Finance

Retirement Planner Definition

Published: January 20, 2024

Looking for a definition of retirement planner in the world of finance? Find out what it means and how it can help you plan for a financially secure future.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

The Importance of Retirement Planning

When it comes to financial security, retirement planning is an essential step that everyone should take. However, for many people, the term “retirement planning” may seem ambiguous or confusing. In this blog post, we will dive into the definition of a retirement planner and why having one in your financial journey is crucial.

Key Takeaways:

- Retirement planners help individuals create and execute a strategic plan for a comfortable retirement.

- They consider various factors like income, expenses, savings, and investment goals to build a personalized retirement plan.

Understanding the Definition of a Retirement Planner

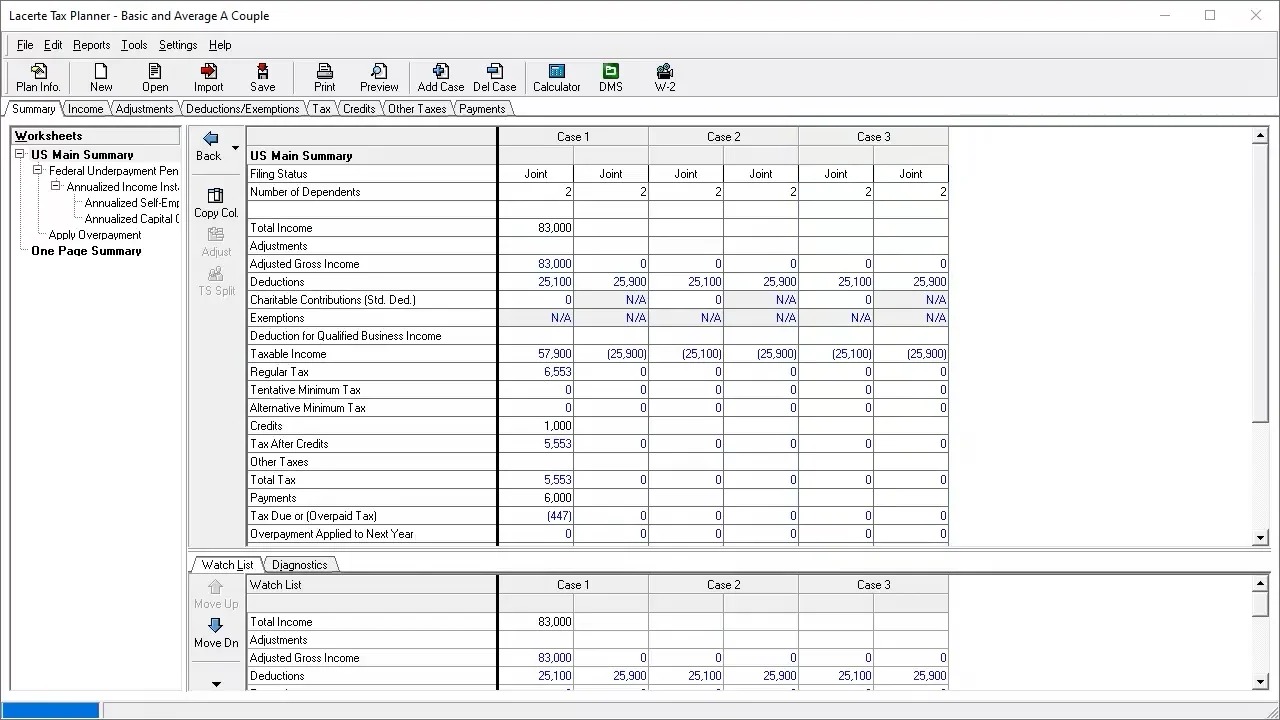

A retirement planner is a financial professional who specializes in the field of retirement planning. Their primary role is to help individuals analyze their financial situation, set retirement goals, and craft a strategic plan to achieve them. Retirement planners have a deep understanding of the complexities involved in retirement planning, including income sources like pensions, social security benefits, and investments.

Retirement planners work closely with their clients to gain a comprehensive understanding of their current financial status and future financial goals. They take into account numerous factors such as annual income, expenses, existing savings, desired retirement lifestyle, and even post-retirement healthcare costs. By considering these factors, retirement planners can develop a personalized retirement plan tailored to each individual’s unique needs and goals.

Once a retirement plan is established, the role of a retirement planner extends beyond just creating a blueprint. They continuously monitor and evaluate the plan, updating it as necessary to account for life changes, market fluctuations, and any other relevant factors. This ongoing management ensures that the plan remains aligned with the client’s goals and helps them stay on track towards a successful retirement.

The Benefits of Working with a Retirement Planner

Partnering with a retirement planner offers a multitude of benefits that can significantly impact your financial future:

- Expert Advice: Retirement planners are financial professionals with expertise in retirement planning. They possess in-depth knowledge of various investment strategies, taxation, and other crucial aspects related to retirement. Their specialized knowledge can provide valuable insight and guidance in making informed decisions throughout your retirement journey.

- Customized Approach: Each individual’s financial circumstances and retirement goals are unique. A retirement planner can customize a plan specifically tailored to your needs, ensuring that it aligns with your goals, risk tolerance, and time horizon.

- Peace of Mind: The process of planning for retirement can be overwhelming, filled with uncertainties and complexities. By working with a retirement planner, you can offload the stress and gain peace of mind knowing that a financial professional is guiding you towards a secure future.

- Long-term Financial Stability: A retirement planner can help you establish a disciplined savings and investment strategy, maximizing your potential for long-term growth. They can also assist in structuring your assets and income sources to optimize tax efficiency, ensuring you maintain financial stability throughout your retirement years.

- Adaptability: As mentioned earlier, life is full of changes, and your retirement plan needs to adapt accordingly. A retirement planner will help you navigate through life events such as marriage, children, career changes, and unexpected circumstances, making necessary adjustments to your retirement plan along the way.

In conclusion, a retirement planner plays a crucial role in defining and achieving your financial goals during retirement. Their expertise, personalized approach, and ongoing guidance can greatly enhance your chances of a comfortable and secure future. Embark on your retirement journey with a trusted retirement planner by your side and take control of your financial destiny.