Home>Finance>What Are Marketable Securities On Balance Sheet

Finance

What Are Marketable Securities On Balance Sheet

Modified: February 21, 2024

Learn about marketable securities on balance sheets and their significance in finance. Explore the types, valuation, and impact on financial statements.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to our comprehensive guide on marketable securities on the balance sheet. In the world of finance, marketable securities play a vital role for companies and investors alike. Understanding what they are, how they are classified, and their importance on the balance sheet is essential for anyone involved in the financial industry.

Marketable securities are financial instruments that are easily bought and sold in the market. They are often regarded as short-term investments that provide liquidity and generate returns. These securities can include stocks, bonds, and other types of investment instruments that can be converted into cash within a short period of time.

In this article, we will delve into the world of marketable securities, exploring their definition, types, classification on the balance sheet, valuation methods, reporting and disclosures, and ultimately, why they are important for businesses.

Whether you work in corporate finance, investment banking, or are an individual investor looking to make informed decisions, this guide will equip you with the knowledge you need to navigate the world of marketable securities with confidence.

Definition of Marketable Securities

Marketable securities refer to financial instruments that are readily tradable in the open market. These securities are considered liquid assets as they can be easily converted into cash. They are typically short-term investments with a maturity period of less than one year, although some may have longer maturity periods.

There are various types of marketable securities, including stocks, bonds, and money market instruments. Stocks, also known as equities, represent ownership shares in a company, while bonds represent debt obligations issued by governments or corporations. Money market instruments include Treasury bills, commercial paper, and certificates of deposit.

These securities are bought and sold on organized exchanges, such as stock exchanges, or over-the-counter markets. Investors can participate in the market by purchasing or selling these securities through brokerage firms or financial institutions.

What sets marketable securities apart from other investments is their high liquidity. Unlike long-term investments, such as real estate or long-term bonds, marketable securities can be quickly converted into cash without significant obstacles or delays. This liquidity allows investors to respond swiftly to changing market conditions, take advantage of investment opportunities, or meet short-term financial obligations.

Furthermore, marketable securities provide investors with the opportunity to earn returns through price appreciation or dividend payments. Stocks, for example, can increase in value over time, allowing investors to sell them at a higher price and make a profit. Bonds, on the other hand, pay interest to bondholders at regular intervals until maturity.

Overall, marketable securities offer flexibility, liquidity, and potential returns, making them an attractive investment option for individuals and businesses alike. Understanding the various types and valuation methods of marketable securities is crucial for investors to make informed decisions and manage their portfolios effectively.

Types of Marketable Securities

Marketable securities encompass a range of financial instruments that can be easily bought and sold in the market. Understanding the different types of marketable securities is crucial for investors to diversify their portfolios and optimize their investment strategies. Let’s explore some of the most common types:

- Stocks: Also known as equities, stocks represent ownership shares in a company. When you invest in stocks, you become a shareholder and have the potential to benefit from the company’s profits through dividends and capital appreciation.

- Bonds: Bonds are debt instruments issued by governments or corporations to raise capital. They typically have a fixed interest rate and maturity date. Bondholders receive periodic interest payments and the return of the principal amount upon maturity.

- Treasury Bills: Treasury bills, also known as T-bills, are short-term debt securities issued by governments. They have a maturity period of one year or less and are considered low-risk investments.

- Commercial Paper: Commercial paper is an unsecured, short-term debt instrument issued by corporations to meet their financing needs. It typically has a maturity period ranging from a few days to several months.

- Certificates of Deposit: Certificates of deposit (CDs) are time deposits offered by financial institutions. They have a fixed maturity date and pay a fixed interest rate. CDs are considered low-risk investments with a predictable return.

- Money Market Funds: Money market funds invest in short-term, low-risk securities such as Treasury bills and commercial paper. These funds provide investors with stability and liquidity.

These are just a few examples of marketable securities, and there are many other types available in the market. Each type has its unique characteristics, risk profile, and potential returns. Investors should carefully analyze their investment goals, risk tolerance, and market conditions to determine the most suitable mix of marketable securities for their portfolios.

It is important to note that the value of marketable securities can fluctuate based on market conditions, interest rates, and other factors. Therefore, conducting thorough research and seeking guidance from financial professionals is vital when investing in these securities.

