Finance

Longevity Derivatives Definition

Published: December 20, 2023

Discover the definition of longevity derivatives in finance and learn how these instruments can be used to manage longevity risk.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

What Are Longevity Derivatives? A Complete Guide

Growing old is a part of life, and while it’s a privilege denied to many, it also presents financial challenges for individuals and institutions alike. When it comes to planning for retirement or managing risks associated with aging populations, unique financial instruments known as longevity derivatives have emerged as a solution. In this article, we will delve into the concept of longevity derivatives, explore their definition, and understand how they can impact the world of finance. So, let’s dive in!

Key Takeaways:

- Longevity derivatives are financial products that allow investors to manage the risks associated with the uncertain lifespan of individuals.

- These derivatives derive their value from the length of time people live and are typically used by insurance companies, pension funds, and other institutions.

So, what are longevity derivatives?

Longevity derivatives are innovative financial contracts that provide protection against the financial risks associated with increasing life expectancy. They are designed to help institutions and individuals manage the impact of longer lifespans on their financial portfolio, especially in terms of pension obligations and annuity payments.

To put it simply, longevity derivatives allow investors to transfer the risk of potential losses due to increased longevity to other parties who are willing to take on that risk. This enables companies and institutions to better manage their longevity-related liabilities, ensuring they can meet their financial commitments in the face of uncertain lifespans.

How do longevity derivatives work?

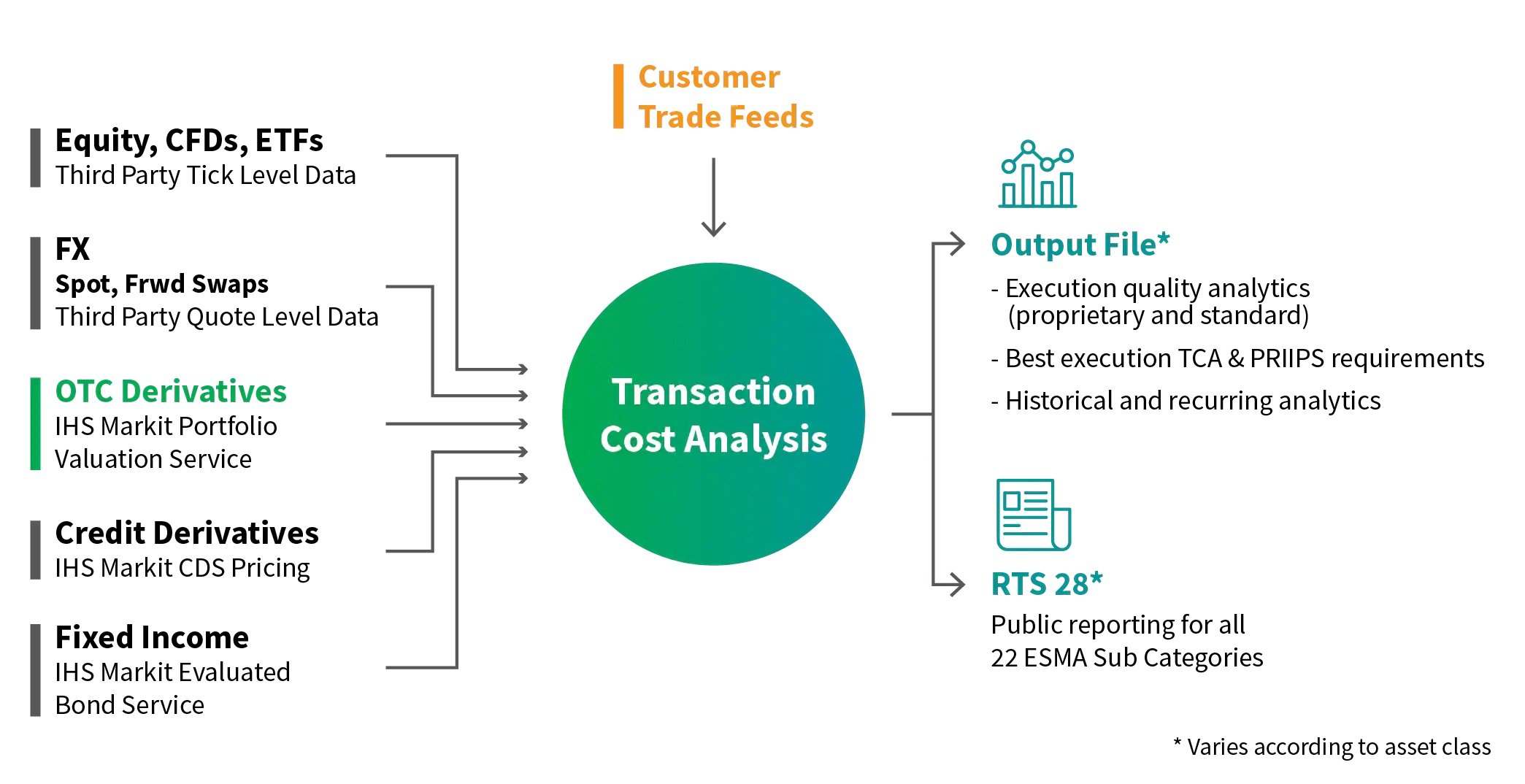

Longevity derivatives function similarly to other types of derivatives, such as futures or options. The value of these contracts is derived from the average life expectancy or mortality rates of a specific group of individuals. Typically, this group represents a defined population, such as retirees, holders of specific insurance policies, or members of a pension scheme.

Insurance companies, pension funds, and other institutions issue longevity derivatives to investors who are willing to take on the risk associated with increased longevity. These investors, known as longevity swap counterparties, will receive regular premium payments in exchange for assuming the risk of having to pay out more if the group lives longer than expected.

On the other hand, institutions issuing longevity derivatives use the premiums received to offset the potential costs of longer-lived individuals in their portfolios. By transferring this risk, companies can better forecast their future financial obligations and ensure the stability of their pension schemes or annuity offerings.

Who uses longevity derivatives?

Longevity derivatives are primarily utilized by insurance companies, pension funds, and other financial institutions dealing with longevity-related risks. Here’s a closer look at how different players in the financial landscape benefit from these innovative instruments:

- Insurance Companies: By issuing longevity derivatives, insurance companies can mitigate the financial risks associated with unexpected increases in life expectancy.

- Pension Funds: Longevity derivatives enable pension funds to hedge against the longevity risk and ensure they can fulfill their future pension obligations.

- Investors: Investors can use longevity derivatives to diversify their portfolios and potentially earn income by assuming the risk of longer lifespans.

Conclusion

Longevity derivatives have emerged as a valuable tool for managing the risks associated with increasing life expectancy. By transferring the risk of longer lifespans to willing investors, institutions can better manage their financial obligations and ensure the stability of their portfolios. Insurance companies, pension funds, and investors alike can all benefit from the innovative nature of longevity derivatives, making them an integral part of the ever-evolving world of finance.