Home>Finance>Mergers And Acquisitions Are Associated With Which Strategy

Finance

Mergers And Acquisitions Are Associated With Which Strategy

Published: February 25, 2024

Discover the strategic implications of mergers and acquisitions in finance. Explore the impact of M&A on financial strategies and business growth.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Mergers and Acquisitions: Unveiling the Strategic Nexus

- Deciphering the Dynamics of M&A

- Delineating the Diverse Forms of Corporate Restructuring

- Unveiling the Motives Underpinning Transformative Transactions

- Unraveling the Strategic Frameworks Underpinning Transformative Transactions

- Navigating the Strategic Terrain of Mergers and Acquisitions

Introduction

Mergers and Acquisitions: Unveiling the Strategic Nexus

Mergers and acquisitions (M&A) represent pivotal maneuvers in the corporate landscape, shaping the destinies of companies and industries. These strategic transactions serve as catalysts for organizational growth, market expansion, and competitive advantage. Understanding the interplay between M&A and overarching business strategies is imperative for comprehending their profound implications.

In the realm of finance and commerce, M&A activities are often shrouded in intrigue and speculation. The allure of synergies, market dominance, and enhanced profitability fuels the fervor surrounding these strategic moves. However, beneath the surface, M&A transactions are deeply entwined with specific business strategies, each tailored to achieve distinct objectives.

Exploring the multifaceted relationship between M&A and strategic frameworks unveils a panorama of insights into the dynamics of corporate evolution and market positioning. By delving into the strategic underpinnings of M&A, we can decipher the intricate tapestry of motives and methodologies that underpin these transformative endeavors. Let us embark on a journey to unravel the strategic confluence of mergers and acquisitions, illuminating the pathways through which businesses chart their course in the ever-evolving global marketplace.

Definition of Mergers and Acquisitions

Deciphering the Dynamics of M&A

Mergers and acquisitions, commonly abbreviated as M&A, encompass a spectrum of strategic transactions through which companies restructure, combine, or transfer their operations and assets. A merger occurs when two separate entities amalgamate to form a new, singular organization, thereby consolidating their resources, capabilities, and market presence. On the other hand, an acquisition involves one company procuring another, thereby gaining control over its assets, intellectual property, and operational infrastructure.

These transactions are pivotal in reshaping the competitive landscape, fostering industry consolidation, and catalyzing shifts in market dynamics. M&A activities can manifest in various forms, including horizontal mergers between competitors operating in the same industry, vertical mergers involving entities within the supply chain, and conglomerate mergers spanning diverse business domains. Additionally, acquisitions can range from friendly takeovers, characterized by mutual agreement, to hostile takeovers, where the acquiring company bypasses the target’s management to directly engage its shareholders.

