Finance

Inverted Spread Definition

Published: December 12, 2023

Discover the meaning of inverted spread in finance and how it affects market conditions and investment strategies.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Inverted Spread: What It Means for Your Finances

Have you ever heard of the term “inverted spread” in the finance world? If you’re looking to expand your financial knowledge, then you’ve come to the right place. In this blog post, we will dive deep into the inverted spread definition, its implications, and how it can affect your finances.

Key Takeaways:

- An inverted spread occurs when short-term interest rates are higher than long-term interest rates.

- It is a rare phenomenon that is often considered a sign of economic uncertainty.

Before delving into the details, let’s define what an inverted spread actually means. In simple terms, an inverted spread happens when short-term interest rates become higher than long-term interest rates. This situation is relatively uncommon and tends to be a result of specific economic conditions and market behavior.

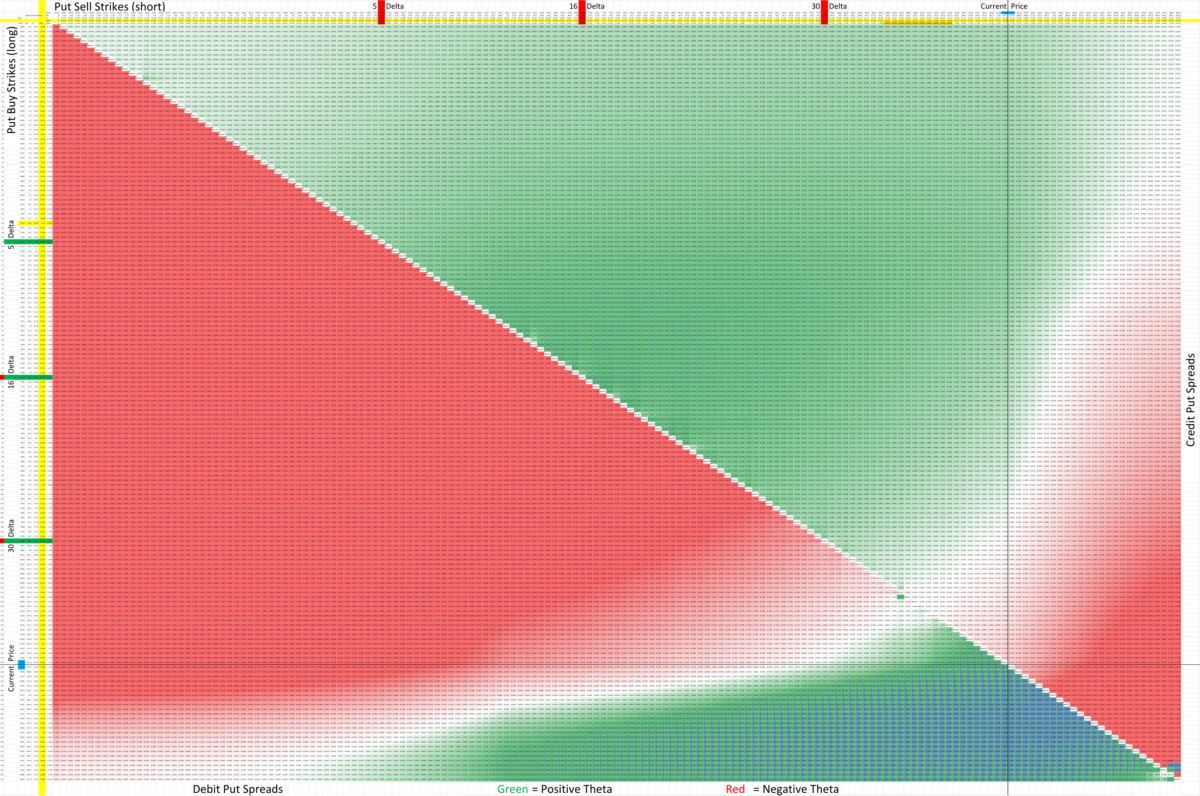

A classic example of an inverted spread is when the yield curve for government bonds becomes inverted. Typically, longer-term bonds have higher yields to compensate for the added risk of holding them for an extended period. However, when economic uncertainty looms, investors may flock to long-term bonds as a safe haven, driving their prices up and thus causing the yields to decrease. Meanwhile, short-term interest rates may remain higher due to central bank policies or market expectations of future rate hikes.

So, how does an inverted spread affect your finances?

1. Mortgage rates: Inverted spreads can impact mortgage rates, making it a prime time for potential homeowners to secure loans. When long-term interest rates are lower than short-term rates, mortgage lenders might offer attractive rates to entice borrowers, as they anticipate possible future rate cuts. As a homeowner, this presents an opportunity to save on interest costs by securing a fixed-rate mortgage with lower interest.

2. Economic indicators: The inverted spread is often viewed as a warning sign for the economy. Historically, an inverted yield curve has preceded economic recessions in many instances. Analysts and policymakers closely monitor this indicator and consider it a signal to exercise caution. Being aware of an inverted spread can help you prepare for potential economic downturns, adjust investment strategies, or make informed decisions regarding your personal finances.

Now that we’ve covered the definition and implications of an inverted spread, it’s important to note that financial markets are complex, and predicting their behavior is challenging. Inverted spreads should be regarded as just one piece of the puzzle when analyzing the economic landscape. Consulting with a financial advisor is always advised for personalized guidance.

In conclusion, understanding what an inverted spread is and how it can impact your finances is a valuable skill for anyone interested in finance. By staying informed and monitoring economic indicators, you can make better decisions to navigate the ever-changing financial world. Utilize this knowledge to your advantage and continue your journey towards financial success!