Finance

Capital Structure: How To Find In Bloomberg

Modified: December 30, 2023

Learn how to find the capital structure of a company using Bloomberg's finance tools. Improve your financial analysis skills with this comprehensive guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- What is Capital Structure?

- Why is Capital Structure Important?

- Utilizing Bloomberg for Capital Structure Analysis

- Accessing Capital Structure Information in Bloomberg

- Key Data Points to Focus on in Bloomberg

- Analyzing Capital Structure Metrics in Bloomberg

- Interpreting Capital Structure Ratios in Bloomberg

- Case Study: Analyzing Capital Structure of Company X using Bloomberg

- Conclusion

Introduction

Welcome to the world of capital structure analysis! Understanding a company’s capital structure is crucial for investors, financial analysts, and business professionals. It provides insights into the financial health, risk profile, and sustainability of a company’s operations.

But what exactly is capital structure? How can it be analyzed effectively? To navigate this vast and complex field, we will explore the features and significance of capital structure analysis and how Bloomberg, a leading financial information platform, can be utilized to access and interpret capital structure information.

Capital structure refers to the way a company finances its operations through a combination of various funding sources, such as equity (stock), debt (loans, bonds), and retained earnings. The ratio of debt to equity determines the capital structure, and it can have a significant impact on a company’s cost of capital, risk exposure, and potential for growth.

Understanding a company’s capital structure is vital as it allows investors and analysts to assess its financial stability, profitability, and capacity to meet its financial obligations. By analyzing the capital structure, investors can make informed decisions regarding investment opportunities and risk management.

Bloomberg, renowned for its comprehensive financial analysis tools and data, offers a wealth of information on capital structure. It provides access to a wide array of financial data points and ratios that assist in evaluating a company’s capital structure. By utilizing the capital structure analysis features in Bloomberg, investors and financial professionals can effectively evaluate a company’s financial performance and make informed decisions.

In this article, we will delve into the world of capital structure analysis using Bloomberg. We will explore how to access capital structure information in Bloomberg, the key data points to focus on, and how to interpret the capital structure metrics provided. Furthermore, we will examine a case study to demonstrate how to analyze the capital structure of a company using Bloomberg’s tools and data.

So, whether you are a seasoned investor, financial analyst, or simply interested in understanding the fundamentals of capital structure analysis, join us on this insightful journey as we uncover the secrets of capital structure analysis with Bloomberg.

What is Capital Structure?

Capital structure refers to the way a company finances its operations by combining different types of funding sources, such as equity and debt. It represents the composition of a company’s liabilities and the proportion of debt and equity used to support its operations.

Equity represents the ownership stake in a company and is usually obtained through issuing shares of stock. Equity holders have a claim on the residual assets and earnings of the company after all debts and other obligations have been paid. They bear the risk of ownership and participate in the company’s profits through dividends and potential capital appreciation.

Debt, on the other hand, is the amount borrowed by a company from various sources, such as loans and bonds. Debt holders are creditors who lend money to the company in exchange for regular interest payments and repayment of the principal amount at maturity.

The structure of a company’s capital can have significant implications for its financial well-being and performance. A well-balanced and optimal capital structure can help a company raise funds efficiently, manage its risk, and maximize shareholder value.

There are various factors that influence a company’s capital structure decisions, including industry norms, cost of capital, risk appetite, and market conditions. Different industries may have different optimal capital structures based on their capital intensity, growth prospects, and risk profiles.

A company’s capital structure can be analyzed through various metrics and ratios. These ratios provide insights into the level of debt, equity, and their respective weights in the company’s financing. Some commonly used capital structure ratios include debt-to-equity ratio, debt ratio, equity ratio, and interest coverage ratio.

By analyzing a company’s capital structure, investors and analysts can assess its risk profile, solvency, and financial flexibility. A high level of debt may indicate higher financial risk and interest obligations, while a higher proportion of equity may suggest a more stable and resilient financial position.

