Finance

Orphan Drug Credit Definition

Published: January 4, 2024

Learn the definition of the Orphan Drug Credit in finance, its benefits, and how it can impact your financial strategy. Explore this unique tax credit today!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding the Orphan Drug Credit: A Boost to Financial Stability

When it comes to navigating the intricate world of finance, staying well-informed is crucial. In the vast realm of financial terminology, the Orphan Drug Credit stands out as a unique and impactful tool that offers potential benefits to businesses. In this blog post, we delve into the definition and relevance of the Orphan Drug Credit, shedding light on its significance for financial stability and growth. So, let’s unravel the mysteries and grasp a firm understanding of this important concept.

Key Takeaways:

- The Orphan Drug Credit provides a tax credit to pharmaceutical companies that develop drugs to treat rare diseases.

- This credit promotes research and development, helping to advance medical breakthroughs for patients with rare diseases.

What is the Orphan Drug Credit?

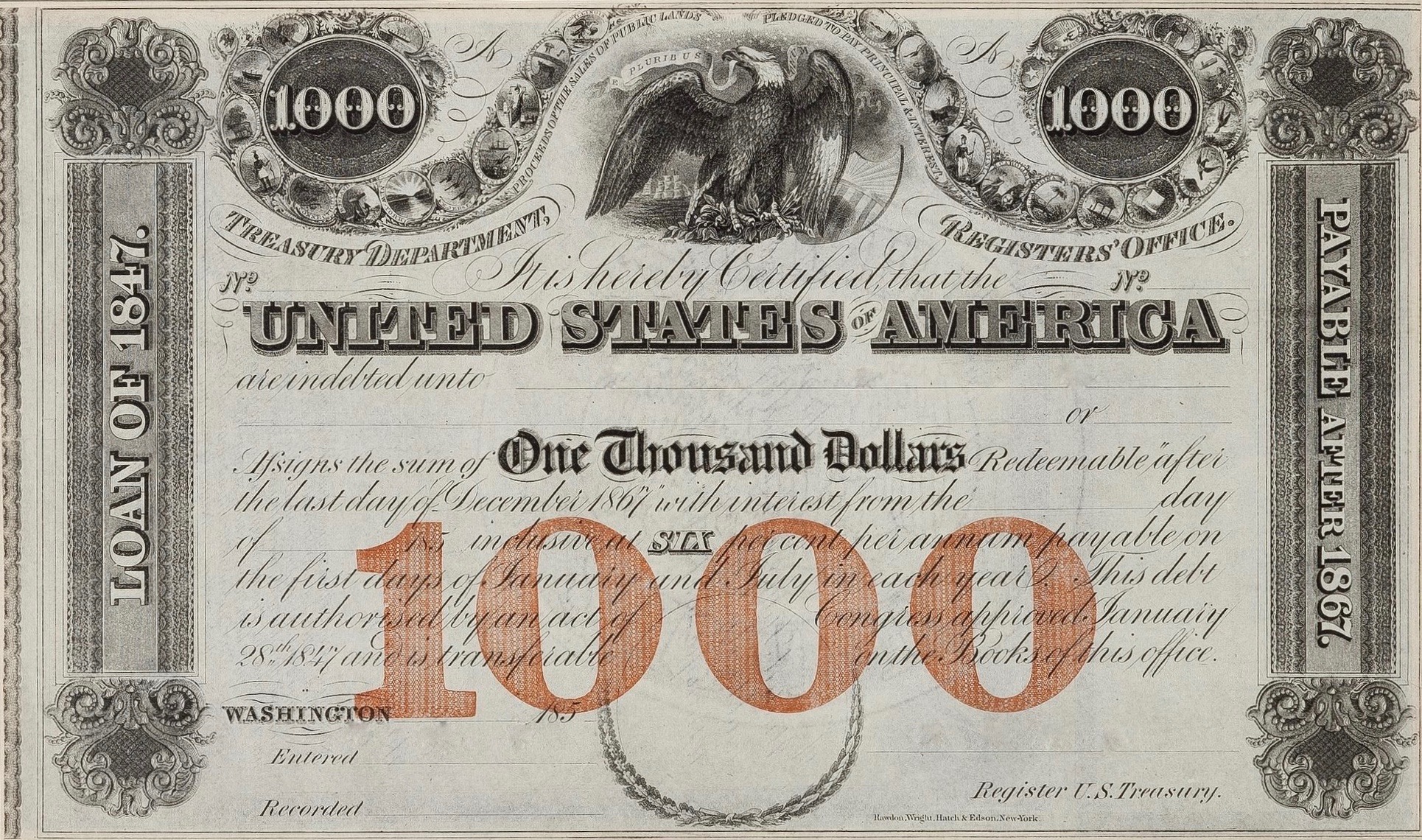

The Orphan Drug Credit is a tax credit provided by the U.S. government to pharmaceutical companies that develop drugs for treating rare diseases. This credit serves as an incentive for companies to invest in the research and development of medications that target diseases affecting a small percentage of the population.

Under the Orphan Drug Act, a rare disease is defined as a condition that affects fewer than 200,000 individuals in the United States. These diseases often have a profound impact on the lives of those affected, yet they may not attract significant commercial interest due to the limited market potential.

The Orphan Drug Credit was introduced to address the financial challenges faced by pharmaceutical companies working to develop treatments for rare diseases. By providing a tax credit, the government aims to stimulate research and development efforts, encouraging companies to pursue innovative solutions for improving the lives of those affected by rare diseases.

Benefits and Impact of the Orphan Drug Credit:

The Orphan Drug Credit offers several benefits to pharmaceutical companies and the broader healthcare industry. Here are some notable impacts of this tax credit:

- Encourages research and development: The financial incentives provided by the Orphan Drug Credit encourage pharmaceutical companies to invest in the development of treatments for rare diseases. This leads to advancements in medical research and the discovery of innovative therapies that may have otherwise been neglected due to financial constraints.

- Promotes financial stability: The Orphan Drug Credit can provide a much-needed boost to the financial stability of pharmaceutical companies. Research and development of drugs can be an expensive and time-consuming process, and the tax credit serves as a valuable incentive to offset some of these costs, improving the financial outlook for companies committed to treating rare diseases.

- Advances medical breakthroughs: By supporting research aimed at rare diseases, the Orphan Drug Credit contributes to the discovery of new medical breakthroughs. These breakthroughs not only benefit patients with rare diseases but can also have broader applications in the field of medicine, leading to improved treatments and healthcare outcomes for a wide range of conditions.

- Bolsters patient access to treatments: The Orphan Drug Credit plays a vital role in facilitating patient access to treatments for rare diseases. Without this incentive, the development of such drugs may not be financially viable for pharmaceutical companies. The credit helps ensure that individuals with rare diseases have a chance to receive the medications they need, improving their quality of life and overall well-being.

Conclusion

The Orphan Drug Credit represents an invaluable tool for promoting financial stability, incentivizing research and development, and improving patient access to treatments for rare diseases. By offering tax credits, the U.S. government encourages pharmaceutical companies to invest in groundbreaking therapies that tackle the challenges faced by individuals with rare diseases. Through this support, medical breakthroughs are accelerated, creating a positive impact on the healthcare industry as a whole. By understanding and leveraging the Orphan Drug Credit, businesses can pave the way for financial growth while contributing to the well-being of those in need.