Finance

Full Delivery Shares Definition

Published: November 29, 2023

Learn the meaning and significance of Full Delivery Shares in the world of finance. Discover the key aspects and implications of this essential concept for investors and traders.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Full Delivery Shares: A Key Component of Financial Planning

When it comes to managing our finances, we often come across various terms and concepts that can sometimes be confusing. One such term is “Full Delivery Shares.” In this blog post, we will dive into the definition of Full Delivery Shares, understand its significance, and how it can play a vital role in your financial planning.

Key Takeaways

- Full Delivery Shares are securities that are physically transferred to the shareholder upon completion of a transaction.

- These shares provide tangible ownership and can be held, sold, or transferred at the shareholder’s discretion.

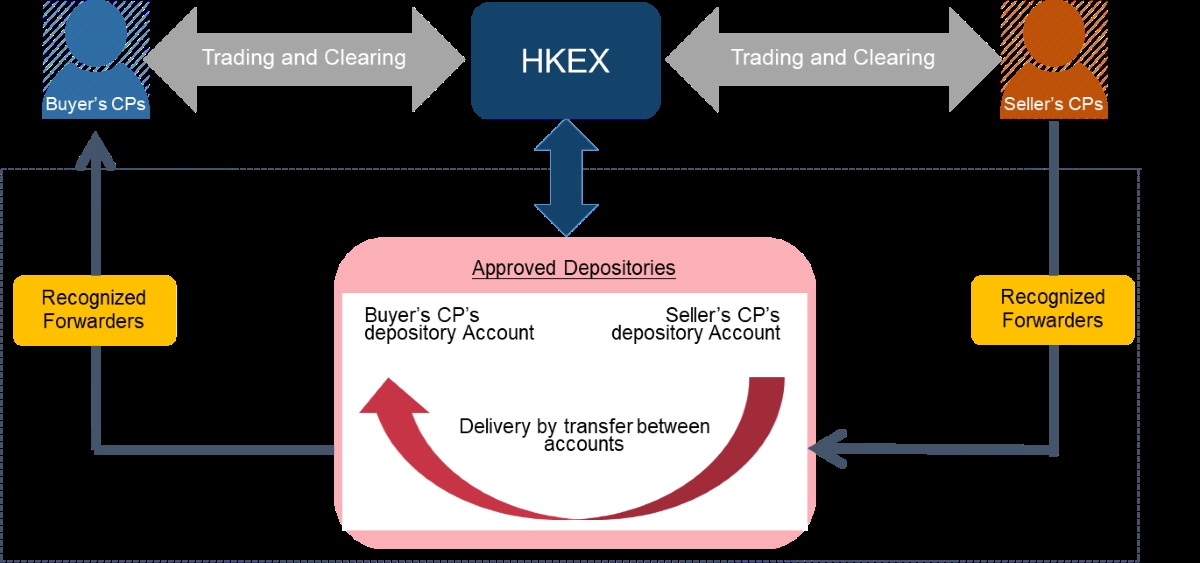

So, what exactly are Full Delivery Shares? In simple terms, Full Delivery Shares refer to securities that are physically transferred to the shareholder upon completion of a financial transaction. It is a method of delivery after a trade settlement is executed. These shares represent tangible ownership in a company or an asset and can be held, sold, or transferred at the discretion of the shareholder.

The significance of Full Delivery Shares lies in the fact that they provide a clear and physical proof of ownership. Unlike virtual or electronic shares that exist only as digital entries in an account, Full Delivery Shares are tangible assets that provide a sense of security to the investor. This physical ownership ensures greater control and transparency over the investment, eliminating any potential risks associated with intangible assets.

Full Delivery Shares are commonly used in various financial markets such as stock exchanges, commodities, and real estate. In the stock market, for example, when you purchase Full Delivery Shares of a company, you become a direct shareholder with the right to receive dividends, attend shareholder meetings, and exercise voting rights. These shares can be either in the form of stock certificates or registered electronically in the investor’s name.

From a financial planning perspective, Full Delivery Shares play a crucial role in portfolio diversification and risk management. By investing in tangible assets, individuals can protect their investments against market volatility, inflation, and other external factors that may impact traditional financial instruments. Holding Full Delivery Shares also allows investors to have a tangible representation of their wealth, which can contribute to their overall financial stability and sense of security.

In summary, Full Delivery Shares are securities that provide physical proof of ownership to the shareholder. They offer tangible assets that can be held, sold, or transferred, ensuring greater control and transparency in financial investments. By understanding the importance of Full Delivery Shares and incorporating them into your financial planning, you can enhance portfolio diversification and safeguard your investments in a tangible way.