Finance

What Are Consolidated Financial Statements

Published: December 22, 2023

Learn about consolidated financial statements, a crucial aspect of finance. Understand their purpose, benefits, and how they provide an accurate overview of a company's financial position.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Consolidated Financial Statements

- Purpose and Benefits of Consolidated Financial Statements

- Entities Required to Prepare Consolidated Financial Statements

- Consolidation Methods

- Preparation Process of Consolidated Financial Statements

- Key Components of Consolidated Financial Statements

- Presentation and Disclosure Requirements for Consolidated Financial Statements

- Importance of Consolidated Financial Statements for Stakeholders

- Limitations and Challenges in Preparing Consolidated Financial Statements

- Conclusion

Introduction

Consolidated financial statements play a vital role in the world of finance, providing a comprehensive view of the financial performance and position of a group of companies. These statements are crucial for investors, creditors, regulators, and other stakeholders to understand the overall financial health of a group and make informed decisions.

When a company owns a controlling interest in one or more subsidiary companies, it is required to consolidate the financial data of those entities into a single document known as consolidated financial statements. This process eliminates intercompany transactions and presents a unified picture of the group’s financial position.

Consolidated financial statements enable stakeholders to evaluate the performance of the entire group rather than just individual entities. They provide a more accurate representation of the group’s assets, liabilities, revenues, expenses, and cash flows.

In this article, we will explore the definition, purpose, and benefits of consolidated financial statements. We will also discuss the entities required to prepare these statements, the consolidation methods used, the preparation process, the key components, and the presentation and disclosure requirements. Furthermore, we will highlight the importance of consolidated financial statements for different stakeholders and address the limitations and challenges associated with their preparation.

Whether you are an investor, creditor, or financial professional, understanding consolidated financial statements is essential for conducting thorough financial analysis and making informed decisions. So, let’s dive into the details of this important financial reporting tool and uncover its significance in the world of finance.

Definition of Consolidated Financial Statements

Consolidated financial statements are comprehensive financial reports that combine the financial information of a parent company and its subsidiary companies into a single set of financial statements. These statements provide a holistic view of the financial position, performance, and cash flows of a group of companies as if they were a single economic entity.

Consolidated financial statements are prepared when a parent company has a controlling interest in one or more subsidiary companies. A controlling interest means that the parent company has the power to direct the activities and policies of the subsidiary, resulting in the potential to have a significant impact on its financial and operational decisions.

The purpose of preparing consolidated financial statements is to eliminate intercompany transactions and present financial information that accurately reflects the overall performance and financial position of the group of companies. This allows stakeholders to assess the group’s financial stability, profitability, and growth potential.

