Finance

Where Is Accounts Payable On Balance Sheet

Published: December 27, 2023

Learn the role of accounts payable in finance and where it appears on the balance sheet. Understand its significance in managing a company's financial obligations.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to understanding the financial health of a company, the balance sheet is a key document. It provides a snapshot of a company’s assets, liabilities, and equity at a specific point in time. One important component of the balance sheet is accounts payable, which represents the money that a company owes to its suppliers and vendors for goods or services that have been received but not yet paid for.

Accounts payable is a crucial aspect of financial management, as it reflects a company’s short-term obligations and the funds that will be required to settle them. It is important for investors, creditors, and other stakeholders to understand where accounts payable is located on the balance sheet and its significance in financial reporting.

In this article, we will delve into the definition of accounts payable, explore the components of a balance sheet, examine the location of accounts payable on the balance sheet, discuss the role of accounts payable in financial reporting, highlight the importance of accurate accounts payable reporting, and address common issues that may arise with accounts payable on the balance sheet.

By the end of this article, you will have a comprehensive understanding of what accounts payable is, where it is located on the balance sheet, and its significance within the realm of financial reporting. Let’s dive in!

Definition of Accounts Payable

Accounts payable is a term used in accounting to refer to the amount of money that a company owes to its suppliers and vendors for goods or services that have been delivered but not yet paid for. It represents the company’s current liabilities, which are the obligations that need to be settled within a year.

When a company purchases goods or services on credit, it creates a liability in the form of accounts payable. This liability is recorded in the company’s accounting records and reflects the amount owed to the supplier/vendor. Until the payment is made, the liability remains as accounts payable on the company’s balance sheet.

Accounts payable can include various types of expenses, such as raw materials, inventory, utilities, rent, and professional services. It is important for companies to accurately record their accounts payable to maintain transparency and ensure timely payment to suppliers.

Accounts payable is typically categorized as a current liability because it represents an obligation to pay within a short period. In contrast, long-term liabilities, such as loans or bonds, are obligations that extend beyond a year.

Managing accounts payable is crucial for businesses to maintain good relationships with their suppliers and vendors. Companies need to carefully monitor their accounts payable balance and ensure payments are made on time to avoid disruptions in the supply chain or damage to their credit standing.

Now that we have covered the definition of accounts payable, let’s move on to the key components of the balance sheet to understand where it fits into the broader context of financial reporting.

