Finance

Post-Retirement Risk Definition

Published: January 9, 2024

Learn about the definition of post-retirement risks and how they can impact your finances. Discover strategies to mitigate these risks and secure a stable retirement.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Post-Retirement Risk Definition: Understanding the Challenges That Await

Welcome to our “FINANCE” category where we delve deep into important financial concepts to help you make informed decisions for a secure future. In this article, we will explore the topic of post-retirement risk definition and shed light on the challenges that lie ahead once you bid farewell to the 9-to-5 grind. So, strap in as we navigate through the complexities of post-retirement risks!

Key Takeaways:

- Post-retirement risk refers to the potential threats and uncertainties that individuals face after retiring from active employment.

- Common post-retirement risks include longevity risk, inflation risk, healthcare costs, market volatility, and inadequate savings.

Retirement is often seen as a time of relaxation, travel, and pursuing hobbies. However, it’s crucial to remember that transitioning into retirement comes with its own set of unique challenges. Defining post-retirement risk is the first step towards proactively addressing these challenges and ensuring financial stability in the years to come.

So, what exactly is post-retirement risk? Put simply, it encompasses the potential threats and uncertainties that individuals face after retiring from active employment. These risks can have a significant impact on one’s financial well-being if not properly managed.

Let’s embark on a journey to gain a better understanding of the different types of post-retirement risks one might encounter:

1. Longevity Risk

Living longer is undoubtedly a blessing, but it also means that your retirement savings need to last for a more extended period. The fear of outliving your money is a real concern, and that’s where longevity risk comes into play. This risk emphasizes the importance of comprehensive financial planning to ensure you have enough funds to sustain yourself throughout your retirement years.

2. Inflation Risk

Inflation is a part of any economy, and it erodes the purchasing power of your money over time. As prices rise, your retirement savings might not stretch as far as you had anticipated. It’s crucial to account for inflation when creating your retirement plan to ensure your income keeps pace with the rising costs of goods and services.

3. Healthcare Costs

The cost of healthcare is on the rise, and this trend is unlikely to change in the coming years. As you age, the need for medical care becomes more prevalent, posing potential financial challenges. Considering the cost of healthcare and long-term care insurance in retirement planning is vital to protect yourself from unexpected medical expenses.

4. Market Volatility

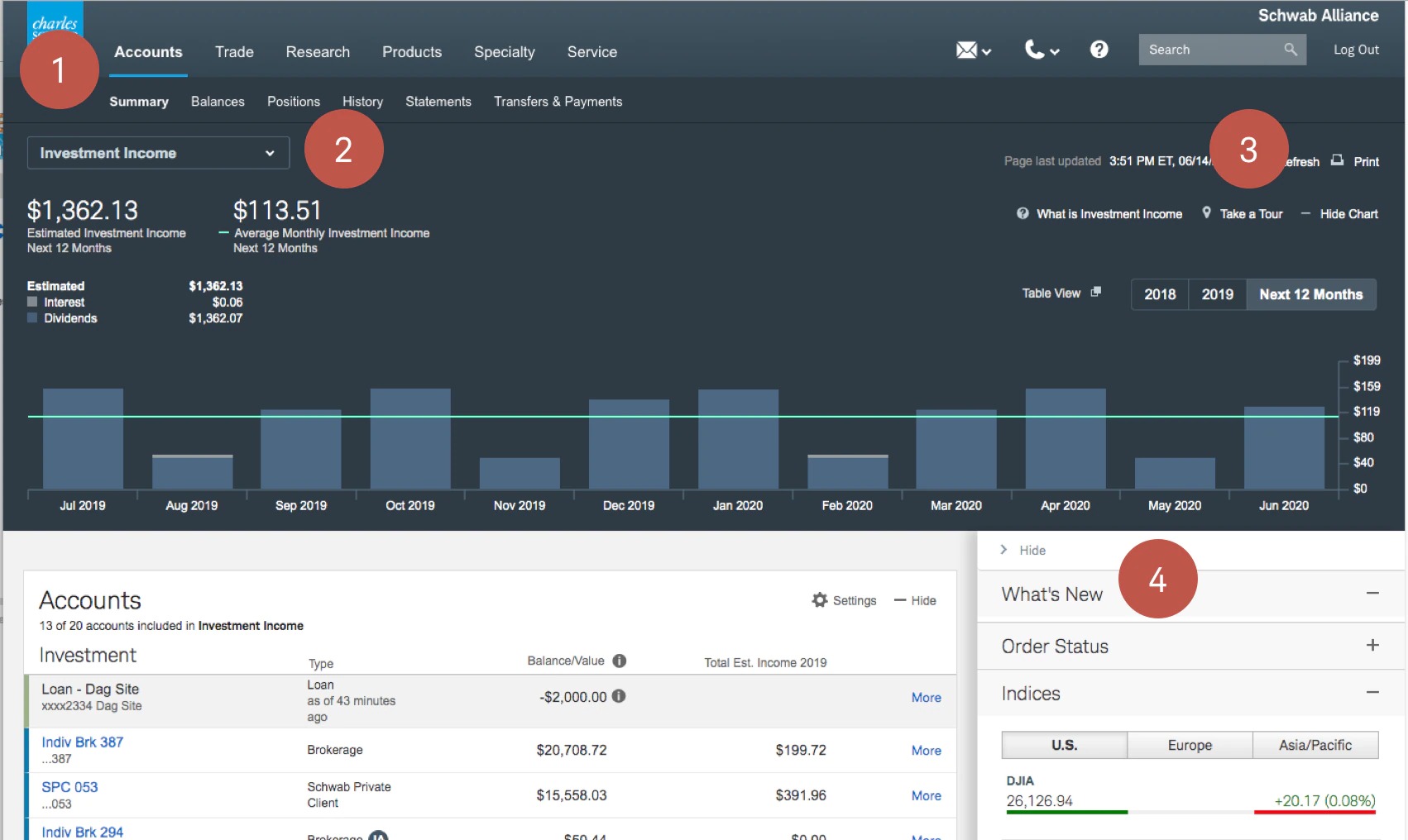

Investing in the stock market is a common strategy to grow wealth and fund retirement. However, market volatility can significantly impact the value of investments, especially for those nearing or already in retirement. It’s essential to have a diversified portfolio and a strategy that factors in market fluctuations to mitigate the risks associated with volatility.

5. Inadequate Savings

Insufficient retirement savings can be a significant source of post-retirement risk. Failing to save enough during your working years can leave you vulnerable to financial hardships later in life. From a young age, it’s crucial to prioritize saving for retirement and take advantage of various investment vehicles to maximize your savings potential.

As we wrap up our exploration of post-retirement risk definition, it becomes clear that preparing for these risks is paramount for a secure and stress-free retirement. By understanding and addressing these challenges, individuals can plan ahead, make informed financial decisions, and safeguard their financial future. Remember, taking control of post-retirement risk management today means enjoying a smoother ride on the retirement highway tomorrow!