Finance

Measuring Principle Definition

Published: December 24, 2023

Learn the definition of measuring principle in finance and understand its importance in financial analysis. Enhance your knowledge of finance with our comprehensive guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

What is the Measuring Principle in Finance?

Welcome to our FINANCE category! Today, we’re going to dive into the concept of measuring principle in finance. If you’re wondering what exactly the measuring principle is and how it applies to the world of finance, you’re in the right place.

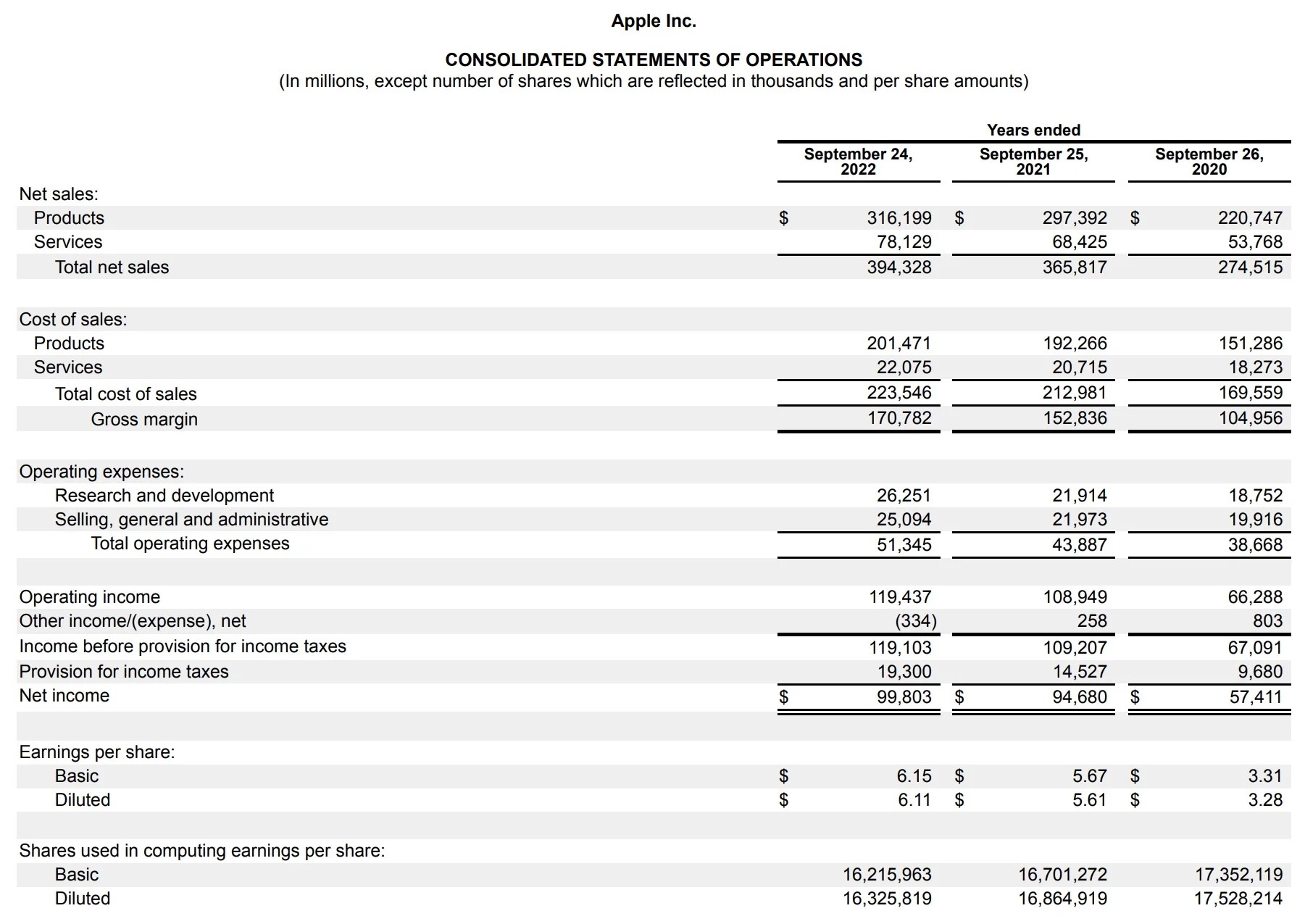

The measuring principle, also known as the principle of measurability, is a fundamental concept in finance that guides how financial information is recorded and reported. It states that financial transactions should be recorded and reported in monetary terms, as this provides a common denominator for measuring and comparing different aspects of a company’s financial performance.

Key Takeaways:

- The measuring principle is a fundamental concept that guides how financial information is recorded and reported in finance.

- It states that financial transactions should be recorded and reported in monetary terms to provide a common denominator for measurement and comparison.

Now, you might be wondering why the measuring principle is so important. Well, let’s break it down further for a better understanding:

The Importance of the Measuring Principle

1. Uniformity: The measuring principle ensures that financial information is recorded and reported in a consistent manner. By using a common monetary unit, such as dollars or euros, it allows for easy comparison between different financial transactions and the overall financial performance of a company.

2. Accuracy: Measuring financial transactions in monetary terms helps to ensure accuracy in financial reporting. It allows for precise measurement and avoids ambiguity or confusion that could arise if different units of measurement were used.

3. Decision Making: The measuring principle is crucial for making informed financial decisions. By providing a standardized way of measuring financial transactions, it enables investors, analysts, and other stakeholders to evaluate the financial health and performance of a company. This information is vital for making investment decisions, assessing risk, and determining the value of a company.

In summary, the measuring principle in finance is a cornerstone concept that ensures consistency, accuracy, and helps drive informed decision-making in the financial world. By recording and reporting financial transactions in monetary terms, businesses and individuals can measure and compare financial performance across time and different entities.

In Conclusion

By understanding the measuring principle and its importance in financial reporting, you’ll gain valuable insights into how financial information is recorded and measured. These insights can help you make better financial decisions, assess the financial health of a company, and contribute to your overall financial success.

We hope this blog post has provided you with a clear understanding of the measuring principle in finance. If you have any further questions or would like to explore more finance topics, be sure to check out our other blog posts in the FINANCE category. Stay tuned for more informative content that will help you navigate the world of finance with confidence!