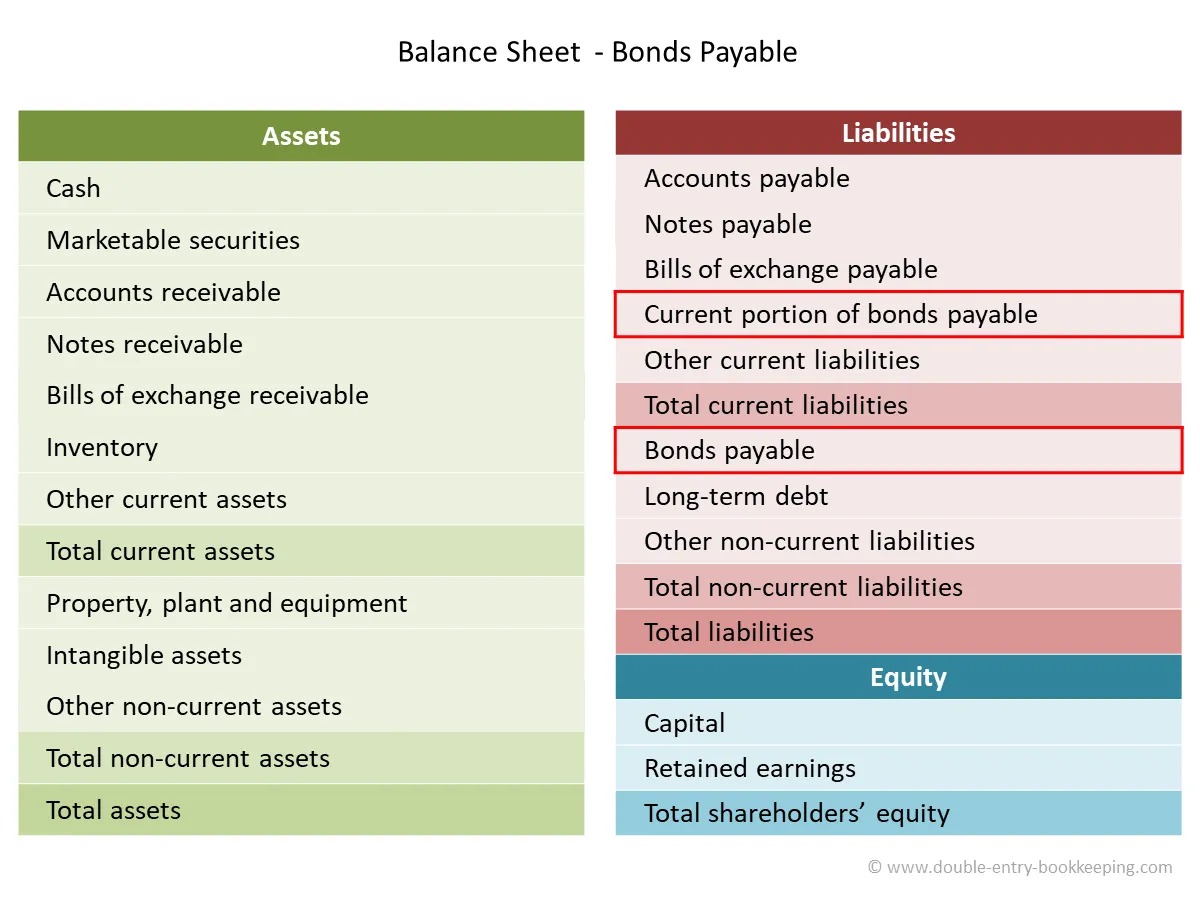

Balance Sheet Components

The balance sheet is a financial statement that provides a snapshot of a company’s financial position at a specific point in time. It is divided into three main components: assets, liabilities, and equity. Understanding these components is crucial for comprehending where accounts payable fits into the overall structure of the balance sheet.

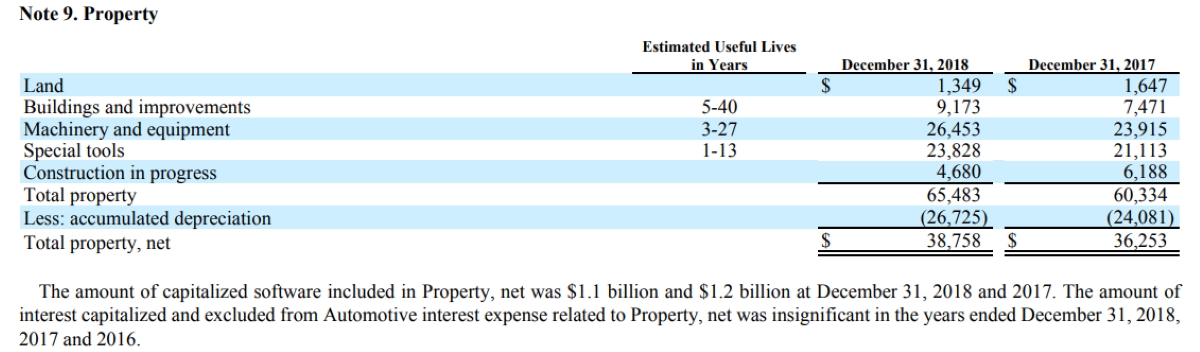

1. Assets: Assets represent what a company owns or controls and are classified into two categories: current assets and long-term assets. Current assets include cash, accounts receivable, inventory, and short-term investments. Long-term assets encompass property, plant, and equipment, investments, and intangible assets. These assets provide an indication of a company’s resources and its ability to generate future cash flows.

