Finance

How To Buy And Sell Penny Stocks On E-Trade

Published: January 17, 2024

Learn how to buy and sell penny stocks on E-Trade and maximize your finance opportunities with expert tips and strategies.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Penny Stocks

- Choosing a Reliable Brokerage Platform

- Opening an E-Trade Account

- Navigating the E-Trade Platform

- Researching Penny Stocks

- Placing a Buy Order for Penny Stocks

- Setting Stop Loss and Take Profit Levels

- Monitoring and Managing Your Penny Stock Portfolio

- Selling Penny Stocks on E-Trade

- Tips for Successful Penny Stock Trading

- Risks and Considerations

- Conclusion

Introduction

Welcome to the world of penny stock trading! If you are looking to dive into the world of high-risk, high-reward investments, penny stocks offer an exciting opportunity. These stocks, typically trading under $5 per share, can see explosive gains in a short period of time. However, it’s important to approach penny stock trading with caution and a solid understanding of the risks involved.

Before you jump into the world of penny stock trading, it’s crucial to have a reliable brokerage platform that can provide the necessary tools and support. One such platform is E-Trade, a well-established online brokerage known for its user-friendly interface and robust trading capabilities.

In this article, we will guide you through the process of buying and selling penny stocks on E-Trade. We will cover everything from opening an E-Trade account to navigating the platform and executing trades. Whether you’re a seasoned trader or just starting out, this guide will provide you with the knowledge and resources to make informed decisions.

Before we delve into the specifics of using E-Trade for penny stock trading, let’s take a moment to understand what penny stocks are and the unique characteristics that set them apart from traditional stocks.

Understanding Penny Stocks

Penny stocks are stocks that trade at a relatively low price, often below $5 per share. These stocks are typically associated with small companies that have a low market capitalization and limited financial resources. Due to their low price and small market capitalization, penny stocks are considered to be highly speculative and volatile investments.

One of the key characteristics of penny stocks is their potential for significant price movements in a short period of time. This volatility can offer opportunities for substantial gains, but it also comes with increased risks. It’s important to note that penny stocks are subject to less regulation than stocks listed on major exchanges. This lack of regulation can make penny stocks susceptible to price manipulation and fraudulent practices.

When investing in penny stocks, it’s crucial to conduct thorough research and due diligence. Some key factors to consider when evaluating penny stocks include the company’s financial health, business model, management team, industry trends, and potential catalysts that could drive the stock price higher.

Additionally, it’s important to understand the different types of penny stocks available. These include turnaround stocks, which are companies that are experiencing challenges but have the potential for a significant recovery; speculative stocks, which are companies with promising technologies or ideas that may or may not materialize; and pump and dump stocks, which are stocks that are artificially inflated through promotional campaigns before being sold off by the perpetrators.

Be aware that penny stocks are not suitable for all investors and should only be considered by those with a high risk tolerance and a willingness to do extensive research. It’s also advisable to allocate only a small portion of your overall investment portfolio to penny stocks, as their volatility can lead to substantial losses.

Now that we have a basic understanding of penny stocks, let’s move on to choosing a reliable brokerage platform for trading these stocks.

Choosing a Reliable Brokerage Platform

When it comes to trading penny stocks, choosing a reliable brokerage platform is paramount. A good brokerage platform will provide you with the tools, resources, and support necessary to navigate the world of penny stock trading effectively.

One well-established brokerage platform that caters to both beginner and experienced traders is E-Trade. With its user-friendly interface, robust trading platform, and a wide range of investment options, E-Trade is a popular choice for those looking to trade penny stocks.

When evaluating brokerage platforms for penny stock trading, consider the following factors:

- Commission Fees: Look for a brokerage platform that offers competitive commission fees for trading penny stocks. This can help minimize costs and maximize your potential profits.

- Research and Analysis Tools: A reliable brokerage platform should provide comprehensive research and analysis tools to help you make informed trading decisions. Look for platforms that offer real-time market data, stock screeners, and news feeds.

- Order Execution: Quick and reliable order execution is crucial when trading penny stocks, as prices can move rapidly. Look for platforms that offer fast and efficient order execution to ensure you don’t miss out on potential opportunities.