Classification of Marketable Securities on Balance Sheet

On the balance sheet, marketable securities are classified based on their liquidity and the intent of the company holding them. The classification determines how these securities are reported and valued on the financial statements. Let’s explore the different categories of marketable securities:

- Trading Securities: Trading securities are marketable securities that are bought and held with the intention of generating short-term profits. These securities are actively traded and their fair market value is reported on the balance sheet. Any changes in the value of trading securities are recorded in the income statement.

- Available-for-Sale Securities: Available-for-sale securities are marketable securities that the company holds with the intention of selling them in the future. They are not actively traded like trading securities, but are held as investment assets. The fair market value of available-for-sale securities is reported on the balance sheet as a separate line item, usually in the “Investments” section. Changes in the value of available-for-sale securities are initially recorded in the equity section of the balance sheet and are later recognized in the income statement when the securities are sold.

- Held-to-Maturity Securities: Held-to-maturity securities are marketable securities that the company intends to hold until their maturity date. These securities are reported on the balance sheet at their amortized cost and any interest earned is recorded as income. Unlike trading securities and available-for-sale securities, changes in the market value of held-to-maturity securities are not recognized until impairment occurs.

The classification of marketable securities on the balance sheet is crucial because it provides valuable information to investors and stakeholders about the company’s investment strategy, risk profile, and potential cash flows. It also helps in evaluating the impact of these securities on the company’s financial health and performance.

It is important for companies to carefully assess the classification of their marketable securities based on their investment objectives and regulatory requirements. Additionally, companies must regularly monitor and review the classification of these securities to ensure compliance with accounting standards and accurate financial reporting.

By understanding the classification of marketable securities on the balance sheet, investors and analysts can gain insights into the company’s investment activities, assess its risk exposure, and make informed decisions about their own investment strategies.

Valuation of Marketable Securities

The valuation of marketable securities is an important aspect of determining their worth on the balance sheet. Accurate valuation is necessary for financial reporting and assessing the financial health of a company. Let’s explore the common methods used to value marketable securities:

- Market Value: Market value refers to the current price at which a security can be bought or sold in the market. Marketable securities that are actively traded, such as stocks, can be valued using their market value. This method provides a real-time estimate of the value of the securities.

- Amortized Cost: Amortized cost is the initial purchase price of a security, adjusted for any premium or discount, and subsequently adjusted for amortization of any discount or premium. This method is commonly used for held-to-maturity securities, where the intent is to hold the securities until maturity.

- Fair Value: Fair value is the estimated value of a security based on various factors, including market conditions, interest rates, risk factors, and the overall performance of the investment. Fair value is often used for available-for-sale securities and is determined through valuation models or third-party data sources.

- Historical Cost: Historical cost refers to the original purchase price of a security and is used less frequently as a valuation method for marketable securities. Under historical cost, the securities are recorded on the balance sheet at their original cost, without subsequent adjustments for changes in market value.

The valuation method used for marketable securities depends on various factors, including the type of security, the intent of the company holding the securities, and accounting regulations. Companies must adhere to specific accounting standards, such as Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS), which provide guidelines on how to value these securities.

Valuing marketable securities accurately is crucial as it affects the reported financial position, income, and cash flow of a company. Proper valuation ensures transparency and helps investors and stakeholders assess the true value and risk of the securities held by the company.

It is worth noting that the value of marketable securities can fluctuate over time due to market conditions, interest rate changes, and other factors. Companies must regularly monitor and reassess the value of these securities to reflect any changes in their fair market value.

Overall, by employing appropriate valuation methods, companies can provide investors and stakeholders with reliable and meaningful information about the value of their marketable securities and their impact on the financial statements.