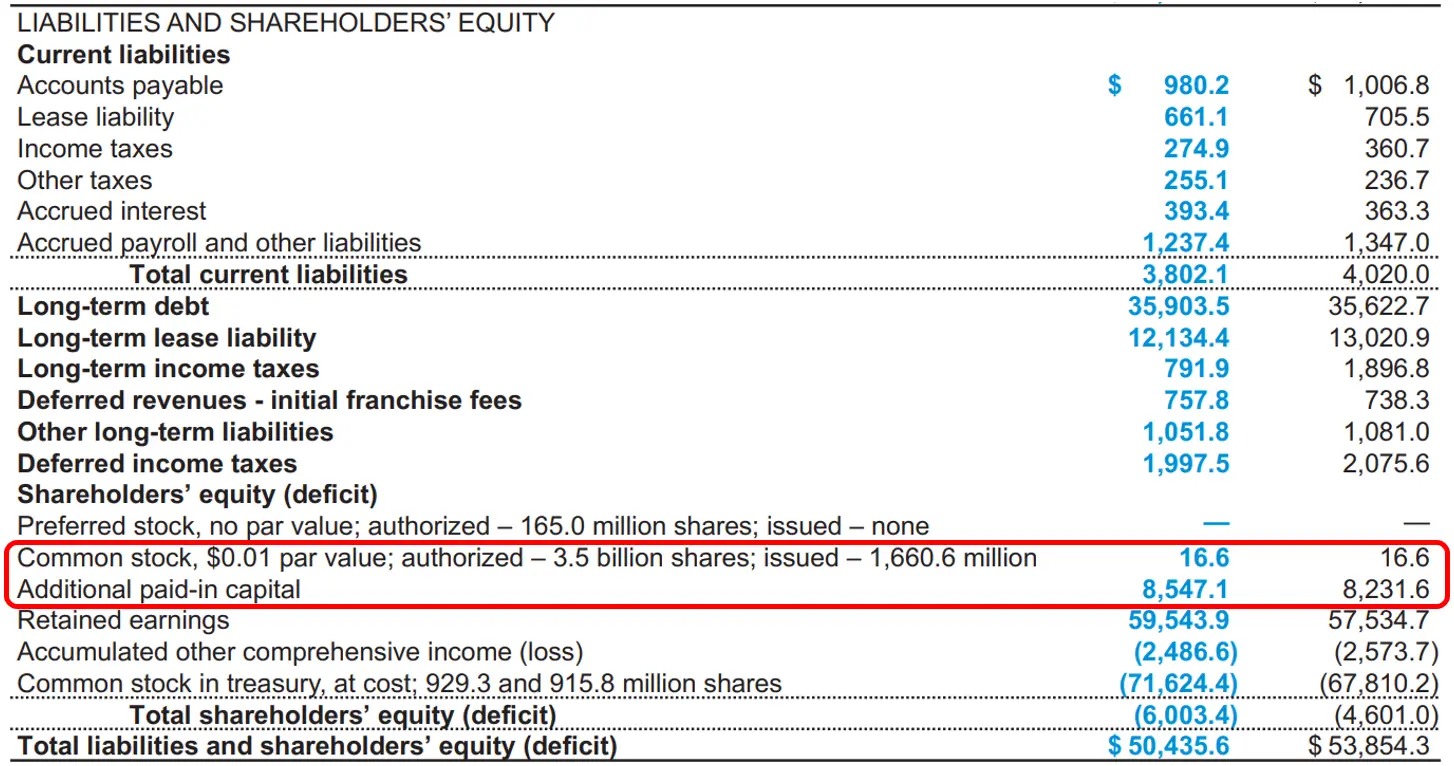

2. Liabilities: Liabilities represent what a company owes to external parties. Like assets, liabilities are classified into current and long-term categories. Current liabilities are obligations that are due within a year and include accounts payable, accrued expenses, and short-term debt. Long-term liabilities, on the other hand, are obligations that extend beyond a year, such as long-term debt or lease obligations.

