Finance

How To Raise FICO Score 5, 4, 2

Published: March 7, 2024

Learn effective strategies to improve your credit score with our comprehensive guide on raising FICO scores. Take control of your finances and boost your creditworthiness today!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Understanding the Importance of a Good FICO Score

Welcome to the world of credit scores, where a three-digit number can significantly impact your financial well-being. Your FICO score, a measure of your creditworthiness, plays a pivotal role in determining the interest rates you’ll be offered on loans and credit cards. It can even influence your ability to secure a mortgage, car loan, or apartment lease. In essence, your FICO score holds the power to shape your financial opportunities and decisions.

Understanding the factors that influence your FICO score and knowing how to improve it are essential steps toward financial empowerment. Whether you’re aiming to qualify for a competitive interest rate on a loan or simply want to strengthen your financial standing, navigating the world of credit scores is a valuable skill.

In this comprehensive guide, we’ll delve into the intricacies of the FICO score and explore actionable steps to elevate it. By the end of this journey, you’ll be equipped with the knowledge and strategies needed to enhance your FICO score and unlock a world of financial possibilities.

Understanding FICO Score

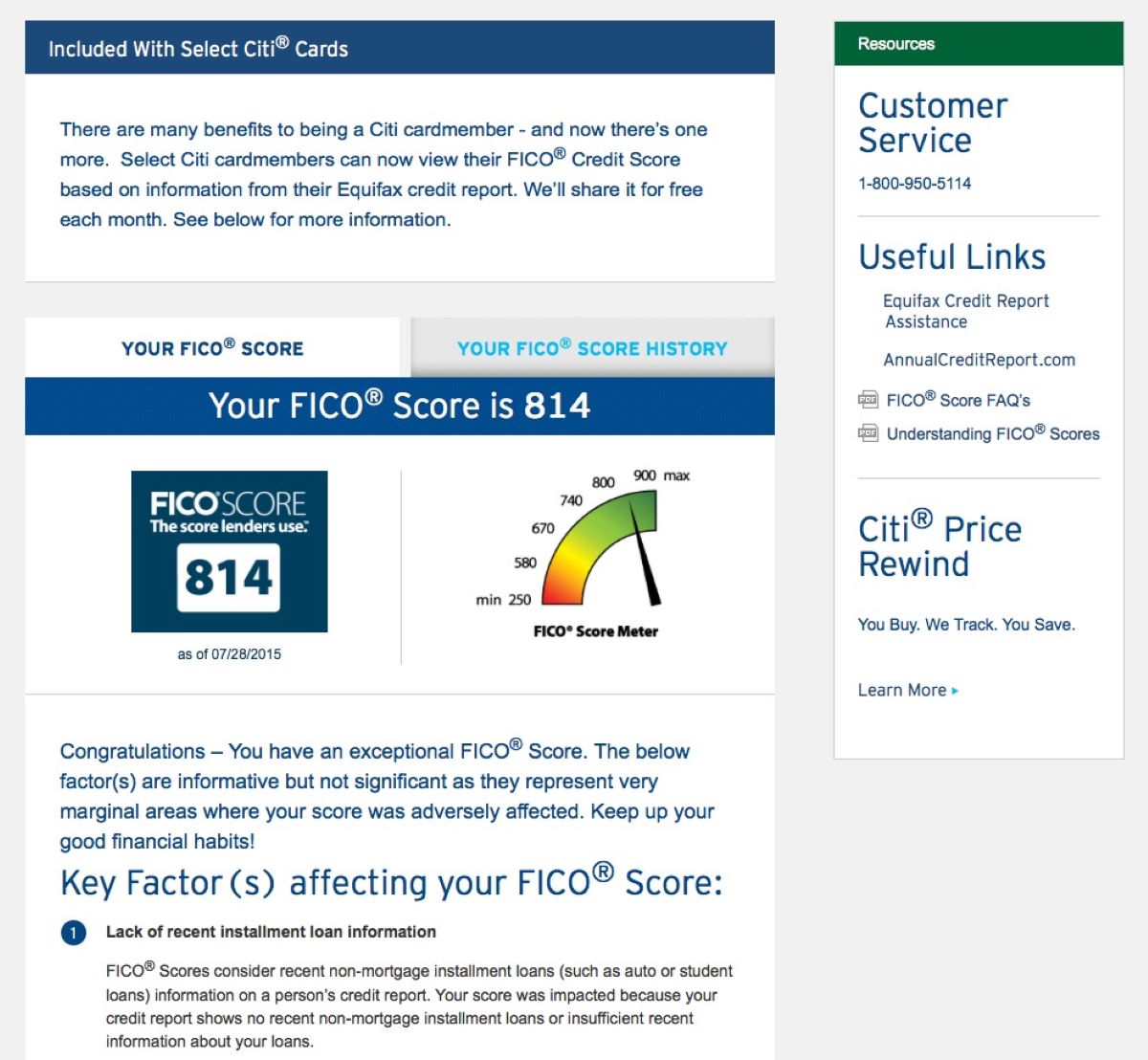

Before embarking on the journey to improve your FICO score, it’s crucial to grasp the fundamentals of this influential metric. The FICO score, developed by the Fair Isaac Corporation, is a numerical representation of an individual’s credit risk. Ranging from 300 to 850, a higher score indicates lower credit risk, making you a more attractive borrower in the eyes of lenders.