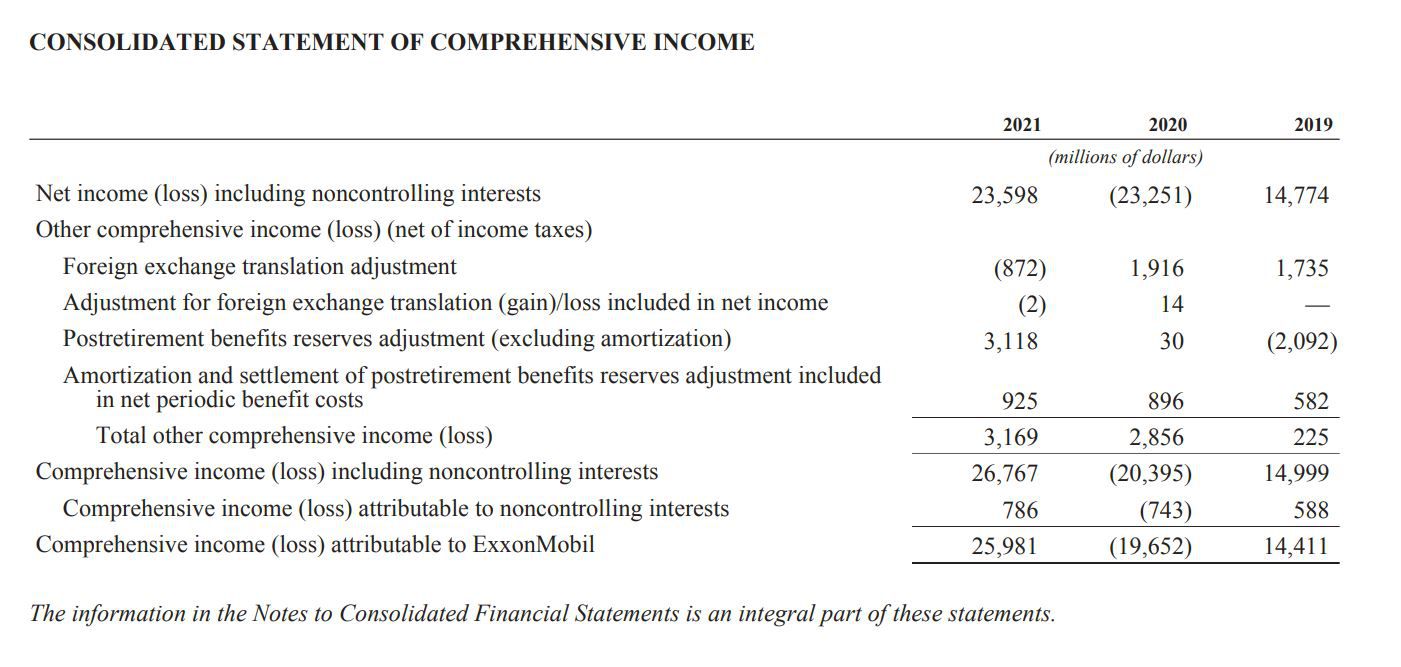

Consolidated financial statements include a balance sheet, income statement, statement of comprehensive income, statement of changes in equity, and cash flow statement. These statements provide a comprehensive overview of the group’s assets, liabilities, equity, revenues, expenses, and cash flows.

Moreover, the consolidated financial statements also include detailed notes and disclosures that provide additional information about the group’s accounting policies, significant transactions, contingent liabilities, and related party transactions. These disclosures enhance transparency and allow stakeholders to make more informed decisions.

It is important to note that consolidated financial statements only include the financial information of the parent company and its subsidiaries. Non-controlling interests, which represent the portion of subsidiary companies’ equity not owned by the parent company, are separately reported to reflect the portion of the group’s performance and financial position that is attributed to external shareholders.

Overall, consolidated financial statements provide a comprehensive and accurate representation of the financial health and performance of a group of companies. They are an essential tool for stakeholders to assess the group’s financial position, make investment decisions, evaluate management’s performance, and comply with regulatory requirements.

Purpose and Benefits of Consolidated Financial Statements

The purpose of preparing consolidated financial statements is to provide stakeholders with a clear and accurate representation of the financial position, performance, and cash flows of a group of companies. These statements serve several important purposes and offer various benefits for investors, creditors, regulators, and other stakeholders.

1. Assessing the Financial Health of the Group: Consolidated financial statements allow stakeholders to evaluate the overall financial health and stability of a group by providing a comprehensive view of its assets, liabilities, equity, revenues, expenses, and cash flows. This helps stakeholders assess the group’s ability to generate profits, manage its debt, and withstand economic downturns.

2. Facilitating Decision Making: Consolidated financial statements provide vital information for stakeholders to make informed investment, lending, and business decisions. Investors can assess the group’s profitability and growth potential, creditors can evaluate the group’s creditworthiness and repayment capacity, and potential business partners can gain insights into the financial strength and stability of the group.

3. Improving Transparency and Accountability: Consolidated financial statements enhance transparency and accountability by presenting a complete and accurate picture of the group’s financial activities. The statements include detailed notes and disclosures that provide additional information about significant transactions, accounting policies, and contingencies. This helps stakeholders understand the group’s financial positions and the risks and uncertainties it faces.

4. Enhancing Comparability: By consolidating the financial information of all subsidiaries, consolidated financial statements provide a standardized format that allows for meaningful comparisons between different entities within the group. This enables stakeholders to analyze the performance and financial position of each subsidiary and the group as a whole.

