Finance

How To Trade Penny Stocks On Fidelity

Modified: February 21, 2024

Learn how to trade penny stocks on Fidelity and enhance your finance skills with our comprehensive guide. Discover expert tips and strategies for successful trading.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- What are Penny Stocks?

- Benefits and Risks of Trading Penny Stocks

- Why Use Fidelity for Trading Penny Stocks

- Setting Up a Fidelity Account for Penny Stock Trading

- Researching Penny Stocks on Fidelity

- Placing Penny Stock Orders on Fidelity

- Managing Your Penny Stock Trades on Fidelity

- Tips for Successful Penny Stock Trading on Fidelity

- Conclusion

Introduction

Trading penny stocks can be an exciting and potentially lucrative venture for investors looking to capitalize on the volatility of the stock market. These low-priced, high-risk stocks have the potential to provide significant returns, but they also come with inherent risks.

When it comes to trading penny stocks, having a reliable and user-friendly platform is crucial. One platform that stands out in the world of online trading is Fidelity. With its comprehensive research tools, intuitive trading interface, and robust customer support, Fidelity is an excellent choice for individuals looking to trade penny stocks.

This article will guide you through the process of trading penny stocks on Fidelity, from setting up your account to researching and placing trades. Whether you’re a seasoned trader or new to investing, this guide will provide you with the necessary information to navigate the world of penny stocks on Fidelity.

Before we dive into the specifics of trading penny stocks on Fidelity, let’s first understand what penny stocks are and the benefits and risks associated with them.

What are Penny Stocks?

Penny stocks are stocks that trade at a very low price, typically under $5 per share. These stocks are often associated with small, relatively unknown companies that have a low market capitalization. Due to their low price and small market presence, penny stocks are considered highly speculative and can be volatile.

While there is no official definition of what constitutes a penny stock, they are generally characterized by their low price, high risk, and lack of liquidity. Because of their low price, penny stocks can attract new investors looking for the potential of high returns on a small investment. However, it is important to note that penny stocks also carry a significant risk of loss.

It’s worth mentioning that penny stocks are often traded on over-the-counter markets (OTC) or on small exchanges, rather than on major stock exchanges such as the New York Stock Exchange or NASDAQ. This limits the amount of information available to investors and can make it more difficult to research and assess the financial health and potential of these companies.

Despite the risks, there are some potential benefits to trading penny stocks. One advantage is the potential for large price movements in a short period. Since penny stocks are often subject to speculative trading, the price can jump dramatically if positive news or rumors emerge.

Additionally, penny stocks can offer the opportunity to invest in emerging industries or companies with high growth potential. For investors who prefer a high-risk, high-reward strategy, penny stocks can present an attractive way to potentially profit from the success of these smaller companies.

However, it is crucial to be aware of the risks involved in trading penny stocks. These risks include the lack of regulation and oversight, limited financial information, low liquidity, potential for pump and dump schemes, and the overall volatility and speculative nature of these stocks.

Now that we understand what penny stocks are and their associated risks and benefits, let’s explore why using Fidelity as a platform to trade penny stocks can be advantageous.

Benefits and Risks of Trading Penny Stocks

Before diving into the world of penny stock trading, it is essential to understand the potential benefits and risks associated with this type of investment. While penny stocks can offer the allure of significant returns, they also come with inherent risks that investors need to be aware of.

Benefits of Trading Penny Stocks

1. Potential for High Returns: Penny stocks have the potential to deliver substantial returns on a relatively small investment. Since they are often priced at under $5 per share, even a small price movement can result in a significant percentage gain.

2. Access to Emerging Industries: Penny stocks often represent companies in emerging industries or with high-growth potential. Investing in these stocks allows investors to get involved in industries that may be in the early stages of development, providing an opportunity for substantial growth if the companies succeed.

3. Diversification of Investment Portfolio: Including penny stocks in a well-balanced investment portfolio can help diversify risk. By allocating a portion of funds to potentially high-risk, high-reward investments like penny stocks, investors can balance out the overall risk profile of their portfolio.

