Finance

How To Calculate APR On A Mortgage

Published: March 3, 2024

Learn how to calculate APR on a mortgage and make informed financial decisions. Understand the true cost of borrowing with our comprehensive guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Understanding APR and its Importance

When it comes to mortgages, the Annual Percentage Rate (APR) plays a pivotal role in understanding the true cost of borrowing. While the interest rate represents the cost of borrowing the principal loan amount, the APR encompasses a broader scope, factoring in additional costs such as lender fees, mortgage insurance, and discount points. Essentially, the APR provides a comprehensive view of the total cost of the mortgage, enabling borrowers to make informed decisions.

The importance of understanding APR lies in its ability to empower borrowers with transparency. By considering all associated costs, the APR allows individuals to compare mortgage offers from different lenders effectively. This transparency is crucial in ensuring that borrowers are not blindsided by hidden expenses, ultimately promoting financial literacy and responsible decision-making.

In essence, the APR serves as a valuable tool for borrowers, offering a holistic perspective on the affordability of a mortgage. By grasping the significance of APR, individuals can navigate the intricate landscape of mortgage options with confidence, ultimately securing a loan that aligns with their financial goals and capabilities.

Components of APR

The Annual Percentage Rate (APR) on a mortgage comprises various components that extend beyond the basic interest rate. Understanding these components is essential for gaining insight into the comprehensive cost of borrowing. The key elements encompassed by the APR include:

- Interest Rate: This forms the foundation of the APR and represents the cost of borrowing the principal loan amount. It is crucial to note that the interest rate alone does not provide a complete picture of the mortgage expenses.

- Lender Fees: These encompass the charges levied by the lender for processing the mortgage, including origination fees, application fees, and underwriting fees. Incorporating these fees into the APR offers a more accurate reflection of the overall cost.

- Mortgage Insurance: If the down payment on the mortgage is less than 20% of the home’s value, lenders typically require mortgage insurance. Factoring in the cost of mortgage insurance into the APR provides a comprehensive overview of the ongoing financial commitment.

- Discount Points: Borrowers have the option to pay discount points upfront to lower the interest rate over the life of the loan. By including the cost of discount points in the APR, borrowers can assess the long-term financial implications of this decision.

- Other Costs: Various additional expenses, such as appraisal fees, title insurance, and prepaid property taxes, contribute to the overall cost of the mortgage and are reflected in the APR.

By considering these components collectively, the APR encapsulates the multifaceted nature of mortgage expenses, enabling borrowers to make well-informed decisions. It is imperative for individuals to delve into the specifics of each component to fully comprehend the financial implications of their mortgage commitment.

