Finance

PEG Payback Period Definition

Published: January 6, 2024

Learn about the finance concept of Payback Period, its definition, and calculation. Invest wisely with PEG's comprehensive guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding the PEG Payback Period: Unlocking the Secrets of Financial Analysis

Welcome to the FINANCE category on our page, where we dive deep into various aspects of the financial world. In this blog post, we will explore the concept of PEG Payback Period, an essential tool for analyzing investment opportunities. Whether you are a novice investor or a seasoned financial professional, understanding the PEG Payback Period can provide valuable insights into the potential profitability of an investment. So, let’s unravel the mysteries of this intriguing financial metric!

Key Takeaways:

- The PEG Payback Period measures the amount of time required for an investment to recoup its initial cost.

- This metric takes into account the profitability of the investment, providing a more complete picture of its financial viability.

What is the PEG Payback Period?

The PEG Payback Period is a financial metric used to determine how long it takes for an investment to generate enough cash flows to recover its initial cost. It takes into consideration both the profitability of the investment and the time it takes to recoup the initial investment. By incorporating these two factors, the PEG Payback Period offers a more holistic view of the investment’s financial performance.

One of the key advantages of using the PEG Payback Period is its ability to provide a clear timeframe for when the investment will start generating positive cash flows. This is particularly useful for investors looking for a quick return or those who need to make strategic financial decisions based on a specific timeline.

How to Calculate the PEG Payback Period

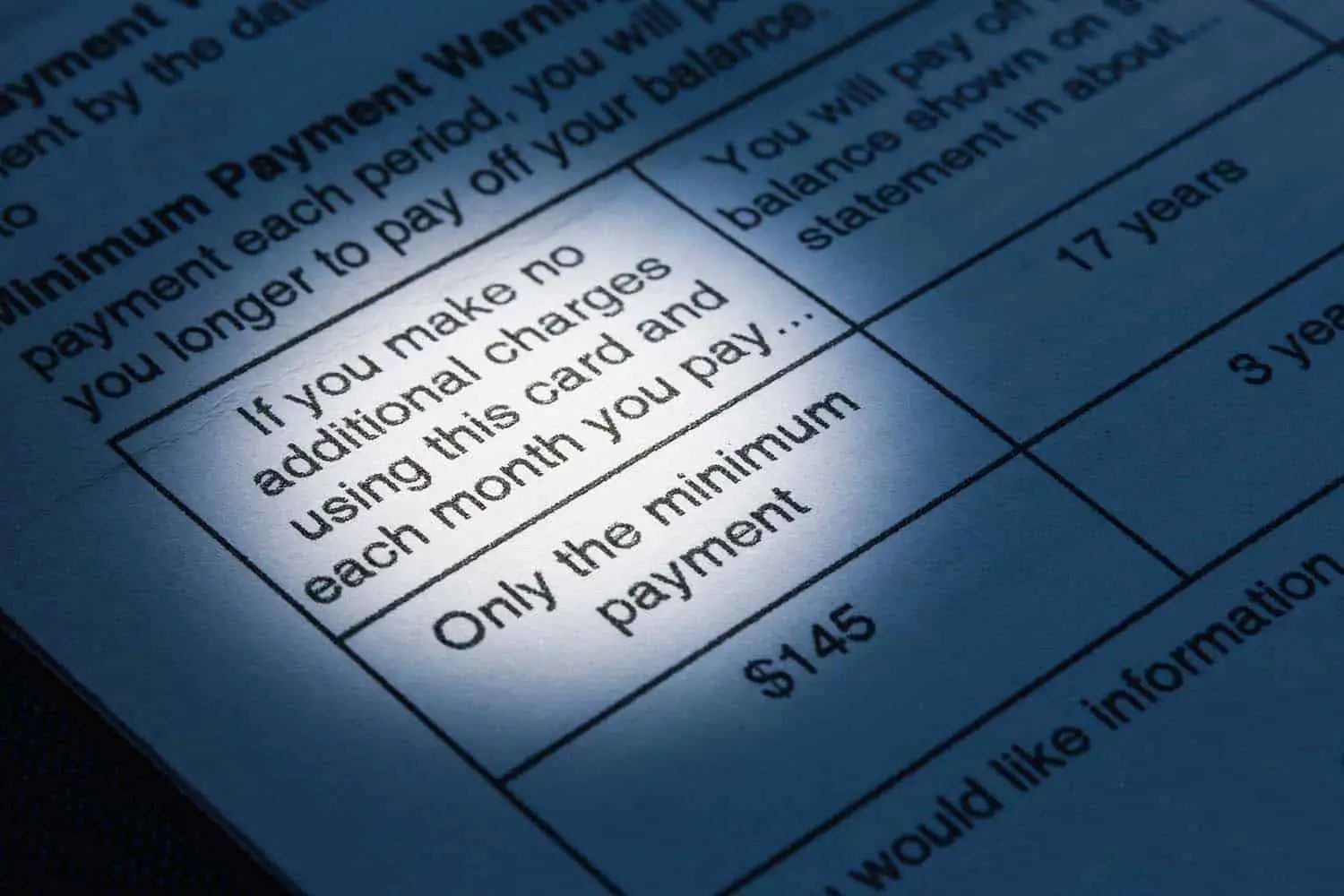

Calculating the PEG Payback Period involves dividing the initial cost of an investment by the annual net cash flows generated. The resulting figure represents the number of years it will take for the investment to recoup its initial cost. The formula is as follows:

PEG Payback Period = Initial Cost of Investment / Annual Net Cash Flows

It is important to note that the annual net cash flows are calculated by subtracting the annual expenses and taxes from the annual income generated by the investment.

Why is the PEG Payback Period Important?

The PEG Payback Period is an important metric for investors as it provides valuable insights into the financial viability of an investment. Here are a few reasons why it should be a part of your financial analysis toolkit:

- Decision-Making Tool: The PEG Payback Period helps investors assess the feasibility of an investment. By knowing how long it will take to recoup the initial cost, investors can make informed decisions about allocating their financial resources.

- Risk Assessment: The PEG Payback Period also assists in evaluating the risk associated with an investment. Investments with shorter payback periods are generally considered less risky.

- Comparative Analysis: By calculating the PEG Payback Period for different investment options, investors can compare and prioritize investment opportunities based on their expected timelines for generating returns.

In Conclusion

The PEG Payback Period is a powerful financial metric that assesses the time it takes for an investment to recoup its initial cost. By considering both the profitability and time factors, it provides valuable insights into an investment’s financial performance. Incorporate the PEG Payback Period into your financial analysis to make informed investment decisions that align with your financial goals. Remember, time is money, and understanding the PEG Payback Period will help you maximize the potential of your investments!