Home>Finance>Indexing: Definition And Uses In Economics And Investing

Finance

Indexing: Definition And Uses In Economics And Investing

Published: December 8, 2023

Discover the meaning and applications of indexing in finance, encompassing its role in economics and investing. Explore the significance and benefits of this financial concept.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Indexing: Definition and Uses in Economics and Investing

Welcome to our FINANCE category! In today’s blog post, we will delve into the world of indexing and explore its definition and uses in economics and investing. If you’ve ever wondered what indexing is and how it can impact your financial decisions, you’ve come to the right place!

Key Takeaways:

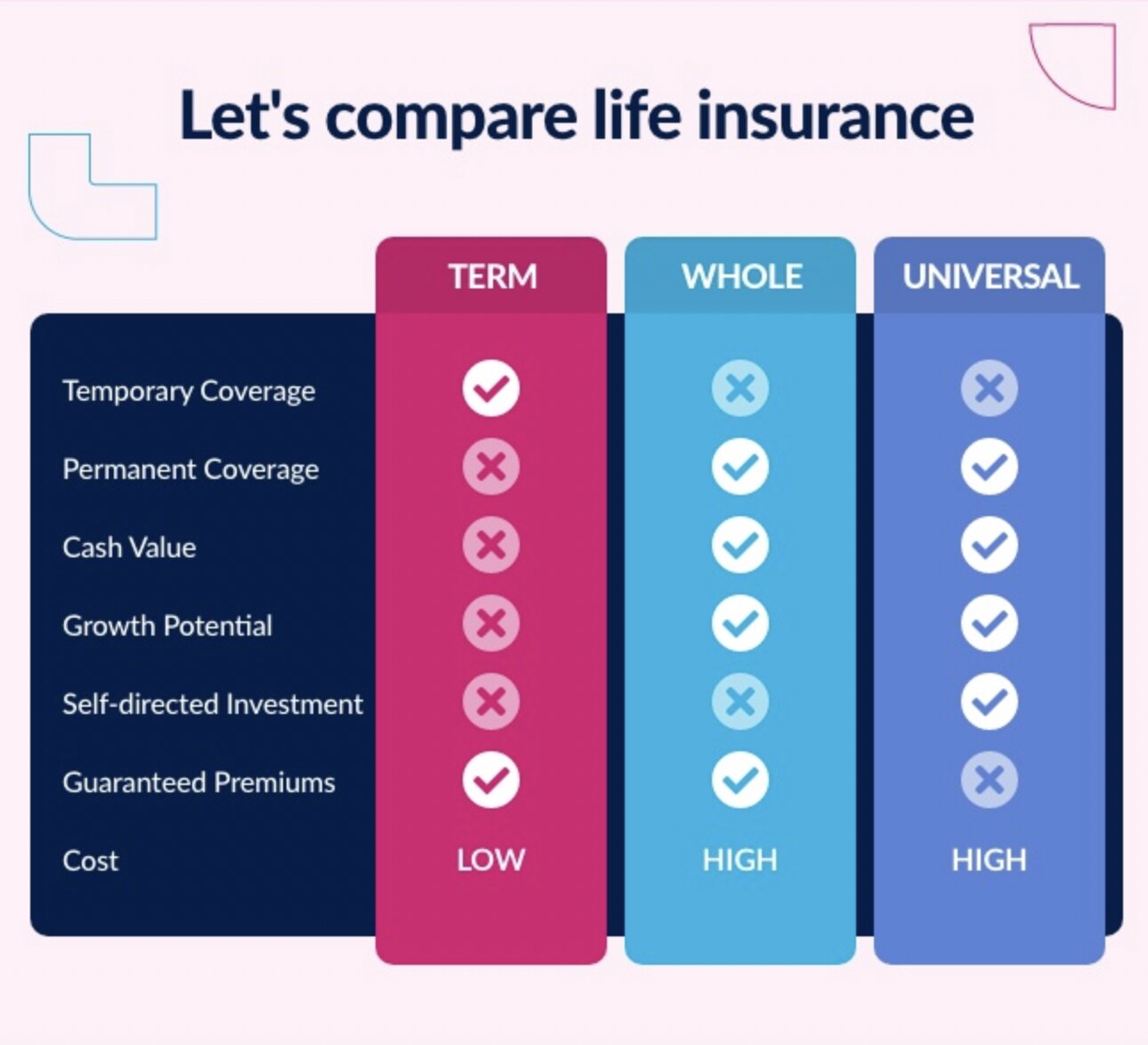

- Indexing is a method used to track and measure the performance of a specific group of stocks, bonds, or other investment vehicles.

- Index funds are popular investment options for individuals seeking diversification and passive investing strategies.

Before we jump into the details, let’s answer the burning question: what exactly is indexing? In the realm of finance, indexing refers to the practice of creating and maintaining an index, which is a statistical measure used to represent the overall performance or changes in a particular market or sector. Indexing allows investors to track the performance of a specific group of assets, such as stocks, bonds, or commodities, without having to own each individual security.

Now that we have a basic understanding of indexing, let’s explore its uses in economics and investing:

1. Measuring Market Performance:

Indexing plays an essential role in measuring the overall performance of a market or sector. By tracking an index, economists and analysts can gauge market sentiment, identify trends, and assess the health of the economy. This information can be crucial for policymakers, investors, and businesses to make informed decisions.

2. Investing and Portfolio Management:

Indexing has revolutionized the investment landscape with the invention of index funds. These funds replicate the performance of a specific index by holding a diversified portfolio of assets that mirror the index’s composition. Index funds provide investors with an opportunity to participate in the broader market without the need for active stock picking or market timing. This passive investment strategy is often favored by those seeking long-term growth and lower fees compared to actively managed funds.

In conclusion, indexing is a powerful tool used in economics and investing to measure market performance and provide investors with passive investment options. Whether you’re an economist analyzing market trends or an individual looking for a low-cost and diversified investment strategy, indexing has something to offer. By understanding the principles behind indexing, you can make more informed decisions and navigate the complex world of finance with confidence!

Thank you for reading our blog post on indexing in economics and investing. We hope you found it insightful and informative. Stay tuned for more exciting topics in our FINANCE category!