Home>Finance>Minimum Payment Of Business Tax When There Is No Revenue

Finance

Minimum Payment Of Business Tax When There Is No Revenue

Published: February 26, 2024

Learn how to navigate the minimum payment of business tax when there is no revenue. Get expert finance advice to manage your tax responsibilities effectively.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Understanding Minimum Payment of Business Tax When There Is No Revenue

Navigating the complex terrain of business taxes can be a daunting task for entrepreneurs and small business owners. Among the myriad tax obligations, the concept of minimum business tax stands out as a crucial yet often misunderstood aspect of financial management. This article aims to shed light on the implications and strategies associated with minimum tax payments, particularly in the scenario where a business generates no revenue.

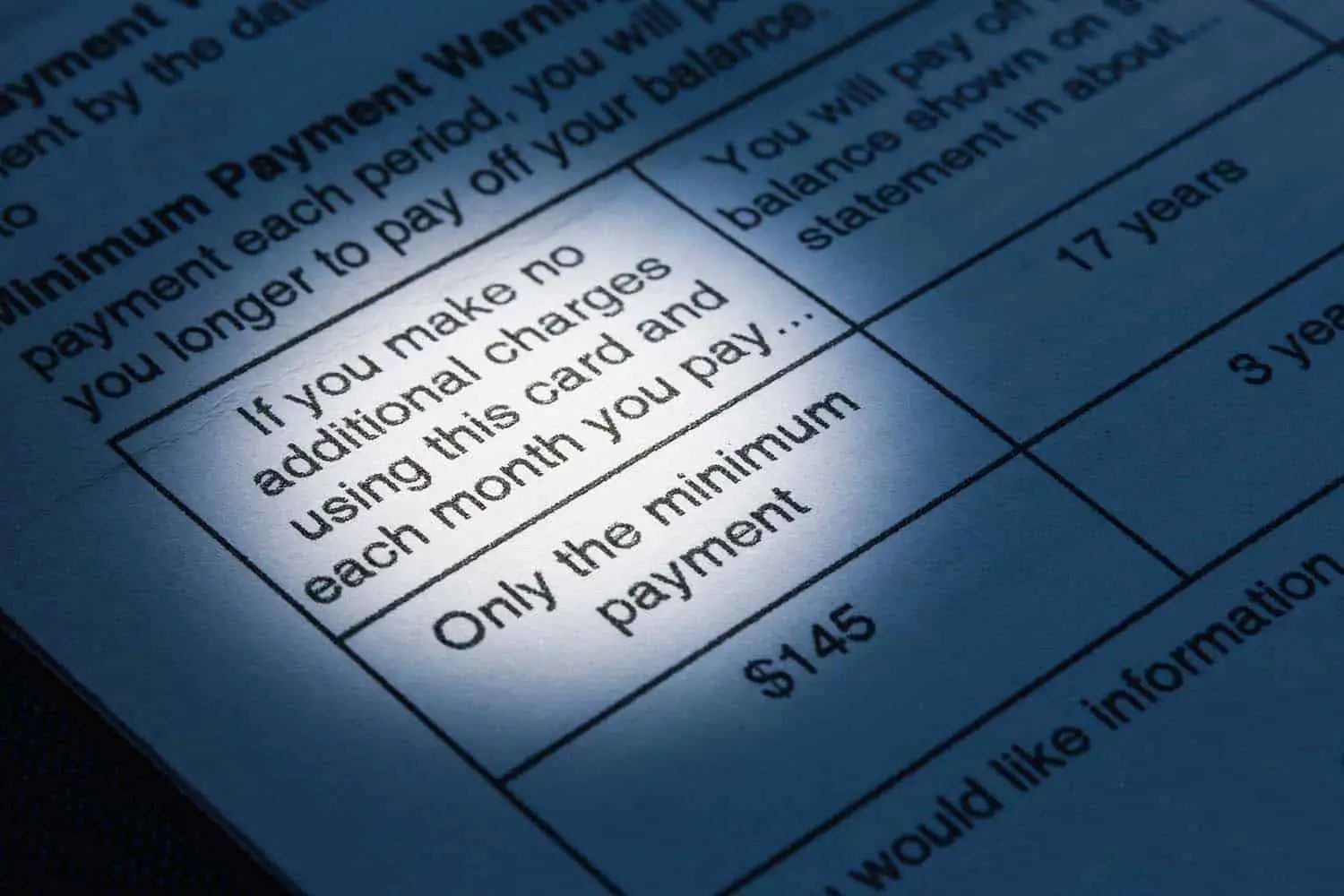

In the realm of taxation, the term "minimum tax" refers to the lowest amount of tax that a business entity must pay, irrespective of its level of profitability or revenue. While the tax laws and regulations governing minimum tax vary across jurisdictions, the fundamental principle remains consistent: businesses are obligated to remit a minimum amount of tax, ensuring that they contribute to the public revenue even in the absence of substantial profits.

