Home>Finance>Money Factor: Definition, Uses, Calculation And Conversion To APR

Finance

Money Factor: Definition, Uses, Calculation And Conversion To APR

Published: December 26, 2023

Learn about the finance concept of money factor, its various uses, calculation methods, and how to convert it to APR for a better understanding of financial terms.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

The Money Factor: Definition, Uses, Calculation, and Conversion to APR

Have you ever come across the term “money factor” while exploring financial options? If you are looking to understand what it means, how it is calculated, and its conversion to APR, you have come to the right place. In this blog post, we will delve deep into the world of money factors, demystifying its definition, explaining its uses, outlining the calculation process, and guiding you through the conversion to APR.

Key Takeaways:

- Money factors are often used in the context of vehicle leases, determining the financing charges.

- Money factors are expressed as decimal numbers, with lower values signifying lower financing costs.

What is a Money Factor?

The money factor, also known as the lease factor or lease rate, is a crucial element when leasing a vehicle or exploring financing options. Essentially, it represents the interest rate equivalent charged by the leasing company. While interest rates are commonly expressed as percentages, money factors present the interest rate as a decimal number, making it easier for the leasing company to calculate the financing costs.

Money factors are primarily used in the leasing industry and are closely tied to the residual value and capitalized cost of the vehicle. By using the money factor, the leasing company determines the amount of interest you will pay throughout the lease term.

How is a Money Factor Calculated?

Calculating the money factor may seem daunting, especially if you are not familiar with the leasing process. However, it can be simplified by converting the annual interest rate into a decimal number and then dividing it by a specific value. The formula for calculating the money factor is as follows:

Money Factor = Annual Interest Rate ÷ Money Factor Constant

The money factor constant is a number used to standardize the calculation process. It varies depending on the leasing company and can range from 2,400 to 24,000. To calculate it, divide the value 2 by the decimal representation of the annual interest rate. Let’s break it down:

- Convert the annual interest rate into a decimal. For example, if the annual interest rate is 6%, convert it to 0.06.

- Divide 2 by the decimal representation of the annual interest rate (in this case, 0.06). The result is 33.33.

- Since the money factor constant is usually expressed as a value multiplied by 1,000, the final money factor constant is 33,333.333.

Now that we have the money factor constant, we can calculate the money factor. Simply divide the annual interest rate by the money factor constant:

Money Factor = 0.06 ÷ 33,333.333

After performing the calculation, we find that the money factor is approximately 0.0018.

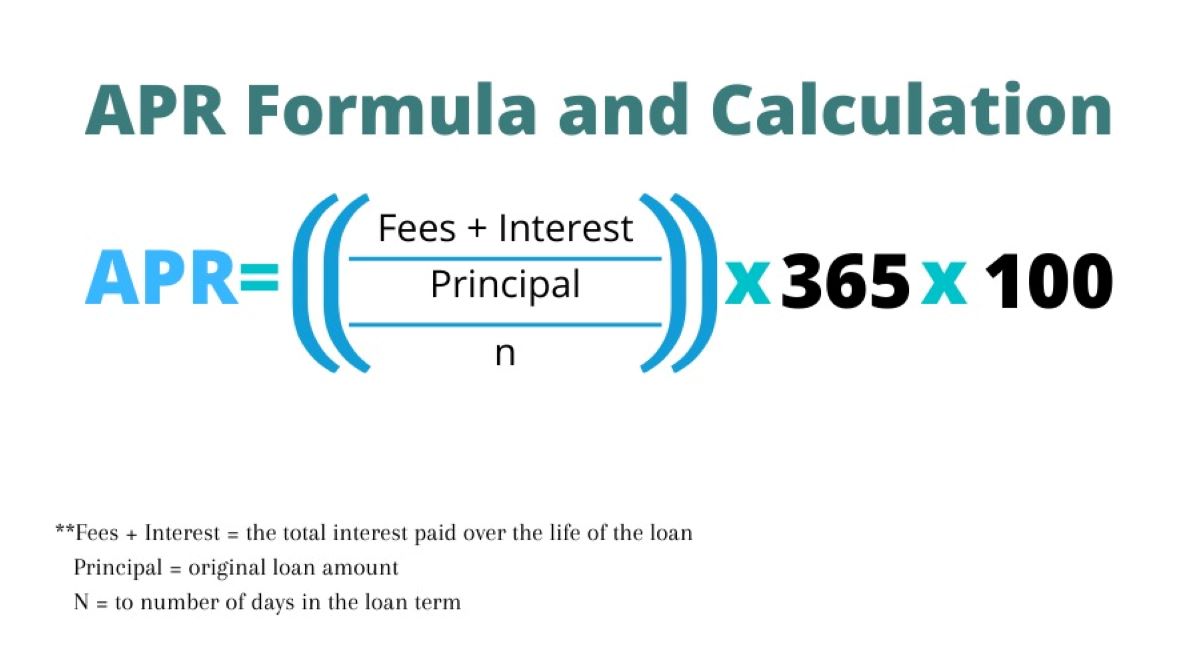

Conversion of Money Factor to APR

While money factors provide a standardized way to express leasing costs, you may be more familiar with annual percentage rates (APR). Fortunately, converting a money factor to its APR equivalent is relatively straightforward. To convert the money factor to APR, follow these steps:

- Multiply the money factor by 2,400.

- Multiply the result by 100 to express it as a percentage.

Using our previous example, the money factor of 0.0018 can be converted to APR as follows:

APR = (0.0018 * 2,400) * 100 = 4.32%

Thus, the money factor of 0.0018 is equivalent to an APR of 4.32%.

Conclusion

Understanding the concept of money factors is essential when it comes to vehicle leasing or exploring financing options. Remember, money factors help determine the interest rate in a decimal format, making it easier for leasing companies to calculate financing charges. By following the steps outlined in this blog post, you can effortlessly calculate the money factor and convert it to its APR equivalent.

Now that you have a comprehensive understanding of money factors, you are well-equipped to make informed decisions when it comes to leasing or financing a vehicle. So the next time you encounter the term “money factor,” you can confidently navigate your options with ease.