Finance

What Is The Term Structure Of Interest Rates?

Modified: February 21, 2024

Discover the concept of term structure of interest rates in finance. Understand how it impacts borrowing costs and investment returns.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of the Term Structure of Interest Rates

- Importance of the Term Structure of Interest Rates

- Factors Affecting the Term Structure of Interest Rates

- Types of Yield Curves

- Theories Explaining the Term Structure of Interest Rates

- Empirical Evidence on the Term Structure of Interest Rates

- Implications for Investors and Financial Institutions

- Conclusion

Introduction

The term structure of interest rates is a fundamental concept in finance that analyzes the relationship between the maturity of debt securities and their corresponding interest rates. It provides valuable insights into the expectations, uncertainties, and risks within the financial markets. Understanding the term structure of interest rates is essential for both investors and financial institutions as it helps in evaluating the attractiveness of various investment opportunities and managing interest rate risk.

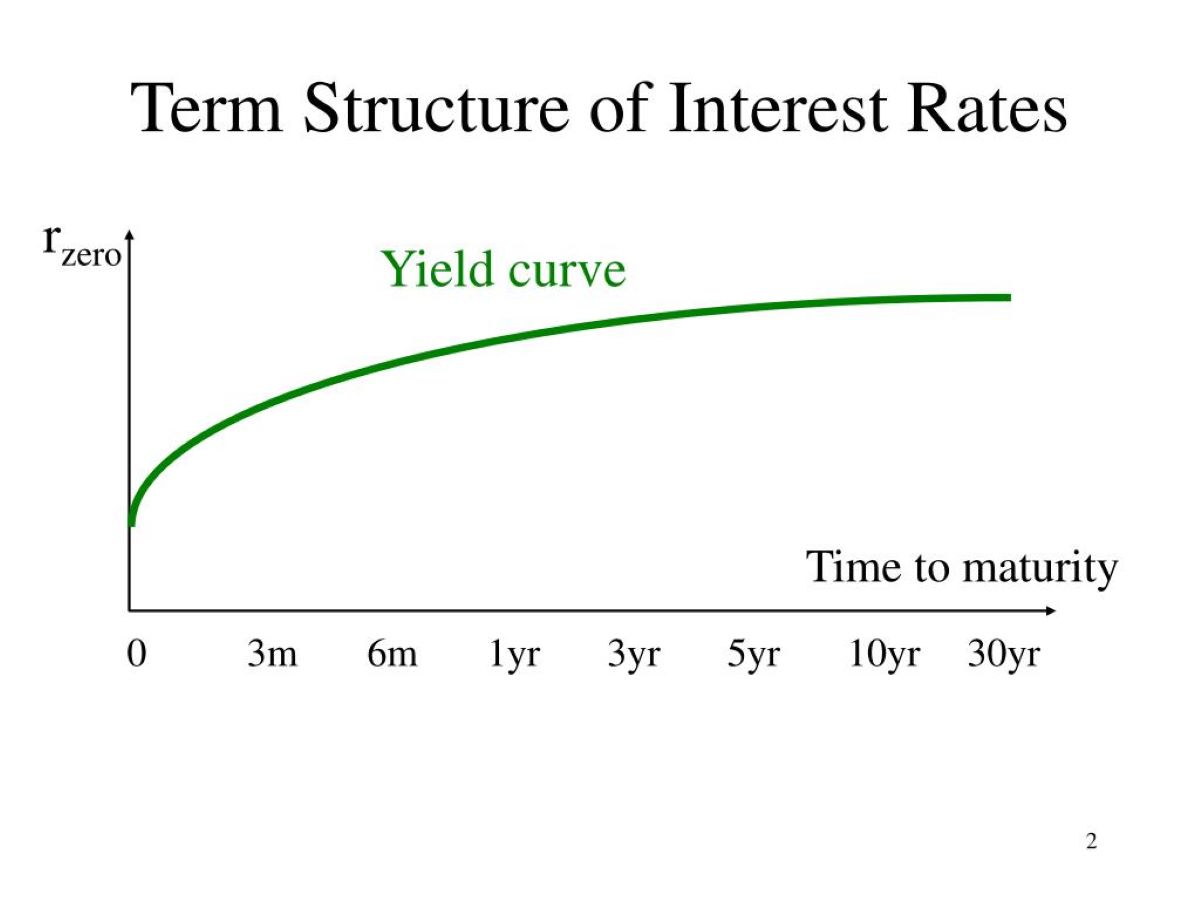

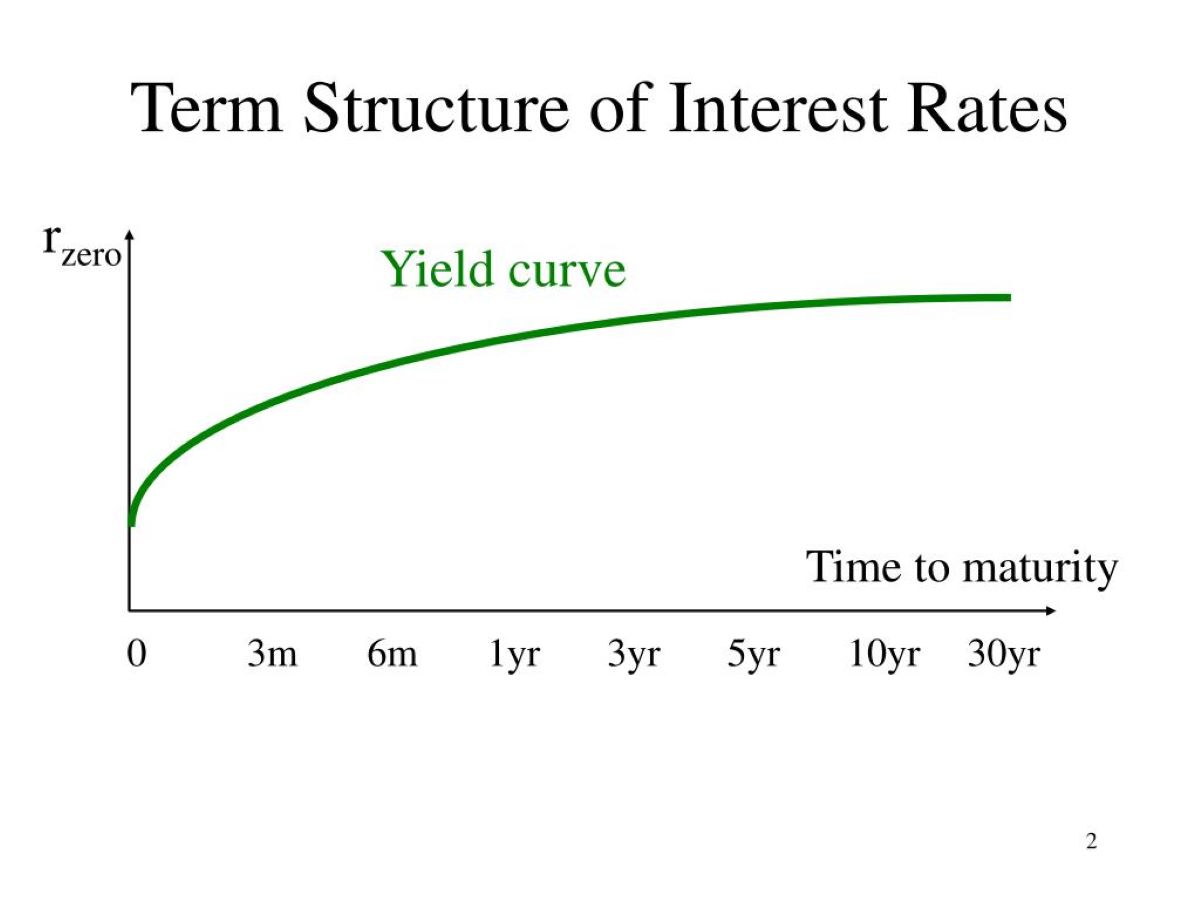

The term structure of interest rates is often represented by the yield curve, which depicts the relationship between the interest rates (or yields) on debt securities of similar credit quality but different maturities. By analyzing the shape and movement of the yield curve, market participants can glean crucial information about market expectations of future interest rates, inflation, economic growth, and market sentiments.

