Finance

What Is A Prime Checking Account

Modified: February 21, 2024

Discover the benefits of a prime checking account for your finances. Manage your money more efficiently with higher interest rates and exclusive perks.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

A prime checking account is a type of financial product offered by many banks and financial institutions. It is designed for customers who have a high credit score and a strong financial standing. This type of account often offers a range of benefits and features that are not typically available with regular checking accounts.

Prime checking accounts are tailored for individuals who want premium services and exclusive perks. They are ideal for those who maintain a high balance in their account or have a significant transaction volume. With a prime checking account, customers can enjoy a variety of privileges, including higher interest rates, waived fees, access to specialized customer service, and enhanced security features.

These accounts are particularly beneficial for individuals who frequently engage in large financial transactions or have complex banking needs. Prime checking accounts often provide added convenience through features such as unlimited ATM fee reimbursements, free checks, and access to a wider network of ATMs.

In this article, we will delve into the details of prime checking accounts, including their definition, features, eligibility requirements, and how to open one. We will also compare them to regular checking accounts, highlighting the advantages they offer. By the end of this article, you will have a clear understanding of the benefits and considerations associated with having a prime checking account.

Definition of a Prime Checking Account

A prime checking account is a specialized type of bank account that is offered to individuals with a high credit score and a strong financial history. It is often considered a premium or elite option due to the exclusive features and benefits it provides.

One of the primary characteristics of a prime checking account is the emphasis on personalized service and exceptional customer support. Account holders enjoy access to dedicated customer service representatives who are trained to provide tailored assistance and address any concerns promptly.

Additionally, prime checking accounts usually come with enhanced security measures, such as advanced fraud detection systems and identity theft protection. These measures help safeguard account holders’ funds and personal information from unauthorized access or fraudulent activities.

Another distinguishing feature of prime checking accounts is the higher interest rates offered on account balances. Unlike regular checking accounts that may only earn minimal or no interest, prime checking accounts allow customers to earn a more competitive rate on their deposited funds. This feature is especially beneficial for individuals who maintain larger account balances.

Furthermore, prime checking accounts often come with waived fees or reduced charges. Account holders typically enjoy benefits such as free checks, no monthly maintenance fees, and unlimited ATM fee reimbursements. These perks can result in significant savings, especially for those who frequently use ATMs or write checks.

Overall, the defining characteristic of a prime checking account is the combination of premium services, higher interest rates, and exclusive perks. It is designed to cater to the needs of financially responsible individuals who value personalized support, enhanced security, and preferential treatment when it comes to their banking services.

Features and Benefits of a Prime Checking Account

A prime checking account offers several features and benefits that set it apart from regular checking accounts. These features are designed to provide added convenience, increased savings, and an enhanced banking experience for account holders. Here are some of the key features and benefits of a prime checking account:

- Higher Interest Rates: One of the major advantages of a prime checking account is the opportunity to earn higher interest rates on your account balance. Unlike traditional checking accounts, which often offer minimal or no interest, prime checking accounts allow you to maximize your savings by earning a competitive interest rate on your deposited funds.

- Waived or Reduced Fees: Prime checking accounts often come with waived or reduced fees. This means that you can save money on common banking services, such as monthly maintenance fees, overdraft fees, and ATM withdrawal fees. With these fees waived or reduced, you can focus on managing and growing your funds without worrying about unnecessary charges.

- Enhanced Security Measures: Prime checking accounts prioritize account security. They often incorporate advanced security measures, such as real-time transaction monitoring, identity theft protection, and fraud detection systems. This ensures that your account and personal information are well-protected from unauthorized access and fraudulent activities.

- Access to Personalized Customer Support: With a prime checking account, you benefit from dedicated customer support. You have access to knowledgeable and responsive customer service representatives who can provide personalized assistance and address any concerns or inquiries you may have. This high level of support adds an extra layer of convenience and peace of mind.

- Exclusive Perks: Prime checking account holders often enjoy exclusive perks, such as access to premium banking services and specialized products. These perks may include unlimited ATM fee reimbursements, free checks, higher daily withdrawal limits, and discounted rates on loans or credit cards. These exclusive benefits enhance the overall banking experience and provide additional value.

- Convenience and Flexibility: Prime checking accounts offer convenience and flexibility through features like online and mobile banking, remote check deposit, bill pay services, and easy fund transfers. These modern banking tools allow you to manage your finances effectively, anytime and anywhere, without the need to visit a physical branch.