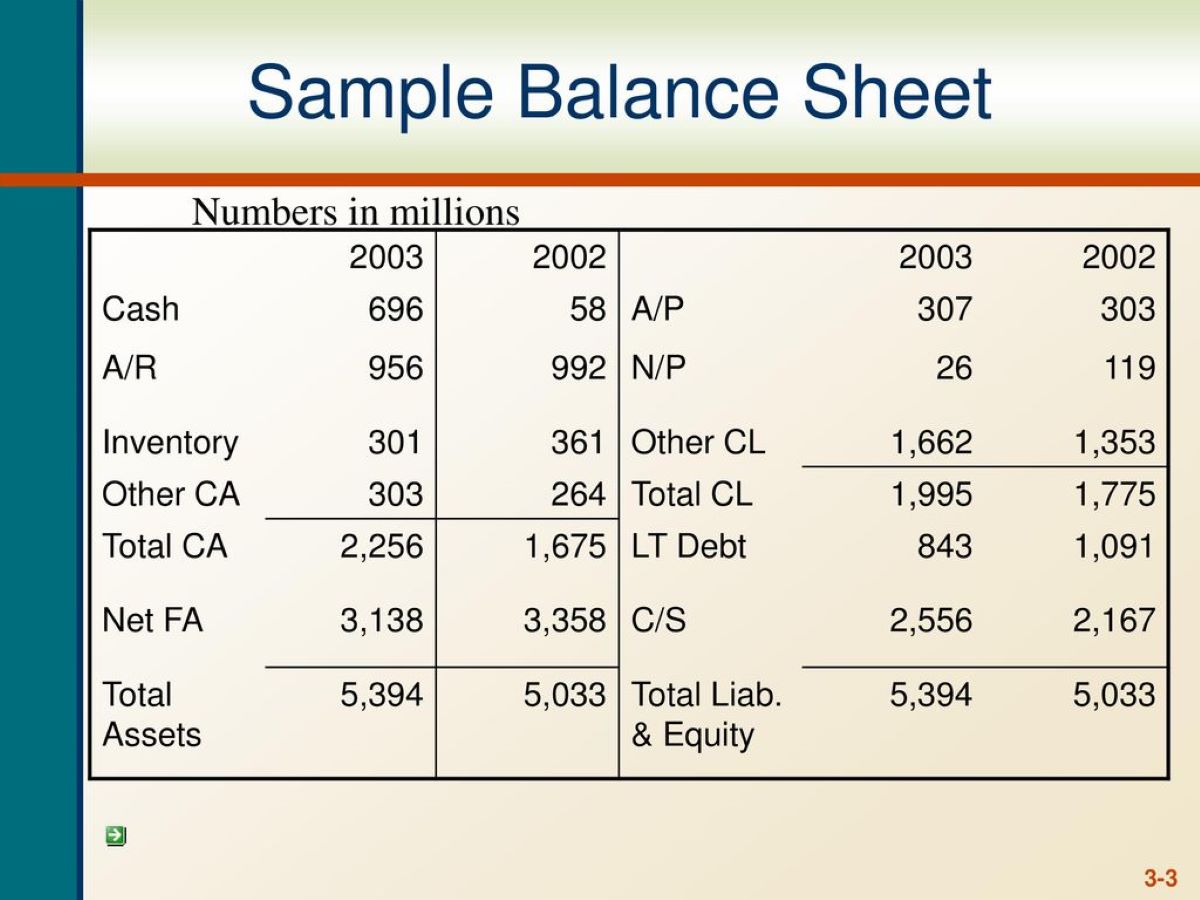

At the core of M&A transactions lies the pursuit of strategic objectives, such as expanding market reach, accessing new technologies, achieving economies of scale, or streamlining operations. These endeavors are underpinned by financial considerations, regulatory compliance, and intricate negotiations, culminating in the reconfiguration of corporate entities and market dynamics.

Understanding the nuances of mergers and acquisitions is pivotal for discerning their impact on businesses, industries, and the broader economy. By delving into the intricacies of these transactions, we can unravel the strategic imperatives that propel companies to engage in transformative endeavors, reshaping the contours of commerce and competition.

Types of Mergers and Acquisitions

Delineating the Diverse Forms of Corporate Restructuring

Mergers and acquisitions manifest in a myriad of forms, each delineating distinct pathways for corporate restructuring and strategic realignment. Understanding the various types of M&A transactions unveils the diverse modalities through which companies harness these strategic maneuvers to achieve specific objectives and propel their growth trajectories.

Horizontal Mergers: In the realm of M&A, horizontal mergers stand as prominent endeavors wherein companies operating in the same industry or market segment consolidate their operations and resources. By uniting forces, these entities aim to achieve economies of scale, broaden their market reach, and fortify their competitive positioning. Horizontal mergers often engender synergies in production, distribution, and research and development, fostering enhanced efficiency and market dominance.

Vertical Mergers: Contrasting with horizontal mergers, vertical mergers involve the consolidation of companies operating at different stages of the supply chain. This strategic maneuver enables entities to streamline their production processes, secure access to critical inputs or distribution channels, and gain greater control over the value chain. Vertical integration through mergers empowers companies to optimize costs, enhance operational coordination, and fortify their market presence.

