Home>Finance>What Is A Red Herring? Definition, Meaning, Benefits, And Example

Finance

What Is A Red Herring? Definition, Meaning, Benefits, And Example

Published: January 17, 2024

Learn what a red herring is in the world of finance, its definition, meaning, benefits, and see an example. Expand your financial knowledge.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

What Is a Red Herring? Definition, Meaning, Benefits, and Example

Welcome to our finance category, where we dive into various aspects of the financial world. Today, we’ll shed some light on a term you may have come across: the red herring. What exactly is a red herring, and how does it relate to the world of finance? In this blog post, we’ll define the term, discuss its meaning and benefits, and provide an example to help you understand it better.

Key Takeaways:

- A red herring is a term used in finance to describe misleading or irrelevant information presented to divert attention from the main point.

- Understanding red herrings can help investors make informed decisions by separating the relevant information from the distractions.

Now, let’s dive right into understanding red herrings and their significance in finance:

What is a Red Herring?

A red herring, in the context of finance, refers to the introduction of misleading or irrelevant information that distracts attention from the main point or argument. The term finds its origins in the practice of using strong-smelling smoked fish, such as herring, to divert hunting dogs from chasing their intended prey. In finance, a red herring typically takes the form of unnecessary details, exaggerated claims, or extravagant visual presentations that can mislead or confuse investors.

As investors navigate the complex world of finance, it is essential to recognize and understand red herrings. Identifying red herrings allows investors to separate useful information from distractions, ensuring that they make well-informed decisions based on reliable data.

The Benefits of Recognizing Red Herrings

Recognizing red herrings in financial information offers several benefits:

- Improved Decision Making: By identifying and filtering out irrelevant or misleading information, investors can make more accurate and informed decisions. This allows them to focus on the data that truly matters when evaluating investment opportunities.

- Reduced Risk: Uncovering red herrings can help investors avoid potential pitfalls and traps. By seeing through the distractions, investors can better assess the risks associated with an investment and allocate their resources wisely.

- Efficient Resource Allocation: Understanding red herrings enables investors to optimize their time and effort by focusing on relevant research and analysis. By cutting through the noise, they can channel their resources towards evaluating factors that truly impact their investment decisions.

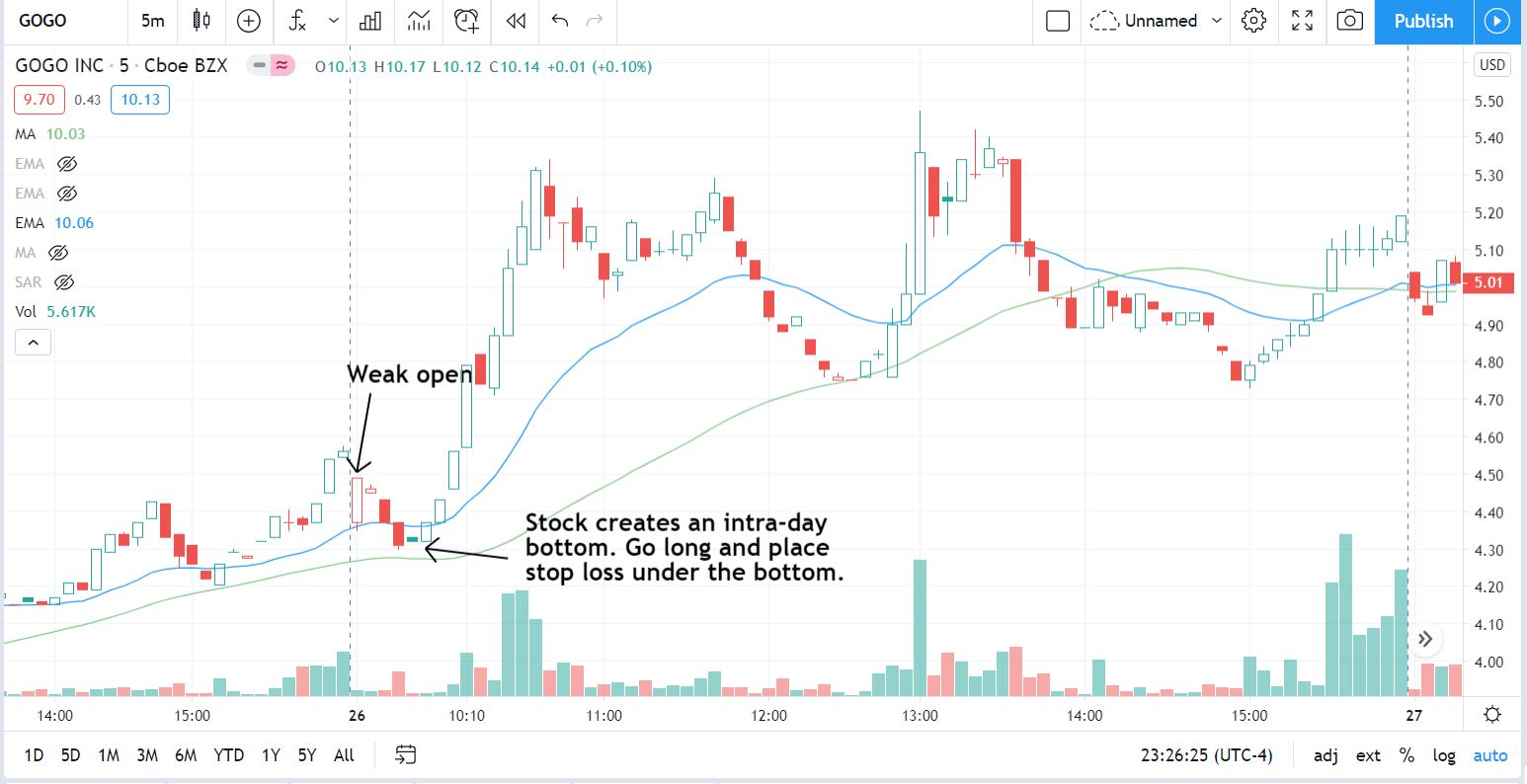

An Example of a Red Herring

Let’s consider an example to illustrate a red herring in practice:

Imagine you are evaluating a potential investment opportunity in Company X. As you review the financial statements, you notice the company’s operating income has increased by 50% over the past year. However, upon deeper analysis, you realize that this growth is primarily due to a one-time insurance payout received by the company following a fire at one of its facilities. This payout is an irrelevant detail that could distract less vigilant investors, leading them to believe that the company’s performance is consistently strong when it may not be.

In this example, the one-time insurance payout acts as a red herring, potentially diverting attention from other critical factors that might impact the investment decision, such as the company’s core business operations and their long-term sustainability.

By being aware of red herrings and actively seeking out relevant and reliable information, investors can make more informed decisions and avoid being swayed by deceptive distractions.

To sum it up, a red herring in finance refers to misleading or irrelevant information presented to divert attention from the main point or argument. Recognizing red herrings empowers investors to make informed decisions, mitigate risks, and allocate their resources efficiently. By understanding what a red herring is and how it can impact investment choices, financial enthusiasts can navigate the complex financial world more effectively.