5. Meeting Regulatory Requirements: Many jurisdictions and accounting standards require companies with subsidiary entities to prepare consolidated financial statements. These statements help companies comply with legal and regulatory requirements, ensuring transparency and accountability in financial reporting.

6. Supporting Investor Relations: Consolidated financial statements are often used in investor relations activities, such as annual reports and investor presentations. These statements provide a clear and concise overview of the group’s financial performance and position, helping to build trust and confidence among existing and potential investors.

7. Facilitating Strategic Planning: Consolidated financial statements provide valuable insights into the overall financial performance and position of a group. This information can be instrumental in strategic planning, including identifying areas of growth, assessing investment opportunities, and evaluating the effectiveness of business strategies.

Overall, consolidated financial statements play a crucial role in providing stakeholders with a comprehensive understanding of the financial performance and position of a group of companies. They serve as an essential tool for decision making, transparency, accountability, and regulatory compliance.

Entities Required to Prepare Consolidated Financial Statements

Consolidated financial statements are required for companies that have a controlling interest in one or more subsidiary entities. In general, both publicly-traded and privately-held companies are obligated to prepare consolidated financial statements if they meet the following criteria:

1. Controlling Interest: The parent company must have a controlling interest in the subsidiary or subsidiaries. A controlling interest is typically defined as owning more than 50% of the voting rights or having the power to control the subsidiary’s financial and operating policies.

2. Significance of the Subsidiary: The subsidiary companies must be significant enough to warrant consolidation. This typically depends on the size of the subsidiary’s assets, liabilities, revenues, or expenses in relation to the parent company and the group as a whole. Accounting standards may specify certain thresholds or criteria for determining the significance of subsidiaries.

3. Legal and Regulatory Requirements: In many jurisdictions, companies are required by law or accounting standards to prepare consolidated financial statements if they meet the criteria mentioned above. Regulatory bodies such as the Securities and Exchange Commission (SEC) in the United States or the International Financial Reporting Standards (IFRS) may impose specific reporting obligations for companies that meet certain thresholds.

4. Investor or Creditor Demand: Even if not required by law or regulation, companies may choose to prepare consolidated financial statements to meet the demands of investors or creditors. Publicly-traded companies, in particular, often opt to provide consolidated financial statements to enhance transparency and meet the expectations of shareholders, potential investors, and lenders.

It is important to note that the requirement to prepare consolidated financial statements may vary depending on the jurisdiction and the applicable accounting standards. Different countries may have their own rules and thresholds for consolidation. For example, some jurisdictions may require the consolidation of entities under common control, whereas others may only necessitate the consolidation of subsidiaries that are wholly or majority-owned.

Regardless of the legal requirements, companies may also have internal policies or strategic considerations that drive the preparation of consolidated financial statements. Consolidated financial statements offer a more accurate and comprehensive view of the financial performance and position of a group of companies, making them a valuable tool for decision making, investor relations, and strategic planning.

Overall, companies with a controlling interest in one or more subsidiary entities need to prepare consolidated financial statements to provide stakeholders with a holistic view of the group’s financial performance and position. Compliance with legal obligations, investor demands, and strategic considerations are all factors that influence the decision to prepare consolidated financial statements.

Consolidation Methods

There are several methods available for consolidating the financial statements of a parent company and its subsidiary entities. The appropriate method to use depends on the level of control the parent company has over the subsidiaries and the nature of their relationships. The commonly used methods for consolidation are:

1. The Acquisition Method: The acquisition method is the most widely used method for consolidation. It is applied when a parent company has acquired a controlling interest in a subsidiary through the purchase of its shares or assets. Under this method, the parent company’s financial statements are combined with those of the subsidiary using the fair value of the identifiable assets and liabilities at the acquisition date.

2. The Equity Method: The equity method is used when a parent company has significant influence but not a controlling interest in the subsidiary. It is typically applied when the parent company owns between 20% and 50% of the voting shares of the subsidiary. Under this method, the parent company’s share of the subsidiary’s profits or losses is recognized as equity income on the parent company’s consolidated financial statements.