Understanding the nuances of minimum business tax is essential for entrepreneurs, as it directly impacts the financial health and compliance status of their ventures. Moreover, in situations where a business experiences a period of no revenue or minimal income, the implications of minimum tax assume heightened significance. By delving into the intricacies of this subject, business owners can gain valuable insights that inform their strategic decision-making and financial planning.

Understanding Minimum Business Tax

Minimum business tax, often referred to as minimum tax or alternative minimum tax, is a regulatory provision aimed at ensuring that all businesses, regardless of their profitability, make a baseline contribution to the public coffers. This safeguard is designed to prevent corporations from leveraging tax deductions and credits to the extent that they pay little to no taxes, thereby fulfilling their civic duty to fund public services and infrastructure.

While the specifics of minimum tax regulations vary by jurisdiction, the underlying principle remains consistent. Businesses are required to calculate their tax liability using both standard tax rules and the alternative minimum tax rules, paying the higher of the two amounts. This mechanism serves as a safeguard against excessive tax avoidance and promotes a fair distribution of the tax burden among businesses of varying sizes and financial capacities.

Minimum tax is often associated with intricate calculations and adjustments, necessitating a comprehensive understanding of tax laws and financial reporting. It is essential for business owners to discern the nuances of minimum tax, as noncompliance can result in penalties, interest accrual, and reputational damage. Furthermore, grasping the interplay between minimum tax and revenue fluctuations empowers entrepreneurs to make informed decisions that align with their financial objectives and regulatory obligations.

Ultimately, comprehending the intricacies of minimum business tax equips entrepreneurs with the knowledge needed to navigate the tax landscape effectively, fostering fiscal responsibility and legal compliance within their business operations.

Circumstances with No Revenue

Amid the dynamic ebb and flow of business operations, there are instances where companies experience periods of minimal to no revenue. This can stem from various factors such as market downturns, operational challenges, or deliberate strategic shifts. In such scenarios, the implications of minimum business tax take on heightened significance, warranting a closer examination of the associated challenges and considerations.

When a business encounters a phase of no revenue, whether due to market forces or deliberate strategic choices, the impact on its tax obligations can be substantial. Despite the absence of income, the requirement to fulfill minimum tax obligations persists, posing a financial burden on the company. This circumstance underscores the critical importance of prudent financial management and tax planning, as businesses must navigate the intricacies of minimum tax payments even in the absence of revenue streams.

Moreover, the absence of revenue necessitates a meticulous assessment of available tax credits, deductions, and carryforwards to offset the minimum tax liability. Leveraging these provisions effectively can mitigate the financial strain imposed by minimum tax obligations, offering a measure of relief during challenging periods. However, optimizing the utilization of tax benefits demands astute financial acumen and a comprehensive understanding of tax laws, underscoring the significance of proactive tax planning.

Furthermore, businesses facing a revenue drought may explore alternative strategies to manage their minimum tax burden, such as restructuring operations, optimizing cost structures, or seeking professional tax guidance. By proactively addressing the implications of minimum tax in the absence of revenue, businesses can bolster their financial resilience and mitigate the adverse effects of tax obligations on their bottom line.

Overall, navigating the complexities of minimum business tax in circumstances devoid of revenue demands strategic foresight, financial prudence, and a nuanced understanding of tax regulations, enabling businesses to weather challenging periods while upholding their tax obligations.

Implications and Consequences

The implications of minimum business tax in the context of no revenue carry multifaceted consequences that warrant careful consideration by business owners and stakeholders. When a company faces the obligation to remit minimum tax despite a lack of revenue, several significant implications and consequences come to the forefront, shaping the financial landscape and strategic decision-making processes.

First and foremost, the imposition of minimum tax in the absence of revenue can strain a company’s financial resources, potentially impeding its operational capabilities and investment initiatives. This financial burden poses a direct impact on cash flow, liquidity, and working capital, necessitating prudent financial management to navigate the ensuing challenges effectively.

Moreover, the implications of minimum tax obligations extend beyond immediate financial constraints, encompassing broader ramifications for a company’s fiscal health and compliance status. Noncompliance with minimum tax requirements can lead to penalties, interest accrual, and reputational damage, undermining the company’s standing and eroding stakeholder confidence. As such, businesses must prioritize adherence to minimum tax obligations to avert adverse consequences and safeguard their financial integrity.