Risks of Trading Penny Stocks

1. Lack of Regulation and Oversight: Penny stocks are often traded on over-the-counter markets or small exchanges, which are less regulated than major stock exchanges. This lack of regulation can make it more challenging to obtain accurate and up-to-date information about the companies and their financials.

2. Limited Financial Information: Compared to larger publicly traded companies, penny stocks often have limited financial information available. This lack of information can make it challenging to perform thorough due diligence and assess the financial health and potential of these companies.

3. Low Liquidity: Penny stocks are typically characterized by low trading volume and limited liquidity. This means that it can be more difficult to buy or sell shares at the desired price, which can lead to increased volatility and potential difficulty in executing trades.

4. Potential for Pump and Dump Schemes: Penny stocks are sometimes targeted by individuals or groups looking to manipulate their prices through fraudulent activity. These schemes, often referred to as “pump and dump,” involve artificially inflating the stock’s price and then selling their shares at a profit, leaving other investors at a loss.

5. Volatility and Speculation: Penny stocks are well-known for their extreme price volatility. This volatility can be driven by speculative trading, news, or rumors, leading to sudden and significant price swings. This makes penny stocks a higher-risk investment compared to more established companies.

It is crucial for investors to thoroughly research and understand the potential risks before venturing into penny stock trading. By being aware of the risks and benefits, investors can make informed decisions and potentially maximize their chances of success.

Now that we understand the benefits and risks associated with penny stock trading, let’s explore why Fidelity is a suitable platform for trading these stocks.

Why Use Fidelity for Trading Penny Stocks

When it comes to trading penny stocks, having a reliable and feature-rich platform is vital. Fidelity, a well-established brokerage firm, offers a range of benefits that make it an excellent choice for investors looking to trade penny stocks.

1. Research Tools and Resources

Fidelity provides robust research tools and resources to help investors make informed trading decisions. Their platform offers access to comprehensive research reports, news updates, analyst ratings, and financial data for both major and penny stocks. This wealth of information enables investors to thoroughly analyze and research the penny stocks they are interested in, helping them make well-informed trading choices.

2. Intuitive Trading Interface

Fidelity’s trading platform is designed with user experience in mind. It offers an intuitive and user-friendly interface that makes trading penny stocks hassle-free. The platform provides real-time quotes, customizable watchlists, and advanced charting tools, allowing investors to monitor and track their penny stocks effectively.

3. Order Execution

Fast and accurate order execution is crucial in penny stock trading, where prices can fluctuate rapidly. Fidelity offers reliable order execution, ensuring that your trades are executed quickly and at the desired price. Their advanced trading technology and access to liquidity providers help minimize slippage and provide a seamless trading experience.

4. Customer Service and Support

Fidelity is known for its excellent customer service and support. They provide various channels for investors to seek assistance, including phone support, live chat, and email. Their knowledgeable customer service representatives are readily available to address any queries or concerns related to penny stock trading on their platform.

5. Education and Guidance

Fidelity offers educational resources and tools to help investors build their knowledge and expertise in penny stock trading. They provide articles, webinars, videos, and tutorials on various trading topics, including strategies specific to trading penny stocks. This educational support helps investors make more informed decisions and navigate the unique challenges associated with penny stock trading.

6. Account Accessibility

Fidelity provides accessibility to trading accounts through multiple platforms, including a web-based platform, mobile apps, and desktop software. This ensures that investors can trade penny stocks conveniently from any device, whether they are at home or on the go.

Overall, Fidelity’s comprehensive research tools, intuitive trading interface, reliable order execution, excellent customer service, educational resources, and account accessibility make it an ideal platform for trading penny stocks. By leveraging these features, investors can enhance their trading experience and potentially improve their chances of success in the dynamic world of penny stock trading.

Now that you understand why Fidelity is a suitable platform for trading penny stocks, let’s learn how to set up a Fidelity account for penny stock trading.

