Finance

How To Calculate APR On A Car Loan

Published: March 3, 2024

Learn how to calculate APR on a car loan and make informed financial decisions. Understand the impact of interest rates on your auto financing.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Understanding the Importance of APR in Car Loans

When it comes to financing a car, understanding the Annual Percentage Rate (APR) is crucial. The APR represents the annual cost of a loan, including the interest rate and additional fees, expressed as a percentage. It’s a key factor in determining the total cost of borrowing and plays a significant role in the affordability of a car loan.

As a potential car buyer, being well-versed in how APR works can empower you to make informed financial decisions. With a deeper understanding of APR, you can effectively compare loan offers from different lenders and choose the most favorable terms. Moreover, comprehending how APR is calculated enables you to assess the true cost of a car loan, helping you avoid potential pitfalls and saving you money in the long run.

In this comprehensive guide, we will delve into the intricacies of APR on car loans, exploring the factors that influence it and providing a step-by-step approach to calculating APR. By the end of this article, you’ll have a clear grasp of how APR impacts your car financing and the tools to make sound financial choices when seeking a car loan.

Understanding APR on Car Loans

Annual Percentage Rate (APR) is a critical component of any car loan. It encompasses not only the interest rate charged by the lender but also any additional fees or charges associated with the loan. This comprehensive figure provides a more accurate representation of the total cost of borrowing, making it an essential metric for comparing loan offers from different financial institutions.

Unlike the nominal interest rate, which only reflects the cost of borrowing the principal amount, APR includes all associated costs, such as origination fees, points, and other finance charges. By considering these additional expenses, the APR offers a more holistic view of the true cost of the loan, allowing borrowers to make informed decisions based on a complete understanding of the financial implications.

It’s important to note that the APR on a car loan can vary significantly from the advertised interest rate, especially when there are substantial fees involved. This is why understanding the APR is crucial for accurately assessing the affordability of a car loan. By comprehending the components that contribute to the APR, borrowers can avoid being blindsided by unexpected costs and ensure that they secure a loan that aligns with their financial goals.

Furthermore, the APR serves as a useful tool for evaluating the long-term financial impact of different loan options. By comparing the APRs of various loan offers, borrowers can identify the most cost-effective financing solution, ultimately saving money over the life of the loan.

Factors Affecting APR on Car Loans

Several key factors influence the Annual Percentage Rate (APR) on car loans, ultimately shaping the overall cost of borrowing. Understanding these determinants is essential for prospective car buyers seeking favorable financing terms. Here are the primary factors that can impact the APR on car loans:

- Credit Score: One of the most influential factors affecting APR is the borrower’s credit score. Lenders use credit scores to assess the risk associated with extending a loan. Individuals with higher credit scores are generally offered lower APRs, as they are perceived as lower-risk borrowers. Conversely, those with lower credit scores may face higher APRs or have difficulty qualifying for loans.

- Loan Term: The length of the loan term can significantly impact the APR. In general, longer loan terms may result in higher APRs, as they pose a greater risk to lenders. Shorter loan terms often come with lower APRs, as they are associated with lower overall interest costs for the borrower.

- Down Payment: The size of the down payment can influence the APR on a car loan. A larger down payment may lead to a lower APR, as it reduces the amount of money being financed and demonstrates the borrower’s commitment to the purchase.

- Market Conditions: Economic factors and prevailing market conditions can affect interest rates and, consequently, the APR on car loans. Fluctuations in the economy, the Federal Reserve’s monetary policy, and changes in the overall interest rate environment can all impact the APR offered by lenders.

- Vehicle Age and Mileage: The age and mileage of the vehicle being financed can also impact the APR. Newer vehicles or those with lower mileage may qualify for more competitive APRs, as they are perceived as lower risk due to their potentially longer lifespan and lower likelihood of requiring costly repairs.

By considering these factors, borrowers can gain insight into the elements that contribute to the APR on car loans. Additionally, being aware of these influences empowers individuals to take proactive steps to improve their creditworthiness and financial standing, potentially leading to more favorable APRs and overall loan terms.

