Home>Finance>How Does A Clearinghouse Facilitate The Trading Of Financial Futures Contracts?

Finance

How Does A Clearinghouse Facilitate The Trading Of Financial Futures Contracts?

Published: December 24, 2023

Discover how a clearinghouse in finance streamlines the trading process for financial futures contracts, ensuring efficient transactions and reducing counterparty risk.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- What is a Clearinghouse?

- Overview of Financial Futures Contracts

- The Role of Clearinghouses in Trading Financial Futures Contracts

- Clearing Mechanisms Used by Clearinghouses

- Margin Requirements and Risk Management

- Default Management Procedures of Clearinghouses

- Advantages of Using Clearinghouses for Trading Financial Futures Contracts

- Conclusion

Introduction

When it comes to the world of finance, the trading of financial futures contracts plays a vital role in managing risk and speculating on future market movements. These contracts allow market participants to buy or sell an asset at a predetermined price and date, providing opportunities for hedging and leveraging investment positions. But how does the trading of these financial futures contracts actually take place? Enter the clearinghouse.

A clearinghouse acts as an intermediary between buyers and sellers in the trading of financial futures contracts. It serves as a central counterparty, guaranteeing the performance of each contract and ensuring the smooth settlement of transactions. In this article, we will explore the role of clearinghouses in facilitating the trading of financial futures contracts and how they contribute to the stability and efficiency of the financial markets.

But before we delve deeper into the function of clearinghouses, let’s first have a brief overview of what financial futures contracts are and how they are traded.

What is a Clearinghouse?

A clearinghouse is a financial institution that acts as an intermediary in the trading of financial derivatives, such as futures contracts. It plays a crucial role in ensuring the smooth functioning and stability of the derivatives market. Clearinghouses provide a centralized platform for buyers and sellers to trade derivatives, effectively managing the associated risks and reducing counterparty default risk.

One of the primary functions of a clearinghouse is to act as a counterparty between buyers and sellers of financial derivatives. When a trader enters into a futures contract, they become obligated to either buy or sell the underlying asset at a specified price and date in the future. The clearinghouse steps in to guarantee the performance of the contract, effectively assuming the counterparty risk.

Clearinghouses achieve this risk management by employing a process known as “novation.” When a futures contract is traded on an exchange, it is submitted to the clearinghouse, which becomes the buyer to every seller and the seller to every buyer. This process effectively creates two separate contracts: one between the original buyer and the clearinghouse, and another between the original seller and the clearinghouse. By creating these two contracts, the clearinghouse effectively replaces the individual counterparty risk with the risk of the clearinghouse itself.

In addition to acting as a counterparty, clearinghouses also provide various other services to market participants. These include:

- Trade confirmation and matching: Clearinghouses ensure accurate trade confirmation and matching, reducing the possibility of errors or disputes in trade settlements.

- Margin requirements and collateral management: Clearinghouses establish margin requirements, which serve as a form of collateral from participants to cover potential losses. They also manage the exchange of collateral between market participants.

- Position monitoring and risk management: Clearinghouses closely monitor the positions of market participants to mitigate systemic risk and maintain the integrity of the market.

- Settlement and delivery: Clearinghouses facilitate the settlement of transactions and ensure the timely delivery of the underlying asset upon contract maturity.

Overall, clearinghouses play a crucial role in centralizing and managing the risks associated with financial derivatives trading. By providing a reliable framework for trade settlement, risk management, and collateral management, clearinghouses contribute to the stability and efficiency of the financial markets.

Overview of Financial Futures Contracts

Financial futures contracts are derivative instruments that enable traders to speculate on the future price movements of various financial assets, including commodities, currencies, interest rates, and stock market indices. These contracts are standardized agreements that obligate the buyer to purchase or the seller to sell the underlying asset at a predetermined price and date in the future.

There are several key components of a financial futures contract:

- Underlying asset: This is the financial instrument or commodity that the contract is based on. Examples include crude oil, gold, stock market indices, or government bonds.