Capital structure decisions also have implications for a company’s cost of capital. The cost of equity is influenced by the level of risk perceived by investors, while the cost of debt is determined by the interest rates and terms of borrowing. The overall cost of capital affects a company’s ability to generate returns and fund its growth initiatives.

Overall, understanding and analyzing a company’s capital structure is essential for investors, financial analysts, and decision-makers to evaluate its financial health, risk profile, and long-term sustainability.

Why is Capital Structure Important?

Capital structure plays a vital role in the financial management of a company and has far-reaching implications for its operations, profitability, and long-term growth. Understanding the importance of capital structure allows investors, financial analysts, and company management to make informed decisions and optimize the allocation of resources.

Here are a few key reasons why capital structure is important:

1. Cost of Capital:

The capital structure of a company determines its cost of capital, which is the required rate of return for investors and lenders. The cost of equity is influenced by the perceived risk associated with the company’s operations and the expected return on investment. The cost of debt is determined by interest rates and contractual obligations. By maintaining an optimal capital structure, a company can minimize its cost of capital, which in turn enhances its profitability and competitiveness.

2. Risk Management:

Capital structure allows companies to manage their financial risk effectively. By striking the right balance between debt and equity, companies can diversify and mitigate risks. Excessive debt can increase the risk of financial distress and the potential for bankruptcy, while too much equity dilutes ownership and reduces the earnings available to shareholders. Achieving an appropriate capital structure helps companies maintain a healthy risk profile and enhance their resilience in uncertain market conditions.

3. Financial Flexibility:

An optimal capital structure provides companies with the flexibility to fund growth initiatives and take advantage of investment opportunities. With an appropriate mix of debt and equity, companies can access capital markets to raise funds at favorable terms. This financial flexibility allows companies to invest in research and development, expand their operations, acquire competitors, or pursue other strategic initiatives to drive long-term growth.

4. Investor Perception:

Capital structure influences how investors perceive a company’s financial stability and growth potential. A well-structured capital base can enhance investor confidence and attract a broader range of investors. Conversely, a heavily leveraged capital structure may raise concerns about repayment ability and financial risk, leading to higher borrowing costs and restricted access to capital.

5. Dividend and Distribution Policy:

Capital structure decisions also impact a company’s ability to distribute profits to shareholders through dividends or share buybacks. Companies with higher levels of distributable profits relative to their debt obligations can offer attractive dividends or repurchase shares, providing value to shareholders. Assessing the capital structure helps determine a company’s capacity to generate consistent dividend payments and promote shareholder value creation.

By understanding the importance of capital structure, investors and analysts can assess a company’s financial health, risk profile, and growth potential. Similarly, management can make informed decisions regarding financing options, risk management strategies, and the pursuit of growth opportunities. A well-optimized capital structure contributes to the long-term success and sustainability of a company in a dynamic and competitive business environment.

Utilizing Bloomberg for Capital Structure Analysis

Bloomberg, a leading financial information platform, offers a wide range of tools and resources to aid in capital structure analysis. It provides access to comprehensive data, analytics, and ratios that enable investors and financial professionals to analyze and evaluate a company’s capital structure effectively.

Here are some key ways in which Bloomberg can be utilized for capital structure analysis:

1. Accessing Capital Structure Information:

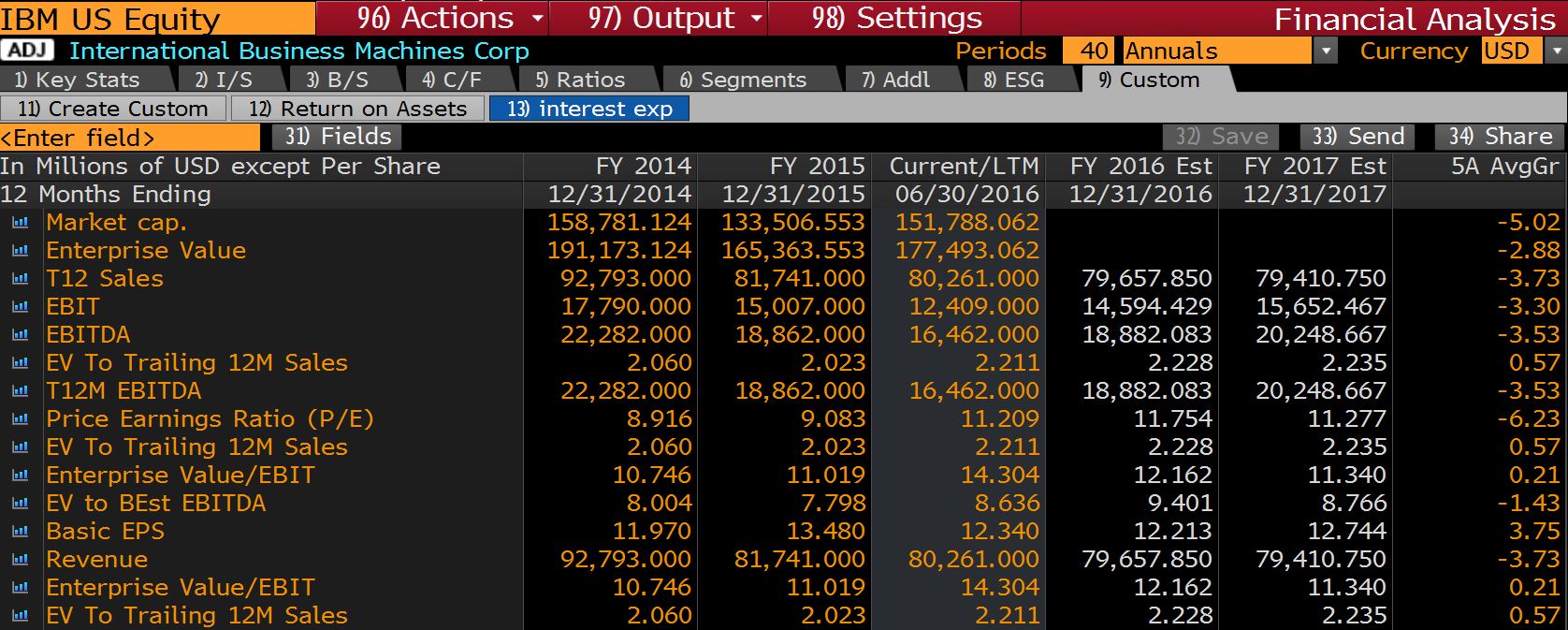

Bloomberg provides easy and convenient access to capital structure information for thousands of companies globally. Users can navigate through the platform to find specific company profiles or search for relevant financial data by entering the company’s ticker symbol or name. Bloomberg’s vast database allows users to retrieve vital financial metrics, ratios, and historical data related to a company’s capital structure.

2. Analyzing Capital Structure Metrics:

Bloomberg offers a range of financial ratios and metrics that are crucial for analyzing a company’s capital structure. Users can access key metrics such as debt-to-equity ratio, debt ratio, equity ratio, interest coverage ratio, and more. These metrics provide insights into the company’s leverage, solvency, and ability to meet its financial obligations. Bloomberg also allows users to compare a company’s capital structure metrics with industry peers for benchmarking purposes.

3. Examining Debt and Equity Issuances:

Bloomberg provides valuable information on a company’s debt and equity issuances, including details on bonds, loans, and equity offerings. Users can access information on the terms, maturity dates, interest rates, and covenants of a company’s debt instruments. This helps in assessing the debt profile, repayment obligations, and risk associated with a company’s capital structure. Similarly, information on equity issuances helps in understanding the dilution effect and the equity portion of a company’s capital structure.

4. Tracking News and Market Developments:

Bloomberg’s news and market monitoring features are instrumental in keeping up with the latest developments that may impact a company’s capital structure. Users can receive real-time news updates, market trends, and analyst reports that provide insights into changes in a company’s capital structure. This information helps users stay informed about debt issuances, equity offerings, credit rating changes, and other relevant factors that affect a company’s capital structure.

