Finance

Possibility Of Failure (POF) Rate Definition

Published: January 9, 2024

Learn the definition of Possibility of Failure (POF) rate in finance and understand its implications. Gain insights into managing risk and making informed financial decisions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding the Possibility of Failure (POF) Rate Definition

When it comes to managing our finances, it’s crucial to have a clear understanding of the various concepts and terms that surround it. One such concept is the Possibility of Failure (POF) rate. In this blog post, we will dive into what the POF rate is, why it’s important, and how it can help you make better financial decisions.

Key Takeaways:

- The Possibility of Failure (POF) rate measures the likelihood of a financial investment or venture failing.

- POF rate helps you assess and mitigate risks in your financial decisions.

Defining the Possibility of Failure (POF) Rate

The Possibility of Failure (POF) rate refers to the likelihood of a financial investment or venture failing. It is a metric that quantifies the risk associated with a particular financial decision or investment. Understanding the POF rate provides crucial insights into the potential risks and helps you make informed choices to safeguard your finances.

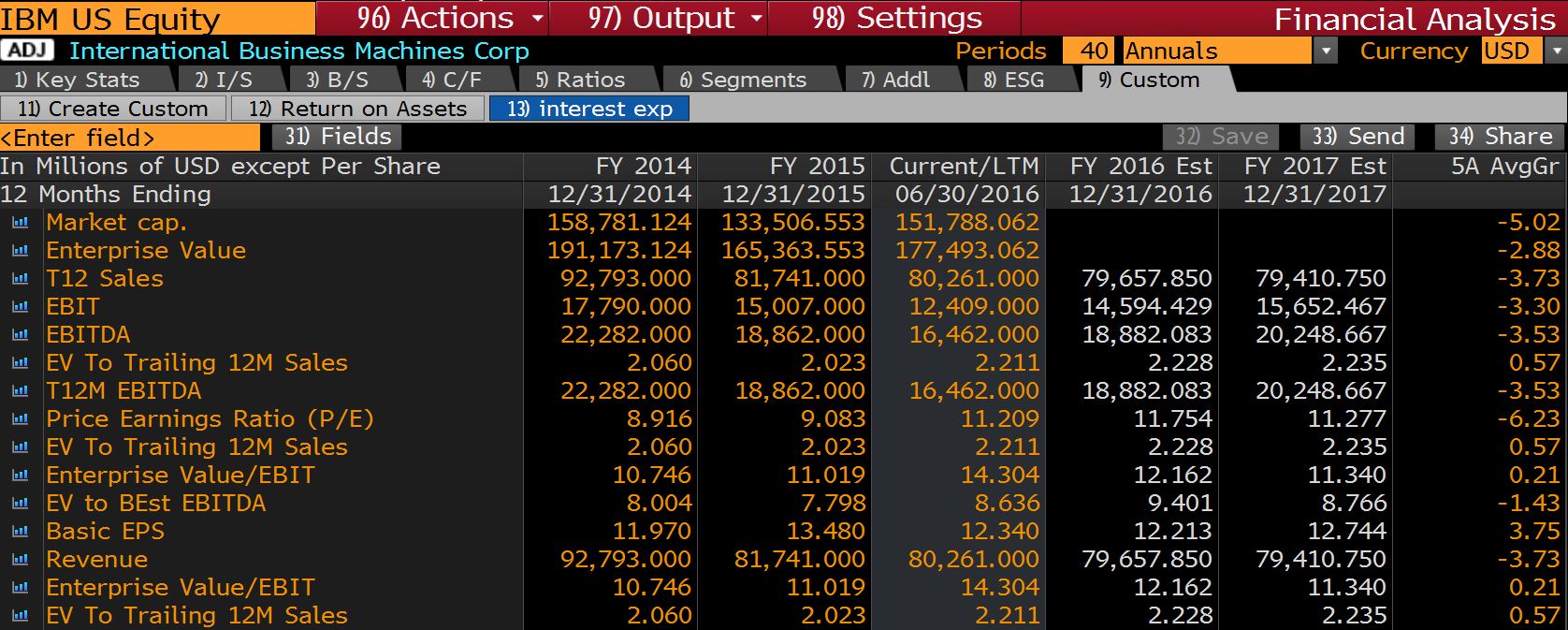

When assessing the POF rate, various factors are taken into consideration. These factors include market dynamics, historical data, and the specific characteristics of the investment or venture. Additionally, external factors such as economic conditions, industry trends, and regulatory changes may also impact the POF rate.

Why is the POF Rate Important?

Having a clear understanding of the POF rate is important for several reasons:

- Risk Assessment: The POF rate allows you to assess the level of risk associated with a financial decision. By understanding the likelihood of failure, you can evaluate and compare different investment opportunities, helping you make more informed choices.

- Financial Planning: Incorporating the POF rate into your financial planning helps you account for potential risks and uncertainties. It enables you to develop contingency plans and allocate your resources wisely.

- Decision-Making: The POF rate guides your decision-making process, helping you avoid potential pitfalls and make choices that align with your risk tolerance and financial goals.

Conclusion

The Possibility of Failure (POF) rate is an essential metric in finance that measures the probability of a financial investment or venture failing. By understanding and considering the POF rate, individuals and businesses can make informed financial decisions, assess risks, and take appropriate actions to protect their finances.

So, the next time you come across the term POF rate, you’ll have a clear understanding of what it means and how it can impact your financial decisions.