Finance

What Are The 5 Principles Of Money Management?

Published: February 28, 2024

Learn the 5 essential principles of money management to secure your financial future. Get expert tips and advice on finance and wealth management.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Understanding the Fundamentals of Money Management

Welcome to the world of money management, where the decisions you make today can significantly impact your financial well-being tomorrow. Whether you’re a recent college graduate, a seasoned professional, or someone navigating the complexities of personal finance, mastering the principles of money management is crucial for achieving long-term financial stability and success. By understanding and applying these principles, you can gain control over your finances, build wealth, and secure a more prosperous future.

In this comprehensive guide, we will explore the five fundamental principles of money management. From budgeting and saving to investing, debt management, and risk management, each principle plays a pivotal role in shaping your financial journey. By delving into these key areas, you’ll gain valuable insights into how to make informed financial decisions, mitigate risks, and work towards achieving your short-term and long-term financial goals.

So, let’s embark on this enlightening journey into the world of money management, where we’ll uncover the strategies, tips, and best practices that can empower you to take charge of your financial destiny.

Principle 1: Budgeting

Budgeting serves as the cornerstone of effective money management, providing a roadmap for your financial decisions and ensuring that you live within your means. At its core, budgeting involves carefully planning and tracking your income and expenses to allocate funds for essential needs, savings, and discretionary spending. By creating and adhering to a well-defined budget, you can cultivate disciplined spending habits and gain a clear understanding of where your money is going.

When crafting a budget, start by calculating your total monthly income from all sources, including salaries, bonuses, and investment returns. Next, itemize your monthly expenses, categorizing them into fixed costs (such as rent or mortgage payments, utilities, and insurance) and variable expenses (such as groceries, dining out, entertainment, and transportation). By analyzing your spending patterns, you can identify areas where you may need to cut back and allocate more funds towards savings or debt repayment.

Furthermore, budgeting empowers you to set specific financial goals, whether it’s building an emergency fund, saving for a down payment on a home, or funding your retirement accounts. By establishing clear objectives within your budget, you can prioritize your financial aspirations and track your progress over time.

Embracing technology can also streamline the budgeting process, with a myriad of user-friendly apps and digital tools available to help you track expenses, set savings targets, and receive real-time insights into your financial health. These resources can simplify the task of budget management and provide valuable visibility into your financial habits.

In essence, budgeting is not about restricting your lifestyle; rather, it’s about making intentional choices with your money to align with your financial goals and aspirations. By cultivating a proactive and disciplined approach to budgeting, you can pave the way for a more secure and prosperous financial future.

Principle 2: Saving

Saving is a fundamental principle of money management that lays the groundwork for financial security and future prosperity. It involves setting aside a portion of your income for future needs and unexpected expenses, thereby building a financial safety net and funding your long-term goals. By cultivating a habit of regular saving, you can weather financial challenges, seize opportunities, and work towards achieving your aspirations.

One of the key strategies for effective saving is to automate the process. Setting up automatic transfers from your checking account to a designated savings account ensures that a portion of your income is consistently earmarked for saving before you have the chance to spend it. This approach leverages the power of consistency and discipline, allowing your savings to grow steadily over time.

Furthermore, it’s essential to establish clear savings goals to give purpose and direction to your saving efforts. Whether you’re saving for a major purchase, an emergency fund, a dream vacation, or retirement, defining specific targets provides motivation and helps you track your progress. Additionally, consider leveraging tax-advantaged savings vehicles such as individual retirement accounts (IRAs) or employer-sponsored 401(k) plans to maximize the growth potential of your savings.

Incorporating frugality into your lifestyle can also bolster your saving endeavors. By consciously seeking ways to reduce expenses, such as dining out less frequently, negotiating better deals on recurring bills, or embracing energy-efficient practices, you can free up more funds to allocate towards saving and investing for the future.

Moreover, it’s crucial to differentiate between short-term and long-term saving goals. Short-term savings cater to immediate needs and contingencies, while long-term savings, such as retirement funds or investment portfolios, are geared towards securing your financial well-being in the distant future. By striking a balance between these objectives, you can ensure that you’re prepared for both the present and the years ahead.

Ultimately, the habit of saving is a powerful tool that empowers you to build resilience, seize opportunities, and achieve financial independence. By embracing a proactive and disciplined approach to saving, you can lay the groundwork for a more secure and fulfilling financial future.

