Finance

Rescaled Range Analysis Definition And Uses

Published: January 19, 2024

Learn the Definition and Uses of Rescaled Range Analysis in Finance. Discover how this statistical method helps analyze financial time series data and predict market trends.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Unlocking the Secrets of Rescaled Range Analysis in Finance

Have you ever wondered how financial analysts make sense of complex data and predict future market trends? One of the tools they rely on is Rescaled Range Analysis (R/S Analysis). In this article, we will explore the definition and uses of Rescaled Range Analysis, helping you understand how this powerful technique can help you navigate the intricacies of the financial world.

Key Takeaways:

- Rescaled Range Analysis is a statistical method used to analyze the long-term dependency, or predictability, of a time series data set.

- By measuring the relationship between the range and the standard deviation of a time series data set, Rescaled Range Analysis provides insights into the underlying structure and behavior of the data.

Understanding Rescaled Range Analysis

Rescaled Range Analysis, also known as R/S Analysis, was first introduced by the famous mathematician and engineer Hurst to study the flow of the Nile River. Over time, its application has expanded to various fields, particularly finance. At its core, R/S Analysis is a statistical method that measures the long-term dependency, or predictability, of a time series data set.

So, how does it work? R/S Analysis examines the relationship between the range and the standard deviation of the data set. The range represents the difference between the maximum and minimum values, while the standard deviation measures the dispersion of the data around the mean. By rescaling the range and dividing it by the standard deviation, analysts obtain a dimensionless quantity known as the rescaled range.

The rescaled range provides valuable insights into the underlying structure and behavior of the data. It can help identify trends, periodicities, and potential anomalies that may impact future market movements. This makes R/S Analysis an indispensable tool for assessing risk, making informed investment decisions, and designing robust trading strategies.

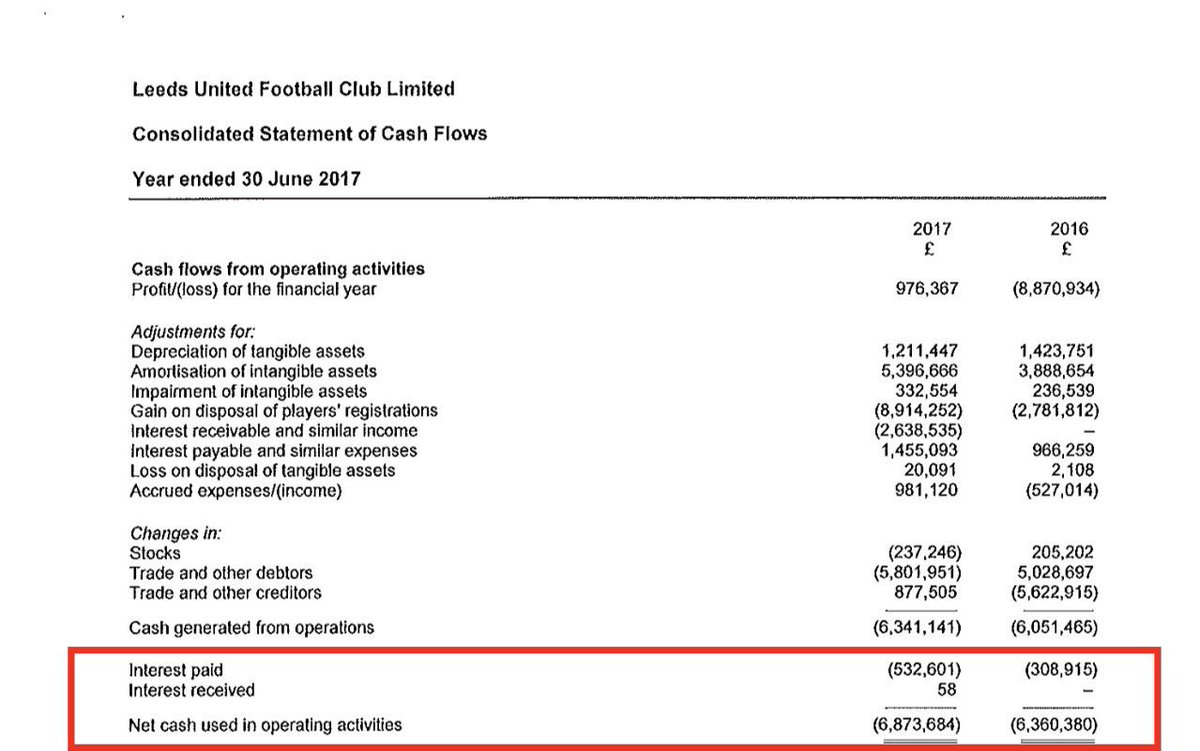

Applications of Rescaled Range Analysis in Finance

The utility of Rescaled Range Analysis extends to various areas within the field of finance. Here are some key uses of R/S Analysis:

- Market Trend Analysis: By analyzing the rescaled range of historical price data, financial analysts can identify long-term trends, assess market efficiency, and predict future price movements.

- Volatility Analysis: R/S Analysis helps quantify the volatility characteristics of financial instruments. By examining the rescaled range, analysts can evaluate the risk associated with an investment and adjust their strategies accordingly.

- Risk Management: Rescaled Range Analysis plays a crucial role in measuring the risk and potential return of investment portfolios. It enables investors to optimize risk allocation and diversify their holdings effectively.

- Asset Allocation: R/S Analysis helps determine the optimal mix of assets in a portfolio to maximize returns while minimizing risks. By understanding the long-term dependencies of different asset classes, investors can allocate their resources strategically.

Rescaled Range Analysis is a powerful technique that offers valuable insights into the complexities of financial markets. By leveraging this method, financial analysts and investors can make more informed decisions and enhance their overall investment strategies, ultimately leading to greater success in the world of finance.

To summarize:

- R/S Analysis measures the long-term dependency, or predictability, of a time series data set.

- It examines the relationship between the range and the standard deviation of the data.

- Rescaled Range Analysis finds applications in market trend analysis, volatility analysis, risk management, and asset allocation.

So, whether you are a seasoned financial analyst or a curious investor, understanding Rescaled Range Analysis can help you gain a deeper understanding of the intricacies of the financial world and make more informed decisions in your journey towards financial success.

Remember, knowledge is power, and Rescaled Range Analysis can be your secret weapon in unlocking the hidden patterns and opportunities within the vast realm of finance.