Reporting and Disclosures for Marketable Securities

Proper reporting and disclosure of marketable securities are essential for transparency and providing accurate financial information to investors and stakeholders. Let’s explore the key aspects of reporting and disclosures for marketable securities:

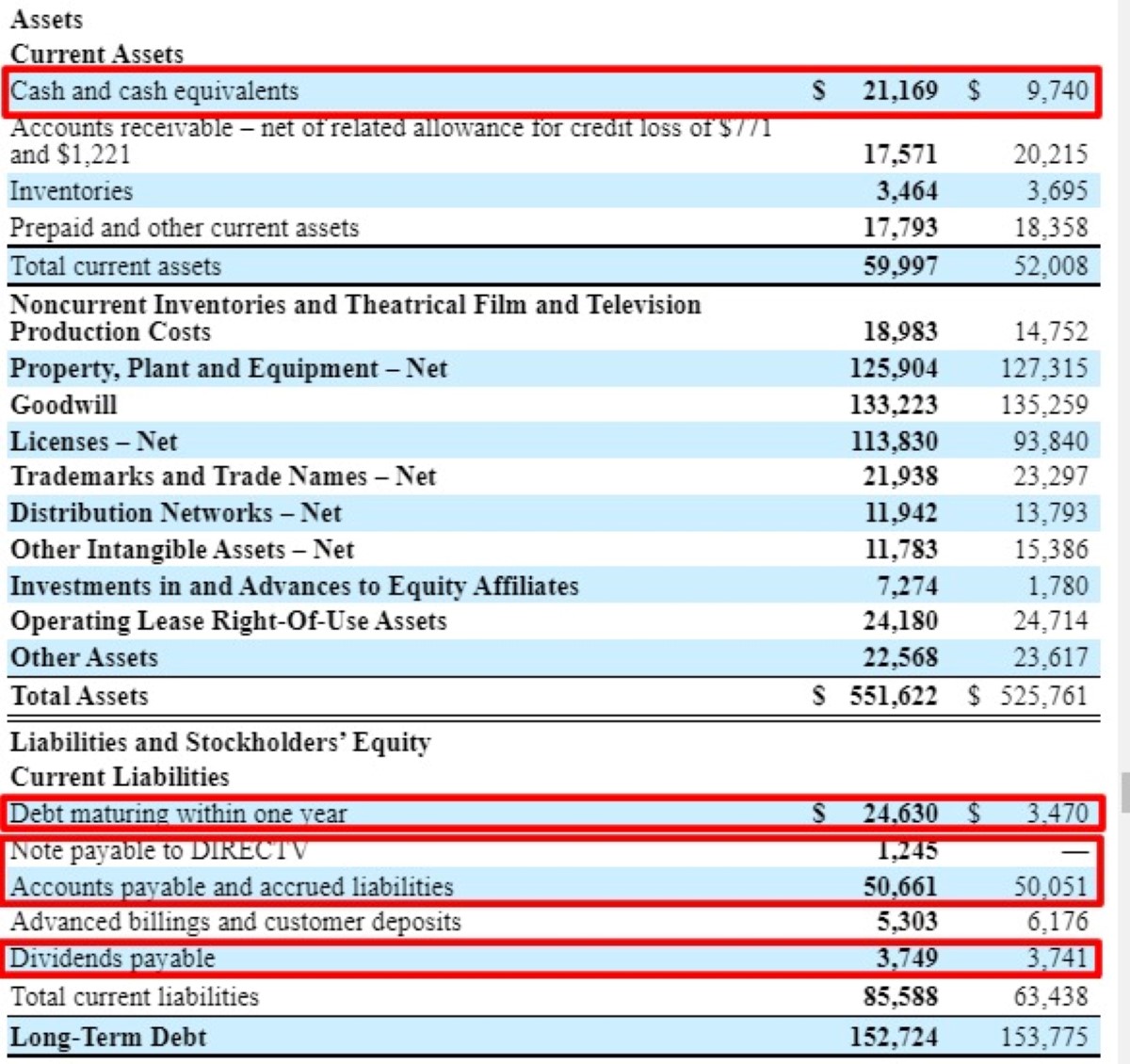

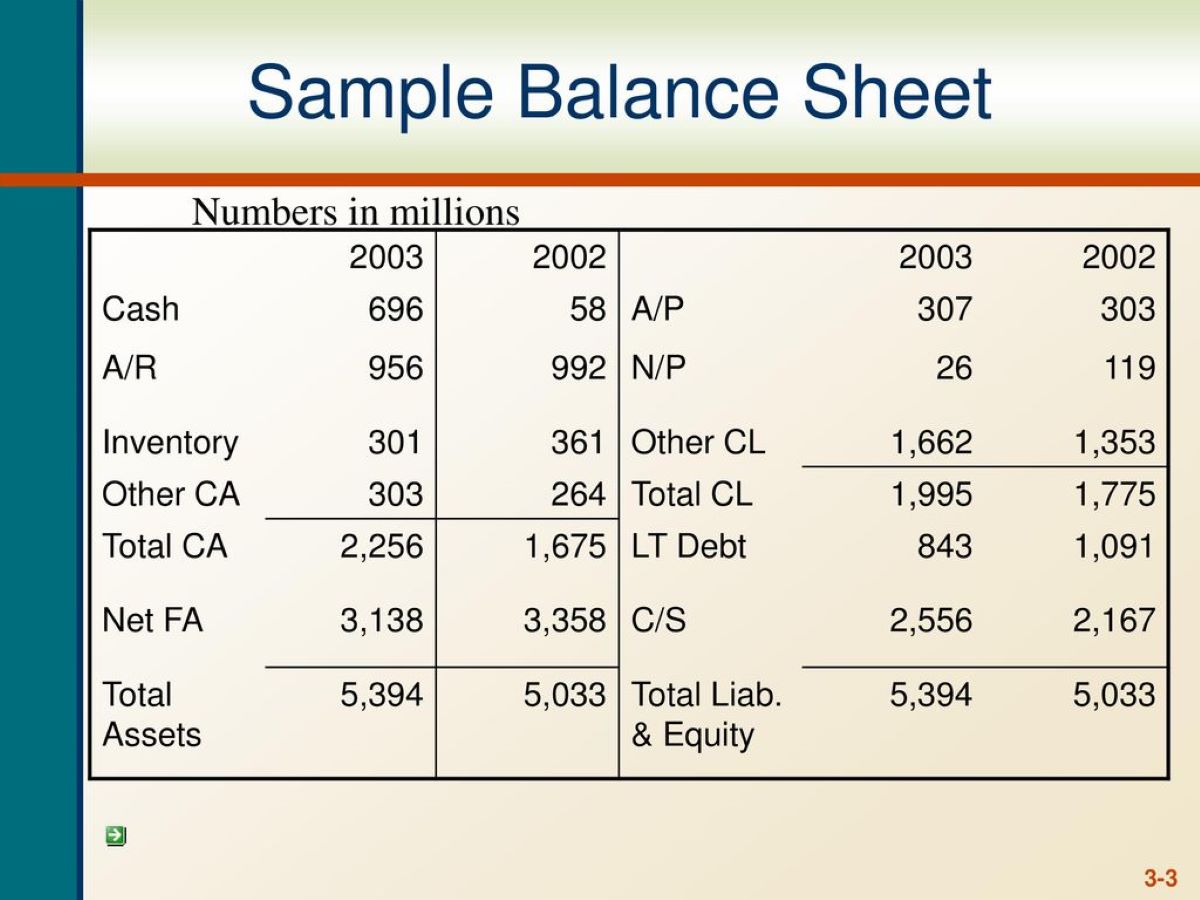

Balance Sheet Presentation: Marketable securities are typically reported on the balance sheet as either current assets or non-current assets, depending on their maturity and liquidity. Current assets are those expected to be converted into cash within one year, while non-current assets have a longer expected conversion period.

Classification: As mentioned earlier, marketable securities are classified based on their intent and use by the company. This classification, such as trading securities, available-for-sale securities, and held-to-maturity securities, determines how these securities are reported and valued on the balance sheet.

Fair Value Disclosures: Companies are required to disclose the fair value of their investments in marketable securities in the footnotes to the financial statements. This includes information about the valuation methods used, significant assumptions made, and the impact of any changes in fair value on the financial statements.

Income Statement Impact: The gains or losses from the sale or valuation of marketable securities are typically reported in the income statement. For trading securities, changes in fair value are immediately recognized as gains or losses. For available-for-sale securities, unrealized gains or losses are initially reported in the equity section of the balance sheet and are later recognized in the income statement when the securities are sold.

Disclosures on Risks: Companies are required to provide disclosures on the risks associated with their marketable securities. This includes information on credit risk, interest rate risk, market risk, and any other significant risks that could impact the value of the securities held.

Regulatory Compliance: Companies must adhere to accounting standards, such as GAAP or IFRS, which provide specific guidelines on reporting and disclosures for marketable securities. Following these standards ensures consistency and comparability of financial statements across different entities.