- Customer Support: Having access to responsive and knowledgeable customer support can be invaluable, especially for beginner traders. Look for platforms that offer multiple channels of customer support, such as phone, email, and live chat.

- Mobile Trading: Consider whether the brokerage platform offers a mobile trading app. This can allow you to monitor and execute trades on the go, providing flexibility and convenience.

E-Trade checks all the boxes when it comes to these factors. With competitive commission fees, a wide range of research and analysis tools, efficient order execution, responsive customer support, and a reliable mobile trading app, E-Trade is a trustworthy choice for penny stock trading.

Now that you understand the factors to consider when choosing a brokerage platform, let’s move on to opening an E-Trade account to start trading penny stocks.

Opening an E-Trade Account

Opening an E-Trade account is a straightforward process that can be completed online. Follow the steps below to get started:

- Visit the E-Trade Website: Go to the official E-Trade website (www.etrade.com) to begin the account opening process.

- Click on “Open an Account”: Look for the “Open an Account” button or link on the homepage and click on it.

- Select Account Type: Choose the type of account you want to open. E-Trade offers various account options, including individual brokerage accounts, joint accounts, retirement accounts, and more. Select the account type that best suits your needs.

- Complete the Application: Fill out the online application form with your personal information, including your name, address, Social Security number, and employment information. You may also be asked to provide financial information and answer questions regarding your investment experience and risk tolerance.

- Verify Your Identity: As part of the account opening process, E-Trade may require you to verify your identity. This can be done by providing a copy of your driver’s license or passport.

- Agree to Terms and Conditions: Read and agree to the terms and conditions set forth by E-Trade.

- Fund Your Account: Once your account application is approved, you will need to fund your E-Trade account. E-Trade offers various funding options, including bank transfers, wire transfers, and electronic transfers from other brokerage accounts.

It’s important to note that E-Trade may require a minimum initial deposit to open a trading account. The minimum deposit requirement varies depending on the type of account you choose.

Once your E-Trade account is funded, you will be ready to start trading penny stocks on their platform. In the next section, we will guide you through the process of navigating the E-Trade platform and executing trades.

Navigating the E-Trade Platform

Once your E-Trade account is open and funded, it’s time to familiarize yourself with the E-Trade platform. Navigating the platform effectively is essential for placing buy and sell orders for penny stocks. Here are key steps to help you get started:

- Login to Your E-Trade Account: Visit the E-Trade website and login with your username and password.

- Dashboard Overview: Upon logging in, you will be taken to the E-Trade dashboard. This is where you will find an overview of your account balance, portfolio holdings, and other essential information.

- Research Tools: Utilize the research tools available on the E-Trade platform to conduct thorough analysis of penny stocks. These tools may include stock screeners, market data, news feeds, and company profiles.

- Placing a Buy Order: To place a buy order for a penny stock, navigate to the “Trade” section of the platform. Here, you can search for the stock symbol of the penny stock you want to buy and input the number of shares you wish to purchase.

