By utilizing trade finance, Company Z expanded their operations across borders, engaged in extensive infrastructure projects, and built a reputation as a reliable and financially capable energy firm.

These case studies demonstrate how multinational firms have leveraged trade finance instruments to overcome challenges, enhance cash flow, manage risks, and expand their international operations. By effectively utilizing trade finance, these companies have not only achieved financial success but have also strengthened their credibility and competitiveness in the global marketplace.

Best Practices for Utilizing Trade Finance in Cross-Border Operations

Utilizing trade finance effectively is essential for multinational firms to optimize their cross-border operations and mitigate risks associated with international trade. Here are some best practices to consider when utilizing trade finance:

- Thoroughly Assess Trade Finance Needs: Conduct a comprehensive assessment of your trade finance requirements, taking into account factors such as payment terms, financing needs, risk tolerance, and compliance obligations. This will help determine the most suitable trade finance instruments for your specific business needs.

- Partner with Reputable Financial Institutions: Choose trusted and reputable financial institutions as your trade finance partners. Collaborate with banks and other financial institutions that have expertise in international trade finance and a strong track record of supporting multinational firms.

- Develop Relationships with Trading Partners: Build strong relationships with your trading partners, including buyers, suppliers, and financial institutions. Open and consistent communication will help establish mutual trust and ensure smooth trade finance transactions.

- Thoroughly Review Trade Finance Contracts: Carefully review and negotiate trade finance contracts to ensure clarity and compliance with your business objectives and legal requirements. Seek legal advice when necessary to understand the terms and obligations of the contracts.

- Implement Robust Risk Management: Establish a robust risk management framework when utilizing trade finance. Conduct risk assessments, perform due diligence on trading partners, monitor market and geopolitical risks, and implement effective internal controls to mitigate potential risks and protect your business interests.

- Stay Updated with International Trade Regulations: Stay abreast of international trade regulations, sanctions, compliance requirements, and export/import regulations. Continuously monitor changes in trade laws and ensure your trade finance activities are in compliance with these regulations to avoid legal and financial repercussions.

- Leverage Technology Solutions: Utilize technology solutions to streamline trade finance operations, improve efficiency, and enhance transparency. Explore digital platforms for document processing, electronic fund transfers, and trade finance management systems to simplify and automate trade finance processes.

- Continuously Evaluate and Optimize: Regularly evaluate the effectiveness of your trade finance strategies and performance. Identify areas for improvement, adapt to changing market conditions, and proactively explore new trade finance solutions that align with your evolving business needs.

By following these best practices, multinational firms can effectively utilize trade finance to enhance their cross-border operations, minimize risks, optimize cash flow, and drive business growth in the global marketplace.

Conclusion

Trade finance plays a vital role in the success of multinational firms operating across international borders. The various trade finance instruments and solutions available provide financial support, risk mitigation, and efficiency optimization for companies engaged in cross-border trade. By utilizing trade finance effectively, multinational firms can navigate the complexities of international trade, enhance their cash flow, mitigate risks, and expand their global footprint.

From letters of credit and trade loans to export credit insurance and factoring, trade finance offers a range of benefits. It mitigates payment risks, optimizes working capital, expands market opportunities, enhances supply chain efficiency, and provides a competitive advantage in the global marketplace.

However, it is essential to acknowledge the challenges and risks associated with trade finance. Complex documentation requirements, credit and counterparty risks, political and economic risks, compliance obligations, operational challenges, and fraud risks require careful management and mitigation strategies.

To best utilize trade finance in cross-border operations, multinational firms should thoroughly assess their trade finance needs, partner with reputable financial institutions, develop strong relationships with trading partners, review contracts diligently, implement robust risk management practices, stay updated with trade regulations, leverage technology solutions, and continuously evaluate and optimize their trade finance strategies.

In conclusion, trade finance is a valuable tool for multinational firms seeking to expand their global presence, manage risks, and maximize business opportunities. By effectively utilizing trade finance and adopting best practices, companies can achieve sustainable growth, optimize their supply chain operations, and maintain a competitive edge in the dynamic global marketplace.