Setting Up a Fidelity Account for Penny Stock Trading

If you’re interested in trading penny stocks on Fidelity, the first step is to set up an account with them. The process is straightforward and can be completed entirely online. Follow the steps below to get started:

1. Visit the Fidelity Website

Go to the official Fidelity website (www.fidelity.com) and click on the “Open an Account” button. This will initiate the account setup process.

2. Choose the Account Type

Select the account type that suits your trading needs. If you’re an individual investor, a brokerage account is generally the most suitable option for penny stock trading on Fidelity. Make sure to review the account options and their associated fees to ensure they align with your preferences.

3. Provide Personal Information

Fill out the required personal information, including your name, address, social security number, and employment details. This information is necessary to verify your identity and maintain compliance with relevant regulations.

4. Set Up Funding

Specify how you intend to fund your Fidelity account. You can choose to link your bank account for electronic funds transfer or mail a check to deposit funds. Fidelity also offers the option to transfer funds from an existing brokerage or retirement account.

5. Complete Account Setup

Review the terms and conditions, disclosures, and any additional documentation required by Fidelity. Once you have read and acknowledged the necessary information, submit your application. Fidelity will generally review and approve your account within a few business days.

6. Fund Your Account

After your account is approved, you can deposit funds to begin trading. Follow the instructions provided by Fidelity to transfer the desired amount of money into your account. The minimum funding requirement varies depending on the type of account you have chosen.

7. Familiarize Yourself with Fidelity’s Trading Platform

Before you start trading penny stocks, take some time to explore Fidelity’s trading platform. Familiarize yourself with the various features, such as real-time quotes, charting tools, news updates, and order placement options. This will help you make informed trading decisions and navigate the platform efficiently.

Setting up a Fidelity account for penny stock trading is a simple process that can be completed online. Once your account is set up and funded, you’re ready to dive into researching and trading penny stocks on the Fidelity platform.

Now that your Fidelity account is ready, let’s move on to the next step: researching penny stocks on Fidelity.

Researching Penny Stocks on Fidelity

When it comes to trading penny stocks, conducting thorough research is key to making informed investment decisions. Fidelity provides a wide range of research tools and resources to help investors research and analyze penny stocks effectively. Here are some steps you can take to research penny stocks on Fidelity:

1. Stock Screener

Utilize Fidelity’s stock screener tool to filter and narrow down the universe of penny stocks based on your specific criteria. You can search for stocks based on parameters like price, market capitalization, sector, and financial metrics. This tool allows you to identify potential penny stock candidates that align with your investment strategy.

2. Company Profiles

Access detailed company profiles and financial information through Fidelity’s research platform. This includes information such as company background, financial statements, earnings history, growth prospects, and key performance indicators. Take the time to thoroughly review these profiles to understand the fundamentals and potential risks associated with the penny stock companies you are considering.

3. Analyst Recommendations and Research Reports

Fidelity provides access to research reports and analyst recommendations for both major and penny stocks. These reports offer valuable insights from industry experts and can help you gauge market sentiment and the potential future performance of specific penny stocks. Consider reading through these reports to gain a broader understanding of the stocks you are researching.

4. News and Market Updates

Stay updated on the latest news and market developments related to the penny stocks you are interested in. Fidelity provides real-time news feeds and market updates that can help you stay informed about important events, corporate announcements, regulatory changes, and other factors that may impact the performance of penny stocks.

5. Technical Analysis Tools

Explore Fidelity’s suite of technical analysis tools to assess stock price trends, patterns, and indicators. These tools can help you identify potential entry and exit points for penny stocks based on historical price movements and technical indicators. It is important to note that technical analysis should be used in conjunction with fundamental analysis for a well-rounded research approach.

6. Peer Comparison and Benchmarking

Compare the financial performance and valuation metrics of penny stocks against their industry peers and benchmarks. Fidelity’s research platform allows you to perform side-by-side comparisons of key financial ratios, growth rates, and valuation multiples. This analysis can help you understand how a specific penny stock stacks up against its competitors and industry standards.