Principle 3: Investing

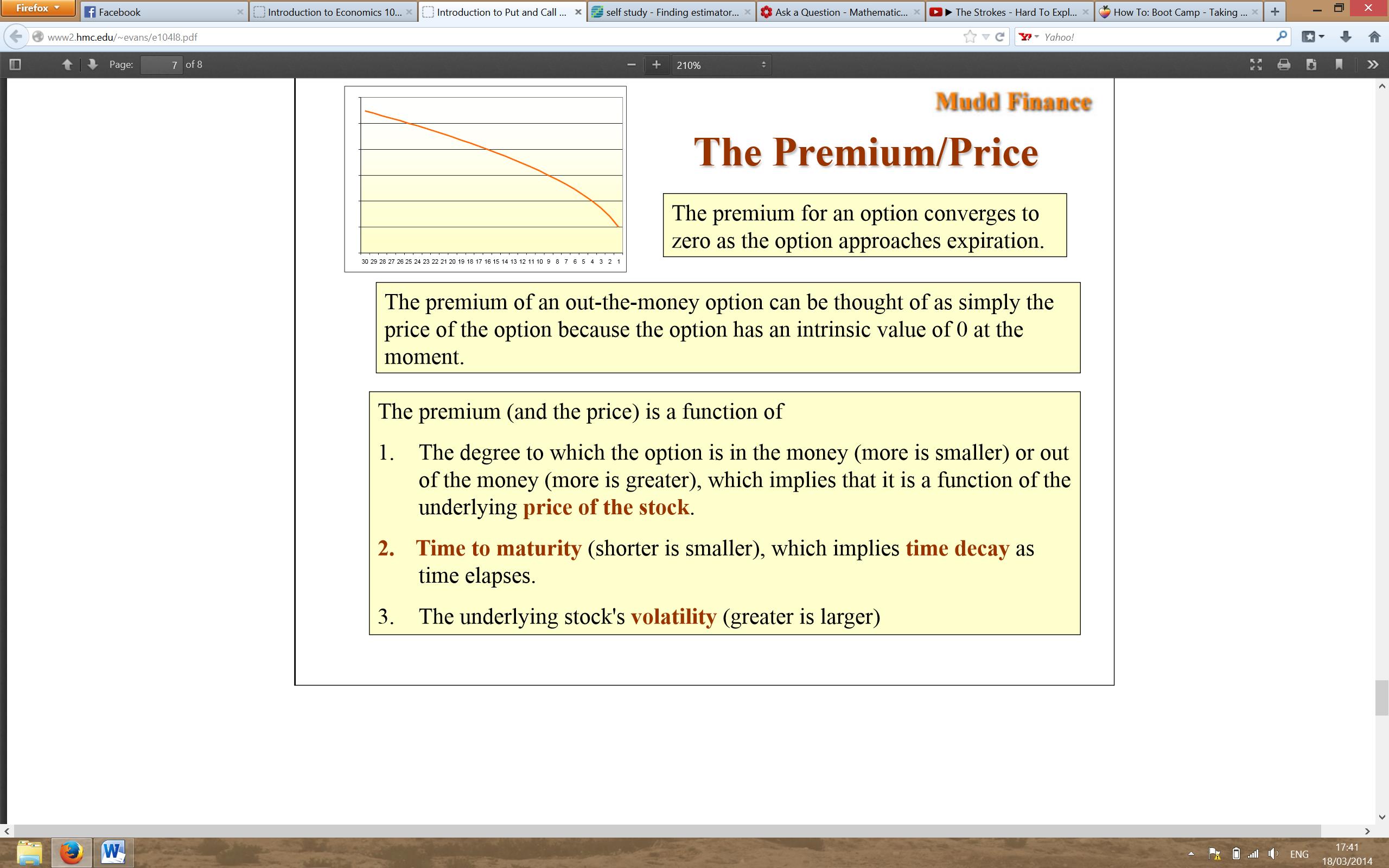

Investing is a cornerstone of wealth creation and long-term financial growth, playing a pivotal role in the realm of money management. By directing your funds into various investment vehicles, such as stocks, bonds, mutual funds, and real estate, you have the opportunity to generate returns that outpace traditional savings methods, thereby accelerating the growth of your wealth over time.

One of the key principles of investing is to start early and remain consistent. By harnessing the power of compounding returns, the earlier you begin investing, the greater your potential for wealth accumulation. Consistent, disciplined contributions to your investment portfolio, even in small amounts, can yield significant growth over the long term.

Diversification is another critical tenet of investing. Spreading your investments across different asset classes and industries helps mitigate risk and minimize the impact of market fluctuations on your overall portfolio. This strategy can enhance the stability of your investments and reduce the potential for significant losses in the event of a downturn in any specific sector.

Moreover, it’s essential to align your investment strategy with your financial goals, risk tolerance, and time horizon. Whether you’re investing for retirement, education, or wealth accumulation, tailoring your investment approach to match your specific objectives is crucial. Additionally, understanding your risk tolerance – the degree of market volatility you can comfortably withstand – enables you to construct an investment portfolio that aligns with your comfort level and long-term aspirations.

Embracing a long-term perspective is integral to successful investing. While market fluctuations and economic cycles may prompt short-term volatility, maintaining a steadfast focus on your long-term financial objectives can help you weather temporary downturns and capitalize on the potential for sustained growth over time.

Lastly, staying informed and seeking professional guidance can enhance your investment acumen. Keeping abreast of market trends, economic indicators, and investment opportunities equips you with the knowledge to make informed decisions. Additionally, consulting with financial advisors or investment professionals can provide valuable insights and tailored strategies to optimize your investment approach.

By integrating the principles of early initiation, diversification, goal alignment, long-term focus, and informed decision-making, you can harness the power of investing to cultivate wealth and achieve your financial aspirations.

