Home>Finance>Incentive Fee: Definition, Calculation Methods, Examples

Finance

Incentive Fee: Definition, Calculation Methods, Examples

Published: December 7, 2023

Explore the concept of incentive fee in finance, including its definition, calculation methods, and real-world examples. Discover how this fee structure influences investment decisions and profitability.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Incentive Fee: Definition, Calculation Methods, Examples

When it comes to investing, understanding the various fees charged by financial institutions is essential. One such fee is the incentive fee, which is commonly associated with certain types of investment funds. In this blog post, we will explore the concept of incentive fees, how they are calculated, and provide real-world examples to help you grasp this important aspect of finance.

Key Takeaways

- An incentive fee is a performance-based fee charged by investment funds to their investors.

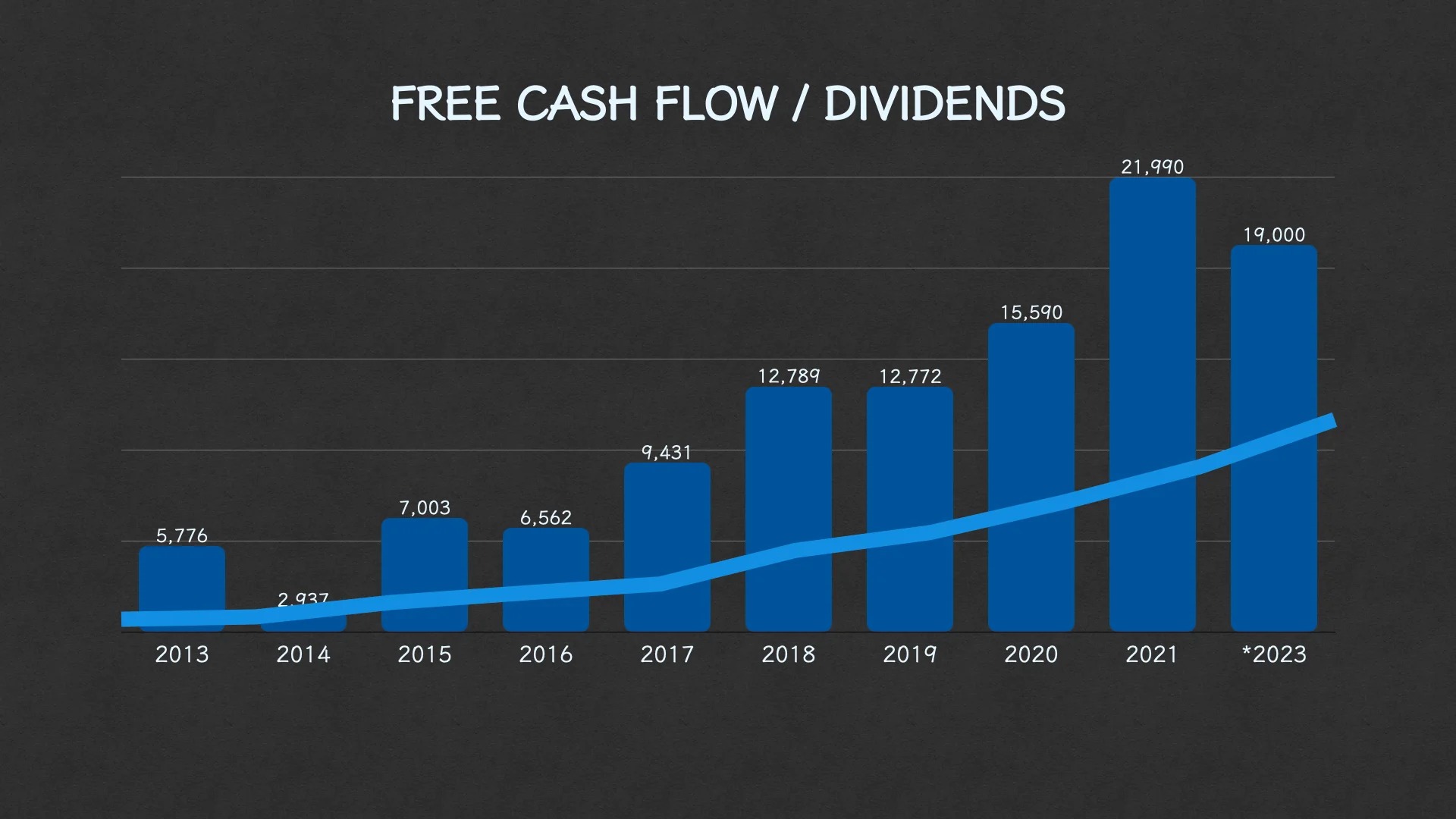

- The calculation of incentive fees typically relies on a specific formula that takes into account the fund’s performance relative to a benchmark or specified target.

So, what exactly is an incentive fee? Simply put, an incentive fee is a charge imposed by investment funds as compensation for achieving above-average returns. Unlike other types of fees, such as management fees that are charged regardless of performance, incentive fees are calculated based on the fund’s performance relative to a benchmark or specified target. This means that investors only pay incentive fees if the fund performs well.

There are various calculation methods used to determine incentive fees. One common method is the “high-water mark” concept, which ensures that incentives are only paid when the fund recovers from any previous losses and surpasses its previous performance peak. This method provides an added layer of protection for investors and motivates fund managers to focus on generating positive returns to recoup any previous losses.

Another calculation method involves applying a predetermined formula that considers the fund’s performance relative to a benchmark or target. This formula often incorporates a tiered structure, with higher levels of performance resulting in higher incentive fees. By using this approach, fund managers are incentivized to strive for superior performance, as a greater portion of the returns generated goes to them as compensation.

Real-World Examples

To illustrate how incentive fees work in practice, let’s consider two examples:

- Example 1: Hedge Fund X

- Hedge Fund X charges a 20% incentive fee.

- The fund’s benchmark is set at a 10% annual return.

- If the fund achieves a 15% annual return, investors would pay an incentive fee equivalent to 20% of the outperformance, which in this case is 5% (15% return – 10% benchmark).

- Example 2: Private Equity Fund Y

- Private Equity Fund Y charges a 25% incentive fee.

- The fund has a high-water mark structure in place.

- If the fund experiences a loss of 5% one year, investors would not be charged an incentive fee until the fund recovers and surpasses its previous high-water mark.

- Once the fund achieves a return of 10%, investors would pay a 25% incentive fee on the portion of returns above the high-water mark.

In both examples, the incentive fee is directly tied to the fund’s performance, providing fund managers the motivation to outperform the benchmark or target return. This alignment of interests between investors and fund managers ensures that both parties benefit when the fund performs well.

Understanding incentive fees is crucial for investors. By knowing how they are calculated and the potential impact on investment returns, investors can make more informed decisions when choosing investment funds. Keep in mind that incentive fees may vary depending on the specific fund and its terms, so it’s essential to carefully review the fee structure before committing capital.

In conclusion, incentive fees are performance-based charges that reward investment fund managers for generating above-average returns. These fees are calculated using various methods, such as the high-water mark concept or predetermined formulas that consider a fund’s performance relative to a benchmark or target. Real-world examples help illustrate how these fees work in practice. As investors, understanding incentive fees will empower you to navigate the world of finance with greater confidence and knowledge.