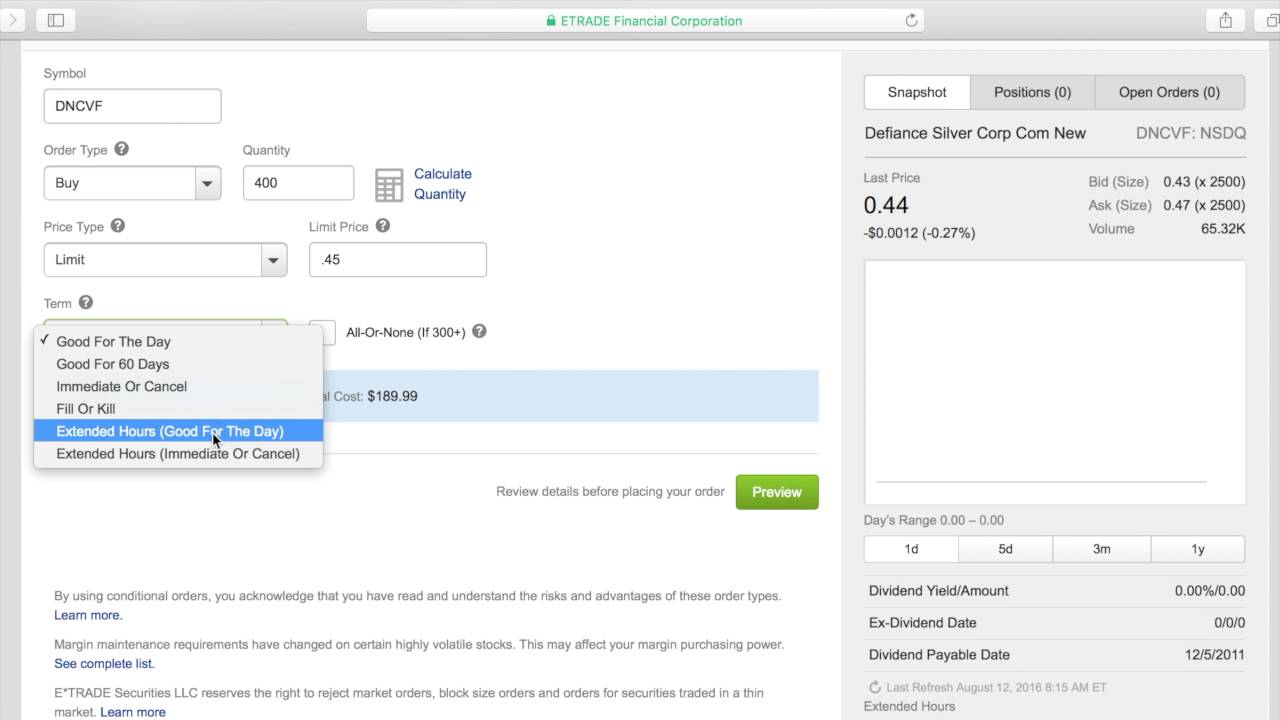

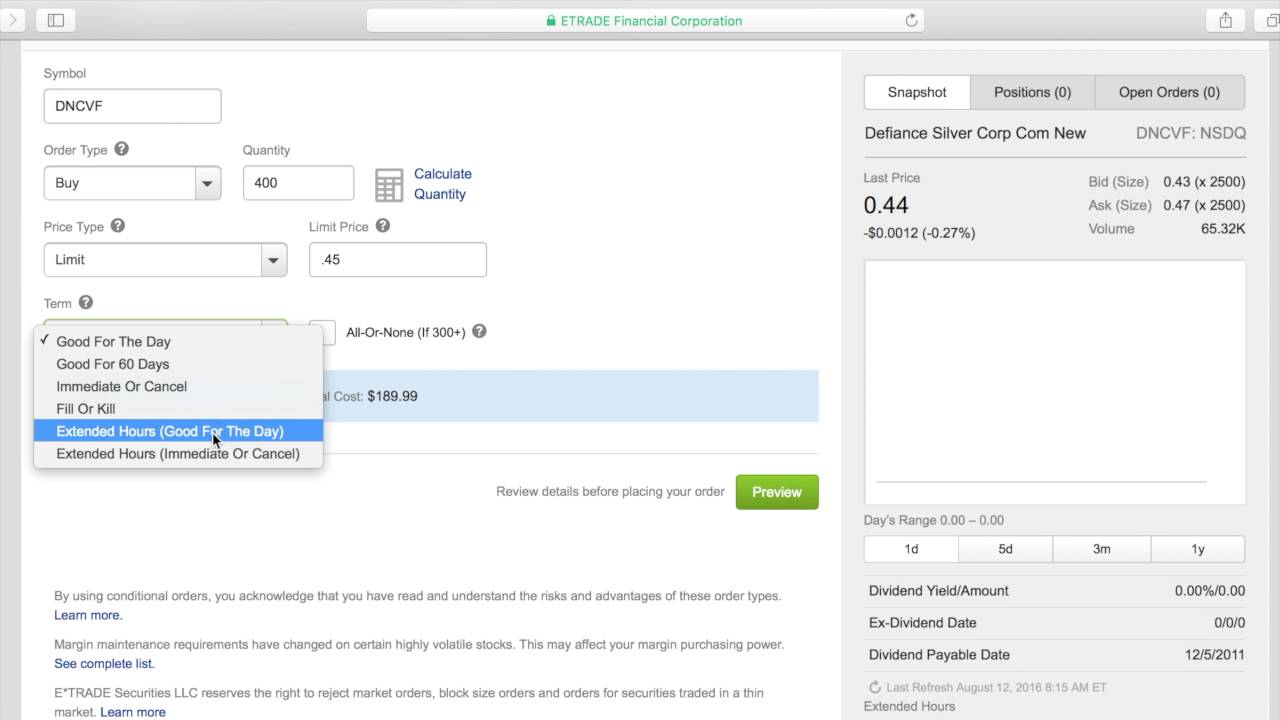

- Order Types: E-Trade offers various order types, including market orders, limit orders, and stop orders. Understand the different order types and select the appropriate one for your trading strategy.

- Setting Stop Loss and Take Profit Levels: When placing a buy order, you may want to consider setting stop loss and take profit levels. These levels act as automated instructions to sell the stock if it reaches a specified price, limiting potential losses or locking in profits.

- Monitoring Your Portfolio: Use the E-Trade platform to monitor your penny stock portfolio. Track your holdings, review performance, and stay updated with relevant news and announcements that may affect your investments.

E-Trade provides a user-friendly interface and comprehensive trading tools to help you navigate the platform with ease. However, if you encounter any difficulties or have specific questions about the platform’s functionality, you can reach out to E-Trade’s customer support for assistance.

In the next section, we will cover the importance of conducting thorough research when trading penny stocks and how to leverage the research tools provided by E-Trade.

Researching Penny Stocks

Research is a crucial aspect of penny stock trading to make informed investment decisions. Investing in penny stocks without proper research can expose you to unnecessary risks. E-Trade provides a range of research tools and resources to help you conduct thorough analysis. Here’s how you can leverage these tools:

- Stock Screeners: Utilize E-Trade’s stock screeners to filter penny stocks based on specific criteria such as price, volume, sector, and market capitalization. Narrowing down your options using these criteria can help you focus on stocks that align with your investment goals and risk appetite.

- Company Profiles: Dive into company profiles to gain insights into the underlying businesses associated with penny stocks. Analyze their financial health, business models, management teams, competitive advantage, and growth potential. Look for indicators of stability and growth prospects to make more informed decisions.