3. The Proportional Consolidation Method: The proportional consolidation method is used when the parent company has joint control over a jointly controlled entity. Joint control exists when the strategic financial and operating decisions of an entity are made collectively by two or more parties. Under this method, the parent company includes its proportionate share of the jointly controlled entity’s assets, liabilities, revenues, expenses, and cash flows in the consolidated financial statements.

4. The Consolidation Using the Net Asset Value Method: The net asset value method is used when a parent company has control over a subsidiary but does not have access to the subsidiary’s financial statements. In this method, the parent company includes its proportionate share of the subsidiary’s net assets in the consolidated financial statements based on the subsidiary’s net asset value.

It is important to note that the determination of the appropriate consolidation method depends on the specific circumstances and the applicable accounting standards. Companies must follow the guidelines provided by the Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS) when selecting the consolidation method to ensure compliance with the relevant reporting requirements.

Furthermore, companies must regularly reassess the consolidation method used to ensure it still accurately reflects the nature of the relationship between the parent company and its subsidiaries. Changes in the level of control or influence over the subsidiaries may require a change in the consolidation method applied.

Overall, the choice of consolidation method is crucial in accurately reflecting the financial position and performance of a group of companies. Companies must carefully evaluate their control or influence over subsidiary entities and select the appropriate consolidation method based on the specific circumstances and applicable accounting standards.

Preparation Process of Consolidated Financial Statements

The preparation process of consolidated financial statements involves several important steps to ensure accurate and comprehensive reporting of the financial position, performance, and cash flows of a group of companies. The process typically includes the following key stages:

1. Identify the Reporting Entities: The first step in preparing consolidated financial statements is to identify the parent company and its subsidiary entities. The parent company is the controlling entity that consolidates the financial information of its subsidiaries. All subsidiary entities that meet the criteria for consolidation must be included in the reporting entities.

