Finance

Red Definition

Published: January 17, 2024

Learn the definition of Red in the world of finance and how it affects your investments. Gain insights on managing risks and navigating market trends.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Finance 101: Demystifying the World of Money Management

Money is an integral part of our lives, and understanding how to manage it properly is crucial for financial stability and success. In this blog post, we will delve into the fascinating world of finance, offering insights, tips, and tricks that will help you navigate this complex landscape. Whether you’re a seasoned investor or just starting to take control of your personal finances, this article aims to provide you with valuable information to make informed decisions.

Key Takeaways:

- Money management is essential for financial stability and success.

- Understanding financial concepts can help you make informed decisions.

1. The Basics of Finance: To understand finance, we need to begin with the fundamentals. Finance involves the study of how individuals, businesses, and governments allocate their resources over time and make decisions about investing, borrowing, and saving. Some key concepts to familiarize yourself with include:

- Income: The money you earn from various sources, such as employment, investments, or business ventures.

- Expenses: The money you spend on necessities, such as housing, food, and transportation, as well as discretionary purchases.

- Budgeting: Creating a plan for how you will allocate and spend your income to cover both your needs and wants.

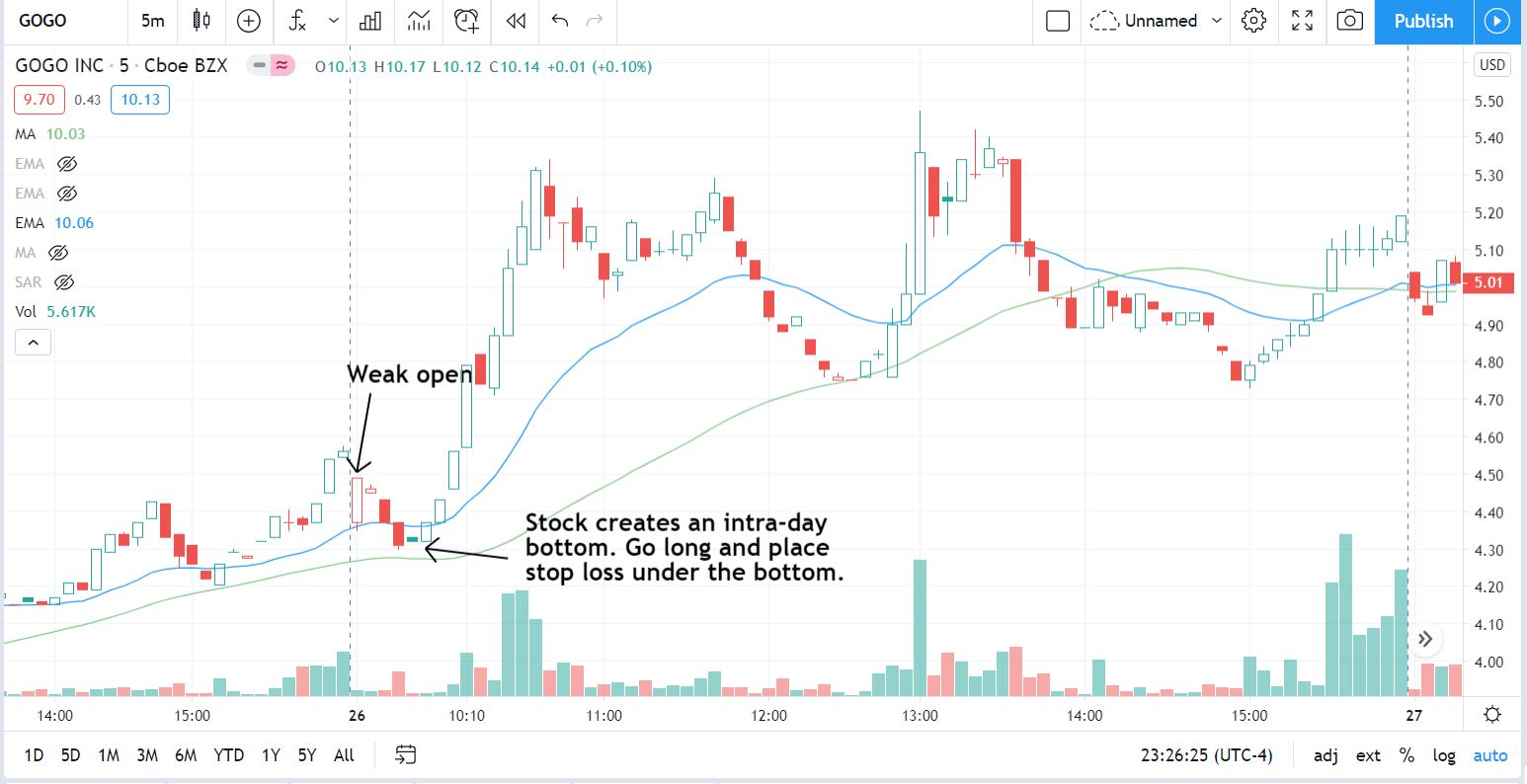

- Investing: Placing your money into assets with the expectation of generating profit or income over time.

- Debt: Money borrowed from a lender that must be repaid, usually with interest.

2. Taking Control of Your Finances: Now that you have a basic understanding of finance, it’s time to take control of your own financial situation. Here are some essential steps to help you on your journey:

- Evaluate your current financial situation: Assess your income, expenses, debts, and savings. Knowing where you stand financially will help you set realistic goals.

- Create a budget: Develop a clear plan for how you will allocate your income to cover your expenses and savings goals. Stick to your budget to avoid overspending and debt accumulation.

- Manage your debt: If you have outstanding debts, create a repayment plan to tackle them systematically. Consider consolidating high-interest debts or seeking professional guidance if needed.

- Build an emergency fund: Set aside a portion of your income for unexpected expenses or financial emergencies. Aim to accumulate at least three to six months’ worth of living expenses.

- Invest wisely: Start investing early and diversify your portfolio to mitigate risk. Consider seeking professional advice or using investment platforms to help you make informed investment decisions.

- Continuously educate yourself: Finance is an ever-evolving field. Stay updated with financial news, read books, and attend workshops or seminars to enhance your financial knowledge.

Taking control of your finances not only sets you on the path to financial freedom but also enables you to achieve your financial goals and dreams. So, empower yourself with financial literacy and embrace the world of finance with confidence.

Remember, everyone’s financial situation is unique, and it’s essential to tailor these suggestions to your individual needs. By employing these foundational principles of finance, you’ll be well on your way to achieving financial well-being and securing a bright future for yourself and your loved ones.