- Financial Statements: Access financial statements such as income statements, balance sheets, and cash flow statements to evaluate a company’s financial performance and stability. Look for consistent revenue growth, manageable debt levels, and positive cash flow.

- News and Analysis: Stay up to date with the latest news and analysis on penny stocks through E-Trade’s news feeds and research reports. Monitor any significant developments, such as earnings releases, product launches, regulatory changes, or industry trends that may impact the stock’s performance.

- Technical Analysis: Utilize charting tools available on E-Trade to perform technical analysis. Analyze price trends, support and resistance levels, and other technical indicators to identify potential entry and exit points for your trades.

Remember, thorough research is essential when trading penny stocks. While no analysis can guarantee success, informed decision-making can improve your odds of making profitable trades. It’s advisable to build a watchlist of penny stocks that you have researched and are interested in, and then monitor them closely for potential opportunities.

In the next section, we will explore the process of placing a buy order for penny stocks using the E-Trade platform.

Placing a Buy Order for Penny Stocks

Now that you have conducted thorough research and identified a penny stock you wish to invest in, it’s time to place a buy order using the E-Trade platform. Here’s a step-by-step guide on how to do it:

- Login to your E-Trade account: Visit the E-Trade website and login with your username and password.

- Navigate to the “Trade” section: Once logged in, click on the “Trade” tab or section of the platform.

- Search for the penny stock: Use the stock symbol or company name to search for the specific penny stock you want to buy.

- Review the stock details: Take a moment to review the stock details, including the current price, bid-ask spread, and any relevant news or announcements.

- Select the order type: Choose the appropriate order type for your trade. E-Trade offers different order types, including market orders, limit orders, and stop orders. Select the one that aligns with your trading strategy and risk tolerance.

- Specify the number of shares: Enter the number of shares you want to purchase. Ensure that you have the necessary funds available in your account to cover the purchase.