By utilizing Fidelity’s research tools and resources, investors can conduct comprehensive analysis and make more informed decisions when trading penny stocks. It is important to remember that no research tool or report should be the sole basis of your trading decisions. Exercise caution and take into account both fundamental and technical factors before making any investment moves.

Now that you have a solid understanding of how to research penny stocks on Fidelity, let’s move on to the next step: placing penny stock orders on the Fidelity platform.

Placing Penny Stock Orders on Fidelity

Once you have conducted thorough research and identified the penny stocks you want to trade on Fidelity, it’s time to place your orders. Fidelity offers various order types to cater to different trading strategies and preferences. Here are the steps to place penny stock orders on the Fidelity platform:

1. Log in to Your Fidelity Account

Access your Fidelity trading account using your login credentials on the Fidelity website or mobile app. Ensure that you have sufficient funds or buying power available in your account to cover the cost of the penny stock order you wish to place.

2. Navigate to the Order Entry Screen

Once logged in, locate the order entry screen on the Fidelity platform. This screen allows you to input the details of your penny stock order, including the stock symbol, quantity, order type, and order duration.

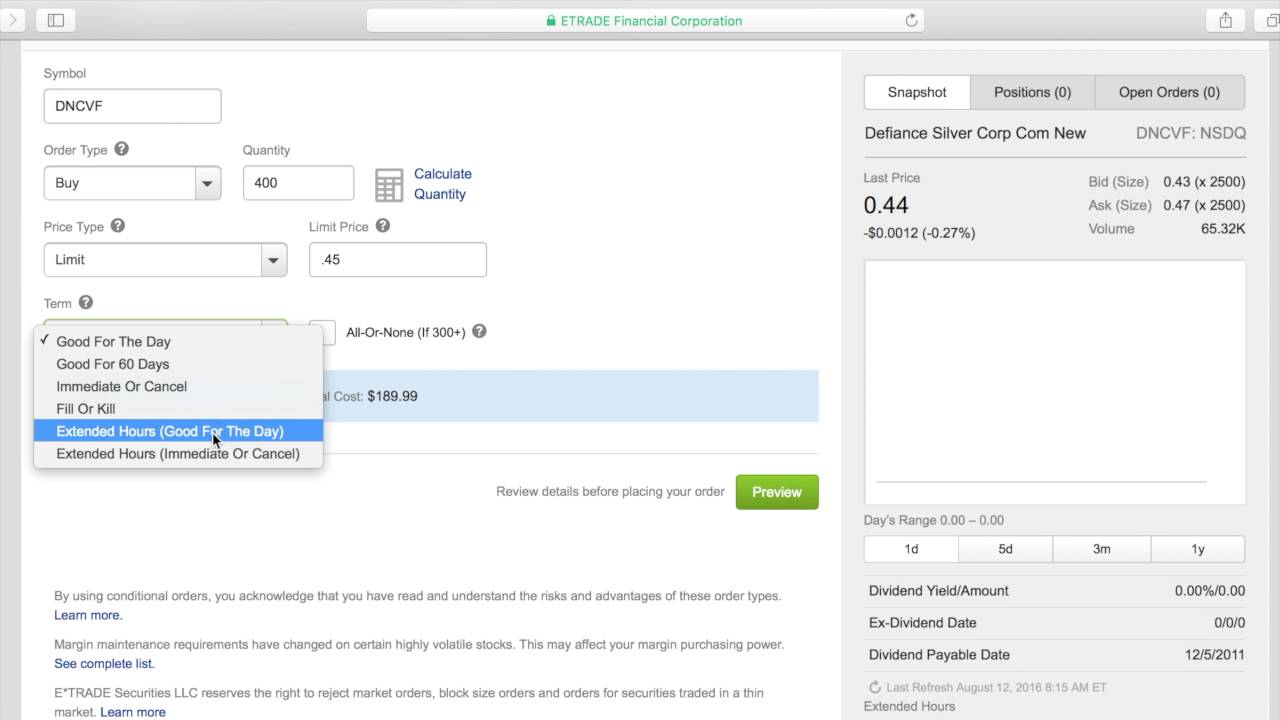

3. Select the Order Type

Choose the appropriate order type based on your trading strategy and preferences. Fidelity offers various order types, including market orders, limit orders, stop orders, and trailing stop orders. Familiarize yourself with each order type and select the one that suits your needs.