Conglomerate Mergers: Conglomerate mergers encompass transactions between entities operating in unrelated business domains. These mergers diversify the acquirer’s portfolio, enabling them to enter new markets, capitalize on emerging trends, and mitigate risks associated with industry-specific fluctuations. By venturing into disparate sectors, companies seek to leverage their core competencies and financial resources to foster sustained growth and resilience.

Acquisitions: Acquisitions represent a spectrum of strategic transactions through which a company procures another entity, thereby gaining control over its assets, intellectual property, and market presence. Friendly acquisitions entail mutual agreement between the acquirer and the target, fostering collaborative integration and synergy realization. In contrast, hostile takeovers involve the acquisition of a resistant target, often sparking contentious battles for control and shareholder support.

Comprehending the diverse typologies of M&A transactions illuminates the strategic imperatives that underpin corporate restructuring and market realignment. By navigating the intricacies of these transactional modalities, businesses can chart informed pathways for growth, resilience, and sustained competitiveness in an ever-evolving marketplace.

Strategic Reasons for Mergers and Acquisitions

Unveiling the Motives Underpinning Transformative Transactions

Mergers and acquisitions are underpinned by a tapestry of strategic imperatives, each delineating a distinct rationale for companies to engage in transformative transactions. These strategic reasons encompass a spectrum of objectives, ranging from market expansion and synergy realization to competitive positioning and risk mitigation. By unraveling the strategic motives driving M&A activities, we can discern the pivotal role of these transactions in shaping the trajectories of companies and industries.

Market Consolidation and Expansion: One of the primary strategic drivers behind M&A transactions is the pursuit of market consolidation and expansion. Through mergers and acquisitions, companies seek to broaden their market reach, gain access to new customer segments, and fortify their presence in existing or emerging markets. By consolidating forces, entities aim to leverage synergies, enhance their competitive positioning, and capitalize on economies of scale to foster sustained growth and market dominance.

Synergy Realization: Mergers and acquisitions offer a pathway for realizing synergies in diverse realms, including operational efficiency, technological innovation, and market penetration. By integrating complementary capabilities, resources, and expertise, companies strive to unlock synergistic value that transcends the sum of individual entities. This synergy realization empowers companies to optimize costs, drive innovation, and bolster their value proposition in the market ecosystem.

Strategic Diversification: For companies seeking to diversify their business portfolios and mitigate industry-specific risks, mergers and acquisitions serve as a strategic conduit for venturing into new domains and expanding their revenue streams. Through strategic diversification, entities aim to capitalize on emerging trends, leverage their core competencies across diverse sectors, and insulate themselves from the volatilities of specific markets or economic cycles.

Technology and Innovation: In the era of rapid technological advancement, M&A transactions often revolve around gaining access to cutting-edge technologies, intellectual property, and innovation capabilities. By acquiring or merging with tech-savvy entities, companies endeavor to bolster their digital transformation initiatives, enhance their product offerings, and fortify their competitive edge in the digital marketplace.

By delving into the strategic underpinnings of mergers and acquisitions, we gain profound insights into the motives propelling companies to engage in transformative transactions. These strategic imperatives, intertwined with market dynamics and competitive forces, underscore the pivotal role of M&A activities in shaping the destinies of businesses and industries.

Associated Strategies with Mergers and Acquisitions

Unraveling the Strategic Frameworks Underpinning Transformative Transactions

Mergers and acquisitions are intrinsically linked to a spectrum of strategic frameworks that guide and govern the transformative trajectories of companies undergoing these transactions. These associated strategies encompass a multifaceted approach to reshaping organizational structures, optimizing operational synergies, and navigating the complexities of market integration. By elucidating the strategic underpinnings of M&A, we can discern the nuanced methodologies through which companies orchestrate these transformative endeavors.

