Home>Finance>Premium: Definition, Meanings In Finance, And Types

Finance

Premium: Definition, Meanings In Finance, And Types

Published: January 10, 2024

Discover the various definitions and meanings of finance, along with its different types. Explore premium finance options and enhance your financial understanding.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Become a Finance Expert: Understanding Premiums and Their Types

Welcome to our Finance Expert Series! In this edition, we delve into the world of premiums in finance. Whether you’re new to the field or looking to expand your knowledge, we’ve got you covered. In this article, we will define premiums, explore their various meanings in finance, and discuss the different types that exist. So, let’s dive in and become premium-savvy!

Key Takeaways

- A premium in finance refers to an additional payment made on top of the regular price or value of an asset or service.

- Premiums often compensate for risks, time value, or the scarcity of a product or service.

What is a Premium?

A premium is an extra cost that is added to the price or value of an asset or service. It represents an amount paid above and beyond the standard rate or value. The concept of premiums is prevalent in various industries, including finance.

Now, you might be wondering, why are premiums charged in the first place? Well, there are a few reasons behind this extra payment:

- Risk Compensation: Premiums often account for the risks associated with an investment or insurance product. For instance, in the insurance industry, a premium is the amount policyholders pay to compensate for the potential loss that the insurer may have to cover.

- Time Value: Premiums can also reflect the time value of money. In finance, the time value of money refers to the concept that a dollar today is worth more than a dollar in the future. Premiums can compensate for this time value by adding an extra cost to the present value of an investment.

- Scarcity: In some cases, a premium may be charged for goods or services that are limited in supply or high in demand. This scarcity premium reflects the extra value that buyers are willing to pay for a rare or exclusive item.

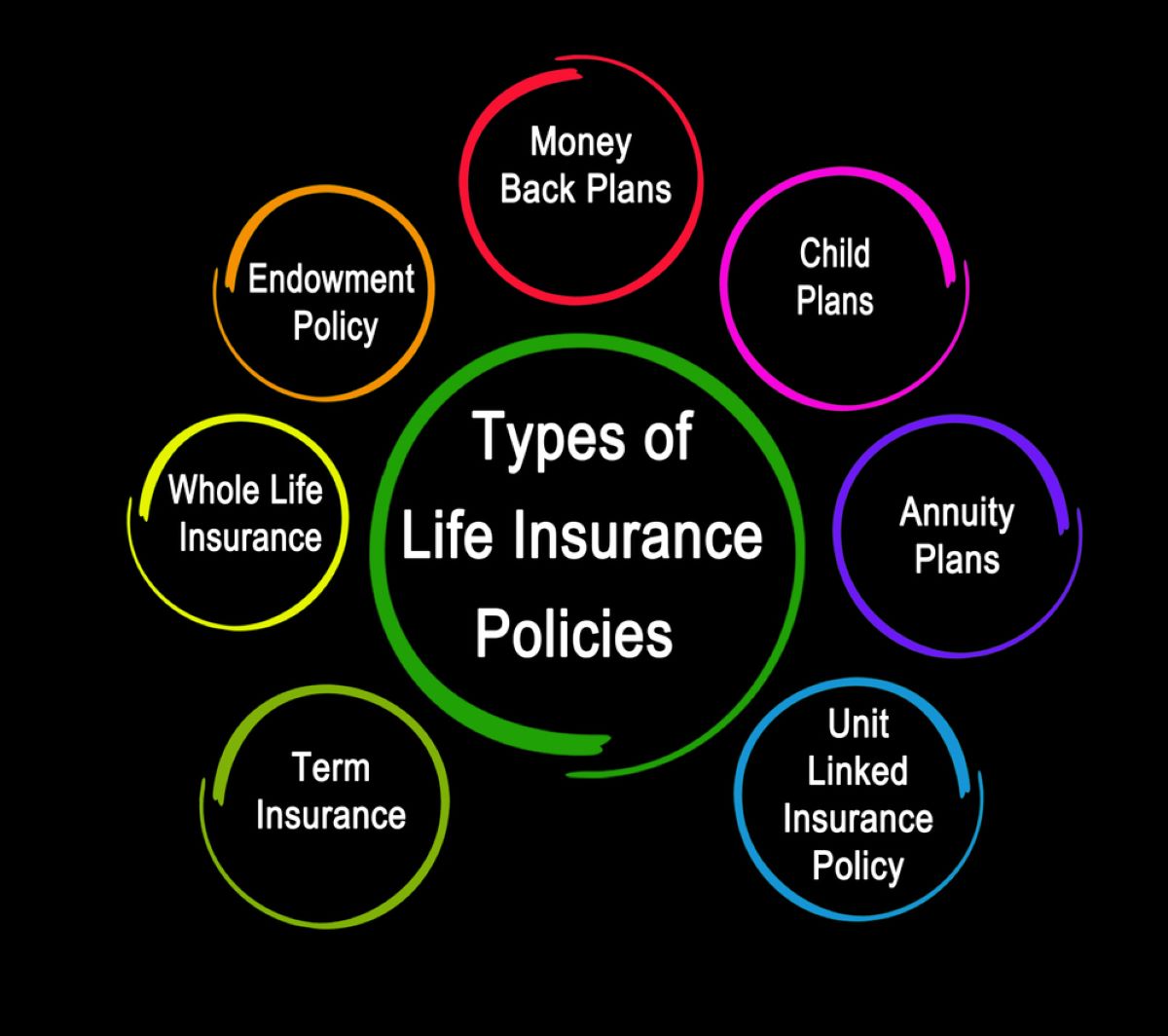

Types of Premiums

Now that we understand the concept of premiums and why they are charged, let’s explore the different types of premiums you may come across in finance:

- Insurance Premiums: In the insurance industry, a premium refers to the regular payment made by policyholders to maintain their coverage. The amount of the premium is determined by factors such as the risk profile of the insured individual, the coverage amount, and the insurance company’s pricing strategy.

- Option Premiums: In options trading, a premium is the price paid for the option contract. An option is a financial derivative that grants the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specified time period. Option premiums are influenced by factors such as the current price of the underlying asset, the time to expiration, and market volatility.

- Bond Premiums: When a bond is issued at a price higher than its face value, it is said to be sold at a premium. Bond premiums may occur when interest rates have decreased since the bond’s issuance, making the bond more attractive to investors. The premium compensates the bondholder for the higher purchase price.

So, whether you’re protecting your assets with insurance, exploring investment opportunities through options, or considering bonds as part of your portfolio, understanding premiums is essential to navigating the world of finance.

Now that you have a better grasp of premiums, make sure to utilize this knowledge to make informed financial decisions. Stay tuned for more fascinating topics in our Finance Expert Series!