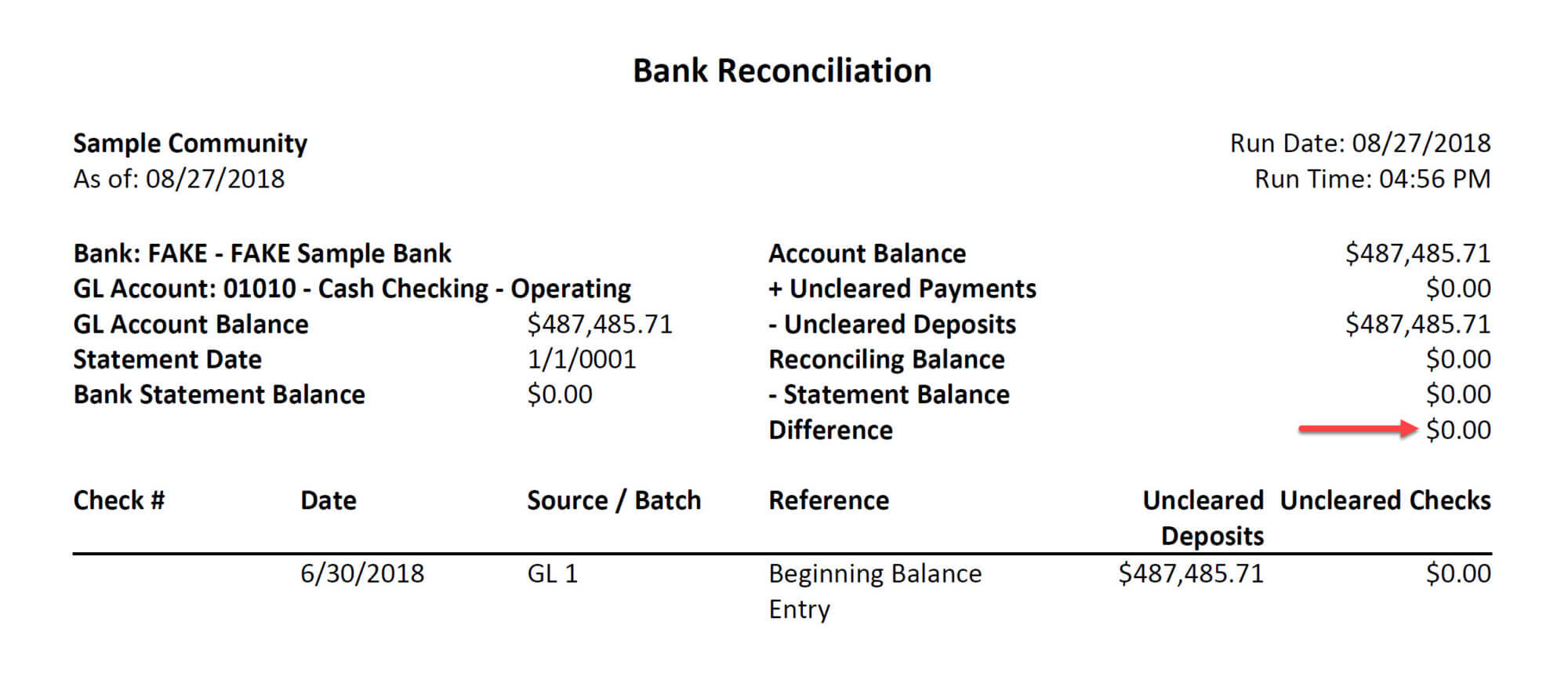

2. Gather Financial Statements: Once the reporting entities are identified, the next step is to gather the financial statements of the parent company and its subsidiaries. This includes the balance sheets, income statements, statement of comprehensive income, statement of changes in equity, and cash flow statements of each entity for the reporting period.

3. Eliminate Intercompany Transactions: Intercompany transactions, such as sales, purchases, and loans between the parent company and its subsidiaries, need to be eliminated to avoid double counting of revenues, expenses, assets, and liabilities. Intercompany balances and transactions are adjusted to reflect only transactions with external parties.

4. Adjust for Non-Controlling Interests: Non-controlling interests represent the portion of subsidiary entities’ equity that is not owned by the parent company. The financial statements are adjusted to reflect the proportionate share of the subsidiary’s net assets attributable to non-controlling interests. This ensures that the consolidated financial statements present a comprehensive view of the group’s financial position and performance.

5. Summarize and Consolidate Financial Data: After eliminating intercompany transactions and adjusting for non-controlling interests, the financial data of the parent company and its subsidiaries are summarized and consolidated. The consolidated financial statements include a consolidated balance sheet, consolidated income statement, consolidated statement of comprehensive income, consolidated statement of changes in equity, and consolidated cash flow statement.

6. Prepare Notes and Disclosures: Consolidated financial statements require comprehensive notes and disclosures that provide additional information and context about significant accounting policies, contingent liabilities, related party transactions, and other relevant details. These notes and disclosures enhance transparency and aid stakeholders in understanding the financial statements.

7. Review and Audit: Once the consolidated financial statements are prepared, they undergo a thorough review and audit by internal or external auditors to ensure accuracy, compliance with accounting standards, and adherence to regulatory requirements. The review and audit process provide an additional level of assurance for stakeholders.

8. Present and Release the Consolidated Financial Statements: Finally, the consolidated financial statements are presented in a format suitable for distribution to stakeholders such as investors, creditors, regulatory bodies, and internal management. These statements are typically included in annual reports, financial statements filings, and other relevant reporting documents.

The preparation of consolidated financial statements requires a meticulous and detailed process to consolidate financial data from different entities into a single set of comprehensive statements. By following this process, companies can provide stakeholders with accurate and reliable information about the financial performance and position of a group of entities.

Key Components of Consolidated Financial Statements

Consolidated financial statements consist of several key components that provide a comprehensive view of the financial position, performance, and cash flows of a group of companies. These components play a crucial role in presenting a unified picture of the group’s financial activities. The key components typically included in consolidated financial statements are:

1. Consolidated Balance Sheet: The consolidated balance sheet reflects the group’s assets, liabilities, and equity at a specific point in time. It combines the assets, liabilities, and equity of the parent company and its subsidiaries into a single financial statement. The consolidated balance sheet provides an overview of the group’s financial positions, including its total assets, liabilities, and shareholders’ equity.