- Review and confirm: Double-check all the details of your trade, including the stock symbol, order type, and number of shares. Confirm that everything is accurate before submitting the order.

- Place the buy order: Once you are satisfied with the trade details, click on the “Place Order” button to execute the buy order for the penny stock.

- Monitor the execution: After placing the buy order, E-Trade will execute the trade based on the prevailing market conditions. Monitor your account to ensure that the purchase goes through successfully.

It’s important to note that penny stocks can be volatile, and prices can move quickly. Be mindful of the bid-ask spread and the potential impact on the execution price of your order. Additionally, consider setting stop loss and take profit levels to manage risk and protect your investment.

In the next section, we will discuss the importance of setting stop loss and take profit levels and how to go about it using the E-Trade platform.

Setting Stop Loss and Take Profit Levels

Setting stop loss and take profit levels is a crucial step in managing risk and protecting your investment when trading penny stocks. Stop loss and take profit orders are automated instructions that are triggered when a stock reaches a specific price. Here’s how you can set these levels using the E-Trade platform:

- Login to your E-Trade account: Visit the E-Trade website and login with your username and password.

- Navigate to your open positions: Once logged in, access the “Positions” or “Portfolio” section of the platform to view your open positions.

- Locate the penny stock: Find the penny stock for which you wish to set stop loss and take profit levels. Click on the stock symbol or name to access the detailed position information.

- Set stop loss level: In the position details, look for the option to set a stop loss level. Enter the desired price at which you want to sell the stock if it goes below that level. This helps limit potential losses.

- Set take profit level: Similarly, set a take profit level by entering the price at which you want to sell the stock to secure profits. This helps lock in gains and prevent potential reversals.

- Review and confirm: Double-check the stop loss and take profit levels you have set. Ensure that they align with your risk management strategy and investment goals.

- Save the changes: Once you are satisfied with the stop loss and take profit levels, save the changes to activate these automated sell orders.

It’s important to note that setting stop loss and take profit levels does not guarantee execution at the desired prices. Market conditions can lead to slippage, where the executed price deviates from the specified level. Nevertheless, these orders can act as valuable risk management tools, helping protect your capital and lock in profits.

Monitor your positions regularly and adjust your stop loss and take profit levels if necessary. As the price of the penny stock fluctuates, you may want to reassess your levels to protect against extreme market movements while still allowing for potential upside.

In the next section, we will discuss how to effectively monitor and manage your penny stock portfolio using the E-Trade platform.

Monitoring and Managing Your Penny Stock Portfolio

Once you have bought penny stocks and set appropriate risk management measures, it’s crucial to actively monitor and manage your portfolio to make informed decisions. Here are some tips on effectively monitoring and managing your penny stock portfolio using the E-Trade platform:

- Regularly review your portfolio: Log in to your E-Trade account and navigate to the “Portfolio” or “Positions” section to review your penny stock holdings. Take note of their performance and any significant changes.

- Stay updated with news and announcements: Use E-Trade’s research tools and news feeds to stay informed about the latest news and announcements related to your penny stocks. Keep an eye on earnings releases, industry developments, and other factors that may affect your investments.

- Keep track of key performance indicators: Monitor key performance indicators such as stock price, volume, and average cost. This will help you assess the overall performance of your penny stock portfolio and make informed decisions.

- Consider trailing stops: E-Trade offers the option to set trailing stop orders, which automatically adjust the stop loss level as the stock price fluctuates. This allows you to capture profits while still protecting against significant downside moves.

- Reassess your investment thesis: Regularly review the reasons you invested in each penny stock and assess whether the company’s fundamentals and prospects still align with your investment goals. Be ready to make adjustments or exit positions if necessary.

- Manage your emotions: Penny stocks can be highly volatile, causing emotions like fear and greed to influence decision-making. It’s important to stay disciplined and avoid making impulsive or emotional trading decisions based on short-term market movements.

- Utilize alerts and notifications: E-Trade provides customizable alerts and notifications to help you stay informed about changes in your penny stock portfolio. Set up alerts for price movements, news updates, and other relevant events to stay on top of your investments.

