Finance

Penny Stock Reform Act Definition

Published: January 7, 2024

Learn about the Penny Stock Reform Act definition and how it impacts the finance industry. Stay informed on important financial regulations and make informed investment decisions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Welcome to the World of Penny Stock Reform Act

When it comes to investing and financial markets, every decision counts. And this is especially true when it comes to penny stocks. If you’re new to the world of investing or looking to explore new opportunities in the stock market, it’s important to understand the Penny Stock Reform Act and its implications. In this blog post, we’ll provide you with an overview of what this act is, its purpose, and how it can impact your investment decisions. So, let’s dive in!

Key Takeaways:

- The Penny Stock Reform Act aims to protect investors from fraudulent practices and ensure transparency in the penny stock market.

- Penny stocks are low-priced stocks with a small market capitalization and high volatility, presenting both opportunities and risks to investors.

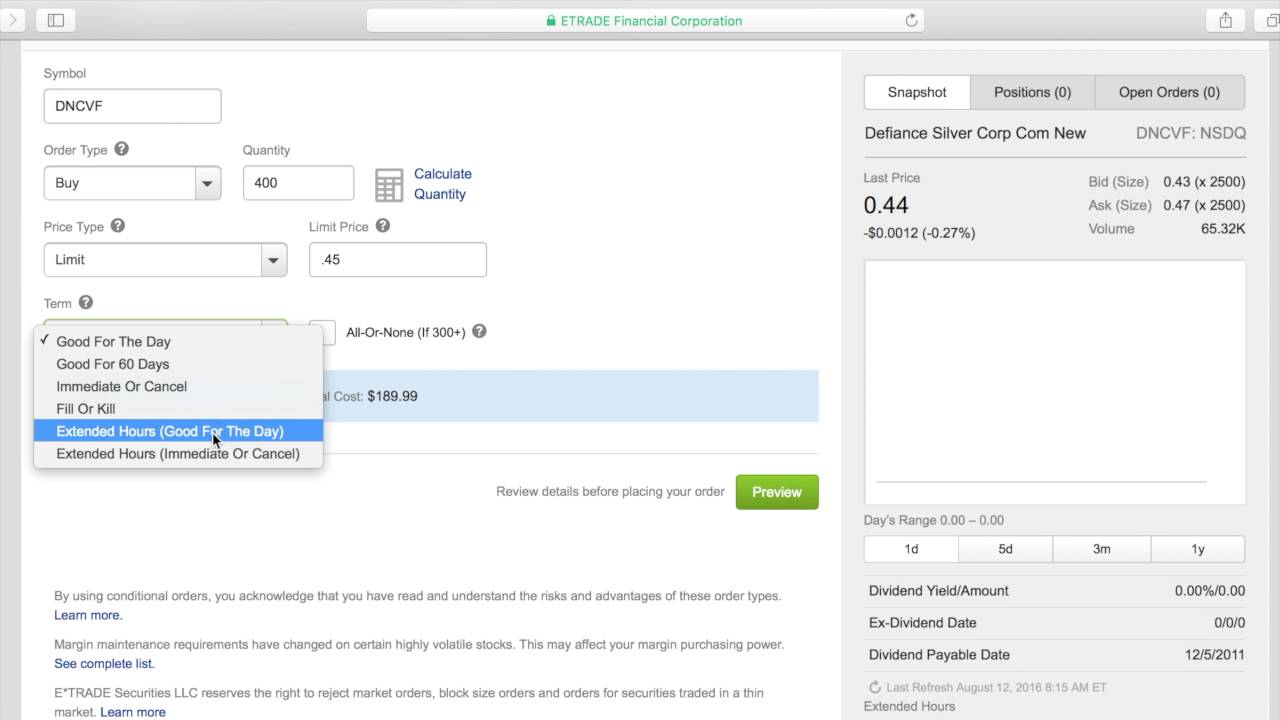

So, what exactly is the Penny Stock Reform Act? In simple terms, it is a federal legislation enacted to regulate the sale and trading of penny stocks. Penny stocks are typically traded below $5 per share and are associated with smaller companies with limited financial resources. Due to their low price and potential for high returns, they have gained popularity among investors looking to make significant gains in a short period.

The Penny Stock Reform Act was introduced to tackle the issues of fraud and market manipulation commonly associated with the penny stock market. This act requires companies that issue and trade penny stocks to meet certain regulatory requirements, including full disclosure of financial information, limitations on the number of shares that can be sold to the public, and the provision of adequate investor education materials.

By implementing these regulations, the Penny Stock Reform Act aims to protect investors from fraudulent practices, ensure transparency in the penny stock market, and reduce the risk of individuals falling victim to pump-and-dump schemes or other manipulative tactics.

It’s important to note that while the Penny Stock Reform Act offers certain safeguards, investing in penny stocks still carries risks. The high volatility and limited liquidity of these stocks make them susceptible to price manipulation and market fluctuations. It is crucial for investors to conduct thorough research, analyze financial fundamentals, and understand the company’s management team before investing in any penny stock.

Here are some key points to consider if you are thinking about venturing into the world of penny stocks:

- Do your due diligence: Before investing in any penny stock, make sure to research the company’s background, financials, and management team. Look for any red flags or signs of fraudulent activity.

- Set realistic expectations: Penny stocks are known for their volatility. While they can offer substantial returns, they can also experience significant losses. Set realistic expectations and be prepared for both outcomes.

- Diversify your portfolio: To mitigate risk, it is wise to diversify your investment portfolio across different sectors and asset classes. Don’t put all your eggs in one basket.

- Seek expert advice: If you are new to investing or uncertain about penny stocks, consider consulting with a financial advisor who specializes in this area. They can offer valuable insights and help you navigate the complexities of the penny stock market.

While the Penny Stock Reform Act has brought about some positive changes in the penny stock market, it is crucial to approach these investments with caution and prudence. Remember, knowledge is power, and arming yourself with information and understanding the risks involved can help you make informed investment decisions.

At the end of the day, investing in penny stocks can be a lucrative opportunity, but it comes with its fair share of risks. By staying informed, conducting thorough research, and seeking professional advice when needed, you can navigate the penny stock market with greater confidence and potentially achieve your financial goals.