5. Scenario Analysis and Modeling:

Bloomberg’s advanced analytics tools enable users to conduct scenario analysis and modeling for capital structure optimization. Users can simulate different scenarios by adjusting debt levels, interest rates, and equity offerings to evaluate the impact on a company’s capital structure and financial metrics. This helps in understanding the trade-offs between debt and equity, estimating the optimal capital structure, and assessing the potential outcomes of different financing strategies.

By leveraging Bloomberg’s vast resources and features, investors and financial professionals can gain valuable insights into a company’s capital structure. The platform’s data, analytics, and modeling capabilities provide a comprehensive view of a company’s financial health, risk profile, and growth prospects. Whether analyzing individual companies or comparing industry trends, Bloomberg is an invaluable tool for effective capital structure analysis.

Accessing Capital Structure Information in Bloomberg

Accessing capital structure information in Bloomberg is a straightforward process that allows users to retrieve comprehensive data and ratios related to a company’s capital structure. By following a few simple steps, investors and financial professionals can gather valuable insights and make informed decisions.

Here is a step-by-step guide on how to access capital structure information in Bloomberg:

Step 1: Log in to Bloomberg:

Start by logging in to your Bloomberg terminal using your unique username and password. Once logged in, you will have access to the platform’s range of features and data.

Step 2: Search for the Company:

Enter the company’s ticker symbol or name in the search bar at the top of the Bloomberg screen. This will bring up the company’s profile page, which provides an overview of its financial information.

Step 3: Navigate to the Capital Structure Section:

Within the company profile page, navigate to the capital structure section. This section will contain essential details about the company’s debt, equity, and overall capital structure.

Step 4: Analyze Debt and Equity Issuances:

In the capital structure section, you can find information on the company’s debt and equity issuances. This includes details such as the type of debt instruments issued, maturity dates, interest rates, and covenants. Additionally, you can access information on equity offerings, including the number of shares issued, issuance dates, and any dilution impact.

Step 5: Review Capital Structure Ratios:

Bloomberg provides various capital structure ratios and metrics that offer insights into a company’s financial leverage and solvency. These ratios include the debt-to-equity ratio, debt ratio, equity ratio, and interest coverage ratio, among others. Analyze these ratios to assess the company’s capital structure and evaluate its risk profile.

Step 6: Compare with Peers:

Bloomberg allows users to compare a company’s capital structure with its industry peers. This feature enables benchmarking and provides a broader perspective on the company’s capital structure performance and financial health. Comparing with peers can help identify trends, outliers, and potential areas of improvement.

Step 7: Utilize Modeling Tools:

Bloomberg’s advanced modeling and scenario analysis tools can assist in optimizing a company’s capital structure. Users can simulate different scenarios by adjusting debt levels, interest rates, and equity offerings to evaluate the impact on the company’s capital structure and financial metrics. This allows for strategic decision-making and exploring potential financing strategies.

By following these steps and leveraging the capabilities of Bloomberg, users can access capital structure information efficiently and effectively. The platform’s comprehensive data, detailed profiles, and analytical tools enable investors and financial professionals to gain valuable insights for capital structure analysis and informed decision-making.

Key Data Points to Focus on in Bloomberg

When accessing capital structure information in Bloomberg, there are several key data points that investors and financial professionals should focus on. These data points provide crucial insights into a company’s capital structure and help in evaluating its financial health, risk profile, and growth prospects.

Here are some of the key data points to focus on in Bloomberg for capital structure analysis:

1. Debt-to-Equity Ratio:

The debt-to-equity ratio is a fundamental metric that indicates the proportion of a company’s financing that comes from debt compared to equity. It is calculated by dividing the company’s total debt by its total equity. A higher debt-to-equity ratio suggests a higher level of financial leverage and potentially increased risk.

2. Debt Ratio:

The debt ratio represents the percentage of a company’s assets that are financed by debt. It is calculated by dividing the company’s total debt by its total assets. A higher debt ratio indicates a higher reliance on debt financing and potentially higher financial risk. Investors often compare a company’s debt ratio with industry peers to assess its relative leverage.