3. Equity: Equity represents the residual interest in the assets of a company, after deducting liabilities. It reflects the company’s ownership interest and is often referred to as shareholders’ equity or owner’s equity. Equity is calculated by subtracting total liabilities from total assets.

The balance sheet follows the fundamental accounting equation: Assets = Liabilities + Equity. This equation ensures that the balance sheet remains in balance, where total assets are equal to the total of liabilities and equity. Accounts payable, as a liability, is an integral part of this equation and plays a crucial role in maintaining the balance between assets and liabilities.

Next, let’s explore where accounts payable is located specifically on the balance sheet.

Location of Accounts Payable on the Balance Sheet

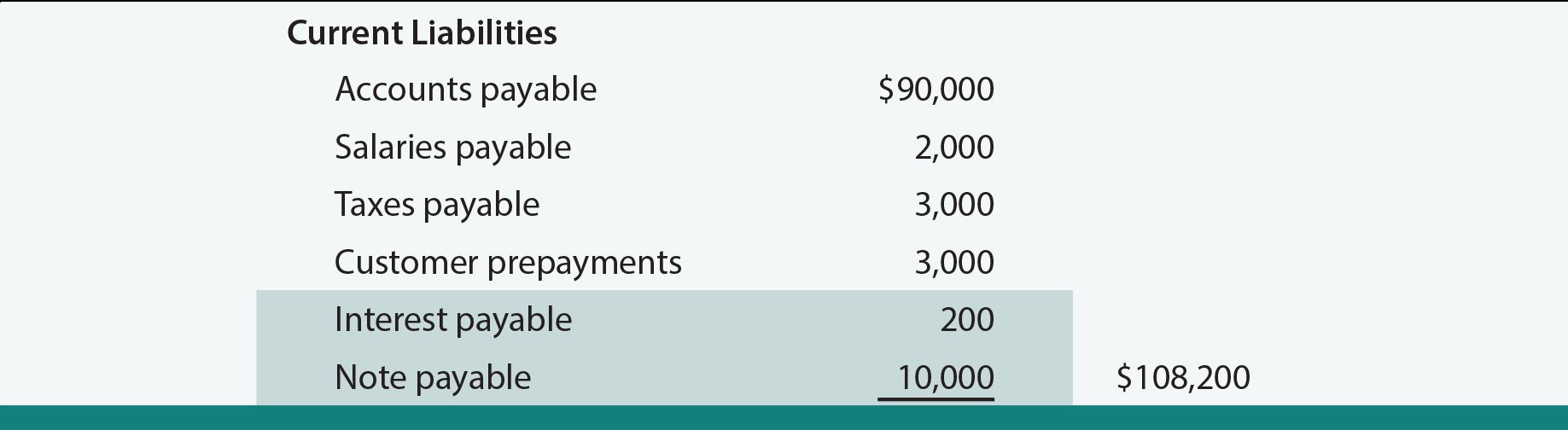

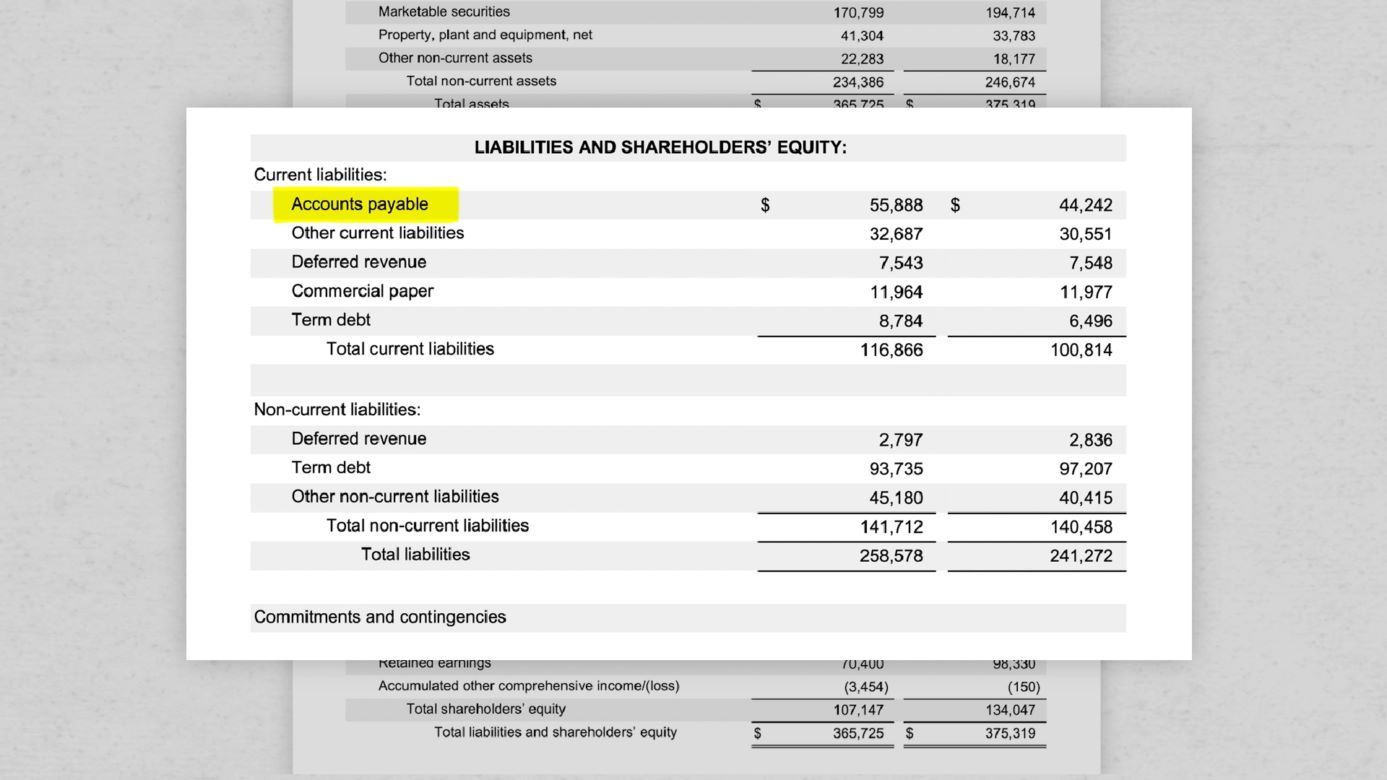

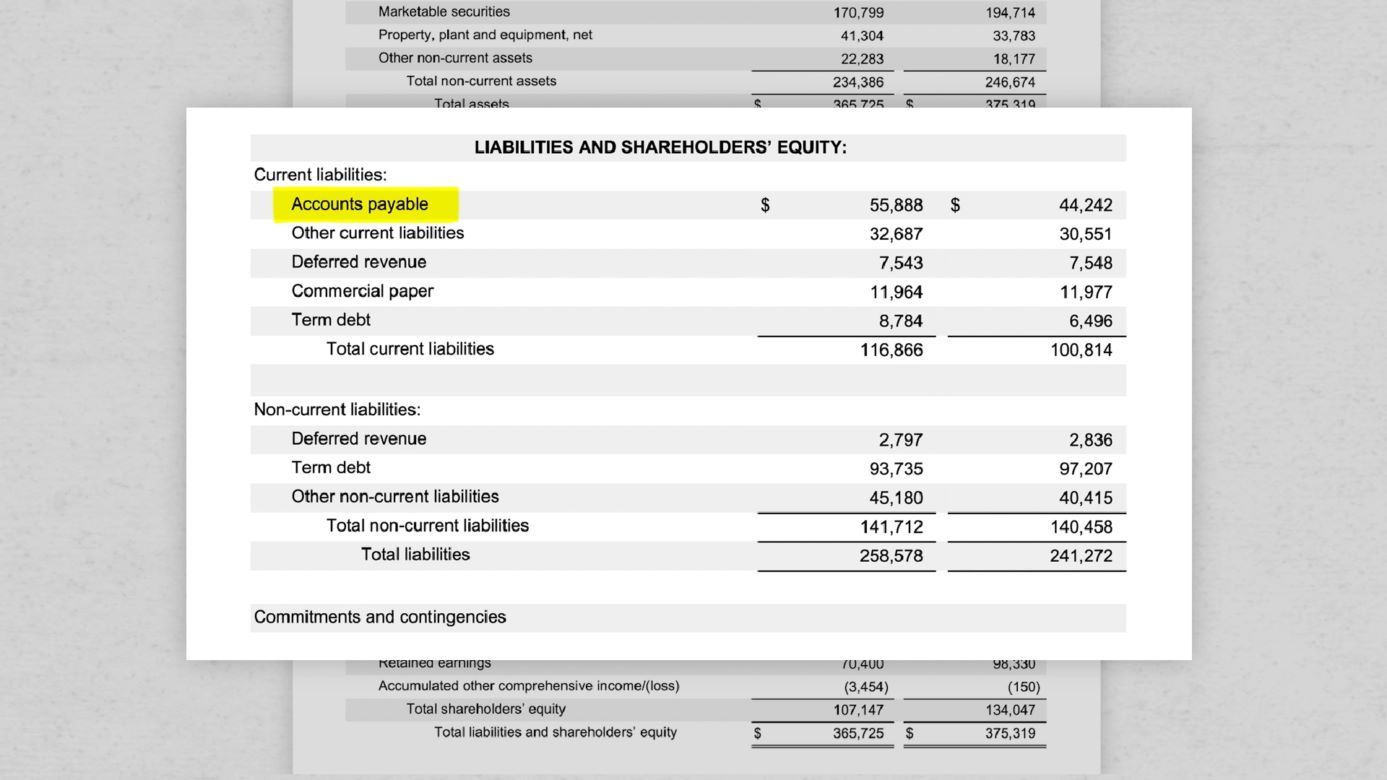