- Contract size: This refers to the quantity of the underlying asset covered by a single futures contract. It is typically standardized to facilitate trading.

- Expiration date: This is the date on which the contract expires, and the delivery or settlement of the underlying asset occurs.

- Contract price: Also known as the futures price, it represents the agreed-upon price at which the underlying asset will be bought or sold when the contract expires.

- Margin: Traders are required to deposit an initial margin, which represents a percentage of the contract value, to secure their positions. This margin acts as collateral and helps to cover potential losses.

Financial futures contracts are traded on specialized exchanges, such as the Chicago Mercantile Exchange (CME) or the Intercontinental Exchange (ICE). These exchanges provide a regulated marketplace where buyers and sellers can transact with each other. The contracts are standardized, meaning that the terms and conditions, such as contract size and expiration date, are predetermined and consistent across all trades.

Trading financial futures contracts offers several benefits for market participants. For speculators, futures contracts provide an opportunity to profit from anticipated price movements without having to physically own the underlying asset. For hedgers, these contracts allow them to protect themselves against adverse price movements by locking in a future price through buying or selling the futures contract.

The liquidity of financial futures contracts enables traders to easily enter and exit positions, facilitating efficient price discovery and market participation. It also allows for leverage, as traders only need to deposit a fraction of the contract value as margin, amplifying potential returns and losses.

Overall, financial futures contracts provide a means for market participants to engage in price speculation, risk management, and portfolio diversification. The standardized nature of these contracts and their trading on organized exchanges ensures transparency and efficiency in the derivatives market.

The Role of Clearinghouses in Trading Financial Futures Contracts

Clearinghouses play a critical role in facilitating the trading of financial futures contracts by providing a centralized platform for market participants to transact and managing the associated risks. They act as intermediaries between buyers and sellers, ensuring the smooth settlement of trades and mitigating counterparty default risk.

One of the primary roles of clearinghouses is to reduce counterparty risk in the derivatives market. When a trader buys or sells a futures contract, they are exposed to the risk that the other party may default on their obligations. Clearinghouses act as a trusted counterparty to every trade, guaranteeing the performance of the contracts. This means that if a buyer fails to pay or a seller fails to deliver the underlying asset, the clearinghouse steps in to fulfill those obligations.

The use of a clearinghouse significantly reduces counterparty default risk, as market participants no longer have to rely solely on the creditworthiness of individual counterparties. Instead, they can trade with confidence, knowing that the clearinghouse stands behind each transaction.

Furthermore, clearinghouses enhance the efficiency and integrity of the derivatives market through centralized clearing and standardized processes. When a futures contract is traded, it is submitted to the clearinghouse, which nets out offsetting positions. This reduces the number of individual contracts that need to be settled and simplifies the settlement process.