3. Equity Ratio:

The equity ratio represents the percentage of a company’s assets that are financed by equity. It is calculated by dividing the company’s total equity by its total assets. A higher equity ratio indicates a higher level of ownership and potentially more financial stability. It is often used to gauge the residual claim of equity shareholders on the company’s assets.

4. Interest Coverage Ratio:

The interest coverage ratio measures a company’s ability to meet its interest obligations. It is calculated by dividing a company’s earnings before interest and taxes (EBIT) by its interest expenses. A higher interest coverage ratio indicates a company’s stronger ability to cover its interest payments with its operating income. It is crucial in assessing a company’s debt-servicing capacity and financial stability.

5. Debt Maturity Profile:

Bloomberg provides information on a company’s debt maturity profile, including the maturity dates and amounts of its outstanding debt. Analyzing the debt maturity profile allows investors to assess a company’s repayment obligations over time and evaluate its liquidity and refinancing risks.

6. Credit Rating:

Bloomberg provides data on a company’s credit rating assigned by reputable credit rating agencies. Credit ratings reflect the agencies’ assessment of a company’s creditworthiness and ability to meet its financial obligations. It can be a helpful indicator of a company’s perceived riskiness and ability to access favorable financing terms.

7. Capital Structure Changes:

Bloomberg keeps users informed of any changes in a company’s capital structure, such as new debt issuances, equity offerings, or changes in share buyback programs. Monitoring these changes helps investors stay updated on a company’s financing decisions and assess their potential impact on the company’s capital structure and financial metrics.

By paying attention to these key data points in Bloomberg, investors and financial professionals can gain valuable insights into a company’s capital structure and make informed decisions. These data points offer a comprehensive view of a company’s leverage, risk exposure, and financial health, contributing to more effective capital structure analysis and investment evaluation.

Analyzing Capital Structure Metrics in Bloomberg

When analyzing capital structure metrics in Bloomberg, it is essential to understand the significance of each metric and how it relates to a company’s financial position and risk profile. Bloomberg provides a range of key capital structure ratios and metrics that investors and financial professionals can utilize to evaluate a company’s capital structure effectively.

Here are some important capital structure metrics to consider when analyzing data in Bloomberg:

1. Debt-to-Equity Ratio:

The debt-to-equity ratio compares the amount of debt a company has taken on to its equity. It is calculated by dividing total debt by total equity. A higher debt-to-equity ratio indicates a higher level of financial leverage and potentially higher risk. Monitoring changes in this ratio over time can provide insights into a company’s capital structure decisions and potential impact on its financial stability.

2. Debt Ratio:

The debt ratio measures the proportion of a company’s assets that are financed by debt. It is calculated by dividing total debt by total assets. A higher debt ratio signifies a greater reliance on debt financing and may indicate higher financial risk. Comparing a company’s debt ratio to industry peers can help assess its relative leverage.

3. Equity Ratio:

The equity ratio determines the proportion of a company’s assets that are financed by equity. It is calculated by dividing total equity by total assets. A higher equity ratio suggests a higher level of ownership and potential financial stability. Monitoring changes in the equity ratio can provide insights into the dilutive effect of new equity issuances or share buybacks.

4. Interest Coverage Ratio:

The interest coverage ratio assesses a company’s ability to meet its interest payments with its operating income. It is calculated by dividing earnings before interest and taxes (EBIT) by interest expenses. A higher interest coverage ratio indicates a company’s stronger ability to cover its interest obligations. A lower ratio may raise concerns about a company’s debt-servicing capacity and financial stability.

5. Debt Maturity Profile:

Bloomberg provides information on a company’s debt maturity profile, including the maturity dates and amounts of its outstanding debt. Analyzing the debt maturity profile allows investors to assess a company’s repayment obligations over time. This information helps evaluate a company’s liquidity, refinancing risks, and its ability to manage its debt obligations effectively.

