Finance

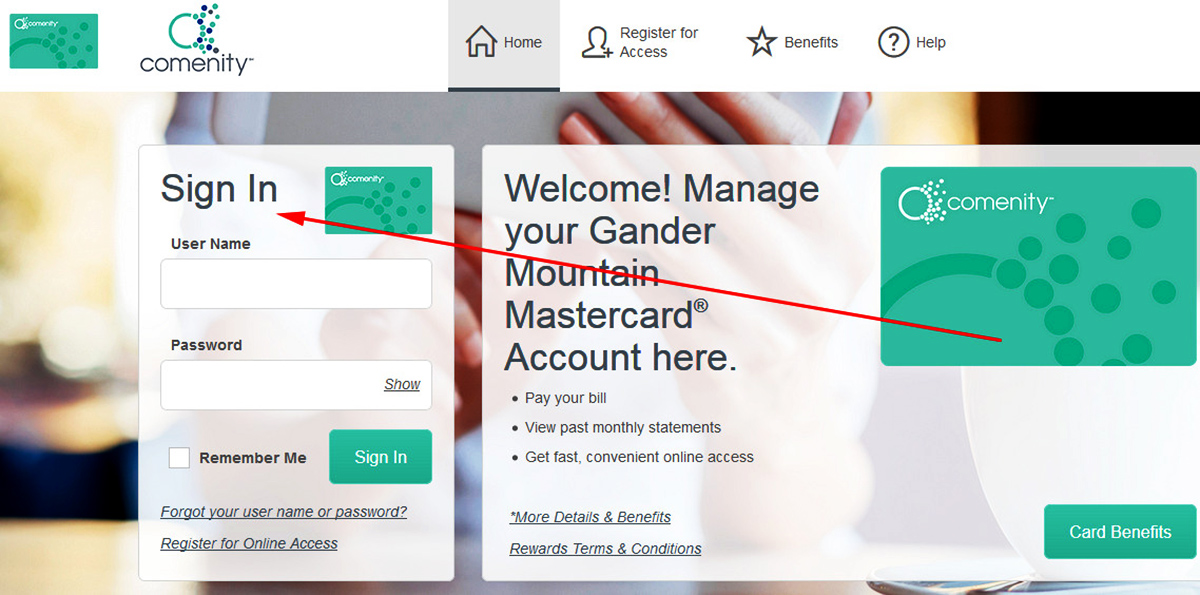

Mountain Range Options Definition

Published: December 27, 2023

Explore the diverse mountain range options available in finance and gain a deeper understanding of their definition and significance. Enhance your financial knowledge and make informed decisions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Mountain Range Options

Welcome to the Finance category of our blog! In this post, we are going to dive into the intriguing world of Mountain Range Options and demystify everything you need to know about them. So if you’re interested in expanding your knowledge of financial instruments and exploring innovative investment strategies, you’ve come to the right place.

What are Mountain Range Options?

Mountain Range Options, also known as MROs, are a type of option contract that provide unique opportunities for investors to manage risk and potentially profit from the volatile movements of an underlying asset. This financial instrument derives its name from the striking visual resemblance it shares with a mountain range when plotted on a graph.

Unlike traditional options that have a fixed expiration date, MROs have multiple predetermined price levels, forming a range within which the underlying asset must trade for the option to be active. This makes them highly flexible and allows investors to tailor their strategies to different market conditions.

Key Takeaways

- MROs are option contracts that derive their name from the visual resemblance of their profit/loss profile to a mountain range.

- They have multiple predetermined price levels forming a range within which the underlying asset must trade for the option to be active.

How do Mountain Range Options work?

Mountain Range Options provide investors with the opportunity to speculate on whether the price of an underlying asset will remain within a certain range over a specified period of time. When trading MROs, investors can choose to buy either a “Call” option if they believe the price will stay within the range or a “Put” option if they anticipate the price will break out of the range. The profit or loss potential of MROs depends on factors such as the width of the range and the time remaining until expiration.

Let’s illustrate this with an example: If an investor purchases a Call option on a stock with a mountain range between $50 and $60, they profit if the price stays within this range until the option’s expiration date. Conversely, if the price falls below $50 or rises above $60, the option would close out of the money and result in a loss.

Advantages of Mountain Range Options

Mountain Range Options offer several advantages for investors looking to diversify their portfolios and increase their trading opportunities. Some of the key advantages include:

- Flexibility: MROs allow investors to customize their options strategies to suit different market conditions, providing greater flexibility than traditional options contracts.

- Defined Risk: With MROs, investors know their maximum potential loss upfront, which helps manage risk more effectively.

- Hedging Capabilities: By using MROs, investors can protect their existing positions and hedge against potential losses in the underlying asset.

- Potential for Higher Returns: The unique structure of MROs presents opportunities for higher potential returns, especially in volatile markets.

Mountain Range Options can be a valuable addition to an investor’s toolkit, offering new strategies and risk management tools. However, like any financial instrument, it’s important to thoroughly understand their mechanics and potential risks before engaging in trading activities.

We hope this article has provided you with a clear understanding of Mountain Range Options and their potential benefits. If you’re interested in exploring more exciting topics in the world of finance, remember to check out our other posts in the Finance category. Happy investing!