These features and benefits make a prime checking account an appealing choice for individuals who seek a comprehensive banking solution that goes beyond the standard offerings of a regular checking account. Prime checking accounts provide an elevated level of service, increased savings opportunities, and a range of perks that cater to the banking needs of financially responsible individuals.

Eligibility Requirements for a Prime Checking Account

In order to qualify for a prime checking account, certain eligibility requirements must be met. These requirements are put in place by banks and financial institutions to ensure that the account is only offered to individuals who demonstrate a strong financial standing. While the specific criteria may vary between institutions, the following are common factors to consider when applying for a prime checking account:

- Minimum Credit Score: To be eligible for a prime checking account, you typically need to have a good or excellent credit score. This score reflects your creditworthiness and is used by banks to assess the risk associated with offering you an account with additional benefits and privileges. Banks may have different credit score thresholds, so it’s important to check with your desired financial institution for their specific requirements.

- Income Level: Financial institutions often consider your income as an important factor when determining eligibility for a prime checking account. Since these accounts usually come with higher interest rates and waived fees, they are targeted towards individuals who have a steady and substantial income. Demonstrating a consistent ability to manage your finances and meet your financial obligations can greatly improve your chances of being approved.

- Account Balance: Some banks may require a certain minimum balance to open and maintain a prime checking account. This is because these accounts are designed for individuals who typically maintain larger account balances. It’s important to review the balance requirements of the financial institution you’re interested in to ensure that you meet their criteria.

- Financial History: Financial institutions may also consider your financial history when evaluating your eligibility. This includes factors such as your banking history, previous loans or credit accounts, and any negative marks like bankruptcies or delinquencies. A positive financial history demonstrates responsible financial management and increases your chances of being approved for a prime checking account.

- Relationship with the Bank: Some banks may prioritize existing customers or those who have a pre-existing relationship with the institution. This could include having other accounts, such as savings accounts or loans, with the same bank. Building a strong relationship with your bank may work in your favor when applying for a prime checking account.

It’s important to note that each financial institution may have its own specific eligibility requirements for a prime checking account. It’s recommended to contact the bank directly or visit their website to understand their criteria in detail and ensure that you meet the necessary qualifications.

Meeting the eligibility requirements for a prime checking account signifies that you are a financially responsible individual with a strong credit profile and the ability to maintain higher account balances. This enables you to enjoy the exclusive benefits and enhanced features that come with a prime checking account.

Comparison with Regular Checking Accounts

When considering opening a prime checking account, it’s important to understand how it differs from a regular checking account. While both types of accounts serve the primary purpose of managing day-to-day transactions and providing access to funds, there are several key differences to consider:

- Interest Rates: One of the main distinctions between a prime checking account and a regular checking account is the interest rate offered. Prime checking accounts typically provide higher interest rates on account balances compared to regular checking accounts, which often offer minimal or no interest. This means that with a prime checking account, you have the potential to earn more money on your deposited funds.

- Additional Benefits: Prime checking accounts often come with additional benefits and perks that are not available with regular checking accounts. These can include waived fees, unlimited ATM fee reimbursements, free checks, access to exclusive banking products, and higher daily withdrawal limits. Regular checking accounts usually do not offer these extra features, making prime checking accounts more attractive for individuals seeking added convenience and savings.

- Eligibility Requirements: Prime checking accounts typically have stricter eligibility requirements compared to regular checking accounts. They are designed for individuals with a higher credit score, stronger financial history, and a greater ability to maintain higher account balances. Regular checking accounts, on the other hand, are more accessible and can be opened by individuals with varying credit scores and financial situations.

- Fees: While regular checking accounts may have associated fees, such as monthly maintenance fees and ATM withdrawal fees, prime checking accounts often have reduced or waived fees. This can result in significant savings over time, particularly for individuals who frequently use ATMs or write checks. The fee structure of a prime checking account is often more favorable compared to regular checking accounts.

- Customer Service: Prime checking account holders often receive superior customer service compared to regular checking account holders. They have access to dedicated customer support representatives who are trained to provide personalized assistance and address any account-related concerns promptly. Regular checking accounts typically offer more basic customer service support without the same level of personalized attention.

Ultimately, the decision between a prime checking account and a regular checking account depends on your financial goals, banking needs, and eligibility. If you have a strong credit profile, maintain higher account balances, and value the added benefits and perks, a prime checking account may be the ideal choice for you. However, if you have a more modest credit score or account balance and prioritize accessibility and basic banking services, a regular checking account may be a better fit.