6. Credit Rating:

Bloomberg also provides credit rating information assigned by reputable credit rating agencies. A company’s credit rating reflects the agencies’ assessment of its creditworthiness and ability to meet financial obligations. A higher credit rating suggests lower credit risk, making it easier for the company to secure favorable financing terms. Monitoring any changes in credit ratings can provide insights into changes in the company’s risk profile.

7. Equity Capital Structure:

In addition to debt-related metrics, Bloomberg allows users to analyze the equity component of a company’s capital structure. This includes information on share buybacks, equity offerings, and dilution impact. Monitoring changes in equity capital structure helps investors assess the impact on ownership, earnings per share, and potential future financing activities.

Analyzing capital structure metrics in Bloomberg helps investors and financial professionals assess a company’s financial leverage, risk profile, and financial health. These metrics provide valuable insights into a company’s ability to meet financial obligations, manage debt levels, and generate sustainable returns. By understanding and interpreting these metrics, users can make informed investment decisions and evaluate the capital structure strategies of companies listed on Bloomberg.

Interpreting Capital Structure Ratios in Bloomberg

Interpreting capital structure ratios in Bloomberg is crucial for understanding a company’s financial health, risk profile, and capital adequacy. Bloomberg provides a range of capital structure ratios that can help investors and financial professionals assess the optimal mix of debt and equity financing employed by a company. By analyzing these ratios, users can gain insights into the company’s leverage, solvency, and ability to meet its financial obligations.

Here are some key capital structure ratios in Bloomberg and how to interpret them:

1. Debt-to-Equity Ratio:

The debt-to-equity ratio compares a company’s total debt to its total equity. A higher ratio indicates higher leverage and potential financial risk. A low debt-to-equity ratio suggests a conservative capital structure with less reliance on debt financing. It is important to consider industry norms and peers’ ratios when interpreting this ratio – excessively low ratios may indicate missed growth opportunities, while excessively high ratios may signal an elevated risk of default or financial distress.

2. Debt Ratio:

The debt ratio measures the percentage of a company’s total assets that are financed by debt. A higher debt ratio indicates a higher proportion of debt, which may suggest higher financial risk. However, certain industries, such as utilities or infrastructure companies, typically have higher debt ratios due to the capital-intensive nature of their operations. Comparing a company’s debt ratio with industry benchmarks helps put the ratio into perspective.

3. Equity Ratio:

The equity ratio shows the proportion of a company’s assets that are financed by equity. A higher equity ratio indicates a larger amount of assets funded by equity, which suggests a more conservative capital structure. A low equity ratio may indicate a higher reliance on debt financing and potentially higher financial risk.

4. Interest Coverage Ratio:

The interest coverage ratio measures a company’s ability to cover its interest expenses with its operating income. A higher interest coverage ratio indicates a company’s stronger ability to meet its interest obligations. A low interest coverage ratio may imply a higher risk of defaulting on interest payments and financial distress. Investors and lenders prefer higher interest coverage ratios as they provide more comfort regarding an entity’s financial stability.

5. Capitalization Ratio:

The capitalization ratio indicates the proportion of a company’s long-term debt in relation to its total capitalization, which includes both debt and equity. A higher capitalization ratio suggests a higher proportion of long-term debt in the company’s capital structure. A lower ratio indicates a larger equity component, which may provide greater financial stability and flexibility. Industries with stable cash flows, such as consumer staples, tend to have lower capitalization ratios.

6. Debt Maturity Profile:

Bloomberg provides information on a company’s debt maturity profile, including the maturity dates and amounts of its outstanding debt. The debt maturity profile offers insights into the company’s repayment obligations over time. A well-distributed debt maturity profile reduces the refinancing risk and provides financial stability.

7. Credit Rating:

Bloomberg provides credit ratings assigned to companies by reputable rating agencies. These ratings reflect the agencies’ assessment of a company’s creditworthiness and the risk associated with its debt obligations. Higher credit ratings indicate lower credit risk and a higher ability to meet financial obligations. Monitoring any changes in credit ratings can provide insights into changes in a company’s risk profile.