2. Consolidated Income Statement: The consolidated income statement presents the group’s revenues, expenses, and resulting net income or loss for a specific period. It combines the revenues, expenses, and net income or loss of the parent company and its subsidiaries. The consolidated income statement helps stakeholders assess the group’s profitability and evaluate its operational performance.

3. Consolidated Statement of Comprehensive Income: The consolidated statement of comprehensive income expands on the consolidated income statement by including other comprehensive income items, such as gains and losses from foreign currency translation or changes in the fair value of financial instruments. It provides a more comprehensive view of the group’s financial performance by incorporating items not reflected in the traditional income statement.

4. Consolidated Statement of Changes in Equity: The consolidated statement of changes in equity depicts the changes in the shareholders’ equity of the group over a specific period. It includes contributions by shareholders, distributions to shareholders, changes in ownership interest, and any gains or losses recognized directly in equity. The statement helps stakeholders understand how the group’s equity has changed over time.

5. Consolidated Cash Flow Statement: The consolidated cash flow statement showcases the group’s cash inflows and outflows from operating, investing, and financing activities. It combines the cash flows of the parent company and its subsidiaries. The consolidated cash flow statement provides insights into the group’s ability to generate and manage cash, which is crucial for assessing its liquidity and sustainability.

6. Notes to the Consolidated Financial Statements: The notes to the consolidated financial statements provide additional information, explanations, and disclosures that complement the financial statements. They provide details about accounting policies, significant transactions, contingencies, related party transactions, and other relevant information. The notes enhance transparency and help stakeholders better understand the group’s financial position, performance, and risks.

These key components collectively present a comprehensive view of the financial activities and condition of a group of companies. They provide stakeholders with the necessary information to analyze the group’s performance, assess its financial position, and make informed decisions.

Presentation and Disclosure Requirements for Consolidated Financial Statements

Consolidated financial statements must adhere to specific presentation and disclosure requirements to provide stakeholders with clear and meaningful information about the financial performance, position, and cash flows of a group of companies. These requirements ensure consistency, comparability, and transparency in reporting. The key presentation and disclosure requirements for consolidated financial statements include:

1. Clear Identification: Consolidated financial statements should clearly identify the reporting entity, including the name of the parent company and its subsidiaries. This helps stakeholders understand the entities involved in the consolidation and the scope of the financial information presented.

2. Appropriate Grouping and Aggregation: Assets, liabilities, revenues, expenses, and cash flows should be appropriately grouped and aggregated to provide meaningful information. This may include categorizing items by nature, function, or other relevant criteria to facilitate analysis and comparison.

3. Consistent Accounting Policies: The consolidated financial statements should disclose the accounting policies used by the parent company and its subsidiaries. Where entities within the group apply different accounting policies, adequate disclosure should be made, along with the reasons for using different policies and the impact on the financial statements.

4. Significant Accounting Estimates and Judgments: Consolidated financial statements should disclose significant accounting estimates and judgments made by management that have a material impact on the financial statements. This may include estimates related to asset impairment, provisions, fair value measurements, and revenue recognition, among others.

5. Contingencies and Commitments: The disclosure of contingencies and commitments is essential in consolidated financial statements. This includes providing information on litigation claims, pending legal proceedings, guarantees, and other contractual commitments that may result in future cash outflows or contingencies.

6. Related Party Transactions: Consolidated financial statements should disclose any significant related party transactions between the parent company, its subsidiaries, and other related parties. This ensures transparency regarding potential conflicts of interest and allows stakeholders to evaluate the impact of these transactions on the group’s financial position and performance.

7. Segment Reporting: If the group operates in different business segments or geographical areas, segmented information should be disclosed. This enables stakeholders to assess the performance, risks, and prospects of each segment within the group.

8. Going Concern Assumptions: The consolidated financial statements should disclose if the group is a going concern or if there are any material uncertainties that could cast significant doubt on the group’s ability to continue operating. This information is crucial for stakeholders to assess the group’s long-term viability.

9. Comparative Information: Consolidated financial statements should present comparative information for the prior year to facilitate trend analysis and comparison. The use of consistent accounting policies and appropriate disclosure of any changes in accounting policies or methods should be made to ensure comparability between periods.