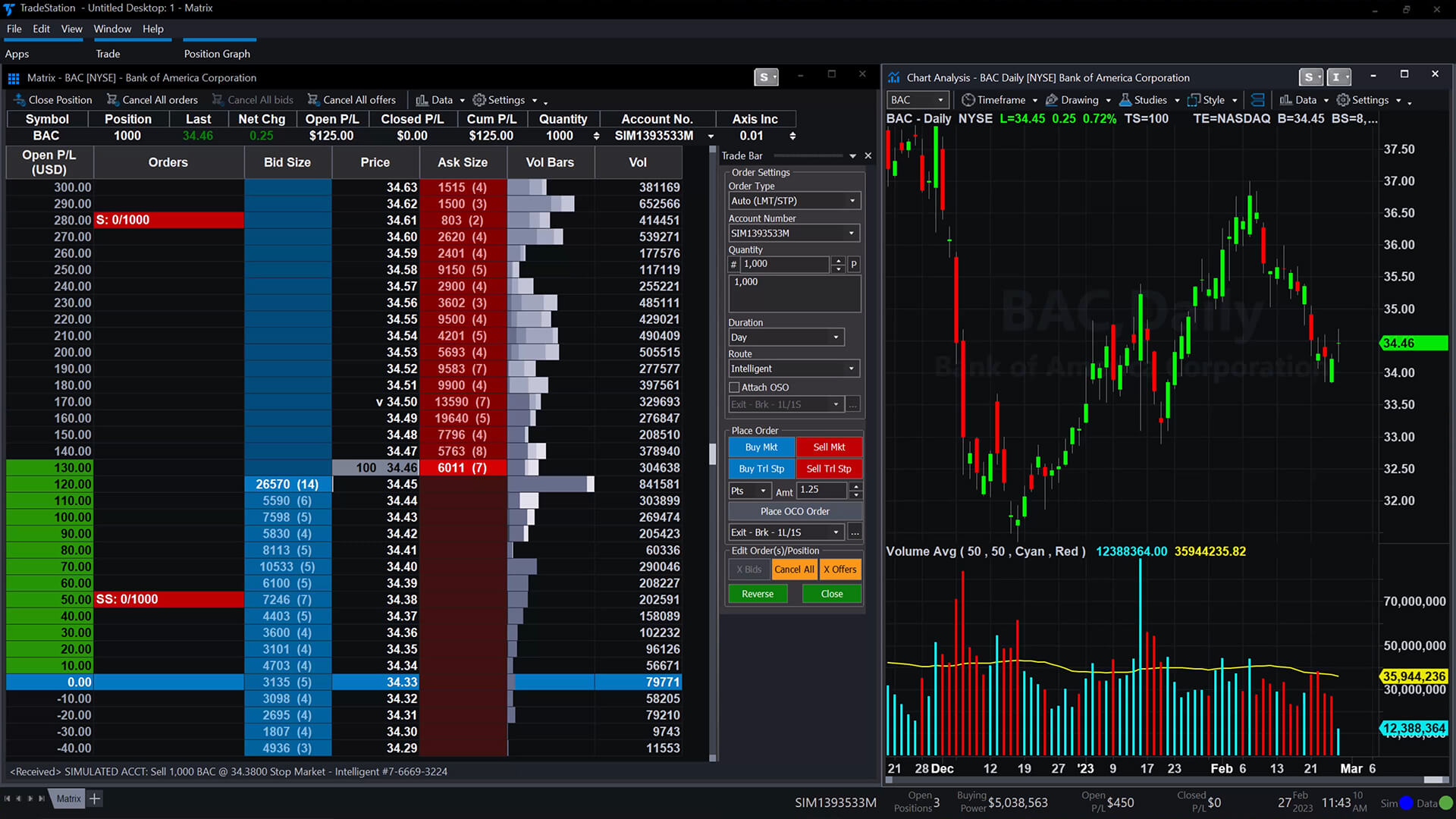

Clearinghouses also establish and enforce margin requirements, which serve as a form of collateral from market participants to cover potential losses. By requiring market participants to deposit an initial margin, the clearinghouse ensures that there is sufficient collateral to protect against adverse price movements and minimize the risk of default. Margin requirements are regularly monitored and adjusted to reflect market conditions and the inherent risks of the underlying assets.

Another crucial role of clearinghouses is to manage risk associated with the derivatives market. They closely monitor the positions of market participants, identifying and mitigating potential systemic risks. This includes monitoring concentration risks, ensuring that no single participant holds an excessive position that could pose a risk to the overall market stability. Clearinghouses also have stringent risk management measures in place, such as regular stress testing and risk modeling, to assess the potential impacts of extreme market scenarios.

Overall, clearinghouses play a vital role in the trading of financial futures contracts by mitigating counterparty risk, streamlining settlement processes, and managing systemic risks. Their presence ensures the stability and integrity of the derivatives market, providing a transparent and efficient platform for market participants to engage in trading and risk management activities.

