Finance

What Is A Profit And Loss Balance Sheet

Published: January 22, 2024

Learn about profit and loss balance sheets and their importance in finance. Understand how to analyze financial performance and make informed decisions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Understanding the Financial Health of a Business: The Profit and Loss Balance Sheet

- Deciphering the Dynamics of Revenue and Expenses

- Unveiling the Financial Position of a Company

- Guiding Financial Decision-Making and Strategic Planning

- Unveiling the Building Blocks of Financial Performance

- Unveiling Insights and Trends for Informed Decision-Making

- Navigating the Financial Landscape with Insight and Acumen

Introduction

Understanding the Financial Health of a Business: The Profit and Loss Balance Sheet

In the world of finance, the profit and loss balance sheet serves as a crucial indicator of a company's financial well-being. It provides a comprehensive overview of the organization's profitability over a specific period, offering insights into its revenue, expenses, and net income. By dissecting this financial document, stakeholders can gain valuable insights into a company's performance, aiding in decision-making processes and strategic planning.

This article delves into the intricacies of profit and loss balance sheets, shedding light on their significance, components, and analytical potential. Whether you're a budding entrepreneur, a finance enthusiast, or a curious individual seeking to broaden your knowledge, understanding the dynamics of profit and loss balance sheets is essential for navigating the complex realm of business finance.

Let's embark on a journey to unravel the mysteries of profit and loss balance sheets, demystifying their elements and unraveling their significance in the corporate landscape. By the end of this exploration, you'll be equipped with a deeper understanding of these financial documents and their pivotal role in assessing the fiscal health of a business.

Understanding Profit and Loss

Deciphering the Dynamics of Revenue and Expenses

At the core of every business operation lies the pursuit of profitability, and the profit and loss statement serves as a compass for navigating this journey. This financial document, also known as the income statement, encapsulates the company’s financial performance by delineating its revenue, expenses, and resulting net income or loss over a specific period.

Revenue, the lifeblood of any enterprise, encompasses the income generated from primary business activities, such as sales of goods or services. It represents the top line of the profit and loss statement, reflecting the total inflow of funds before deducting expenses. On the flip side, expenses encompass the costs incurred in the process of generating revenue, including operational expenditures, salaries, marketing costs, and depreciation. By subtracting these expenses from the revenue, the statement unveils the net income, serving as a pivotal metric for assessing the company’s financial performance.

Understanding the intricacies of the profit and loss statement empowers stakeholders to gauge the company’s ability to generate profits, control expenses, and sustain long-term growth. Whether it’s investors evaluating the company’s potential, management devising strategic initiatives, or employees comprehending the organization’s financial trajectory, the profit and loss statement serves as a beacon of financial transparency and insight.

By comprehending the nuances of revenue generation and expense management, individuals gain a holistic perspective on the financial underpinnings of a business, enabling informed decision-making and a deeper appreciation of the company’s fiscal dynamics.