Integration Planning: A pivotal strategy associated with mergers and acquisitions revolves around meticulous integration planning, wherein companies chart a comprehensive roadmap for harmonizing operations, cultures, and systems post-transaction. This entails aligning organizational hierarchies, streamlining processes, and fostering cross-functional collaboration to realize synergies and minimize disruptions. Strategic integration planning is instrumental in ensuring a seamless transition and maximizing the value derived from the combined entities.

Market Positioning and Differentiation: M&A transactions often pivot around strategic initiatives aimed at fortifying market positioning and differentiation. Companies endeavor to leverage the combined strengths of the entities to carve a distinct niche in the market, capitalize on unique value propositions, and outmaneuver competitors. This strategic approach involves meticulous market analysis, brand positioning, and customer segmentation to optimize the competitive advantage stemming from the transformative transaction.

Change Management and Cultural Alignment: Given the transformative nature of mergers and acquisitions, strategies centered on change management and cultural alignment are paramount for ensuring organizational cohesion and employee engagement. Companies focus on fostering a culture of openness, transparency, and inclusivity to navigate the complexities of post-merger integration, mitigate resistance to change, and align the workforce with the overarching strategic objectives. By nurturing a cohesive organizational culture, companies strive to harness the collective potential of the merged entities and propel their growth trajectory.

Risk Mitigation and Regulatory Compliance: M&A activities necessitate robust strategies for mitigating risks and ensuring compliance with regulatory frameworks governing these transactions. Companies engage in meticulous due diligence, legal scrutiny, and risk assessment to identify and address potential contingencies, safeguarding the interests of stakeholders and ensuring adherence to legal and ethical standards. This strategic imperative is integral to fostering stakeholder confidence, mitigating uncertainties, and sustaining the long-term viability of the post-transaction entity.

By delving into the associated strategies with mergers and acquisitions, we unravel the intricate tapestry of methodologies that underpin transformative transactions, shaping the destinies of companies and recalibrating the contours of industries. These strategic frameworks, intertwined with meticulous planning and execution, underscore the pivotal role of strategy in navigating the complexities of M&A and realizing the full potential of these transformative endeavors.

Conclusion

Navigating the Strategic Terrain of Mergers and Acquisitions

As we traverse the strategic landscape of mergers and acquisitions, we unravel the intricate interplay between transformative transactions and the strategic imperatives that underpin them. Mergers and acquisitions, encompassing diverse typologies and strategic rationales, serve as catalysts for reshaping industries, fostering market dynamism, and propelling the growth trajectories of companies.

The strategic nexus of M&A transactions extends beyond mere corporate restructuring, encapsulating a profound interplay of market dynamics, competitive positioning, and organizational realignment. Companies embarking on these transformative endeavors navigate a multifaceted terrain, wherein strategic planning, integration frameworks, and risk mitigation strategies converge to shape the destinies of the post-transaction entity.

By delving into the diverse typologies of M&A, ranging from horizontal and vertical mergers to strategic diversification and acquisitions, we gain insights into the nuanced pathways through which companies harness these transactions to achieve specific objectives. Market consolidation, synergy realization, and technological innovation emerge as pivotal drivers underpinning these strategic maneuvers, underscoring the multifaceted nature of M&A transactions.

Furthermore, the associated strategies with mergers and acquisitions, encompassing integration planning, market positioning, change management, and risk mitigation, illuminate the meticulous orchestration required to harmonize the operations, cultures, and regulatory compliance of the merged entities. These strategies underscore the pivotal role of strategic foresight, meticulous planning, and adept execution in navigating the complexities of transformative transactions.

In conclusion, the strategic confluence of mergers and acquisitions represents a captivating tapestry of market dynamics, competitive imperatives, and organizational transformation. By unraveling the strategic underpinnings of M&A, we gain profound insights into the transformative potential of these transactions and the strategic imperatives that propel companies to engage in these endeavors. As businesses continue to navigate the ever-evolving marketplace, the strategic nexus of mergers and acquisitions stands as a testament to the enduring interplay between corporate strategy and market dynamics, shaping the contours of commerce and competition.