- Periodically rebalance your portfolio: Evaluate your penny stock holdings periodically and consider rebalancing your portfolio to maintain your desired asset allocation. Selling winners and adding to underperforming positions can help align your portfolio with your long-term investment strategy.

Active monitoring and management of your penny stock portfolio are essential to adapting to market conditions, making necessary adjustments, and maximizing potential returns while minimizing risk. By leveraging the tools and features offered by E-Trade, you can stay informed and make informed decisions based on your investment goals.

In the next section, we will discuss the process of selling penny stocks on the E-Trade platform.

Selling Penny Stocks on E-Trade

Selling penny stocks on the E-Trade platform follows a similar process to buying them. When you decide to sell a penny stock, here’s what you need to do:

- Login to your E-Trade account: Visit the E-Trade website and login with your username and password.

- Navigate to the “Trade” section: Once logged in, click on the “Trade” tab or section of the platform.

- Search for the penny stock: Use the stock symbol or company name to search for the specific penny stock you want to sell.

- Review the stock details: Take a moment to review the stock’s current price, bid-ask spread, and any relevant news or announcements that may impact your decision to sell.

- Select the order type: Choose the order type for your sell order. E-Trade provides options such as market orders, limit orders, and stop orders. Select the one that aligns with your selling strategy.

- Specify the number of shares: Enter the number of shares you want to sell. Make sure you have enough shares in your portfolio to meet the sell order.

- Review and confirm: Double-check all the details of your sell order, including the stock symbol, order type, and number of shares. Confirm that everything is accurate before submitting the order.

- Place the sell order: Once you are satisfied with the trade details, click on the “Place Order” button to execute the sell order for the penny stock.

- Monitor the execution: After placing the sell order, monitor your E-Trade account to ensure that the sale goes through successfully. Pay attention to any notifications or confirmations regarding the execution of your sell order.

It’s worth noting that the price at which your penny stock sells may be subject to market fluctuations and the prevailing bid-ask spread. Monitor the stock’s market price closely to decide when to sell, taking into consideration your desired profit targets or risk management strategies like trailing stops.

Proactively managing your sell orders and staying on top of your portfolio can help you capture potential gains and manage risk effectively. Regularly review your positions and adjust your sell orders as necessary to align with your investment goals and market conditions.

In the next section, we will provide you with some tips for successful penny stock trading on the E-Trade platform.

Tips for Successful Penny Stock Trading

Penny stock trading can be highly rewarding, but it comes with added risks due to the volatile nature of these stocks. To increase your chances of success, consider the following tips when trading penny stocks on the E-Trade platform:

- Do thorough research: Conduct extensive research on the penny stocks you plan to invest in. Evaluate the company’s financials, industry trends, and potential catalysts to make informed decisions.

- Set realistic expectations: Understand that not all penny stocks will become overnight success stories. Set realistic expectations and be prepared for potential losses.

- Manage risk: Implement risk management strategies such as setting stop loss and take profit levels to protect your capital and limit potential losses.

- Diversify your portfolio: Spread your investments across different penny stocks to mitigate the impact of individual stock volatility. Diversification can help balance potential risks and returns.

- Stay disciplined: Stick to your trading plan and avoid making impulsive decisions. Emotions like fear and greed can cloud judgment, so rely on your research and analysis.

- Stay updated on market news: Keep track of market news and announcements that may impact your penny stocks. Stay informed about earnings reports, industry developments, and regulatory changes.

- Take advantage of E-Trade’s research tools: Utilize the research tools provided by E-Trade to make informed trading decisions. Leverage stock screeners, research reports, and real-time market data to identify potential opportunities.

- Monitor your portfolio: Regularly review and reassess your penny stock portfolio. Stay vigilant and adjust your positions and orders as needed based on market conditions and your investment goals.

- Learn from your experiences: Reflect on your trades, both successful and unsuccessful. Learn from your past experiences and continually refine your trading strategy.

- Consider seeking professional advice: If needed, don’t hesitate to consult with a financial advisor or seek professional guidance to help you navigate the complexities of penny stock trading.

Remember, penny stock trading carries a higher level of risk compared to investing in larger, more established companies. It’s important to approach penny stock trading with caution and conduct your due diligence.

