Home>Finance>Outstanding Shares Definition And How To Locate The Number

Finance

Outstanding Shares Definition And How To Locate The Number

Published: January 4, 2024

Learn the definition of outstanding shares in finance and discover how to easily locate the number with our comprehensive guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Outstanding Shares: A Comprehensive Guide

Welcome to our Finance category where we delve into various aspects of the financial world. In this blog post, we will explore the concept of outstanding shares and provide you with valuable insights on how to locate the number. Whether you are a seasoned investor or just getting started in the world of finance, understanding outstanding shares is essential for making informed investment decisions. So, let’s dive right in!

Key Takeaways:

- Outstanding shares represent the total number of shares issued by a company and held by its shareholders.

- The number of outstanding shares is a critical factor in determining a company’s market capitalization and ownership distribution.

What Are Outstanding Shares?

Before we delve deeper, let’s answer the question: what are outstanding shares? In simple terms, outstanding shares refer to the total number of shares issued by a company and held by its shareholders, including institutional investors, insiders, and individual investors.

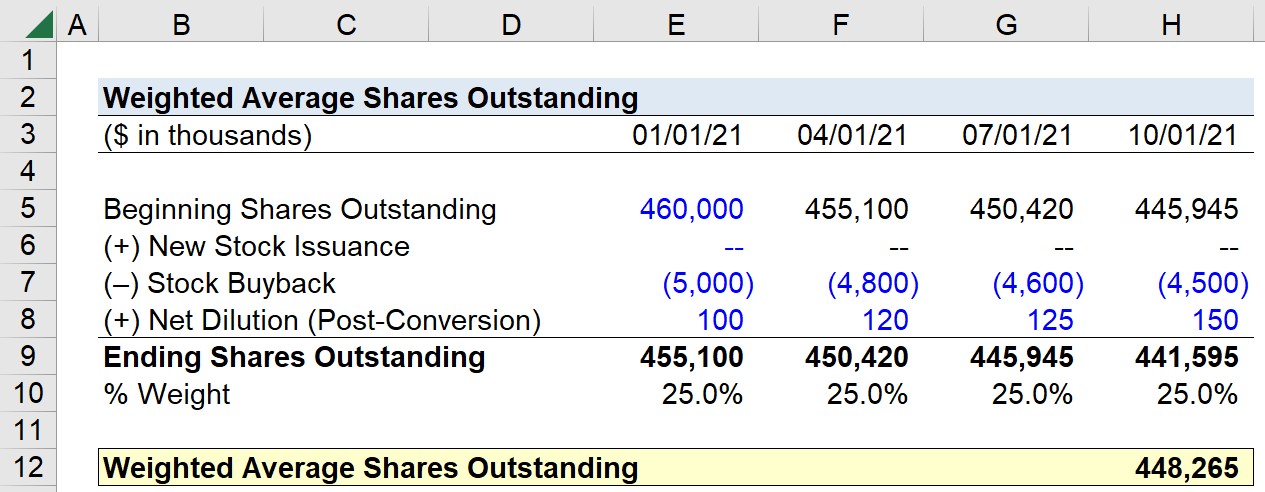

Outstanding shares are different from authorized shares, which represent the total number of shares a company is legally permitted to issue. As companies issue shares to raise capital, the number of outstanding shares can change over time through stock offerings, convertible securities, stock splits, or share buybacks.

Calculating outstanding shares is crucial for determining a company’s market capitalization, which is calculated by multiplying the current stock price by the number of outstanding shares. Investors also use the outstanding shares to analyze ownership distribution and assess a company’s overall valuation.

How to Locate the Number of Outstanding Shares

Locating the number of outstanding shares of a company is relatively simple thanks to the easily accessible resources available. Here are a few ways to find this information:

- Company’s Investor Relations Website: Many publicly traded companies provide investor relations sections on their websites where they disclose important financial information, including the number of outstanding shares.

- Company’s Annual Report and 10-K Filings: Publicly traded companies are required to file annual reports and 10-K filings with the Securities and Exchange Commission (SEC). These documents contain comprehensive financial information, including the number of outstanding shares.

- Financial News Platforms: Various financial news platforms provide access to information on outstanding shares for publicly traded companies. These platforms may include financial databases, market research websites, or online brokerage platforms.

Why Understanding Outstanding Shares Matters

Now that you know how to locate the number of outstanding shares, let’s explore why understanding this concept is vital for investors:

- Company Valuation: The number of outstanding shares directly affects a company’s market capitalization, which is crucial for determining its value. Investors analyze outstanding shares to assess a company’s overall worth and make informed investment decisions.

- Ownership Structure: The distribution of outstanding shares provides valuable insights into a company’s ownership structure. It helps investors understand the percentage of ownership held by insiders, institutional investors, and retail investors. This information can influence investment strategies and decisions.

As you explore the financial markets, understanding the concept of outstanding shares is essential for evaluating companies and making informed investment choices. By keeping an eye on the number of outstanding shares and combining it with other financial metrics, you can gain a deeper understanding of a company’s valuation and ownership structure.

So, the next time you come across a company you’re interested in investing in, make sure to locate its number of outstanding shares and use this information to make informed financial decisions. Happy investing!