By following these presentation and disclosure requirements, consolidated financial statements provide stakeholders with transparent and meaningful information about the group’s financial performance, position, and cash flows. This enhances transparency, enables informed decision-making, and ensures compliance with accounting standards and regulatory requirements.

Importance of Consolidated Financial Statements for Stakeholders

Consolidated financial statements are of significant importance for various stakeholders who rely on them to assess the financial performance, position, and cash flows of a group of companies. These statements provide a comprehensive view of the group’s financial activities and are essential for making informed decisions. The importance of consolidated financial statements for stakeholders includes:

1. Investors: Investors rely on consolidated financial statements to evaluate the group’s financial health, profitability, and growth potential. By analyzing the statements, investors can assess the group’s ability to generate returns, make sound investment decisions, and identify opportunities for portfolio diversification.

2. Creditors: Creditors use consolidated financial statements to evaluate the group’s creditworthiness and repayment capacity. The statements help creditors assess the group’s ability to meet its debt obligations, determine the interest rates or terms of lending, and make informed decisions about extending credit or financing to the group.

3. Regulators and Government Agencies: Regulators and government agencies utilize consolidated financial statements to monitor compliance with financial reporting standards, ensure transparency in financial disclosure, and assess the group’s regulatory compliance. The statements assist in detecting fraudulent activities, identifying risks, and protecting the interests of the public.

4. Analysts and Financial Professionals: Analysts and financial professionals rely on consolidated financial statements to conduct detailed financial analysis, evaluate the group’s performance against competitors, and make informed recommendations to clients or management. The statements provide essential data for assessing profitability, liquidity, efficiency, and other key financial metrics.

5. Management and Internal Stakeholders: Consolidated financial statements help management and internal stakeholders monitor the group’s financial performance, make informed decisions about resource allocation, assess the impact of strategic initiatives, and evaluate the effectiveness of business operations. The statements enable management to identify areas of improvement and guide decision-making processes.

6. Shareholders and Potential Investors: Shareholders and potential investors use consolidated financial statements to gain insights into the group’s financial performance and position, assess the fair value of their investments, and make decisions about buying, holding, or selling shares. The statements help shareholders assess the returns on their investments and potential investors evaluate the group’s attractiveness as an investment opportunity.

7. Employees and Labor Unions: Consolidated financial statements provide employees and labor unions with insights into the group’s financial health, which can affect decisions regarding compensation, benefits, and collective bargaining agreements. The statements help employees and unions understand the group’s ability to support employment stability, growth, and investment in human capital.

8. Business Partners and Suppliers: Business partners and suppliers rely on consolidated financial statements to evaluate the group’s financial stability, creditworthiness, and ability to maintain a steady and consistent business relationship. The statements assist in assessing the group’s capacity to fulfill contractual agreements, manage supply chain risks, and make informed decisions about partnership or supplier arrangements.

Overall, consolidated financial statements play a vital role in providing stakeholders with accurate and comprehensive information about the financial performance, position, and cash flows of a group of companies. They enable stakeholders to make informed decisions, manage risks, assess investment opportunities, and safeguard their interests in the group.

Limitations and Challenges in Preparing Consolidated Financial Statements

The preparation of consolidated financial statements poses several limitations and challenges that can impact the accuracy, completeness, and timeliness of the reporting. Understanding these limitations and challenges is crucial for stakeholders to interpret the statements effectively. The key limitations and challenges in preparing consolidated financial statements include:

1. Diverse Accounting Policies: Subsidiary entities within a group may follow different accounting policies, which can create challenges in consolidating financial information. The use of diverse accounting policies may require adjustments and reconciliations to ensure consistency and comparability in the consolidated financial statements.

2. Currency Translation: Consolidating financial statements from entities operating in different currencies requires the conversion of financial information into a common reporting currency. This process, known as currency translation, introduces complexities in assessing the impact of currency fluctuations on the group’s financial performance and position.

3. Intercompany Transactions and Balances: Consolidation involves eliminating intercompany transactions and balances to avoid double-counting of revenues, expenses, assets, and liabilities. Identifying and accurately eliminating these transactions and balances can be challenging, especially in groups with numerous subsidiaries and complex transactional relationships.