Clearing Mechanisms Used by Clearinghouses

Clearinghouses employ various mechanisms to facilitate the smooth and efficient clearing of financial futures contracts. These mechanisms ensure the proper matching, netting, and settlement of trades, reducing the operational and counterparty risks associated with derivatives trading.

One of the key clearing mechanisms used by clearinghouses is the process of novation. Novation refers to the replacement of the original parties to a contract with the clearinghouse itself. When a futures contract is traded on an exchange, it is submitted to the clearinghouse, which becomes the buyer to every seller and the seller to every buyer. By becoming the counterparty to each trade, the clearinghouse effectively eliminates the need for market participants to rely on the creditworthiness of each other. This helps reduce counterparty risk and ensure the smooth performance of the contracts.

Clearinghouses also implement a process known as trade matching or confirmation. When trades are executed on an exchange, the clearinghouse verifies the details of each trade, including the contract specifications, price, quantity, and the identity of the buyer and seller. Matching is essential to ensure accuracy and eliminate any discrepancies or errors that could undermine the integrity of the clearing process.

In addition to trade matching, clearinghouses utilize netting mechanisms to simplify the settlement process. Netting involves offsetting positions and aggregating transactions to minimize the number of individual contracts that need to be settled. By netting positions, clearinghouses reduce the operational complexity and cost associated with settling each trade separately. This streamlines the settlement process and improves efficiency in the clearing system.

Margin requirements are another crucial clearing mechanism used by clearinghouses. Clearinghouses set and enforce margin requirements to ensure that market participants have sufficient collateral to cover potential losses. Initial margin, collected when trades are initiated, acts as a form of collateral to protect against adverse price movements. Maintenance margin, on the other hand, refers to the minimum level of margin that market participants must maintain in their accounts. If the margin falls below this threshold, participants are required to top up their accounts. Margin requirements help mitigate the risk of default and protect the financial stability of the clearinghouse and the overall market.

Furthermore, clearinghouses employ sophisticated risk management techniques, including stress testing and risk modeling, to assess and manage the potential risks associated with derivatives trading. Regular stress tests help evaluate the resilience of clearinghouses under extreme market scenarios, ensuring they can withstand significant fluctuations in price and volatility. Risk modeling allows clearinghouses to quantify and monitor potential risks in their clearing portfolios to prevent undue concentrations and manage systemic risks.

Overall, clearing mechanisms such as novation, trade matching, netting, and margin requirements are integral to the clearing process conducted by clearinghouses. These mechanisms enhance the efficiency, reduce counterparty risk, and ensure the smooth settlement of financial futures contracts, contributing to the stability and integrity of the derivatives market.

Margin Requirements and Risk Management

Margin requirements play a crucial role in the risk management framework of clearinghouses. Clearinghouses establish and enforce margin requirements to ensure that market participants have sufficient collateral to cover potential losses and reduce the risk of default.

When trading financial futures contracts, market participants are required to deposit an initial margin, which represents a percentage of the contract value. The initial margin acts as collateral and serves several important purposes:

- Risk mitigation: Margin requirements help mitigate the risk of default by ensuring that market participants have sufficient funds or collateral to cover potential losses. By requiring the deposit of an initial margin, clearinghouses reduce the likelihood of a participant defaulting on their obligations.

- Price volatility: Futures contracts are subject to price fluctuations. Margin requirements account for this volatility by ensuring that participants have enough funds to absorb potential losses resulting from adverse price movements. This protects the financial integrity of the clearinghouse and the overall market.

- Liquidity management: Margin requirements also serve as a mechanism for managing liquidity risk. By requiring participants to deposit an initial margin, clearinghouses ensure that sufficient funds are available in case participants need to meet their margin obligations.

Clearinghouses regularly monitor margin requirements to ensure they reflect the inherent risks of the traded assets and adjust them accordingly. Margin requirements may vary based on factors such as the volatility of the underlying asset, the participant’s trading history, and the economic conditions. Maintaining appropriate margin levels helps ensure that market participants have adequate financial resources to cover potential losses, enhancing the stability and integrity of the derivatives market.