4. Set the Order Duration

Specify the duration for which you want the order to remain active. Fidelity provides options such as day orders, good ’til canceled (GTC) orders, and immediate or cancel (IOC) orders. The order duration determines how long Fidelity will attempt to execute the order before canceling it.

5. Review and Confirm the Order Details

Double-check all the order details, including the stock symbol, quantity, order type, order duration, and any applicable special instructions. Ensure that the information is accurate before proceeding to place the order.

6. Place the Order

Once you are satisfied with the order details, click on the “Place Order” or similar button to submit your penny stock order. Fidelity will process the order and attempt to execute it at the specified price and within the defined duration.

7. Monitor the Order Status

After placing the order, monitor its status to determine if it is filled, partially filled, or remains open. Fidelity’s trading platform provides real-time updates on the status of your orders, allowing you to stay informed throughout the trading process.

It is important to remember that penny stocks can be highly volatile and have limited liquidity. As a result, it may be prudent to monitor your penny stock orders closely and adjust them if market conditions change or if your investment thesis evolves.

Now that you know how to place penny stock orders on Fidelity, let’s move on to the next step: managing your penny stock trades on the Fidelity platform.

Managing Your Penny Stock Trades on Fidelity

Once you have successfully placed your penny stock orders on Fidelity, it’s essential to actively manage your trades to maximize potential profits and minimize potential losses. Fidelity provides several tools and features to help you efficiently manage your penny stock trades. Here are some key steps to consider:

1. Monitor Your Trade Positions

Keep a close eye on your penny stock positions and monitor their performance regularly. Fidelity’s trading platform provides real-time updates on trade positions, including the current price, change in value, and percentage gain or loss. By staying informed, you can make more informed decisions about whether to hold, sell, or buy more shares of a particular penny stock.

2. Set Stop-Loss Orders

Consider setting stop-loss orders to protect yourself from significant losses. A stop-loss order is an instruction to sell a stock if its price falls to a specified level. By placing stop-loss orders, you can limit potential losses and protect your investment capital in case the penny stock’s price declines unexpectedly.

3. Use Trailing Stop Orders

Utilize trailing stop orders to protect your gains and lock in profits as the price of a penny stock rises. A trailing stop order is an instruction to sell a stock if its price falls a certain percentage from its highest value since the order was placed. This allows you to capture potential upside while still protecting your profits if the penny stock’s price starts to decline.

4. Stay Informed with Real-Time News and Alerts

Stay updated with real-time news, company announcements, and market alerts related to your penny stocks. Fidelity provides access to news feeds and alerts that can help you stay informed about any developments that may impact the performance of your penny stocks. By staying informed, you can make timely decisions and adjust your trading strategy accordingly.

5. Review and Adjust Your Trading Strategy

Regularly review your trading strategy and reassess your penny stock portfolio. Evaluate the performance of your trades, identify patterns, and make any necessary adjustments to your strategy. It’s essential to be flexible and adapt to changing market conditions to optimize your penny stock trading approach.

6. Seek Professional Guidance if Needed

If you require additional assistance or guidance in managing your penny stock trades, don’t hesitate to reach out to Fidelity’s customer support or consider consulting with a financial advisor. They can provide expert advice tailored to your specific investment goals and help you make well-informed decisions.

By actively managing your penny stock trades on Fidelity and staying proactive, you can increase your chances of generating positive returns while effectively managing risk. Remember that penny stocks can be highly volatile, so diligent monitoring and timely decision-making are essential.

Now that you have learned how to manage your penny stock trades on Fidelity, it’s important to keep in mind some tips for successful penny stock trading. Let’s explore these tips in the next section.