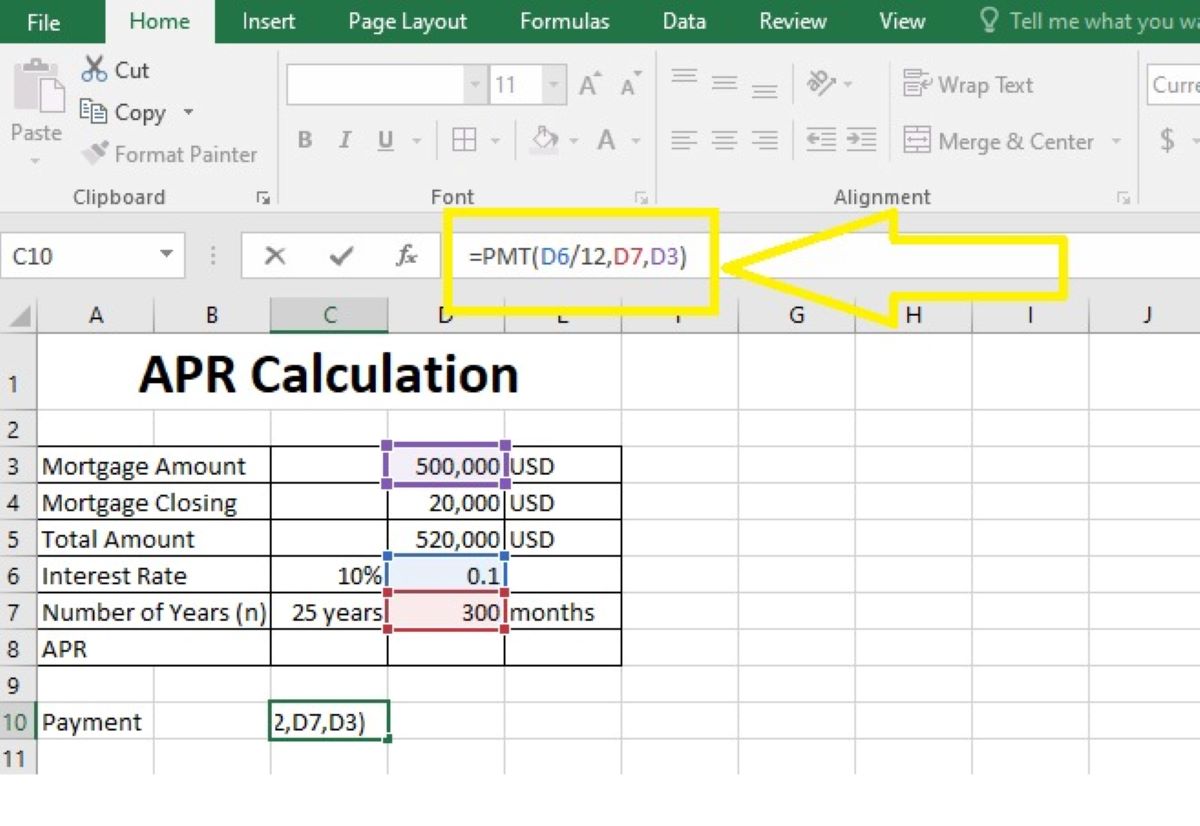

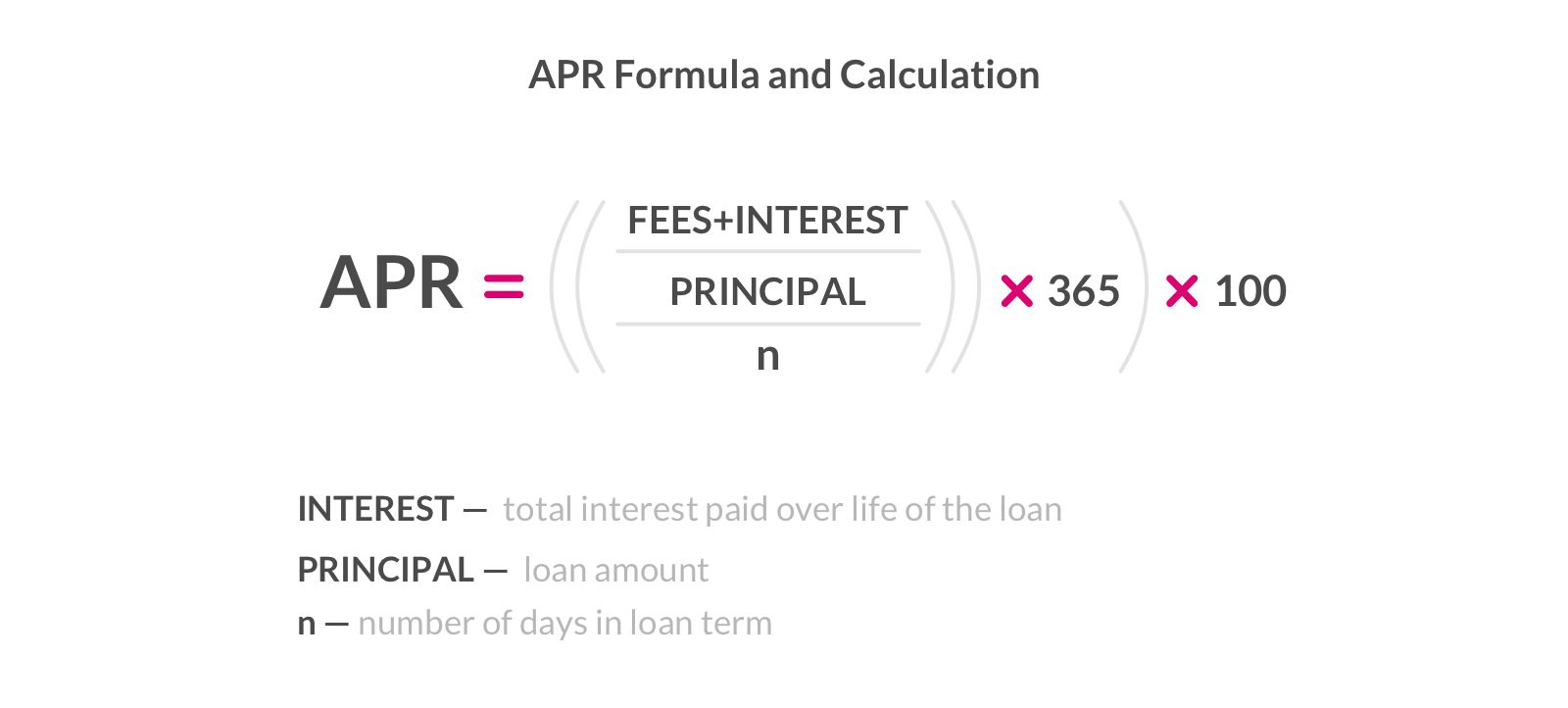

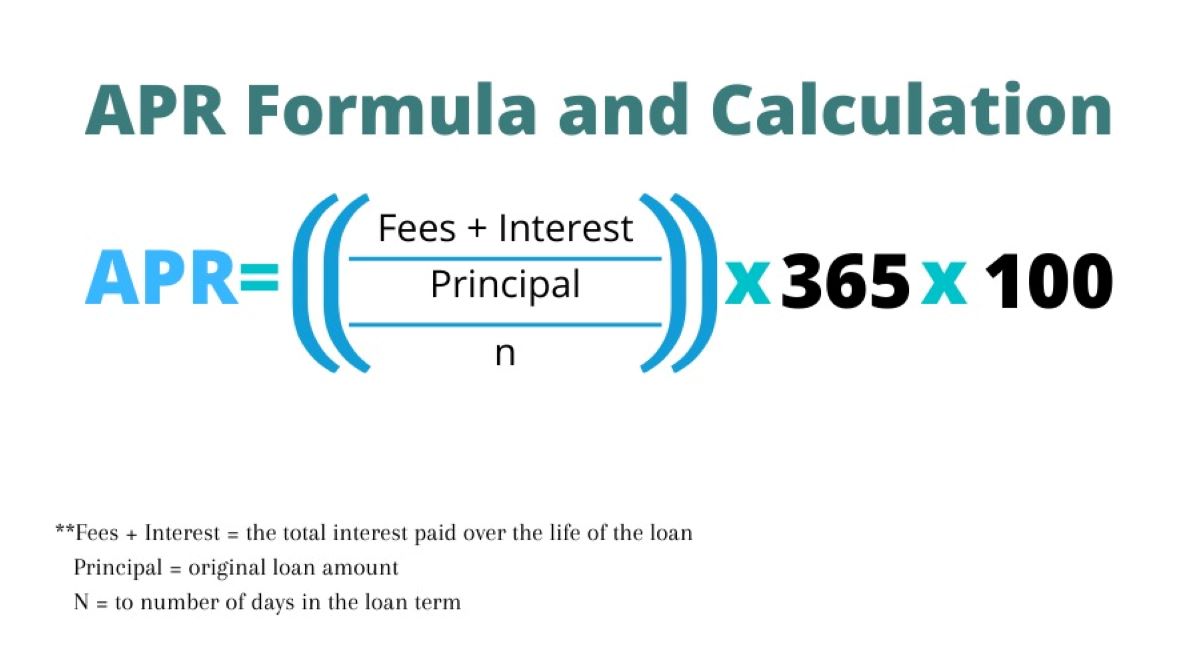

Calculating APR on a Mortgage

Calculating the Annual Percentage Rate (APR) on a mortgage involves a meticulous process that integrates various components to derive the comprehensive cost of borrowing. While the exact calculation can be complex, understanding the fundamental steps provides clarity on the overall methodology.

The calculation of the APR encompasses the following key elements:

- Compile All Costs: To initiate the calculation, gather all the costs associated with the mortgage, including the interest rate, lender fees, mortgage insurance, discount points, and other relevant expenses.