Understanding Balance Sheets

Unveiling the Financial Position of a Company

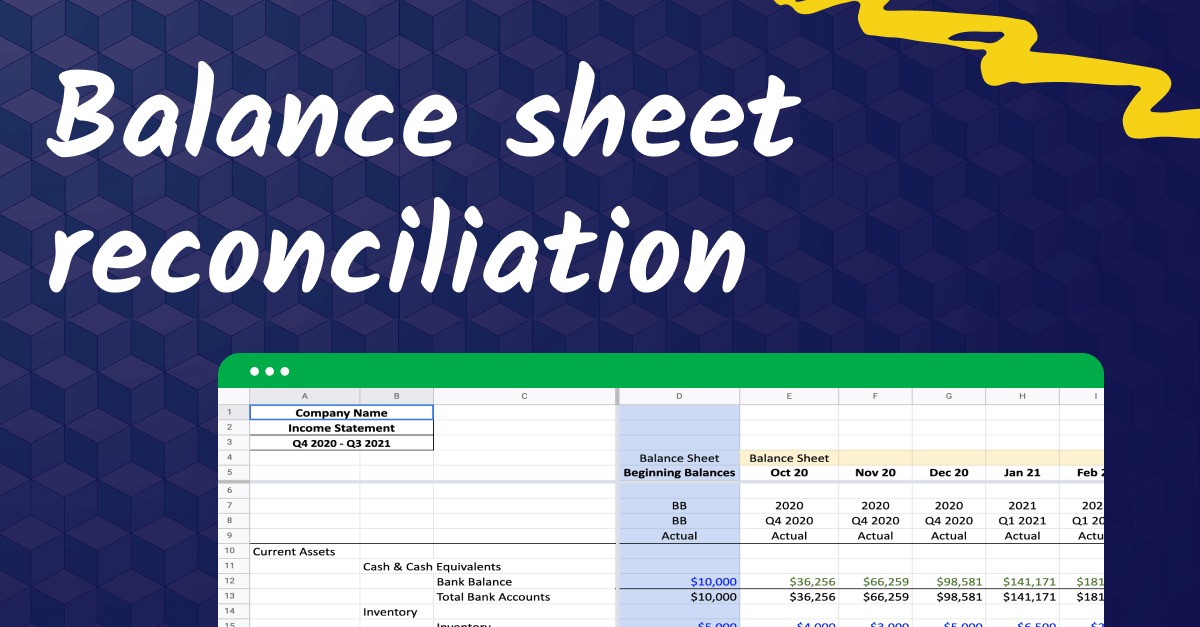

While the profit and loss statement illuminates a company’s financial performance over a specific period, the balance sheet offers a snapshot of its financial position at a given point in time. Often referred to as the statement of financial position, this document provides a comprehensive overview of the company’s assets, liabilities, and shareholders’ equity, encapsulating its financial health and solvency.

At the heart of the balance sheet lie the fundamental accounting equation: Assets = Liabilities + Shareholders’ Equity. Assets encompass everything of value that the company owns, including cash, inventory, property, equipment, and investments. Liabilities, on the other hand, represent the company’s obligations and debts, ranging from accounts payable and loans to accrued expenses. Shareholders’ equity reflects the residual interest in the company’s assets after deducting its liabilities, portraying the stakeholders’ ownership claim on the business.

By dissecting the balance sheet, stakeholders can glean insights into the company’s liquidity, leverage, and overall financial stability. It serves as a compass for assessing the company’s ability to meet short-term and long-term obligations, showcasing the interplay between its resources and obligations. Whether it’s investors evaluating the company’s financial soundness, creditors assessing its creditworthiness, or management devising financial strategies, the balance sheet stands as a cornerstone of financial analysis and decision-making.

Understanding the nuances of balance sheets empowers individuals to comprehend the intricate web of a company’s financial structure, fostering a deeper appreciation for its financial standing and strategic imperatives. By unraveling the components of assets, liabilities, and shareholders’ equity, stakeholders can decode the financial DNA of a company, paving the way for informed assessments and strategic initiatives.

Importance of Profit and Loss Balance Sheets

Guiding Financial Decision-Making and Strategic Planning

The profit and loss balance sheet holds paramount significance in the realm of corporate finance, serving as a compass for stakeholders to navigate the turbulent waters of financial decision-making and strategic planning. Its multifaceted importance transcends numerical figures, offering invaluable insights that shape the trajectory of a business.

First and foremost, the profit and loss balance sheet provides a comprehensive overview of a company’s financial performance, encapsulating its revenue, expenses, and resulting net income. This financial snapshot not only aids in assessing the company’s profitability but also serves as a benchmark for evaluating its operational efficiency and growth prospects. Whether it’s identifying revenue trends, scrutinizing expense patterns, or assessing the impact of strategic initiatives, the profit and loss balance sheet serves as a critical tool for stakeholders to gauge the company’s financial trajectory.

Moreover, this financial document plays a pivotal role in fostering transparency and accountability within the organization. By delineating the sources of revenue, the nature of expenses, and the resulting profitability, the profit and loss balance sheet enhances financial transparency, instilling confidence in investors, creditors, and other external stakeholders. It serves as a testament to the company’s commitment to financial prudence and accountability, bolstering its reputation and credibility in the competitive landscape.

Besides its internal implications, the profit and loss balance sheet holds substantial external significance. It serves as a cornerstone for attracting potential investors, as it provides a comprehensive overview of the company’s financial performance and growth potential. Additionally, creditors utilize this document to assess the company’s creditworthiness and financial stability, influencing lending decisions and terms. By wielding the insights derived from the profit and loss balance sheet, stakeholders can make informed investment, lending, and strategic decisions, shaping the financial landscape of the company.

In essence, the profit and loss balance sheet represents more than just a financial document; it embodies the financial narrative of a company, encapsulating its triumphs, challenges, and aspirations. By embracing its importance and leveraging its insights, stakeholders can chart a course toward sustainable growth, financial prudence, and strategic resilience.