Furthermore, the implications of minimum tax in the absence of revenue underscore the critical importance of proactive tax planning and strategic decision-making. Business owners and financial stakeholders must leverage available tax credits, deductions, and incentives to offset the minimum tax liability, optimizing their tax position and mitigating the financial strain imposed by regulatory obligations.

Additionally, the consequences of navigating minimum tax in the context of no revenue necessitate a comprehensive assessment of the company’s tax position, financial resilience, and long-term sustainability. This evaluation informs strategic initiatives aimed at optimizing operational efficiency, exploring alternative revenue streams, and fortifying the company’s financial posture amidst challenging circumstances.

In essence, the implications and consequences of minimum business tax in the absence of revenue underscore the imperative of astute financial management, proactive tax planning, and strategic resilience. By navigating these challenges effectively, businesses can uphold their tax obligations while safeguarding their financial viability and long-term prosperity.

Strategies for Managing Minimum Tax

Navigating the complexities of minimum business tax in the absence of revenue necessitates the implementation of strategic measures aimed at managing tax obligations while preserving the financial health and operational resilience of the company. To address the challenges posed by minimum tax requirements amid revenue drought, businesses can leverage a range of proactive strategies designed to optimize their tax position and mitigate the financial strain imposed by regulatory obligations.

One fundamental strategy for managing minimum tax in the absence of revenue involves meticulous tax planning and compliance. By engaging professional tax advisors and leveraging comprehensive tax planning tools, businesses can identify available deductions, credits, and incentives to offset their minimum tax liability, thereby reducing the financial burden and promoting fiscal efficiency.

Furthermore, businesses can explore the utilization of tax carryforwards, such as net operating losses and tax credits, to mitigate the impact of minimum tax obligations during periods of no revenue. Leveraging these carryforwards effectively can provide a valuable mechanism for managing tax liabilities and preserving the company’s financial resources.

Additionally, proactive restructuring of operations and cost optimization initiatives can offer avenues for managing minimum tax in the absence of revenue. By streamlining operational expenses, enhancing efficiency, and exploring alternative revenue streams, businesses can mitigate the financial strain imposed by minimum tax obligations while fostering resilience and sustainability.

Moreover, strategic initiatives aimed at diversifying revenue streams, expanding market presence, and capitalizing on growth opportunities can bolster a company’s financial position, mitigating the impact of minimum tax obligations during periods of revenue drought. By pursuing strategic growth initiatives, businesses can fortify their financial resilience and mitigate the adverse effects of regulatory obligations on their bottom line.

Ultimately, the effective management of minimum tax in the absence of revenue hinges on astute financial acumen, proactive tax planning, and strategic resilience. By implementing these strategies, businesses can navigate the challenges posed by minimum tax requirements while safeguarding their financial viability and long-term prosperity.

Conclusion

In conclusion, the landscape of minimum business tax presents a multifaceted terrain that warrants careful navigation, particularly in the context of no revenue. The implications and consequences of minimum tax obligations in the absence of revenue underscore the critical importance of proactive tax planning, strategic decision-making, and financial resilience for businesses.

Amid periods of minimal to no revenue, businesses face the imperative of managing their minimum tax obligations while preserving their financial health and operational capabilities. By leveraging proactive strategies such as meticulous tax planning, utilization of tax carryforwards, operational restructuring, and strategic growth initiatives, companies can mitigate the financial strain imposed by minimum tax requirements, fostering fiscal efficiency and long-term sustainability.

Furthermore, the interplay between minimum tax and revenue fluctuations necessitates a comprehensive understanding of tax laws, financial reporting, and regulatory compliance. By equipping themselves with the knowledge and insights needed to navigate the complexities of minimum tax, business owners can make informed decisions that align with their financial objectives and regulatory obligations.

Ultimately, the effective management of minimum tax in the absence of revenue demands strategic foresight, financial prudence, and a nuanced understanding of tax regulations. By addressing these challenges proactively, businesses can uphold their tax obligations while safeguarding their financial viability and operational resilience, positioning themselves for sustained success amidst dynamic market conditions.

In essence, the landscape of minimum business tax in the context of no revenue underscores the imperative of astute financial management, proactive tax planning, and strategic resilience. By navigating these challenges effectively, businesses can uphold their tax obligations while fortifying their financial integrity and long-term prosperity, fostering resilience and sustainability in the face of regulatory obligations.