- Consider the Timeframe: Assess the timeframe over which these costs will be incurred. This duration is essential for factoring in the long-term impact of expenses such as discount points.

- Adjust for Timing of Costs: Some costs may be incurred at different intervals throughout the life of the mortgage. Adjusting for the timing of these expenses ensures an accurate representation of the overall cost.

- Calculate the Effective Interest Rate: By incorporating all costs and adjusting for their timing, compute the effective interest rate that encapsulates the comprehensive expense structure of the mortgage.

- Expressing the APR: Once the effective interest rate is determined, it is expressed as the APR, providing a holistic representation of the total borrowing cost.

While the intricacies of the calculation may require professional expertise, gaining a basic understanding of the process empowers borrowers to engage meaningfully with lenders and comprehend the true cost of their mortgage. By delving into the intricacies of the APR calculation, individuals can make informed decisions that align with their financial objectives and preferences.

Importance of Understanding APR on a Mortgage

Comprehending the Annual Percentage Rate (APR) on a mortgage holds immense significance as it equips borrowers with the knowledge to make informed financial decisions. The importance of understanding APR extends beyond mere numerical comprehension; it encapsulates several pivotal aspects that directly influence the borrowing experience.

Transparency and Comparison: Understanding the APR fosters transparency, enabling borrowers to compare mortgage offers from different lenders effectively. This empowers individuals to assess the true cost of borrowing and make informed decisions aligned with their financial capabilities and long-term goals.

Financial Literacy: Grasping the intricacies of the APR cultivates financial literacy among borrowers. It encourages individuals to delve into the comprehensive components of mortgage expenses, thereby enhancing their overall understanding of financial commitments and lending practices.

Preventing Surprises: By comprehending the APR, borrowers mitigate the risk of encountering unexpected expenses or hidden costs associated with the mortgage. This proactive approach promotes financial prudence and shields individuals from unforeseen financial burdens.

Empowered Decision-Making: Understanding the APR empowers borrowers to engage meaningfully with lenders, asking pertinent questions and seeking clarity on the components that contribute to the overall borrowing cost. This proactive engagement facilitates confident decision-making and ensures that borrowers are well-informed throughout the mortgage process.

Long-Term Financial Planning: The APR serves as a valuable tool for individuals to assess the long-term financial implications of their mortgage commitment. By understanding the APR, borrowers can align their mortgage choices with their broader financial plans, thereby promoting stability and foresight in their financial journey.

Ultimately, the significance of understanding APR on a mortgage transcends numerical comprehension, encapsulating empowerment, transparency, and informed decision-making. By embracing the nuances of the APR, borrowers navigate the realm of mortgage borrowing with confidence and clarity, securing a financial foundation that aligns with their aspirations and fiscal prudence.

Conclusion

Understanding the Annual Percentage Rate (APR) on a mortgage is not merely a matter of numerical comprehension; it is a gateway to empowerment, transparency, and informed decision-making. By delving into the components and significance of the APR, borrowers gain a comprehensive understanding of the true cost of borrowing, enabling them to navigate the intricate landscape of mortgage options with confidence and clarity.

The components of the APR, ranging from the basic interest rate to lender fees, mortgage insurance, and discount points, collectively portray the multifaceted nature of mortgage expenses. This holistic perspective empowers borrowers to make well-informed decisions and engage meaningfully with lenders, fostering transparency and financial literacy.

Calculating the APR on a mortgage, while intricate, provides a fundamental insight into the comprehensive cost of borrowing. By considering all associated costs and adjusting for their timing, borrowers can derive the effective interest rate that encapsulates the true expense structure of the mortgage, paving the way for informed decision-making.

The importance of understanding APR extends beyond numerical comprehension, encompassing transparency, financial literacy, and long-term financial planning. By comprehending the APR, individuals prevent surprises, engage proactively with lenders, and align their mortgage choices with their broader financial goals, ultimately fostering stability and foresight in their financial journey.

In essence, the APR serves as a beacon of financial empowerment, guiding borrowers towards prudent and informed decisions. By embracing the nuances of the APR, individuals secure a mortgage that not only fulfills their immediate housing needs but also aligns with their long-term financial aspirations, laying the groundwork for a stable and prosperous financial future.