Home>Finance>Preferred Redeemable Increased Dividend Equity Security (PRIDES) Definition

Finance

Preferred Redeemable Increased Dividend Equity Security (PRIDES) Definition

Published: January 10, 2024

Learn the definition of Preferred Redeemable Increased Dividend Equity Security (PRIDES) in finance. Discover how it can benefit your investment strategy.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Preferred Redeemable Increased Dividend Equity Security (PRIDES) Definition

When it comes to navigating the world of finance, it can often feel like you’re wading through a sea of acronyms and complex jargon. One such term that you may have come across is “Preferred Redeemable Increased Dividend Equity Security,” or PRIDES for short. But what exactly does this term mean and how does it impact your financial decisions? In this article, we’ll delve into the PRIDES definition, explain its significance, and explore its potential benefits.

Key Takeaways:

- PRIDES stands for Preferred Redeemable Increased Dividend Equity Security.

- It is a type of investment instrument that combines features of both preferred stock and traditional debt securities.

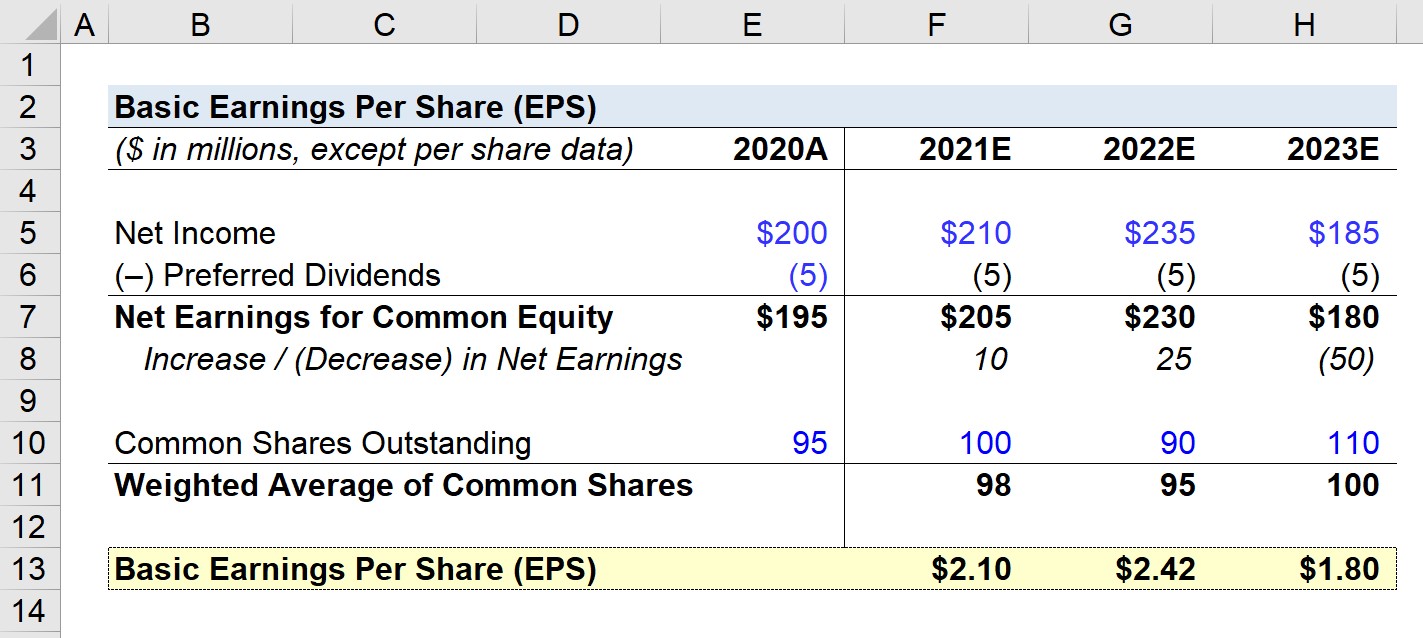

So, what exactly is a PRIDES? In simple terms, it is a hybrid financial instrument that combines features of both preferred stock and traditional debt securities. This means that PRIDES can offer investors a unique set of advantages and potentially higher returns compared to other investment options.

One of the key characteristics of PRIDES is that they offer increased dividends. This means that holders of PRIDES may receive higher dividends compared to traditional preferred stock or debt securities. This increased dividend feature can make PRIDES an attractive option for investors looking for potential income-generating investments.

Additionally, PRIDES are redeemable, which means that the issuer has the option to repurchase the securities from the investor at a specified price and time. This provides flexibility to the issuer and can potentially offer investors an avenue for liquidity in the future.

Now that we understand the basics of PRIDES, let’s explore some potential benefits that this investment instrument may offer:

Benefits of PRIDES:

- Higher income potential: PRIDES can offer increased dividend payments compared to traditional preferred stock or debt securities, potentially providing investors with higher income streams.

- Liquidity options: Due to the redeemable nature of PRIDES, investors may have the option to sell their securities back to the issuer, providing a potential source of liquidity.

It’s worth noting that PRIDES may also come with certain risks, such as the potential for the issuer to call or redeem the securities before they reach full maturity, which could impact investor returns. Therefore, it’s essential to carefully evaluate your individual investment goals, risk tolerance, and consult with a financial advisor before considering PRIDES or any other investment instrument.

In conclusion, PRIDES, or Preferred Redeemable Increased Dividend Equity Security, is a unique investment instrument that combines features of preferred stock and traditional debt securities. It offers potential benefits such as higher income potential and liquidity options, making it an option worth considering for investors looking to diversify their portfolios and potentially generate income.

Remember, investing always carries risks, and it’s important to do thorough research and seek professional advice before making any financial decisions.