Several factors contribute to the calculation of your FICO score, with payment history carrying the most significant weight. This encompasses your track record of making timely payments on credit accounts, including credit cards, loans, and mortgages. The amount owed, length of credit history, new credit inquiries, and credit mix also play roles in shaping your FICO score.

Understanding the weight of each factor can shed light on areas that require attention. For instance, carrying high balances on credit cards can adversely impact your credit utilization ratio, a key component of the amount owed factor. Similarly, opening multiple new credit accounts within a short period can raise red flags for lenders, potentially lowering your score.

It’s important to note that different lenders may have varying criteria for evaluating creditworthiness, and they may use FICO scores in conjunction with other factors to make lending decisions. Nonetheless, a solid understanding of the core components of the FICO score can empower you to make informed financial choices and take proactive steps to enhance your credit profile.

Now that we’ve established a foundational understanding of the FICO score, let’s proceed to explore actionable steps to elevate this influential metric and pave the way for improved financial opportunities.

Steps to Raise FICO Score

Now that we comprehend the significance of the FICO score, it’s time to explore actionable strategies to elevate this pivotal metric. Improving your FICO score requires a combination of diligence, financial prudence, and strategic maneuvers. By implementing the following steps, you can embark on a journey toward a healthier credit profile and enhanced financial prospects.

Evaluate Your Credit Report

The first step to raising your FICO score is to obtain and review your credit report from all three major credit bureaus: Equifax, Experian, and TransUnion. Scrutinize the report for inaccuracies, such as erroneous late payments or accounts that don’t belong to you. Disputing and rectifying these errors can potentially boost your FICO score.

Manage Credit Utilization

Strive to maintain a low credit utilization ratio by keeping credit card balances well below the credit limits. Aim to utilize no more than 30% of your available credit, as high utilization can signal financial strain and negatively impact your FICO score.

Timely Payments

Consistently making on-time payments on all credit accounts is paramount for FICO score improvement. Set up payment reminders or automatic debits to ensure punctuality, thereby fortifying your payment history and bolstering your score.

Strategic Debt Repayment

If feasible, devise a plan to strategically reduce outstanding debts, prioritizing high-interest balances. By chipping away at debts, you can lower credit utilization and demonstrate responsible financial management, positively influencing your FICO score.

Strategic Credit Applications

Exercise caution when applying for new credit accounts, as each application triggers a hard inquiry, which can marginally lower your FICO score. Limiting new credit inquiries can help maintain a favorable credit profile.

Diversify Credit Mix

A well-rounded credit portfolio that includes a mix of credit cards and installment loans can contribute to a healthier FICO score. However, avoid opening unnecessary accounts solely to diversify, as this can backfire.

By diligently implementing these steps and maintaining responsible financial habits, you can steadily raise your FICO score, paving the way for improved financial opportunities and peace of mind.

Conclusion

Congratulations on embarking on the journey to elevate your FICO score and fortify your financial standing. By gaining a comprehensive understanding of the FICO score and implementing strategic steps to enhance it, you’ve taken a proactive stride toward unlocking a world of improved financial opportunities and peace of mind.

As you navigate the realm of credit scores, remember that patience and perseverance are key virtues. Improving your FICO score is a gradual process that requires consistent financial prudence and responsible credit management. By regularly monitoring your credit report, managing credit utilization, prioritizing timely payments, and strategically handling debts, you can steadily elevate your FICO score and bolster your creditworthiness.

It’s essential to approach the journey with a long-term perspective, understanding that positive changes in your credit profile may take time to reflect in your FICO score. However, each proactive step you take contributes to a stronger financial foundation and enhanced borrowing capabilities.

Lastly, as you strive to raise your FICO score, remember that your creditworthiness extends beyond numerical metrics. Responsible financial habits, sound budgeting, and informed decision-making are integral aspects of a robust financial profile. By integrating these principles into your financial journey, you can cultivate a holistic approach to financial well-being.

Armed with the knowledge and strategies outlined in this guide, you’re empowered to navigate the realm of credit scores with confidence and poise. As you forge ahead on this path of financial empowerment, may your elevated FICO score open doors to favorable interest rates, enhanced loan approvals, and a brighter financial future.