Interpreting capital structure ratios in Bloomberg requires considering industry norms, historical trends, and comparisons with industry peers. It is important to assess ratios in the context of a company’s specific circumstances and business model. By understanding these ratios and their implications, investors and financial professionals can evaluate a company’s capital structure and make informed decisions regarding investment, risk management, and financial health.

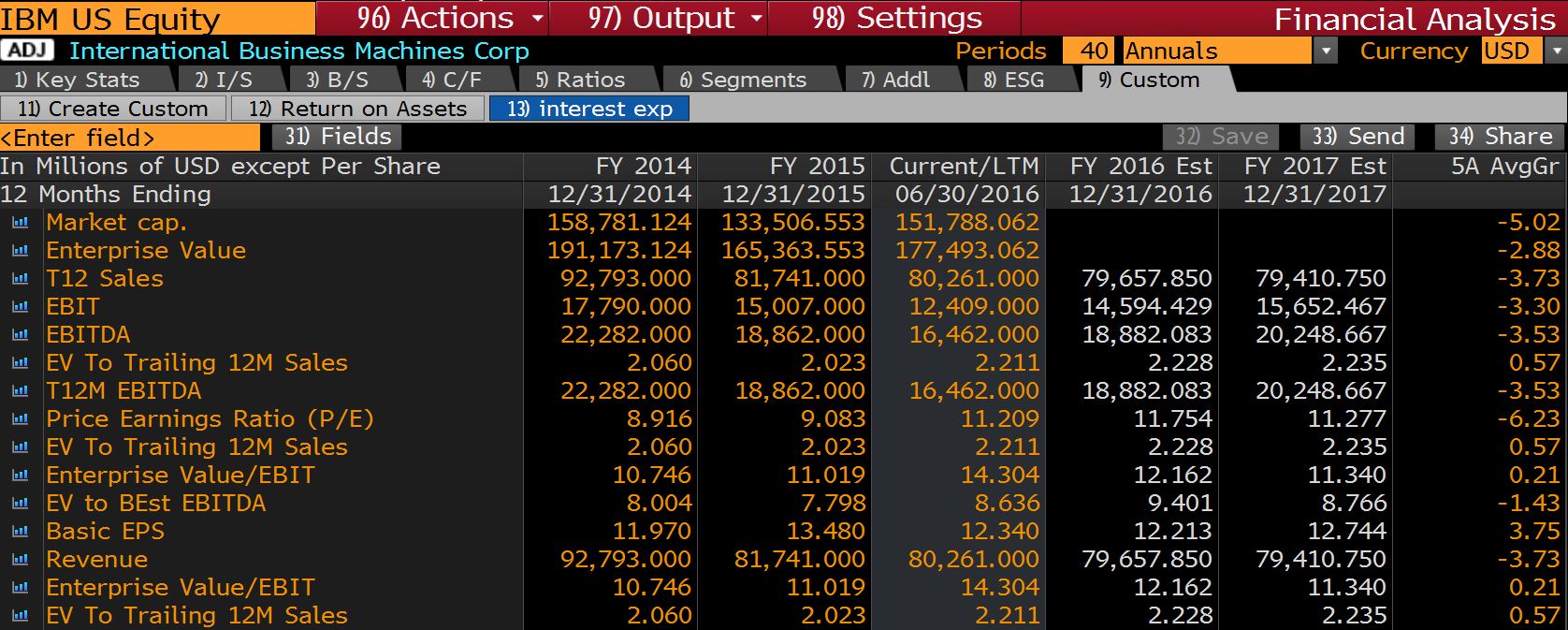

Case Study: Analyzing Capital Structure of Company X using Bloomberg

To demonstrate the practical application of capital structure analysis using Bloomberg, let’s consider a case study involving Company X. Company X is a multinational manufacturing company operating in the automotive industry. We will explore how Bloomberg’s tools and data can provide insights into Company X’s capital structure and help in assessing its financial health and risk profile.

Step 1: Accessing Company X’s Profile:

Using Bloomberg’s search function, enter Company X’s ticker symbol or name to access their profile. This will provide an overview of the company’s financial information and capital structure metrics.