Incorporating these tips into your trading approach, combined with a disciplined and informed mindset, can increase your chances of success when trading penny stocks on the E-Trade platform.

In the next section, we will discuss the risks and considerations associated with penny stock trading.

Risks and Considerations

Trading penny stocks on E-Trade, like any investment strategy, comes with its own set of risks and considerations. It’s important to be aware of these factors before diving into penny stock trading. Here are some key risks and considerations to keep in mind:

- Volatility: Penny stocks are known for their high volatility, which means their prices can fluctuate dramatically in a short period. Extreme price swings can result in substantial gains as well as significant losses.

- Lack of Liquidity: Some penny stocks have limited trading volumes, which can lead to illiquidity. This means it may be challenging to buy or sell shares at desired prices, and the bid-ask spread can be wide.

- Market Manipulation: Penny stocks are susceptible to market manipulation and fraudulent activities due to lower regulation compared to stocks listed on major exchanges. Be cautious of “pump and dump” schemes, where unscrupulous individuals artificially inflate stock prices before selling off their own shares.

- Limited Financial Information: Penny stocks issued by smaller companies often have limited public financial information available. This can make it difficult to assess their true financial health and performance.

- Company Risk: Many penny stocks are associated with small or newly established companies that may lack a proven track record or have uncertain business models. Investing in these companies carries a higher degree of risk compared to established firms.

- Lack of Analyst Coverage: Penny stocks typically receive limited attention from analysts and financial institutions. The lack of reliable analyst coverage can make it challenging to gather comprehensive and unbiased information about these stocks.

- Emotional Trading: The high volatility and potential for quick gains in penny stocks can lead to emotional decision-making. Greed and fear can cloud judgment, causing investors to make impulsive and irrational trading decisions.

- Due Diligence: Conducting thorough research and due diligence is crucial when trading penny stocks. Failing to do so can lead to uninformed investment decisions and potential losses.

- Capital Losses: While penny stocks present opportunities for significant gains, they also carry the risk of substantial losses. It’s important to be prepared for the possibility of losing your investment capital.

- Regulatory Risks: Changes in regulations or compliance requirements can impact the trading of penny stocks. Stay updated on any regulatory developments that may affect the market and your investments.

It’s essential to understand and carefully consider these risks and considerations before engaging in penny stock trading. Develop a clear investment strategy, set realistic expectations, and allocate only a portion of your overall investment portfolio to penny stocks.

Seeking advice from financial professionals and leveraging the research tools provided by E-Trade can help you mitigate risks and make informed decisions.

Finally, be prepared to continuously educate yourself about the dynamics of penny stocks and adapt your trading approach based on market conditions and the ever-changing landscape of the penny stock market.

Disclaimer: The information provided in this article is for informational purposes only and should not be considered as financial advice. Trading penny stocks involves risk, and it’s important to do your own research and consult with a professional advisor before making investment decisions.

Conclusion

Trading penny stocks on the E-Trade platform can be an exciting and potentially rewarding endeavor, but it is not without risks. Before diving into the world of penny stock trading, it’s crucial to understand the unique characteristics of these stocks and the considerations they entail.

In this article, we have covered the fundamentals of penny stock trading on E-Trade, starting from opening an account and navigating the platform to conducting research, placing buy and sell orders, and managing your portfolio. We have also provided tips for successful trading and highlighted the risks involved.

E-Trade offers an array of tools, resources, and support to help traders navigate the world of penny stocks. By leveraging the research tools, monitoring your portfolio, setting stop loss and take profit levels, and staying informed about market news, you can increase your chances of success.

Remember to approach penny stock trading with caution, allocate only a portion of your portfolio to these high-risk investments, and conduct thorough research before making any decisions. Keep your expectations realistic and be prepared for both gains and losses.

It’s important to continually educate yourself about the market, adapt your trading strategy, and seek professional advice when needed. Managing your emotions and staying disciplined are key factors in successful penny stock trading.

Finally, always remember to stay informed about the latest market trends, regulatory changes, and company news that may impact your penny stock investments.

Trading penny stocks can be a thrilling journey, but it requires careful planning, research, and risk management. With the right approach, endurance, and knowledge, you can navigate the world of penny stocks and potentially unlock opportunities for profit.