This article aims to provide a comprehensive understanding of the term structure of interest rates, covering its definition, importance, factors influencing it, types of yield curves, theories explaining its formation, empirical evidence, and implications for investors and financial institutions. By exploring these aspects, readers will gain a deeper insight into the intricacies of the term structure of interest rates and its significance within the broader financial landscape.

Definition of the Term Structure of Interest Rates

The term structure of interest rates refers to the relationship between the maturity of debt securities and the corresponding interest rates or yields. It explains how the interest rates on bonds, Treasury bills, or other fixed-income securities vary across different time periods. The term structure is typically represented by the yield curve, which is a graphical representation of interest rates plotted against the various maturities of debt instruments.

The yield curve provides valuable information about market expectations of future interest rates, inflation, and economic conditions. It helps investors, lenders, and borrowers make informed decisions regarding their investment and borrowing strategies.

The term structure of interest rates is influenced by a complex interplay of factors, including economic conditions, monetary policy, inflation expectations, and market sentiment. As these factors change, the shape and slope of the yield curve may fluctuate, indicating shifts in market expectations and risk perceptions.

It is important to note that the term structure of interest rates can exhibit different shapes, such as upward-sloping (normal), downward-sloping (inverted), or flat, depending on prevailing market conditions. Each shape conveys unique information about the market’s expectations of future interest rates.

Understanding the term structure of interest rates is crucial for investors and financial institutions. It allows them to assess the risk-return profile of different fixed-income investments, manage interest rate risk, and make informed decisions about refinancing or issuing debt. By analyzing the term structure, market participants can gain insights into market expectations and potentially identify arbitrage opportunities.

Overall, the term structure of interest rates is a vital component of financial markets, providing valuable information about the pricing of fixed-income securities and helping market participants navigate the ever-changing landscape of interest rates.

Importance of the Term Structure of Interest Rates

The term structure of interest rates plays a crucial role in financial markets and has significant implications for various stakeholders, including investors, financial institutions, and policymakers. Here are some key reasons why the term structure is important:

- Valuation of Fixed-Income Securities: The term structure helps investors in determining the fair value and pricing of fixed-income securities. By analyzing the yield curve, investors can assess the attractiveness of bonds and other debt instruments by comparing their yields to prevailing market rates.

- Interest Rate Expectations: The term structure provides insights into market expectations of future interest rates. By observing the shape and slope of the yield curve, investors and financial institutions can gauge whether the market anticipates interest rates to rise or fall in the future. This information assists in making strategic investment decisions and managing interest rate risk.

- Economic Conditions and Inflation: The term structure reflects market expectations of economic conditions and inflation. A steep upward-sloping yield curve generally indicates expectations of strong economic growth, while a flat or inverted yield curve may signal economic uncertainty or expectations of an economic downturn.

- Financial Planning and Borrowing Decisions: Individuals and businesses can utilize the term structure to evaluate borrowing costs and plan their financial activities. For instance, by analyzing the yield curve, borrowers can determine whether it is advantageous to take out a fixed or variable rate loan, depending on their expectations of interest rate movements.

- Monetary Policy Analysis: Central banks and policymakers closely monitor the term structure to assess the effectiveness of monetary policy measures. By observing changes in the yield curve, central banks can evaluate the impact of interest rate adjustments and implement appropriate policy actions to maintain economic stability.

Overall, the term structure of interest rates provides valuable insights into market expectations, economic conditions, and the pricing of fixed-income securities. Understanding and analyzing the term structure is essential for investors, financial institutions, and policymakers in making informed decisions, managing risk, and navigating the dynamic landscape of interest rates.

