Home>Finance>Multi-Asset Class: Definition, Fund Types, Benefits

Finance

Multi-Asset Class: Definition, Fund Types, Benefits

Published: December 27, 2023

Learn about multi-asset class in finance, its definition, fund types, and the benefits it offers. Enhance your investment knowledge and diversify your portfolio with this comprehensive guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Multi-Asset Class: Definition, Fund Types, Benefits

Welcome to our finance blog! In this post, we will be diving into the world of multi-asset class investing. If you’ve ever wondered what it means, the different types of funds available, and the benefits it can provide, you’re in the right place. So let’s get started!

Key Takeaways:

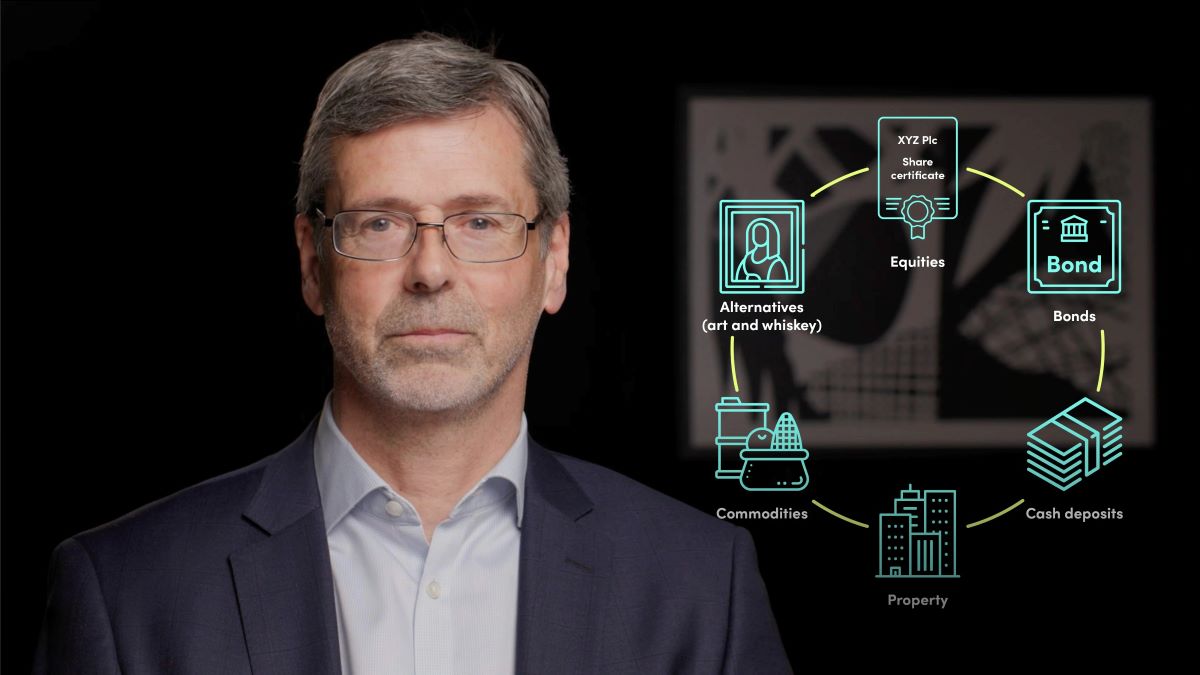

- Multi-asset class investing involves diversifying your portfolio by investing in different asset classes such as stocks, bonds, real estate, and commodities.

- There are different types of multi-asset class funds, including target-date funds, balanced funds, and asset allocation funds.

So, what exactly is multi-asset class investing? In simple terms, it refers to a strategy where an investor spreads their investments across multiple asset classes, rather than focusing on just one. By diversifying their portfolio, investors aim to reduce the risk associated with any single asset class and potentially increase their chances of achieving their investment goals.

Now, let’s examine the different types of multi-asset class funds:

- Target-Date Funds: These funds are designed to cater to investors with specific target retirement dates. The fund’s allocation is gradually adjusted over time to become more conservative as the target date approaches. This type of fund offers simplicity and automatic rebalancing, making it popular among long-term investors.

- Balanced Funds: As the name suggests, balanced funds maintain a balance between different asset classes, typically stocks and bonds. These funds aim to provide both growth and income by combining capital appreciation from stocks and income from bonds. Balanced funds generally have a fixed allocation ratio that is periodically readjusted by the fund manager.

- Asset Allocation Funds: These funds take a dynamic approach to asset allocation, often adjusting their investments based on current market conditions. The allocation of asset classes can vary significantly within these funds, making them more adaptable to changing market environments. They are suitable for investors who prefer a more active strategy.

Now that we understand the different types of multi-asset class funds, let’s explore the benefits of this investment strategy:

- Diversification: By investing in multiple asset classes, you spread your risk across different sectors and reduce the impact of any single investment. This can help protect your portfolio from market volatility and decrease the chance of substantial losses.

- Potential for Higher Returns: Multi-asset class investing allows you to capitalize on the growth potential of various asset classes. While some asset classes may perform poorly at a given time, others may experience growth. By diversifying your investments, you increase your chances of participating in different markets and capturing higher potential returns.

In conclusion, multi-asset class investing is an effective way to diversify your portfolio and potentially achieve better risk-adjusted returns. Whether you choose a target-date, balanced, or asset allocation fund, incorporating multiple asset classes can help you navigate the complexities of the financial markets.

Remember to consult with a financial advisor or conduct thorough research before making any investment decisions. Here’s to building a well-rounded portfolio!