Accounts payable is classified as a current liability and is typically listed under the liabilities section of the balance sheet. It is important to note that the balance sheet follows a specific format, and the order in which the components are presented is standardized.

Under the liabilities section, accounts payable is often grouped with other short-term obligations, such as accrued expenses, short-term loans, and taxes payable. This grouping helps stakeholders quickly identify a company’s current liabilities and assess its liquidity and ability to meet short-term obligations.

Within the liabilities section, accounts payable is listed after any short-term debt obligations. It is important to present accounts payable prominently and accurately, as it represents a significant financial commitment that the company has to fulfill.

The exact location of accounts payable on the balance sheet may vary slightly depending on the specific format used by the company, but generally, it falls within the Current Liabilities section, below short-term debt and above other short-term obligations.

For example, a simplified representation of a balance sheet may look like this:

- Assets

- Liabilities

- Current Liabilities

- Accounts Payable

- Short-term Debt

- Accrued Expenses

- Taxes Payable

- Long-term Liabilities

- Current Liabilities

- Equity

By clearly indicating the location of accounts payable on the balance sheet, companies provide transparency to investors, creditors, and other stakeholders regarding their short-term financial obligations.

Now that we have explored the location of accounts payable on the balance sheet, let’s move on to discussing its role in financial reporting.

Role of Accounts Payable in Financial Reporting

Accounts payable plays a crucial role in financial reporting as it represents a significant liability that a company must accurately report. This section will outline the key functions of accounts payable in financial reporting.

