Finance

Protective Stop Definition

Published: January 13, 2024

Learn what a protective stop is in finance and how it can help you mitigate risk and protect your investments.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Protective Stop Definition: What You Need to Know

Welcome to our Finance category! Here, we dive into various topics related to managing your finances, investing wisely, and making informed financial decisions. In this blog post, we will explore the concept of protective stops and why they are crucial for investors. If you’ve ever wondered what a protective stop is and how it can help you mitigate risks in your investment portfolio, you’ve come to the right place!

Key Takeaways:

- A protective stop is a risk management technique used by investors to limit potential losses on an investment.

- By setting a protective stop, investors can automatically sell their position if it reaches a predefined price level, protecting their capital.

Before we delve into the details, let’s start with the basics. What exactly is a protective stop? A protective stop, also known as a stop-loss order, is a risk management technique employed by investors to limit potential losses on an investment. It involves setting a price level at which an investor is willing to automatically sell their position to protect their capital.

Now that we understand the definition, let’s take a closer look at how protective stops work and why they are essential in managing investment risks:

1. Limiting Losses:

One of the primary benefits of implementing a protective stop is its ability to limit losses. By setting a protective stop at a predetermined price level below the current market price, investors can ensure that they limit their potential downside. If the investment’s price falls and reaches this predefined level, the protective stop will trigger and automatically sell the position, minimizing the loss.

2. Emotion-Free Decision Making:

Another significant advantage of using protective stops is that they allow for emotion-free decision making. As humans, we are prone to emotional biases that can influence our investment decisions. However, by setting a protective stop, investors take the emotion out of the equation. The predefined price level acts as an objective trigger, preventing impulsive or irrational reactions to market fluctuations.

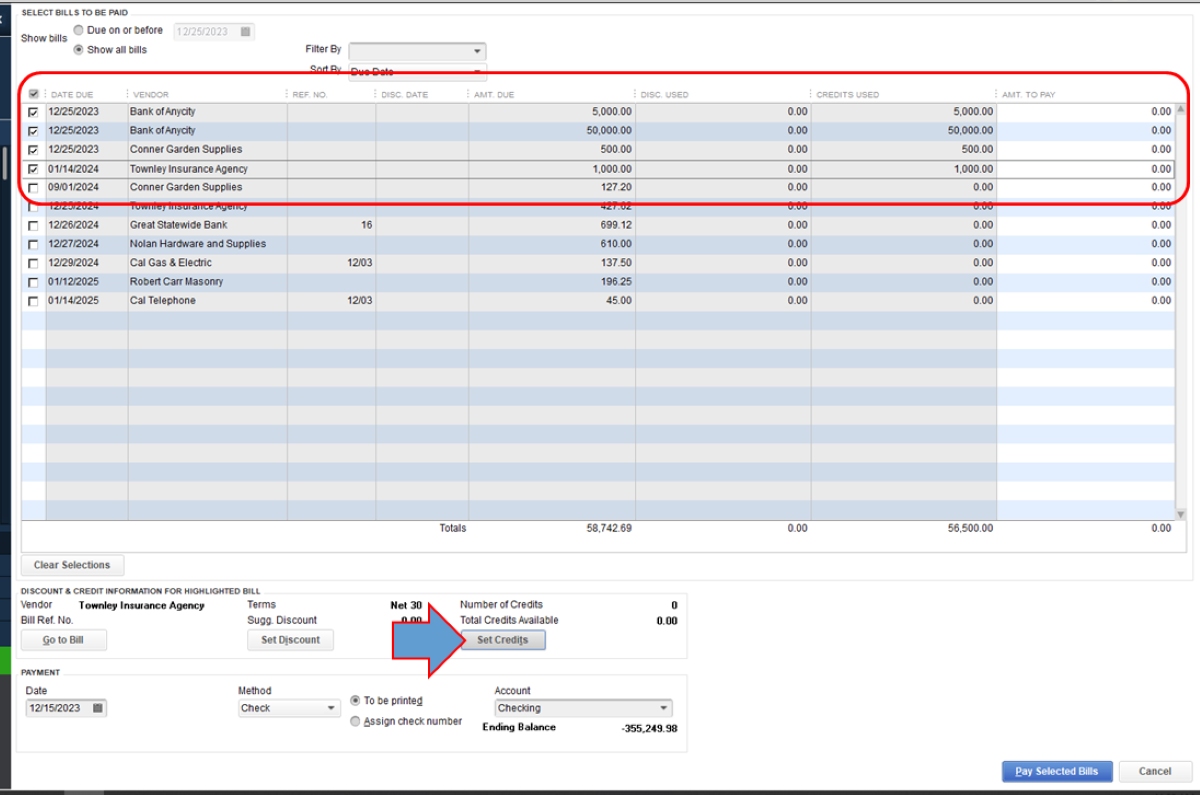

Implementing a protective stop is a relatively straightforward process. Here are some key steps to follow:

- Identify an investment you want to protect with a stop-loss order.

- Determine your risk tolerance and the maximum loss you are willing to bear.

- Select an appropriate price level to set as your protective stop.

- Enter a stop-loss order with your broker, specifying the investment and the predefined price level.

- Monitor your investment and adjust your protective stop as necessary based on market conditions and your risk tolerance.

Remember, setting a protective stop is not a foolproof strategy, and it won’t guarantee profits. However, it is an essential risk management technique that can help investors protect their capital and make more informed investment decisions.

In conclusion, protective stops play a vital role in managing investment risks. By setting predefined price levels at which to automatically sell positions, investors can limit potential losses and remove emotional biases from their decision-making process. If you’re serious about protecting your capital and making smarter investment choices, consider incorporating protective stops into your investment strategy.