Finance

Market Perform Definition

Published: December 22, 2023

Learn the meaning of market perform in finance and how it impacts investment decisions. Gain insights into financial performance analysis and strategies.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Market Perform: A Comprehensive Guide

Posted on May 20th, 2022 | Category: Finance

When it comes to investing in the stock market, there are a multitude of terms and jargon that can be overwhelming for beginners. One such term that you may come across is “Market Perform”. In this blog post, we will delve into what Market Perform means and how it can impact your investment strategy.

Key Takeaways:

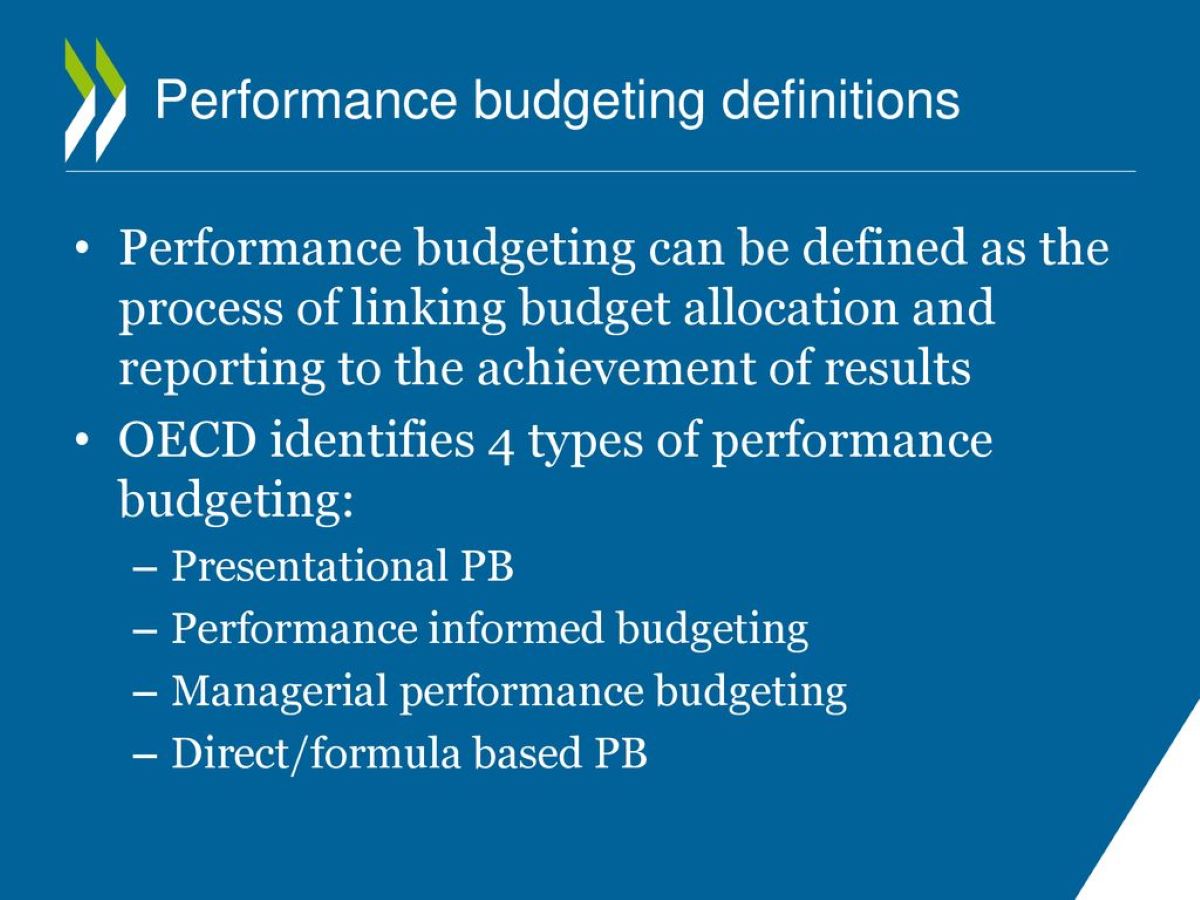

- Market Perform is a rating given to a stock by analysts, indicating that the stock’s performance is expected to be in line with the overall market.

- It is important for investors to consider other factors such as market trends, company fundamentals, and risk tolerance before making investment decisions based solely on a Market Perform rating.

Before we dive into the details, let’s start with a simple question: What does it mean when a stock is rated as “Market Perform”?

Market Perform is a term used by financial analysts to give their opinion on the expected performance of a stock. When a stock is given a Market Perform rating, it means that the analysts believe the stock will perform in line with the overall market. Essentially, this rating indicates that the stock is expected to generate returns that are average or average-plus when compared to other stocks in the market.

This rating is typically given when analysts believe that there are no significant factors that would make the stock outperform or underperform the market. It is considered a neutral rating, indicating stability in the stock’s performance with no major catalysts to drive it to exceptional highs or lows.

Market Perform ratings can be seen as a middle ground between other common ratings given to stocks, such as “Outperform” or “Underperform”. An “Outperform” rating suggests that the stock is expected to perform better than the market, while an “Underperform” rating suggests the opposite, indicating that the stock is expected to perform worse than the overall market.

It is important to note that a Market Perform rating is not a recommendation to buy, sell, or hold a stock. It is simply an analyst’s opinion on the expected performance of the stock in relation to the market. As an investor, it is crucial to consider other factors before making investment decisions based solely on a Market Perform rating.

Considering Other Factors

While a Market Perform rating can provide some insight into a stock’s expected performance, it is not the only factor to consider when making investment decisions. Here are some other factors that investors should take into account:

- Market Trends: Analyze the overall market conditions and trends to understand how they might impact the stock’s performance. Consider factors such as economic conditions, industry trends, and geopolitical events.

- Company Fundamentals: Evaluate the company’s financial health, growth prospects, competitive position, and management team. Look for indicators of solid performance, such as consistent revenue growth, strong balance sheets, and positive cash flow.

- Risk Tolerance: Assess your own risk tolerance and investment goals. Determine whether a Market Perform rating aligns with your investment strategy and risk appetite.

- Diversification: Maintain a well-diversified portfolio to spread the risk across different sectors, industries, and asset classes.

By considering these additional factors along with the Market Perform rating, investors can make more informed decisions regarding their investment strategies.

Final Thoughts

While a Market Perform rating may provide a general indication of a stock’s expected performance, it should not be the sole basis for making investment decisions. It is important to conduct thorough research, analyze various factors, and consult with a financial advisor if needed.

Remember, investing in the stock market involves risks, and no rating can guarantee a stock’s future performance. A Market Perform rating should be used as one piece of the puzzle in building a diversified investment portfolio that aligns with your financial goals and risk tolerance.

Stay informed, keep learning, and make educated investment choices. Happy investing!