1. Accurate Recording of Liabilities: Accounts payable ensures that a company accurately records its short-term obligations. By tracking and documenting the amounts owed to suppliers and vendors, accounts payable helps provide a clear picture of the company’s total liabilities on the balance sheet. This information is essential for investors and creditors to assess the financial health of the company and make informed decisions.

2. Timely Payment of Obligations: Accounts payable serves as a reminder to the company of its upcoming payment obligations. It provides a framework for monitoring and managing payment deadlines, ensuring that the company pays its vendors and suppliers on time. Timely payment not only helps maintain good relationships with creditors but also avoids any potential disruptions in the supply chain.

3. Expense Allocation: Accounts payable is crucial for accurately allocating expenses to the appropriate accounting periods. When goods or services are received but not yet paid for, they represent an expense that needs to be recognized in the appropriate period. Proper tracking of accounts payable allows for the accurate recording of expenses in the company’s financial statements, ensuring compliance with accounting principles and regulations.

4. Financial Analysis: Accounts payable provides valuable information for financial analysis. By analyzing the accounts payable turnover ratio, which measures how quickly a company pays its suppliers, stakeholders can gain insights into the company’s liquidity, cash flow management, and financial efficiency.

5. Budgeting and Cash Flow Planning: Accounts payable plays a crucial role in budgeting and cash flow planning. It helps companies anticipate and plan for upcoming payment obligations, allowing them to manage their cash flow effectively. By maintaining accurate and up-to-date accounts payable records, companies can create realistic budgets and forecast their cash flow needs.

Overall, accounts payable is not only a critical liability to be reported accurately but also plays a vital role in financial reporting by providing valuable information for decision-making, financial analysis, and cash flow management.

Next, let’s explore the importance of accurate accounts payable reporting.

Importance of Accurate Accounts Payable Reporting

Accurate accounts payable reporting is essential for several reasons. It not only ensures compliance with accounting principles and standards but also provides stakeholders with reliable information for decision-making. This section will highlight the importance of accurate accounts payable reporting in financial management and business operations.

1. Financial Transparency: Accurate accounts payable reporting promotes financial transparency within a company. By properly recording and reporting liabilities, companies provide stakeholders with a clear understanding of their financial commitments. This transparency builds trust and confidence among investors, creditors, and other stakeholders, which is crucial for maintaining strong relationships and attracting capital.

2. Effective Cash Flow Management: Accurate accounts payable reporting enables companies to effectively manage their cash flow. By knowing the exact amount they owe to suppliers and vendors, companies can plan their cash outflows and ensure they have sufficient funds to meet their payment obligations. This helps avoid cash flow disruptions and potential penalties for late payments.

3. Budgeting and Financial Planning: Accurate accounts payable reporting is key to creating realistic budgets and financial plans. By having up-to-date information on their outstanding liabilities, companies can forecast their future cash needs and allocate resources effectively. This enables better financial decision-making and improves the overall financial health of the organization.

4. Supplier Relationships: Accurate accounts payable reporting plays a vital role in maintaining positive relationships with suppliers and vendors. By paying them promptly and accurately, companies can foster goodwill and strengthen these relationships. This can lead to better terms, discounts, and improved supply chain management, ultimately benefiting the company’s bottom line.

5. Compliance and Auditing: Accurate accounts payable reporting is crucial for compliance with accounting standards and regulations. It ensures that financial statements are prepared in accordance with the relevant guidelines, making audits smoother and minimizing the risk of financial irregularities or penalties.

6. Strategic Decision-making: Accurate accounts payable reporting provides valuable insights for strategic decision-making. By analyzing accounts payable data, companies can identify purchasing patterns, negotiate better terms, and optimize their supplier relationships. This can result in cost savings, improved operational efficiency, and better overall competitiveness.

In summary, accurate accounts payable reporting is vital for financial transparency, effective cash flow management, budgeting, supplier relationships, compliance, and strategic decision-making. It is an integral part of financial management and contributes to the overall success and sustainability of a company.