Principle 4: Debt Management

Debt management is a critical aspect of money management, as it directly impacts your financial well-being and future prospects. Effectively managing and reducing debt empowers you to alleviate financial stress, enhance your creditworthiness, and free up resources for saving and investing.

One of the fundamental principles of debt management is to prioritize high-interest debt repayment. By targeting debts with the highest interest rates, such as credit card balances or personal loans, you can minimize the long-term interest costs and expedite your journey towards debt freedom. Implementing a structured repayment plan, such as the debt snowball or debt avalanche method, can provide a clear roadmap for tackling multiple debts systematically.

Furthermore, it’s essential to avoid accumulating additional debt while striving to reduce existing balances. By exercising prudence in your spending habits and refraining from taking on new debt, you can prevent the compounding of financial liabilities and maintain progress towards debt reduction.

Consolidating high-interest debts through strategies such as balance transfers or debt consolidation loans can also streamline repayment efforts and reduce interest expenses. This approach consolidates multiple debts into a single, more manageable payment, potentially at a lower interest rate, thereby simplifying your financial obligations and accelerating your path to debt freedom.

Additionally, cultivating financial discipline and embracing frugality can expedite debt repayment. By scrutinizing your expenses, identifying discretionary spending that can be curtailed, and redirecting those funds towards debt reduction, you can accelerate the process of regaining financial freedom.

Finally, maintaining open communication with creditors and exploring options for renegotiating payment terms or seeking hardship programs can provide relief in challenging financial circumstances. Proactively addressing financial hardships and seeking viable solutions with creditors can prevent delinquencies and protect your credit standing.

By integrating these principles into your debt management strategy, you can regain control of your financial health, reduce the burden of debt, and pave the way for a more secure and prosperous financial future.

Principle 5: Risk Management

Risk management is a fundamental principle in the realm of money management, encompassing strategies to safeguard your financial well-being and mitigate potential setbacks. By identifying and addressing various types of financial risks, you can fortify your financial resilience and protect your assets from unforeseen adversities.

One of the primary elements of risk management is the establishment of an emergency fund. This financial safety net, typically comprising three to six months’ worth of living expenses, serves as a buffer against unexpected events such as job loss, medical emergencies, or major household repairs. By maintaining an emergency fund, you can navigate financial disruptions without resorting to high-interest debt or depleting long-term savings.

Insurance plays a pivotal role in risk management, shielding you from the potential financial fallout of unforeseen events. Whether it’s health insurance to mitigate medical expenses, auto insurance to protect against vehicular mishaps, or homeowner’s insurance to safeguard your property, comprehensive insurance coverage provides a layer of financial protection and peace of mind.

Diversification within investment portfolios is a key strategy for mitigating investment risk. By spreading your investments across various asset classes and geographic regions, you can reduce the impact of market volatility on your overall portfolio. This approach helps minimize the potential losses from any single investment and enhances the resilience of your investment holdings.

Moreover, estate planning and the establishment of legal safeguards are integral components of comprehensive risk management. Creating a will, establishing trusts, and designating power of attorney empower you to protect your assets and ensure that your financial affairs are managed according to your wishes in the event of unforeseen circumstances.

Finally, staying informed and seeking professional guidance can enhance your risk management acumen. Whether it’s consulting with financial advisors, estate planning attorneys, or insurance professionals, leveraging expert insights and tailored strategies can bolster your overall risk management approach.

By integrating these principles into your financial strategy, you can proactively address potential risks, fortify your financial stability, and cultivate resilience in the face of unforeseen events, thereby safeguarding your long-term financial well-being.

Conclusion

Congratulations! You’ve embarked on a journey through the fundamental principles of money management, gaining valuable insights into budgeting, saving, investing, debt management, and risk management. By embracing these principles, you are equipped to navigate the complexities of personal finance, make informed decisions, and work towards achieving your financial aspirations.

As you apply these principles to your financial journey, remember that each principle is interconnected, forming a cohesive framework for your money management strategy. Budgeting serves as the foundation, providing a roadmap for your financial decisions and enabling you to allocate resources effectively. Saving empowers you to build a financial safety net, seize opportunities, and work towards your long-term goals. Investing offers the potential for wealth creation and long-term growth, provided it aligns with your objectives and risk tolerance. Debt management liberates you from financial burdens, paving the way for a more secure and prosperous future. Risk management safeguards your financial well-being, fortifying your resilience against unforeseen adversities.

By integrating these principles into your financial practices, you are empowered to make intentional choices, mitigate risks, and cultivate a more secure and fulfilling financial future. Whether you’re striving to build an emergency fund, save for a dream vacation, invest for retirement, or eliminate debt, these principles serve as your guiding beacons, empowering you to take charge of your financial destiny.

As you continue your financial journey, remember that progress is incremental, and each step towards financial empowerment is a testament to your dedication and foresight. Embrace the principles of money management as lifelong companions, adapting them to your evolving financial landscape and leveraging them to achieve your aspirations.

With these principles as your allies, you possess the knowledge and tools to navigate the dynamic terrain of personal finance, seize opportunities, and build a foundation for lasting financial well-being. Your commitment to mastering these principles sets the stage for a future defined by financial stability, resilience, and the realization of your dreams.