Home>Finance>Quarterly Income Preferred Securities (QUIPS) Definition

Finance

Quarterly Income Preferred Securities (QUIPS) Definition

Published: January 15, 2024

Looking to understand Quarterly Income Preferred Securities (QUIPS)? Discover the definition, features, and benefits of QUIPS in the world of finance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

What are Quarterly Income Preferred Securities (QUIPS)?

Welcome to the Finance category on our blog, where we dive deep into various financial topics to help you gain a better understanding of different investment instruments and strategies. Today, we’re going to explore the world of Quarterly Income Preferred Securities (QUIPS) and shed some light on what they are and how they can be a valuable addition to your investment portfolio. So, let’s get started!

Key Takeaways:

- QUIPS are a type of security that offer regular income payments on a quarterly basis.

- They are hybrid securities, combining features of both stocks and bonds.

So, what exactly are Quarterly Income Preferred Securities? QUIPS are hybrid securities that combine features of both stocks and bonds. They are issued by companies as a means to raise capital, and they offer investors regular income payments on a quarterly basis.

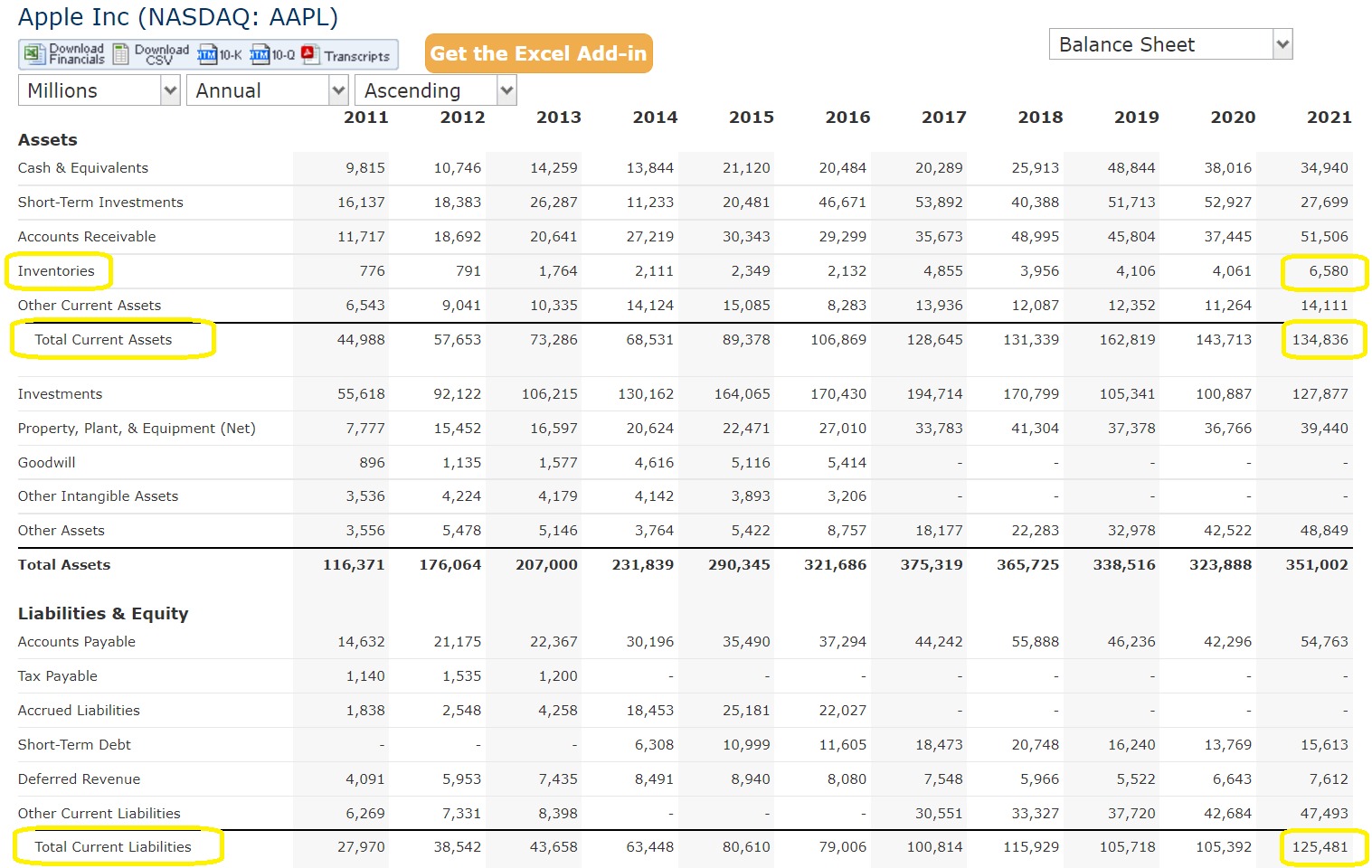

QUIPS work in a similar way to preferred stocks, where investors receive a fixed dividend payment at regular intervals. However, unlike common stocks, QUIPS do not offer voting rights to investors. They are considered higher up in the corporate capital structure than common stocks, meaning that in the event of a company’s bankruptcy, QUIP holders have priority over common stockholders when it comes to receiving assets.

While QUIPS may seem similar to bonds due to their income distribution, they have a crucial difference. Unlike bonds, QUIPS do not have a specific maturity date. This means that the issuer retains the right to redeem the securities after a certain period if they choose to do so.

With QUIPS, investors have the potential to earn a regular income stream while also enjoying the potential for capital appreciation. The security’s value may fluctuate based on the company’s financial performance and prevailing market conditions. It’s important to note that QUIPS are not risk-free investments, and investors should carefully evaluate the creditworthiness of the issuer before investing.

If you are considering adding QUIPS to your investment portfolio, there are a few key points to keep in mind:

- Diversification: As with any investment, diversification is important. Consider investing in a range of QUIPS from different companies and industries to spread your risk.

- Research: Thoroughly research the issuer’s financial health, credit rating, and the terms and conditions of the QUIPS before making an investment decision.

- Income vs. Capital Appreciation: Evaluate your investment goals and determine whether you are primarily seeking a regular income stream or potential capital gains.

QUIPS can be an attractive investment option for income-focused investors looking for regular income payments. However, they also come with their own set of risks and considerations. As always, it’s essential to consult with a financial advisor who can provide personalized advice based on your individual financial situation and goals.

We hope this blog post has provided you with a better understanding of Quarterly Income Preferred Securities and how they can fit into your investment strategy. Stay tuned for more informative content on various financial topics in our Finance category!