Now, let’s discuss some common issues that may arise with accounts payable on the balance sheet.

Common Issues with Accounts Payable on the Balance Sheet

While accounts payable is a crucial component of the balance sheet, there can be several common issues that companies may encounter when recording and reporting their accounts payable. This section will highlight some of these issues and their potential impact on financial reporting and business operations:

1. Missing or Inaccurate Invoices: One common issue is the presence of missing or inaccurate invoices in the accounts payable process. This can lead to discrepancies between the recorded amount in the accounts payable ledger and the actual amount owed. It is important for companies to have robust systems and processes in place to ensure that all invoices are received, recorded accurately, and authorized for payment.

2. Duplicate Payments: Duplicate payments occur when a company mistakenly pays an invoice multiple times. This can happen due to manual errors, system glitches, or inadequate controls. Duplicate payments not only impact the accuracy of accounts payable reporting but also result in financial losses for the company. Implementing stringent review and approval processes can help prevent such errors.

3. Unrecorded Liabilities: Unrecorded liabilities refer to amounts owed by the company that have not been captured in the accounts payable ledger. This can occur due to oversight, delayed invoice entry, or improper tracking. Unrecorded liabilities distort the accuracy of the balance sheet and can lead to incorrect financial reporting. It is crucial for companies to have effective systems and processes to track and record all liabilities promptly.

4. Late Payments: Late payments to suppliers can occur due to cash flow constraints, operational inefficiencies, or mismanagement of accounts payable. Late payments can strain supplier relationships, result in late payment penalties, and even lead to disruptions in the supply chain. Companies should have strategies in place to manage accounts payable effectively and prioritize timely payment to suppliers.

5. Fraudulent Activities: Accounts payable can be a target for fraudulent activities, such as vendor scams, invoice fraud, or collusion between employees and vendors. These activities can result in significant financial losses for the company. Implementing strong internal controls, regularly reviewing vendor information, and conducting periodic audits can help mitigate the risk of fraudulent activities.

6. Inadequate Reconciliation: Failure to reconcile accounts payable with supplier statements can result in discrepancies between the recorded liabilities and the actual amounts owed. This can lead to inaccurate financial reporting and strain supplier relationships. Regular and thorough reconciliation is essential to ensure the accuracy and integrity of accounts payable balances.

To address these issues, companies should focus on implementing robust accounts payable processes, leveraging automated systems, strengthening internal controls, and conducting regular monitoring and reconciliations. By addressing these common issues, companies can ensure accurate accounts payable reporting and maintain a healthy financial position.

Now, let’s summarize the key points discussed in this article.

Conclusion

Accounts payable is a fundamental component of the balance sheet and plays a vital role in financial reporting. It represents the money that a company owes to its suppliers and vendors for goods or services received but not yet paid for. Understanding the location of accounts payable on the balance sheet and its significance in financial reporting is crucial for investors, creditors, and other stakeholders.

Accurate accounts payable reporting is essential in maintaining financial transparency, effective cash flow management, and compliance with accounting principles and regulations. It enables companies to create realistic budgets, make informed strategic decisions, and build strong relationships with suppliers.

However, there can be common issues with accounts payable, such as missing or inaccurate invoices, duplicate payments, unrecorded liabilities, late payments, fraudulent activities, and inadequate reconciliation. It is important for companies to implement robust systems, processes, and internal controls to address these issues and ensure accurate reporting.

In conclusion, accounts payable is a critical aspect of financial management and plays a significant role in the financial health of a company. By maintaining accurate accounts payable records, companies can improve their financial transparency, cash flow management, and decision-making processes. It is important for companies to prioritize accurate accounts payable reporting to maintain strong relationships with stakeholders, comply with regulations, and achieve long-term success.

Thank you for reading this article. We hope it has provided you with valuable insights into accounts payable and its importance on the balance sheet.