Risk management is a critical aspect of clearinghouse operations. Clearinghouses employ various risk management techniques to assess, monitor, and mitigate potential risks associated with derivatives trading. These techniques include:

- Stress testing: Clearinghouses conduct regular stress tests to evaluate their robustness and resilience under extreme market scenarios. Stress tests help identify vulnerabilities and assess the potential impacts of adverse events on clearinghouse portfolios. This enables clearinghouses to take proactive measures to enhance risk management and ensure the continuity of their operations.

- Risk modeling: Clearinghouses utilize advanced risk modeling techniques to quantify and monitor potential risks within their clearing portfolios. Risk models assess factors such as market volatility, liquidity, and correlation to measure the potential exposure within the clearinghouse’s portfolio. This helps in managing concentration risks and identifying potential systemic risks.

- Default management procedures: Clearinghouses establish robust default management procedures to handle instances when a participant fails to fulfill their obligations. These procedures outline the steps taken by the clearinghouse to minimize losses and ensure an orderly resolution in case of default. Measures may include the auctioning of the defaulting participant’s positions, the use of contingency funds, or the allocation of losses among non-defaulting participants.

By implementing sound risk management practices, clearinghouses enhance the stability and integrity of the derivatives market. Margin requirements, stress testing, risk modeling, and default management procedures are integral components of the risk management framework, ensuring the protection of market participants and the overall financial system.

Default Management Procedures of Clearinghouses

Clearinghouses play a crucial role in managing the risk of default in the derivatives market. While the occurrence of defaults is rare, clearinghouses have robust default management procedures in place to mitigate the impact and ensure the orderly resolution of any defaulting participant.

When a participant fails to fulfill their obligations, whether due to financial distress or other reasons, the default management procedures of clearinghouses are activated. These procedures aim to protect the financial integrity of the clearinghouse and minimize the potential losses incurred by non-defaulting participants. Here are some key elements of the default management procedures:

- Initial margin usage: Clearinghouses utilize the initial margin deposited by the defaulting participant to cover any losses resulting from their default. The initial margin acts as collateral and serves as a buffer to absorb potential losses. The defaulting participant’s positions may be liquidated, and the proceeds from the liquidation are used to cover losses and satisfy outstanding obligations.

- Auctioning of positions: In certain cases, clearinghouses may conduct auctions to dispose of the defaulting participant’s positions. The aim is to obtain the best possible price for those positions and minimize the potential market impact. Non-defaulting participants may participate in the auction to potentially acquire the positions or offset their own exposures.

- Contingency funds: Many clearinghouses have contingency funds or mutualized resources to absorb losses in the event of a default. These funds are contributed by non-defaulting participants and are used to cover any remaining losses not covered by the initial margin or proceeds from position liquidation. The availability of contingency funds helps ensure that the financial impact of a default is shared among market participants.

- Allocation of losses: If the initial margin and the proceeds from position liquidation are insufficient to cover all losses, clearinghouses may allocate the remaining losses to non-defaulting participants. This allocation is typically based on predefined rules that consider factors such as open positions, portfolio composition, and trading activity. The allocation helps distribute the losses equitably and ensures that no single participant bears an excessive burden.

- Communication and transparency: Clearinghouses maintain open lines of communication with market participants during a default event. They provide regular updates and information regarding the default management procedures, including the status of position liquidation, the use of contingency funds, and the allocation of losses. Transparency is paramount to maintain confidence in the overall clearing process.

It is important to note that default management procedures may vary slightly among different clearinghouses, but they all aim to ensure the orderly resolution of defaults and minimize the systemic impact on the derivatives market.

By having rigorous default management procedures in place, clearinghouses ensure the stability and integrity of the derivatives market. These procedures help protect non-defaulting participants, promote market confidence, and contribute to the overall risk management framework of clearinghouses.