Factors Affecting the Term Structure of Interest Rates

The term structure of interest rates is influenced by a wide range of factors, both macroeconomic and financial in nature. These factors interact with each other to shape the yield curve and determine the relationship between interest rates and bond maturities. Understanding these factors is crucial for interpreting changes in the term structure. Here are some key factors that affect the term structure of interest rates:

- Economic Conditions: Macroeconomic conditions, such as GDP growth, inflation, and unemployment, have a significant impact on the term structure. During periods of economic expansion, expectations of higher future interest rates may result in an upward-sloping yield curve. On the other hand, during recessions or economic uncertainty, the yield curve may flatten or even invert as expectations of rate cuts increase.

- Monetary Policy: The monetary policy decisions made by central banks, such as interest rate adjustments and quantitative easing programs, can heavily influence the term structure. When central banks raise interest rates to combat inflation, short-term rates rise, leading to a flattening yield curve. Conversely, when central banks lower rates to stimulate economic growth, the yield curve may steepen as short-term rates decrease.

- Inflation Expectations: Inflation expectations play a crucial role in shaping the term structure. If market participants anticipate higher inflation in the future, long-term interest rates are likely to rise relative to short-term rates, resulting in a steepening yield curve. Conversely, if inflation expectations are low, the yield curve may flatten or even invert.

- Supply and Demand Dynamics: The supply and demand dynamics of bonds also affect the term structure. When there is high demand for long-term bonds, their prices rise, leading to lower yields and a downward-sloping yield curve. Conversely, if there is an oversupply of long-term bonds, their prices may fall, causing yields to increase and the yield curve to steepen.

- Risk Premium: Different maturities of bonds have varying levels of risk associated with them. Investors typically require a risk premium for holding longer-term bonds. If perceived risks increase, such as during periods of economic volatility or geopolitical uncertainty, the term structure may steepen as investors demand higher yields for longer-term bonds.

- Market Sentiment: Market sentiment and investor expectations can influence the term structure. Positive sentiment and optimism about future economic conditions may result in a steeper yield curve, while negative sentiment and concerns about economic stability can flatten or invert the yield curve.

It is important to note that these factors are interconnected and can interact in complex ways, leading to changes in the term structure of interest rates. Market participants closely monitor these factors to understand the drivers behind yield curve movements and adjust their investment strategies accordingly.

Types of Yield Curves

The term structure of interest rates can manifest in different shapes, resulting in various types of yield curves. These yield curve shapes provide insights into market expectations and can help investors and financial institutions assess the prevailing economic conditions. Here are some common types of yield curves:

- Upward-Sloping (Normal) Yield Curve: An upward-sloping yield curve is characterized by higher yields on long-term bonds compared to short-term bonds. This shape typically indicates that market participants expect higher future interest rates and economic growth. It is considered a normal yield curve and is commonly observed in stable or expanding economies.

- Flat Yield Curve: A flat yield curve occurs when there is little difference between short-term and long-term interest rates. This shape implies that market participants have limited expectations for future interest rate changes or economic growth. A flat yield curve can be a signal of economic uncertainty or a transition period between different market conditions.

- Inverted Yield Curve: An inverted yield curve is characterized by higher yields on short-term bonds compared to long-term bonds. This shape indicates market expectations of lower future interest rates and potentially signals an economic downturn or recession. Inverted yield curves have historically been associated with impending economic contractions.

- Humped (Bell-Shaped) Yield Curve: A humped yield curve features a peak in the middle, with short-term and long-term interest rates higher than intermediate-term rates. This curve shape suggests market uncertainty and mixed expectations about future interest rates and economic conditions. It may reflect a transitional phase or an equilibrium point between different market forces.

It is important to note that yield curve shapes can change over time due to shifts in economic conditions, market sentiments, and monetary policy. Market participants closely monitor these changes to gain insights into the prevailing market expectations and to inform their investment strategies and risk management decisions.