Components of a Profit and Loss Balance Sheet

Unveiling the Building Blocks of Financial Performance

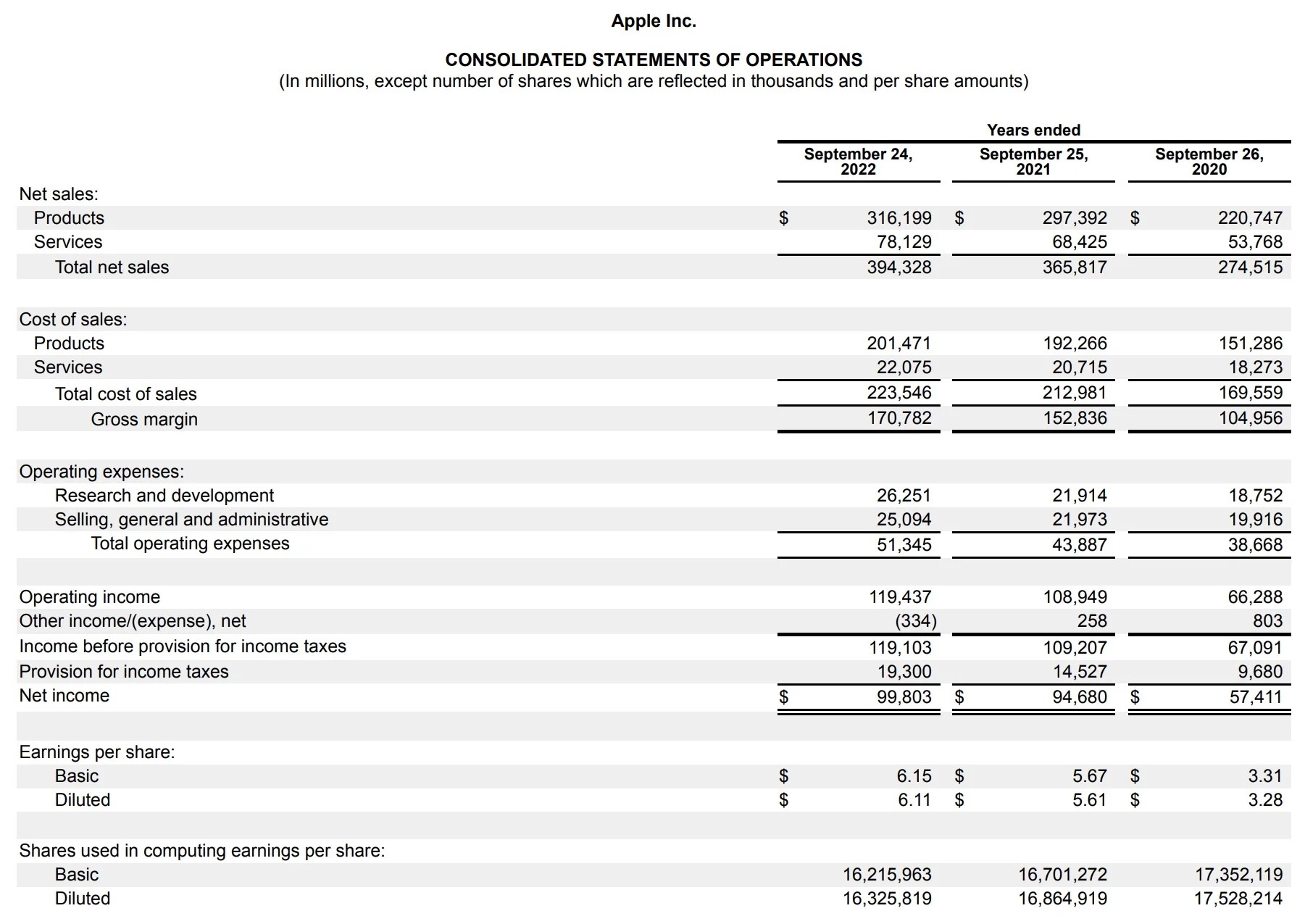

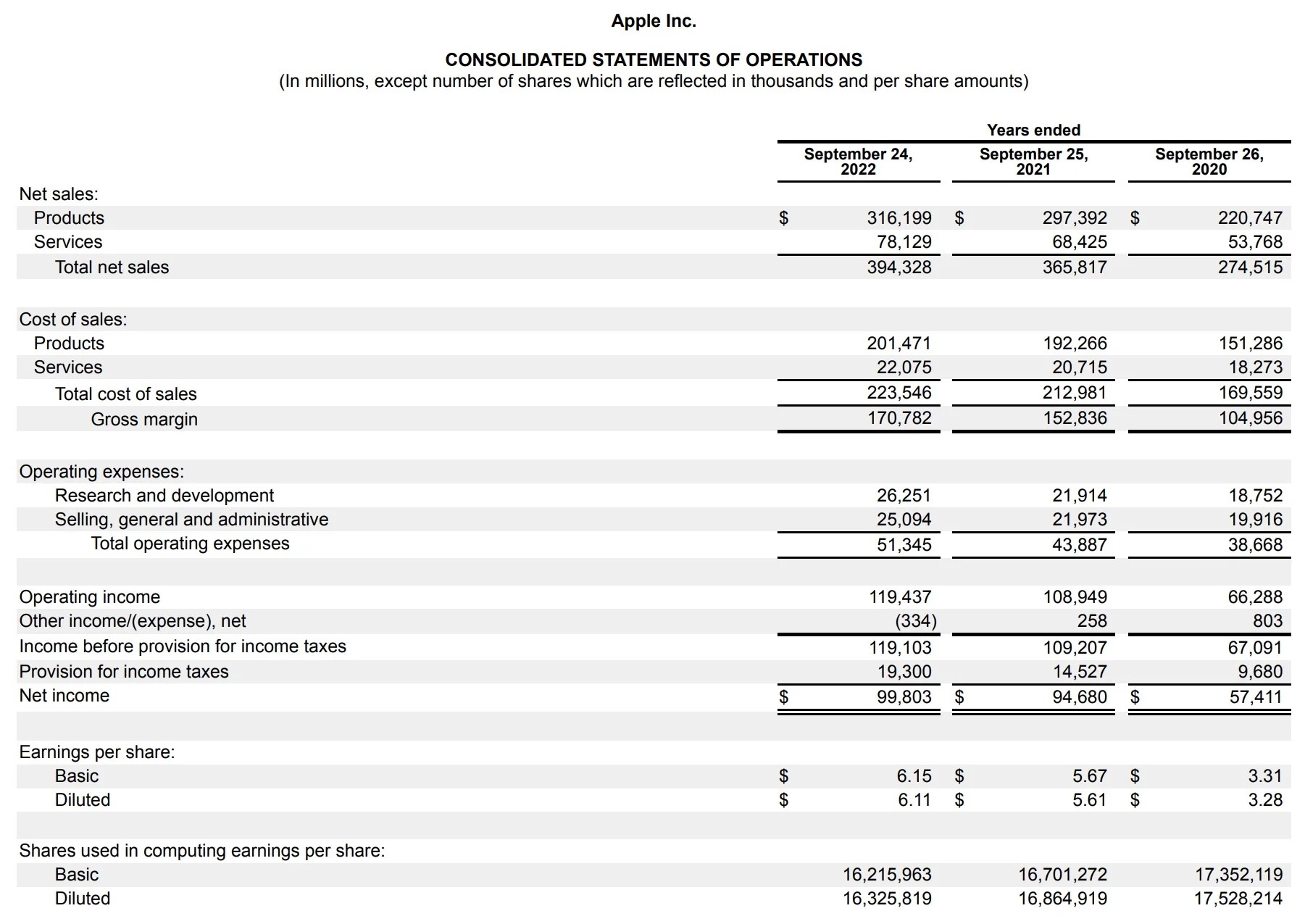

The profit and loss balance sheet comprises several key components that collectively unravel the intricate tapestry of a company’s financial performance. Each element plays a pivotal role in delineating the revenue, expenses, and resulting profitability, offering stakeholders a comprehensive understanding of the company’s financial dynamics.

- Revenue: At the nucleus of the profit and loss balance sheet lies the revenue, representing the income generated from the company’s primary business activities. This component serves as the lifeblood of the organization, reflecting the total inflow of funds before deducting expenses. Revenue encompasses various streams, including sales of goods, provision of services, and other income sources, laying the foundation for the company’s financial performance.

- Cost of Goods Sold (COGS): In the realm of product-based businesses, the cost of goods sold represents the direct costs associated with producing or purchasing the goods sold by the company. It encompasses expenses such as raw materials, labor, and manufacturing overhead, serving as a critical component in determining the company’s gross profit margin.

- Gross Profit: Arising from the variance between revenue and the cost of goods sold, the gross profit portrays the profitability of the company’s core business operations. It serves as a pivotal metric for assessing the efficiency of production and sales, offering insights into the company’s ability to generate profits from its primary revenue streams.

- Operating Expenses: This component encompasses the day-to-day expenses incurred in running the business, including salaries, rent, utilities, marketing costs, and administrative expenses. By scrutinizing these expenses, stakeholders can gauge the company’s operational efficiency and cost management strategies, influencing decisions related to resource allocation and expenditure control.

- Operating Income: Derived from the difference between gross profit and operating expenses, the operating income reflects the profitability of the company’s core business activities before considering interest and taxes. It serves as a pivotal metric for assessing the company’s operational efficiency and the profitability of its primary revenue streams.