Advantages of Using Clearinghouses for Trading Financial Futures Contracts

Clearinghouses provide several advantages for market participants when it comes to trading financial futures contracts. These advantages contribute to the stability, transparency, and efficiency of the derivatives market. Here are some key benefits of using clearinghouses:

- Counterparty risk reduction: Clearinghouses act as trusted intermediaries, assuming the counterparty risk for each trade. By becoming the buyer to every seller and the seller to every buyer, clearinghouses effectively replace individual counterparty risk with the risk of the clearinghouse itself. This reduces the credit risk associated with trading derivatives and enhances market participants’ confidence in the performance and settlement of contracts.

- Trade guarantee: Clearinghouses guarantee the performance of financial futures contracts, ensuring that both buyers and sellers fulfill their obligations. If a participant defaults, the clearinghouse steps in and ensures that the contract settles, reducing the risk of transaction failures and ensuring the smooth functioning of the market.

- Risk management: Clearinghouses implement risk management measures, including margin requirements and collateral management, to protect the financial stability of the market. Margin requirements ensure that market participants have sufficient collateral to cover potential losses, reducing the risk of default. By actively monitoring positions, managing concentration risks, and conducting stress tests, clearinghouses contribute to the overall risk management framework of the market and help maintain its stability.

- Operational efficiency: Clearinghouses streamline the settlement process by netting positions and aggregating transactions. By reducing the number of individual contracts that need to be settled, clearinghouses enhance operational efficiency and reduce costs. This simplifies the settlement process and improves overall market liquidity.

- Transparent pricing: Trading financial futures contracts on a centralized clearing platform provides transparent pricing and dissemination of market data. Clearinghouses ensure that prices are readily available to all market participants, promoting fair and equitable trading. Transparent pricing also facilitates the efficient discovery of market prices, benefiting both speculators and hedgers.

- Liquidity and market access: By offering liquidity through centralized clearing, clearinghouses provide market participants with increased access to a broad range of financial futures contracts. This enables traders to easily enter and exit positions and fosters a more vibrant and competitive marketplace.

- Regulatory compliance: Clearinghouses operate under stringent regulatory oversight, ensuring compliance with relevant laws and regulations. This regulatory scrutiny helps protect market participants and instills confidence in the financial system.

Overall, clearinghouses offer numerous advantages for market participants when trading financial futures contracts. By reducing counterparty risk, guaranteeing trades, implementing risk management measures, improving operational efficiency, offering transparent pricing, providing liquidity, and ensuring regulatory compliance, clearinghouses contribute to the stability and integrity of the derivatives market.

Conclusion

Clearinghouses play a pivotal role in facilitating the trading of financial futures contracts, ensuring the smooth functioning and stability of the derivatives market. By acting as intermediaries between buyers and sellers, clearinghouses reduce counterparty risk and provide a trusted platform for market participants to transact.

Through mechanisms such as novation, trade matching, netting, and margin requirements, clearinghouses streamline the trading and settlement processes, enhancing operational efficiency and reducing costs. With their risk management practices, including stress testing, risk modeling, and default management procedures, clearinghouses mitigate risks and protect the financial integrity of the market.

Advantages of using clearinghouses for trading financial futures contracts include the reduction of counterparty risk, the guarantee of trades, efficient risk management, transparent pricing, improved liquidity, and regulatory compliance. These benefits not only contribute to the stability and efficiency of the derivatives market but also instill confidence in market participants.

Clearinghouses are essential for providing a transparent, secure, and well-regulated framework for trading financial futures contracts. They act as the backbone of the derivatives market, ensuring fair and orderly outcomes, managing risk, and fostering market liquidity.

In conclusion, the role of clearinghouses in the trading of financial futures contracts cannot be overstated. Their presence promotes market confidence, protects participants from counterparty risk, and facilitates efficient and transparent trading. By providing reliable clearing and settlement services, clearinghouses contribute to the overall stability and integrity of the financial markets, ensuring the smooth functioning of the derivatives market for the benefit of all participants.