Steps to Calculate APR on a Car Loan

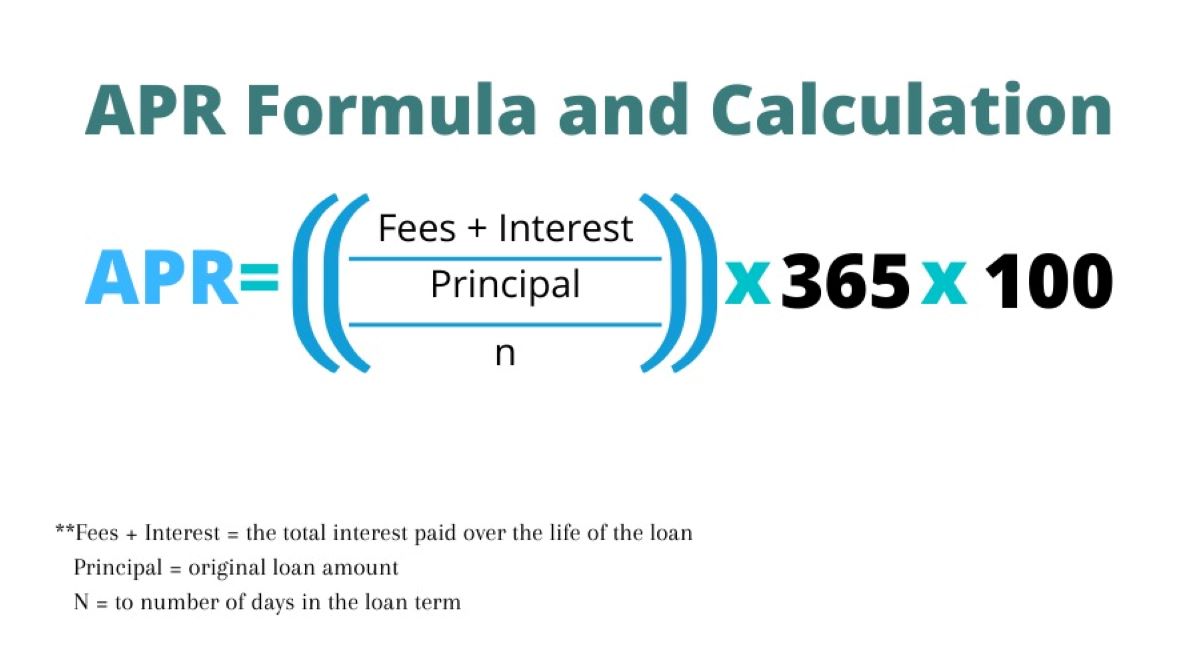

Calculating the Annual Percentage Rate (APR) on a car loan involves several essential steps that provide insight into the true cost of borrowing. By understanding the methodology behind APR calculations, borrowers can make informed decisions when evaluating loan offers. Here’s a comprehensive guide to calculating the APR on a car loan:

- Collect Loan Details: Start by gathering all pertinent information related to the car loan, including the principal amount, the term of the loan, the total interest paid over the loan term, and any additional fees or charges.

- Account for Additional Costs: Identify any extra expenses associated with the loan, such as origination fees, points, or other finance charges. These costs must be factored into the overall APR calculation to provide a comprehensive view of the borrowing costs.

- Determine the Effective Interest Rate: Calculate the effective interest rate, which reflects the true annual interest expense, considering any additional costs associated with the loan. This step involves adjusting the nominal interest rate to account for the impact of fees and charges on the total borrowing cost.

- Consider the Loan Term: Evaluate the length of the loan term, as this can significantly influence the APR. Longer loan terms may result in higher overall interest costs, potentially leading to a higher APR, while shorter terms often yield lower APRs.

- Factor in Monthly Payments: Analyze the monthly loan payments and their distribution between principal and interest. Understanding how the payments contribute to the overall borrowing costs provides valuable insight into the loan’s affordability and long-term financial implications.

- Calculate the Total Repayment Amount: Determine the total amount repaid over the life of the loan, incorporating both the principal and the total interest paid. This figure offers a comprehensive view of the financial commitment associated with the loan.

- Compute the APR: Utilize the gathered information to calculate the APR using established formulas or online APR calculators. By inputting the relevant loan details, borrowers can obtain the APR, enabling them to compare loan offers effectively and make informed financing decisions.

By following these steps, borrowers can gain a deeper understanding of the true cost of a car loan and accurately assess the APR associated with different financing options. This knowledge empowers individuals to make informed financial choices, ultimately securing loan terms that align with their budget and long-term financial objectives.

Conclusion

Understanding the Annual Percentage Rate (APR) is paramount when navigating the landscape of car loans. By grasping the intricacies of APR and the factors that influence it, borrowers can make informed financial decisions, ultimately saving money and securing favorable loan terms. The APR encapsulates the true cost of borrowing, incorporating not only the interest rate but also additional fees and charges, providing a comprehensive metric for comparing loan offers.

Factors such as credit score, loan term, down payment, market conditions, and the age and mileage of the vehicle all play a significant role in shaping the APR on car loans. By considering these influences, borrowers can take proactive steps to enhance their creditworthiness and improve their overall financial standing, potentially leading to more favorable APRs and loan terms.

Calculating the APR on a car loan involves a series of essential steps, including collecting loan details, accounting for additional costs, determining the effective interest rate, evaluating the loan term, considering monthly payments, calculating the total repayment amount, and computing the APR. By following these steps, borrowers can gain a comprehensive understanding of the true cost of borrowing and make well-informed financing decisions.

Ultimately, a thorough understanding of APR empowers individuals to navigate the car financing process with confidence. By leveraging this knowledge, borrowers can effectively compare loan offers, identify the most cost-effective financing solutions, and secure loan terms that align with their financial goals. Armed with the tools to assess the true cost of borrowing, individuals can embark on their car-buying journey with clarity and financial prudence, paving the way for a more secure and rewarding vehicle purchase experience.