- Net Income: Representing the bottom line of the profit and loss balance sheet, net income encapsulates the company’s total profitability after deducting all expenses, including interest, taxes, and non-operating costs. It serves as a comprehensive metric for evaluating the company’s overall financial performance, offering insights into its ability to generate profits and sustain long-term growth.

By comprehending the nuances of these components, stakeholders can unravel the financial narrative of the company, gaining insights into its revenue generation, expense management, and resulting profitability. These building blocks collectively shape the financial performance of the organization, offering a comprehensive overview of its operational efficiency, growth prospects, and strategic imperatives.

Analyzing Profit and Loss Balance Sheets

Unveiling Insights and Trends for Informed Decision-Making

Delving into the labyrinth of a profit and loss balance sheet unveils a treasure trove of insights and trends that empower stakeholders to make informed decisions and strategic maneuvers. By scrutinizing the components and interplay of revenue, expenses, and resulting profitability, individuals can extract valuable nuggets of wisdom that shape the trajectory of a company’s financial landscape.

One of the primary facets of analyzing a profit and loss balance sheet involves assessing revenue trends and patterns. By scrutinizing the sources of revenue and their fluctuations over different periods, stakeholders can discern the efficacy of the company’s sales and revenue generation strategies. Whether it’s identifying burgeoning revenue streams, detecting seasonal fluctuations, or evaluating the impact of market dynamics, analyzing revenue trends fosters a deeper understanding of the company’s revenue-generating capabilities.

Moreover, delving into the realm of expense analysis unveils critical insights into the company’s cost management strategies and operational efficiency. Scrutinizing the composition of operating expenses, their variance over time, and their proportion to revenue sheds light on the company’s ability to control costs, optimize resource allocation, and sustain profitability. By identifying expense patterns and their impact on the company’s bottom line, stakeholders can devise strategies to enhance cost efficiency and bolster financial resilience.

Furthermore, analyzing profitability metrics, such as gross profit margin, operating income, and net income, offers a comprehensive overview of the company’s financial performance. These metrics serve as barometers for assessing the company’s operational efficiency, core business profitability, and overall financial health. By deciphering these metrics and their trends, stakeholders can gauge the company’s ability to generate profits, sustain growth, and weather financial challenges.

Additionally, comparative analysis of profit and loss balance sheets over different periods unveils the trajectory of the company’s financial performance, highlighting areas of progress, challenges, and strategic imperatives. Whether it’s year-over-year comparisons, quarterly assessments, or trend analysis, delving into historical data offers a comprehensive perspective on the company’s financial evolution and the efficacy of its strategic initiatives.

In essence, analyzing profit and loss balance sheets transcends numerical scrutiny; it embodies a journey of unraveling the company’s financial narrative, deciphering its triumphs, challenges, and strategic imperatives. By wielding the insights derived from this analysis, stakeholders can chart a course toward informed decision-making, strategic resilience, and sustainable growth.

Conclusion

Navigating the Financial Landscape with Insight and Acumen

As we conclude our exploration of the profit and loss balance sheet, we emerge with a profound appreciation for its pivotal role in unraveling the financial narrative of a company. This financial document, adorned with components that encapsulate revenue, expenses, and resulting profitability, serves as a compass for stakeholders to navigate the complex terrain of financial decision-making and strategic planning.

From understanding the dynamics of revenue and expenses to unraveling the components of assets, liabilities, and shareholders’ equity, we have embarked on a journey of deciphering the multifaceted dimensions of corporate finance. The profit and loss balance sheet, with its intricate tapestry of numerical figures and trends, offers a comprehensive overview of a company’s financial performance, fostering transparency, accountability, and strategic acumen.

By delving into the labyrinth of this financial document, stakeholders can glean insights that shape the trajectory of a company’s financial landscape. From analyzing revenue trends and expense patterns to deciphering profitability metrics and historical trends, the profit and loss balance sheet serves as a repository of wisdom that empowers stakeholders to make informed decisions, foster financial resilience, and chart a course toward sustainable growth.

As we embrace the importance of this financial document, we recognize its transformative potential in shaping the financial landscape of a company. It transcends numerical figures, embodying the financial narrative of a business, encapsulating its triumphs, challenges, and aspirations. By leveraging the insights derived from the profit and loss balance sheet, stakeholders can navigate the financial landscape with insight, acumen, and strategic resilience.

In the ever-evolving realm of corporate finance, the profit and loss balance sheet stands as a testament to the company’s financial journey, offering a beacon of financial transparency, insight, and strategic foresight. By embracing its significance and wielding its insights, stakeholders can chart a course toward sustainable growth, financial prudence, and strategic resilience, shaping the financial narrative of the company.