Theories Explaining the Term Structure of Interest Rates

The term structure of interest rates has long been the subject of study and analysis by economists and financial theorists. Several theories have been proposed to explain the relationship between bond maturities and interest rates. Understanding these theories can provide insights into the driving forces behind the term structure. Here are some prominent theories explaining the term structure of interest rates:

- Expectations Theory: The Expectations Theory suggests that long-term interest rates are determined by market expectations of future short-term interest rates. According to this theory, an upward-sloping yield curve implies that market participants expect short-term interest rates to rise in the future. Conversely, a downward-sloping yield curve indicates expectations of lower future interest rates. This theory assumes that investors are risk-neutral and make investment decisions based on their expectations of future interest rate movements.

- Liquidity Preference Theory: The Liquidity Preference Theory, proposed by John Maynard Keynes, posits that investors have a preference for holding liquid assets, such as cash or short-term government bonds, due to their lower risk and higher liquidity. As a result, investors require a premium, known as a liquidity premium, to hold long-term bonds. This theory suggests that the term structure of interest rates reflects the market’s assessment of the liquidity premiums required by investors for holding longer-term bonds.

- Market Segmentation Theory: The Market Segmentation Theory asserts that the term structure of interest rates is influenced by the supply and demand dynamics within specific segments of the bond market. According to this theory, investors have preferences for specific maturities of bonds, leading to independent demand and supply conditions in each segment. Changes in investor preferences and the relative supply and demand for different bond maturities can result in changes in their respective interest rates, shaping the overall term structure.

- Preferred Habitat Theory: The Preferred Habitat Theory combines elements of both the Expectations Theory and the Market Segmentation Theory. It suggests that investors may be willing to move outside their preferred maturity segments (habitats) if they are compensated with higher yields. This theory recognizes that investors have varying preferences for bond maturities based on factors such as risk tolerance, investment horizons, and regulatory constraints. Changes in the relative attractiveness across different maturity segments can lead to shifts in the term structure of interest rates.

It is worth noting that these theories offer different perspectives on the term structure of interest rates and have their limitations. The term structure is influenced by a complex interplay of various factors, and no single theory fully captures all the dynamics at play. Nonetheless, these theories provide valuable frameworks for understanding the drivers behind the term structure and serve as building blocks for further research and analysis.

Empirical Evidence on the Term Structure of Interest Rates

There has been extensive empirical research on the term structure of interest rates, aiming to validate and understand the theories that explain its formation. Empirical evidence provides insights into the behavior of interest rates across different maturities and helps investors and policymakers make informed decisions. Here are some key empirical findings on the term structure of interest rates:

- Expectations Theory: Studies have found mixed support for the Expectations Theory. While some evidence suggests that short-term interest rates are a good predictor of future long-term rates, other studies have shown that the correlation between short-term and long-term rates is weak. Factors such as market sentiment, liquidity preferences, and risk premiums can influence the relationship between short-term and long-term rates, potentially undermining the accuracy of the Expectations Theory.

- Liquidity Preference Theory: Empirical evidence generally supports the idea of a liquidity premium in the term structure of interest rates. Long-term bonds tend to have higher yields compared to short-term bonds, indicating a compensation for the additional risk and illiquidity associated with longer maturities. However, the magnitude of liquidity premiums and their stability over time vary, indicating that other factors also play a role in shaping the term structure.

- Market Segmentation Theory: The evidence on the Market Segmentation Theory is mixed. Some studies find that changes in the supply and demand dynamics within specific segments of the bond market can indeed impact the term structure. However, other studies argue that the term structure is better explained by broader macroeconomic factors and expectations of future interest rates, rather than segment-specific influences.

- Preferred Habitat Theory: Empirical evidence on the Preferred Habitat Theory is limited but suggests that investors may exhibit preferences for certain maturities based on factors such as risk tolerance and investment horizons. However, these preferences may not be fixed, and investors may be willing to adjust their habitat if they are adequately compensated with higher yields.