4. Complex Group Structures: Groups with complex structures, including joint ventures, associates, and variable interest entities, present additional challenges in consolidation. Each type of entity requires specific accounting treatments and disclosures, which may increase the complexity of preparing consolidated financial statements.

5. Changes in Ownership Stake: Changes in the ownership stake of subsidiary entities during the reporting period can complicate the consolidation process. The impact of changes in ownership, such as dilution or acquisition of additional interests, need to be appropriately accounted for to reflect the accurate financial positions and ownership interests in the consolidated financial statements.

6. Timeliness of Financial Reporting: Consolidating financial statements involving multiple entities can be time-consuming. Gathering, verifying, and consolidating the financial data from different subsidiaries takes time, which can delay the reporting of consolidated financial statements. This delay may affect stakeholders’ ability to perform timely analysis and decision-making.

7. Complex Regulations and Accounting Standards: Complying with complex accounting regulations and standards, such as Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS), adds to the challenges of preparing consolidated financial statements. Understanding and applying the relevant accounting standards can be complex, especially in cases where there are differing interpretations or changes in regulatory requirements.

8. Accuracy of Financial Information: The accuracy of input financial information from subsidiary entities is crucial for the integrity of consolidated financial statements. Reliance on the financial reporting processes and internal control systems of subsidiaries can bring challenges in ensuring the accuracy and reliability of the information used in consolidation.

9. Disclosure of Non-Controlling Interests: Non-controlling interests represent the portion of equity in subsidiary entities not owned by the parent company. Accurately disclosing and presenting the non-controlling interests in the consolidated financial statements requires careful consideration and adherence to accounting standards and regulations.

Despite these limitations and challenges, consolidated financial statements remain a vital tool for stakeholders to gain insights into the financial performance and position of a group of companies. It is essential for preparers and users of these statements to be aware of these limitations and challenges and exercise due diligence in their interpretation and decision-making processes.

Conclusion

Consolidated financial statements are a crucial element in the world of finance, providing stakeholders with a comprehensive view of the financial performance, position, and cash flows of a group of companies. These statements serve a multitude of purposes and offer numerous benefits for investors, creditors, regulators, and other stakeholders.

By consolidating the financial information of the parent company and its subsidiaries, consolidated financial statements allow stakeholders to assess the overall financial health and stability of the group. They provide a more accurate representation of the group’s assets, liabilities, revenues, expenses, and cash flows, enabling stakeholders to make informed decisions based on a comprehensive understanding of the group’s financial position.

Consolidated financial statements offer transparency and accountability by presenting financial information that reflects the entire group’s activities, eliminating intercompany transactions, and providing clear disclosures. They facilitate decision-making for investors and creditors, ensuring that they have the necessary information to evaluate the group’s creditworthiness, growth potential, and profitability.

These statements also play a vital role in regulatory compliance, offering a standardized format for reporting and ensuring transparency in financial reporting. Moreover, they provide a valuable tool for management and internal stakeholders in monitoring the group’s financial performance, making strategic decisions, and evaluating the effectiveness of business operations.

However, the preparation of consolidated financial statements comes with its own set of challenges and limitations. Diverse accounting policies, currency translation, intercompany transactions, and complex group structures can make the consolidation process complex and time-consuming. Compliance with complex regulations and accounting standards, ensuring the accuracy of financial information, and disclosing non-controlling interests add further complexities to the preparation process.

Despite these challenges, consolidated financial statements remain an indispensable tool for stakeholders in assessing the financial health and performance of a group of companies. They provide the necessary information for investors, creditors, regulators, and other stakeholders to make informed decisions, conduct thorough financial analysis, and protect their interests in the group.

In conclusion, consolidated financial statements serve as the backbone of financial reporting for a group of companies. They provide a comprehensive and accurate representation of the group’s financial position, performance, and cash flows, offering crucial insights for stakeholders. By understanding the importance, components, and challenges of consolidated financial statements, stakeholders can harness the power of these statements to make informed decisions and navigate the complex world of finance.