Home>Finance>Interest Rate Cap Structure: Definition, Uses, And Examples

Finance

Interest Rate Cap Structure: Definition, Uses, And Examples

Published: December 11, 2023

Learn about interest rate cap structure, its definition, uses, and examples in finance. Discover how this tool can benefit your financial strategies.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Interest Rate Cap Structures: Definition, Uses, and Examples

Welcome to another installment of our Finance category, where we explore various aspects of the financial world. In today’s blog post, we will dive into the intriguing realm of interest rate cap structures. If you are wondering what an interest rate cap structure is, how it is used, and what examples exist, then you are in the right place. So, let’s get started!

Key Takeaways:

- An interest rate cap structure is a financial instrument that limits the maximum interest rate that a borrower will pay on a loan or the maximum interest rate that an investor will receive on an investment.

- Interest rate cap structures are commonly used by individuals and businesses to manage interest rate risk and protect against unexpected increases in interest rates.

What is an Interest Rate Cap Structure?

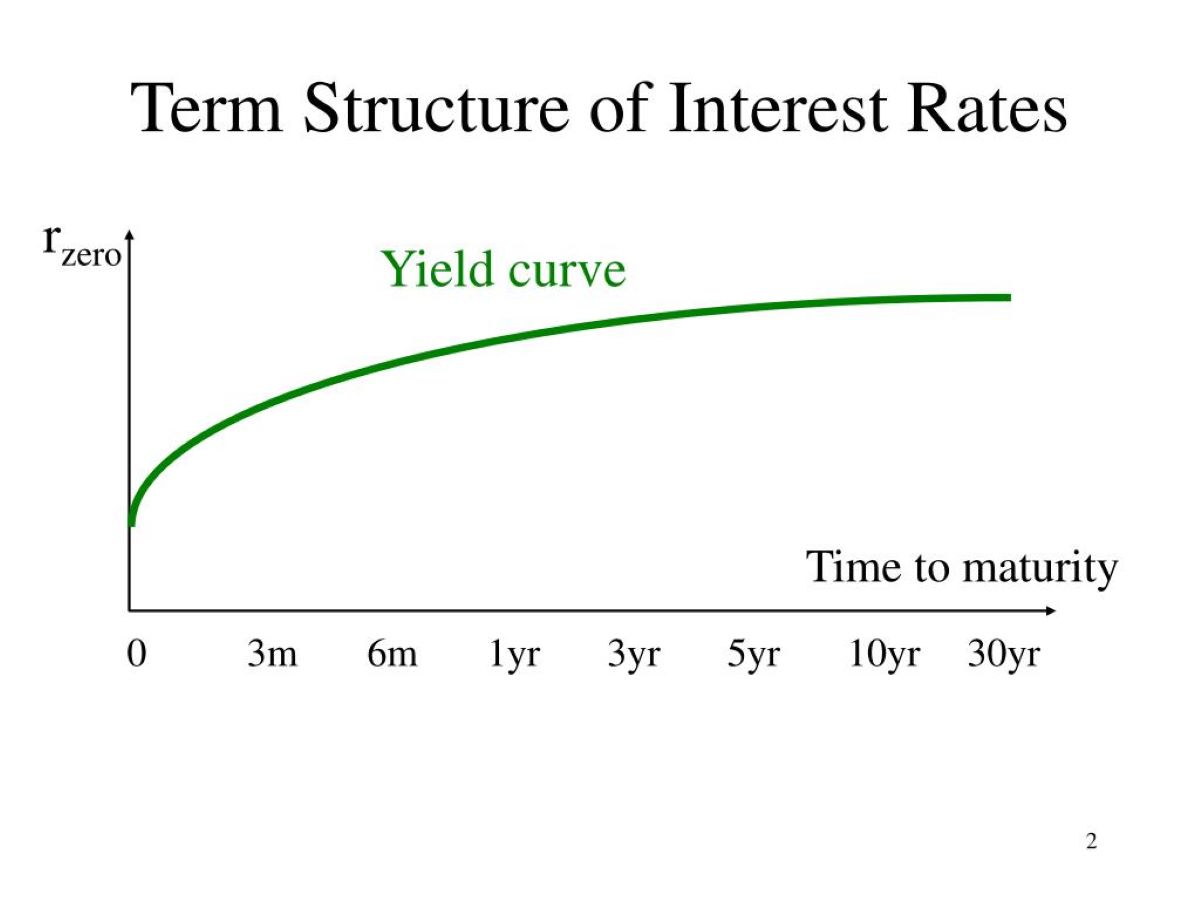

An interest rate cap structure is a financial tool that sets a limit on the maximum interest rate that a borrower will pay or the maximum interest rate that an investor will receive on a particular loan or investment. This arrangement creates a safety net for the borrower or investor, protecting them from steep increases in interest rates that could result in financial strain or reduced returns.

Interest rate cap structures are typically implemented through contracts known as interest rate caps. These contracts establish the maximum interest rate that will be charged or received, and they provide a measure of certainty and security for both parties involved.

Uses of Interest Rate Cap Structures:

Interest rate cap structures serve various purposes and have a range of applications. Here are some common uses:

- Manage Interest Rate Risk: By implementing an interest rate cap structure, borrowers can protect themselves from unexpected increases in interest rates that could lead to higher loan interest payments. It allows them to plan their finances more effectively by limiting their exposure to interest rate fluctuations.

- Stabilize Cash Flow: For individuals or businesses with variable rate loans, an interest rate cap structure can help stabilize cash flow by ensuring that interest payments remain within a manageable range. This stability can be especially crucial for budget planning and avoiding financial strain.

- Hedge Investments: Investors who hold fixed-income securities, such as bonds, can utilize interest rate cap structures to protect themselves against declining interest rates. By setting a maximum interest rate, they can ensure a minimum level of return on their investment.

- Secure Financing: Businesses seeking financing from lenders can use interest rate cap structures as a negotiation tool. By incorporating an interest rate cap, they can make their loan proposal more attractive to lenders, as it reduces the lender’s risk exposure.

Examples of Interest Rate Cap Structures:

Now that we have covered the definition and uses of interest rate cap structures, let’s take a look at a few examples:

- A homeowner with a variable rate mortgage may enter into an interest rate cap structure that limits the maximum interest rate they will pay. This protects them from dramatic increases in mortgage payments if interest rates rise.

- A corporate borrower securing a loan may negotiate an interest rate cap with the lender. This ensures that even if interest rates increase during the loan term, the borrower’s interest payments will not exceed a predetermined level.

- An investor holding a bond with a fixed interest rate may purchase an interest rate cap structure to hedge against declining interest rates. This guarantees a minimum level of return even if market rates drop.

These examples showcase how interest rate cap structures can be customized to meet the specific needs of borrowers and investors across different financial scenarios.

Interest rate cap structures play a critical role in managing interest rate risk and providing stability in the financial world. By limiting exposure to unpredictable interest rate fluctuations, individuals and businesses can make informed financial decisions and protect their overall financial well-being.

We hope this blog post has provided you with a clear understanding of interest rate cap structures and their significance in the realm of finance.