Step 2: Analyzing Debt and Equity Ratios:

In Company X’s profile, review the debt-to-equity ratio, debt ratio, and equity ratio. These ratios offer insights into the company’s leverage and capital structure composition. For example, a low debt-to-equity and debt ratio may indicate a conservative capital structure, suggesting lower financial risk.

Step 3: Examining Debt Maturity Profile:

Next, examine Company X’s debt maturity profile. Bloomberg provides information on the company’s outstanding debt, including maturity dates and amounts. A well-distributed debt maturity profile with manageable repayment obligations reduces refinancing risk and boosts financial stability.

Step 4: Analyzing Interest Coverage Ratio:

Assess Company X’s interest coverage ratio, which measures its ability to meet interest obligations with operating income. A higher interest coverage ratio suggests stronger financial health and lower risk of default. A declining interest coverage ratio may indicate potential challenges in servicing debt and may warrant further investigation.

Step 5: Comparing with Industry Peers:

Utilize Bloomberg’s comparative analysis tools to compare Company X’s capital structure metrics with industry peers. This enables benchmarking and provides insights into how Company X’s capital structure stacks up against competitors. Significant deviations from industry norms may suggest unique strategic considerations or risks.

Step 6: Monitoring Credit Rating:

Keep an eye on Company X’s credit rating, provided by reputable rating agencies on Bloomberg. Credit ratings reflect the agencies’ assessment of the company’s creditworthiness and risk exposure. Any changes in the credit rating may indicate shifts in the company’s financial stability and borrowing costs.

Step 7: Analyzing Equity Capital Structure:

Consider Company X’s equity capital structure, including information on share buybacks or equity offerings. Utilize Bloomberg’s data to evaluate the dilutive effect of equity issuances or the impact on earnings per share. Understanding the equity component is important for assessing ownership and potential impact on future financing activities.

By utilizing Bloomberg’s tools and data, investors and financial professionals can analyze Company X’s capital structure comprehensively. The information obtained helps evaluate the company’s financial health, risk profile, and growth prospects. Ultimately, this analysis supports informed decision-making regarding investments, risk management strategies, and understanding the company’s capital structure dynamics in the automotive industry.

Conclusion

Capital structure analysis is a fundamental aspect of evaluating a company’s financial health, risk profile, and long-term sustainability. By understanding a company’s capital structure, investors and financial professionals can make informed decisions regarding investment opportunities, risk management strategies, and financing options.

Through the utilization of Bloomberg’s comprehensive tools and data, capital structure analysis becomes more accessible and effective. Accessing capital structure information in Bloomberg allows users to retrieve key data points, ratios, and metrics pertinent to analyzing a company’s capital structure.

Key takeaways from utilizing Bloomberg for capital structure analysis include:

- Accessing capital structure information in Bloomberg is simple and intuitive, providing a wide range of data and metrics to analyze a company’s capital structure.

- Analyzing capital structure metrics in Bloomberg helps users understand a company’s leverage, risk profile, and ability to meet financial obligations.

- Interpreting capital structure ratios in Bloomberg requires considering industry norms, historical trends, and comparisons with industry peers.

- Using Bloomberg’s tools, users can conduct in-depth analysis of a company’s capital structure and monitor changes in its credit ratings, debt maturity profile, and equity capital structure.

In practice, a case study involving Company X demonstrated how capital structure analysis can be conducted using Bloomberg. By assessing the company’s debt-to-equity ratio, debt ratio, equity ratio, interest coverage ratio, and other key metrics, investors gained insights into Company X’s financial health, risk profile, and industry position.

In conclusion, capital structure analysis is essential for understanding a company’s funding mix, risk exposure, and financial stability. Utilizing Bloomberg’s resources and tools streamlines the process, empowering investors and financial professionals with the necessary insights to make informed decisions. By leveraging these capabilities, market participants can navigate the intricacies of capital structure analysis, ultimately contributing to successful investment strategies and risk management practices.