Tips for Successful Penny Stock Trading on Fidelity

Penny stock trading can be challenging and risky, but with the right strategies and mindset, it is possible to find success in this volatile market. Here are some tips to help you navigate the world of penny stock trading on Fidelity:

1. Do Your Research

Thoroughly research the penny stocks you are interested in before making any trades. Analyze the company’s financials, industry trends, news, and any other relevant information. The more informed you are, the better equipped you will be to make educated trading decisions.

2. Create a Trading Plan

Develop a clear and well-defined trading plan that outlines your goals, risk tolerance, entry and exit strategies, and position sizing. Having a plan in place helps you stay focused and disciplined in your trading approach, reducing the likelihood of making impulsive decisions based on emotions.

3. Start with a Small Position Size

When trading penny stocks, it’s generally advisable to start with a small position size. This allows you to manage risk more effectively and limits potential losses. As you gain experience and confidence, you can gradually increase your position sizes.

4. Use Stop-Loss Orders

Implement stop-loss orders to protect yourself from significant losses. Set your stop-loss levels based on your risk tolerance and the specific characteristics of the penny stocks you are trading. This will help you limit losses and preserve your capital in case the price moves against your trade.

5. Be Disciplined and Patient

Practice discipline and patience in your trading activities. Stick to your trading plan and avoid chasing hot tips or getting caught up in market hype. Remember that penny stocks can be highly volatile, so it’s essential to stay level-headed and avoid making impulsive decisions.

6. Diversify Your Portfolio

Avoid putting all your eggs in one basket by diversifying your penny stock portfolio. Invest in a variety of penny stocks across different industries to spread out the risk. By diversifying, you can potentially cushion losses from any underperforming stocks with gains from others.

7. Manage Your Emotions

Control your emotions when trading penny stocks. Fear and greed can lead to irrational decision-making. Stick to your trading plan, trust your research, and avoid getting swept up in market sentiments. Maintain a rational mindset and make decisions based on logic and data.

8. Continuously Learn and Evolve

Never stop learning and honing your trading skills. Stay updated on market trends, trading strategies, and new developments in the penny stock world. Continuously evaluate and refine your trading approach based on your experiences to improve your chances of success.

Remember, penny stock trading carries risks, and there are no guarantees of success. It’s crucial to approach it with caution and be prepared for potential losses. Always trade with an amount of money you can afford to lose.

By following these tips and maintaining a disciplined and informed approach to penny stock trading, you can position yourself for potential success on the Fidelity platform.

Now that you are equipped with valuable tips, it’s time to wrap up our guide to trading penny stocks on Fidelity.

Conclusion

Trading penny stocks on Fidelity can be an exciting and potentially profitable venture for investors. With its comprehensive research tools, intuitive trading interface, reliable order execution, and excellent customer support, Fidelity provides a robust platform for trading these high-risk, high-reward stocks.

Throughout this guide, we have covered the basics of penny stocks, the benefits and risks associated with trading them, why Fidelity is a suitable platform for trading penny stocks, and the steps involved in setting up a Fidelity account for penny stock trading.

We have also explored how to conduct thorough research on penny stocks using Fidelity’s research tools, how to place penny stock orders on the platform, and how to manage and monitor your penny stock trades effectively.

Additionally, we provided tips for successful penny stock trading, emphasizing the importance of research, having a trading plan, managing risk, and maintaining discipline and patience.

Trading penny stocks on Fidelity requires a combination of knowledge, skill, research, and risk management. It’s vital to continuously educate yourself, stay informed about market trends, and adapt your trading strategies as required.

As with any form of trading, it’s important to remember that there are risks involved, and losses can occur. It’s crucial to only invest what you can afford to lose and to consult with a financial advisor if you need personalized guidance.

Now that you have a solid understanding of trading penny stocks on Fidelity, it’s the perfect time to put your knowledge into action. Open a Fidelity account, start researching penny stocks, and begin your exciting journey as a penny stock trader.

Best of luck in your penny stock trading endeavors!