It is important to note that empirical evidence on the term structure of interest rates can vary due to different data sets, methodologies, and time periods analyzed. The dynamic nature of financial markets and changing economic conditions also contribute to variations in empirical findings. Consequently, market participants and researchers continue to explore and refine their understanding of the term structure through ongoing empirical studies.

Implications for Investors and Financial Institutions

The term structure of interest rates has significant implications for both investors and financial institutions, influencing their investment strategies, risk management practices, and overall decision-making processes. Here are some key implications of the term structure:

- Investment Decisions: The term structure provides valuable information to investors when making investment decisions. By analyzing the yield curve, investors can determine the relative attractiveness of different bond maturities. An upward-sloping yield curve may indicate opportunities for higher yields on longer-term bonds, while a flat or inverted yield curve could suggest caution or a potential economic downturn. Investors can use this information to adjust their portfolios and seek optimal risk-return profiles.

- Interest Rate Risk Management: Financial institutions, such as banks and insurance companies, are exposed to interest rate risk in their operations. The term structure helps them manage this risk by providing insights into the future direction of interest rates. By monitoring the yield curve, financial institutions can adjust the duration and mix of their fixed-income investments, ensuring a balance between income generation and interest rate risk mitigation.

- Lending and Borrowing Decisions: The term structure influences borrowing costs for individuals and businesses. By assessing the shape of the yield curve, borrowers can make informed decisions about opting for fixed or variable-rate loans. For instance, during a steep upward-sloping yield curve, borrowers may choose a fixed-rate loan to secure a stable interest rate over the long term.

- Valuation of Fixed-Income Securities: The term structure plays a crucial role in the valuation of fixed-income securities. Investors and financial institutions rely on the yield curve to determine the fair value of bonds and other debt instruments. By comparing yields on specific securities to yields on similar-maturity benchmarks, market participants can identify potential mispricings and arbitrage opportunities.

- Monetary Policy Analysis: Policymakers closely monitor the term structure to assess the transmission of their monetary policy measures and respond to changes in economic conditions. By analyzing the impact of their policy decisions on the yield curve, central banks can evaluate the effectiveness of interest rate adjustments and implement appropriate measures to maintain price stability and economic growth.

Overall, the term structure of interest rates is a vital tool for investors and financial institutions, providing insights into investment opportunities, interest rate risk management, decision-making processes, and monetary policy analysis. By understanding and interpreting the term structure, market participants can navigate the complex dynamics of interest rates and optimize their financial strategies.

Conclusion

The term structure of interest rates is a crucial concept in finance, offering valuable insights into the relationship between bond maturities and interest rates. Through the analysis of the yield curve, market participants can gain a deeper understanding of market expectations, economic conditions, and risk perceptions. This understanding has significant implications for investors, financial institutions, and policymakers.

Throughout this article, we have explored various aspects of the term structure of interest rates. We defined the term structure and highlighted its importance in valuing fixed-income securities and assessing interest rate expectations. We discussed the factors that influence the term structure, including economic conditions, monetary policy, inflation expectations, supply and demand dynamics, risk premiums, and market sentiments.

We also covered the different types of yield curves, such as the upward-sloping normal curve, flat curve, inverted curve, and humped curve, and delved into the theories that explain the term structure, including the Expectations Theory, Liquidity Preference Theory, Market Segmentation Theory, and Preferred Habitat Theory.

Furthermore, we discussed the empirical evidence surrounding the term structure, highlighting the mixed findings and the need for ongoing research and analysis. Finally, we explored the implications of the term structure for investors and financial institutions, including its impact on investment decisions, interest rate risk management, lending and borrowing decisions, valuation of fixed-income securities, and monetary policy analysis.

In conclusion, the term structure of interest rates is a complex and dynamic concept that plays a fundamental role in financial markets. By gaining a deep understanding of the term structure, market participants can make informed decisions, manage risk effectively, and take advantage of various investment opportunities. Ongoing research and analysis will continue to enhance our understanding of the term structure and its implications, aiding investors, financial institutions, and policymakers in navigating the ever-evolving landscape of interest rates.