Auditor’s Opinion: The auditor of a company’s financial statements reviews the accounting treatment and disclosures related to marketable securities. The auditor provides an opinion on the fairness of the presentation and the compliance with accounting standards.

Proper reporting and disclosure of marketable securities provide investors and stakeholders with a clear understanding of a company’s investment activities, risk exposure, and financial performance. It enables them to make informed decisions and evaluate the company’s ability to manage its investment portfolio effectively.

Companies should ensure compliance with accounting standards and regulatory requirements, regularly monitor the reporting and disclosures for marketable securities, and provide clear and meaningful information to users of the financial statements.

Importance of Marketable Securities on Balance Sheet

Marketable securities play a crucial role on the balance sheet of a company. They provide several key benefits and serve as important assets. Let’s explore the significance of marketable securities on the balance sheet:

Liquidity and Cash Management: Marketable securities offer liquidity to a company, allowing it to quickly convert these investments into cash when needed. This liquidity is vital for managing short-term cash flow requirements, such as paying operating expenses, meeting financial obligations, or seizing investment opportunities.

Diversification and Risk Management: By including marketable securities in their investment portfolio, companies can diversify their risk exposure. Investing in different types of marketable securities spreads out the risk, reducing the reliance on a single investment and potentially mitigating potential losses.

Income Generation: Marketable securities provide companies with the potential to generate income. For example, dividend-paying stocks can provide a consistent stream of income, while interest-bearing bonds can generate regular interest payments. This income can contribute to the company’s profitability and enhance shareholder value.

Investment Flexibility: Marketable securities offer companies the flexibility to adapt their investment strategies to changing market conditions. They can buy or sell these securities based on market opportunities, economic trends, or specific business needs. This flexibility allows companies to optimize their investment returns and adjust their portfolios as necessary.

Capital Appreciation: Many marketable securities have the potential for capital appreciation, meaning their value can increase over time. This appreciation can result in capital gains when the securities are sold. Companies can benefit from capital appreciation by selling the securities at a higher price than their purchase cost, generating profits that can contribute to financial growth.

Investor Confidence: The presence of marketable securities on the balance sheet can enhance investor confidence and attract potential investors. It demonstrates that the company has diversified its investments, manages its cash effectively, and utilizes available resources to generate returns. This can improve the overall perception of the company’s financial stability and soundness.

Financial Reporting Transparency: Reporting marketable securities on the balance sheet provides transparency for company stakeholders, including shareholders, lenders, and regulatory bodies. It enables these stakeholders to assess the liquidity position, investment activities, and risk exposure of the company. Transparent reporting of marketable securities helps maintain trust and credibility in the financial reporting process.

Overall, marketable securities on the balance sheet are valuable assets that provide liquidity, income potential, risk management, and investment flexibility for companies. They contribute to effective cash management, portfolio diversification, and financial stability. Understanding and properly managing marketable securities is vital for maximizing returns and maintaining a healthy financial position.

Conclusion

Marketable securities are an important component of the balance sheet, offering companies liquidity, diversification, income generation, and investment flexibility. These financial instruments, such as stocks, bonds, and money market instruments, provide companies with the ability to easily buy and sell assets in the market, respond to short-term cash flow needs, and optimize their investment strategies.

Understanding the different types of marketable securities and their classification on the balance sheet is crucial for accurate financial reporting. Companies must adhere to accounting standards and ensure proper valuation, reporting, and disclosures to provide transparent and meaningful information to stakeholders.

Marketable securities contribute to the financial health and performance of a company, offering benefits such as risk management, capital appreciation, and financial stability. The presence of marketable securities on the balance sheet enhances investor confidence and attracts potential investors.

However, it is important to note that marketable securities come with their own risks and uncertainties. The value of these securities can fluctuate based on market conditions, interest rates, and other factors. Companies must carefully manage and monitor their marketable securities to mitigate risks and maximize returns.

In conclusion, marketable securities on the balance sheet are valuable assets that provide companies with liquidity, income, diversification opportunities, and investment flexibility. By effectively managing these assets and ensuring proper reporting and disclosures, companies can optimize their financial position, meet short-term cash flow needs, and attract investor confidence.

Whether you are a company executive, investor, or financial professional, a solid understanding of marketable securities on the balance sheet is essential for making informed decisions, assessing a company’s financial health, and designing effective investment strategies.