It’s important to carefully evaluate the features, requirements, and costs associated with each type of account to make an informed decision that aligns with your financial priorities and enables you to effectively manage your money.

How to Open a Prime Checking Account

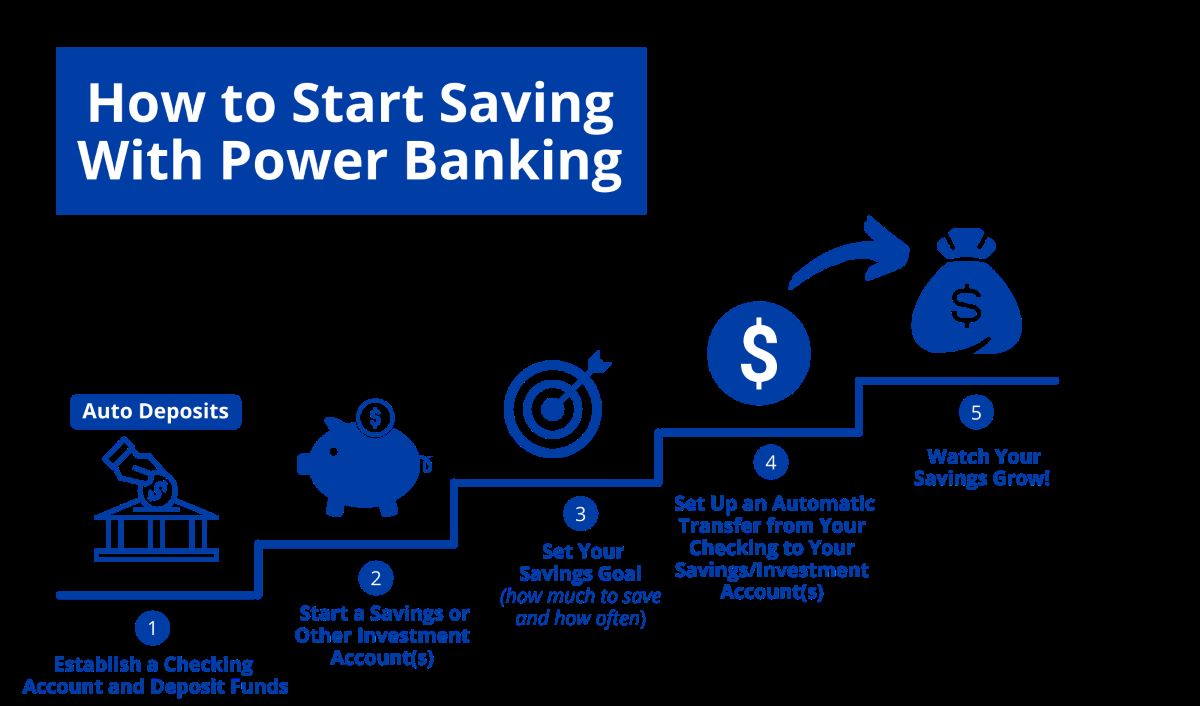

Opening a prime checking account involves a series of steps to ensure that you meet the eligibility requirements and provide the necessary documentation. While the specifics may vary between financial institutions, here are the general steps to open a prime checking account:

- Research Financial Institutions: Begin by researching different banks and financial institutions that offer prime checking accounts. Compare their features, benefits, fees, and eligibility requirements to find the one that best suits your needs and preferences.

- Gather Required Documentation: As part of the application process, you will need to gather certain documents. These may include proof of identification, such as a driver’s license or passport, proof of address, such as a utility bill or lease agreement, and proof of income, such as pay stubs or tax documents. Make sure to have these documents readily available to streamline the application process.

- Visit the Bank: Schedule an appointment at the chosen bank or financial institution to begin the account opening process. During the appointment, a representative will guide you through the necessary steps and answer any questions you may have.

- Complete the Application: Fill out the application form provided by the bank. The form will typically require personal information, such as your name, address, social security number, and employment details. Complete the form accurately and thoroughly, ensuring that all the required fields are filled in correctly.

- Provide Required Financial Information: In addition to personal information, you will need to provide details about your financial situation. This may include information about your income, assets, and liabilities. Be prepared to share this information to help the bank assess your eligibility for a prime checking account.

- Review and Sign the Account Agreement: Carefully review the terms and conditions of the prime checking account, including any associated fees, features, and benefits. Once you agree to the terms, sign the account agreement to officially open your prime checking account.

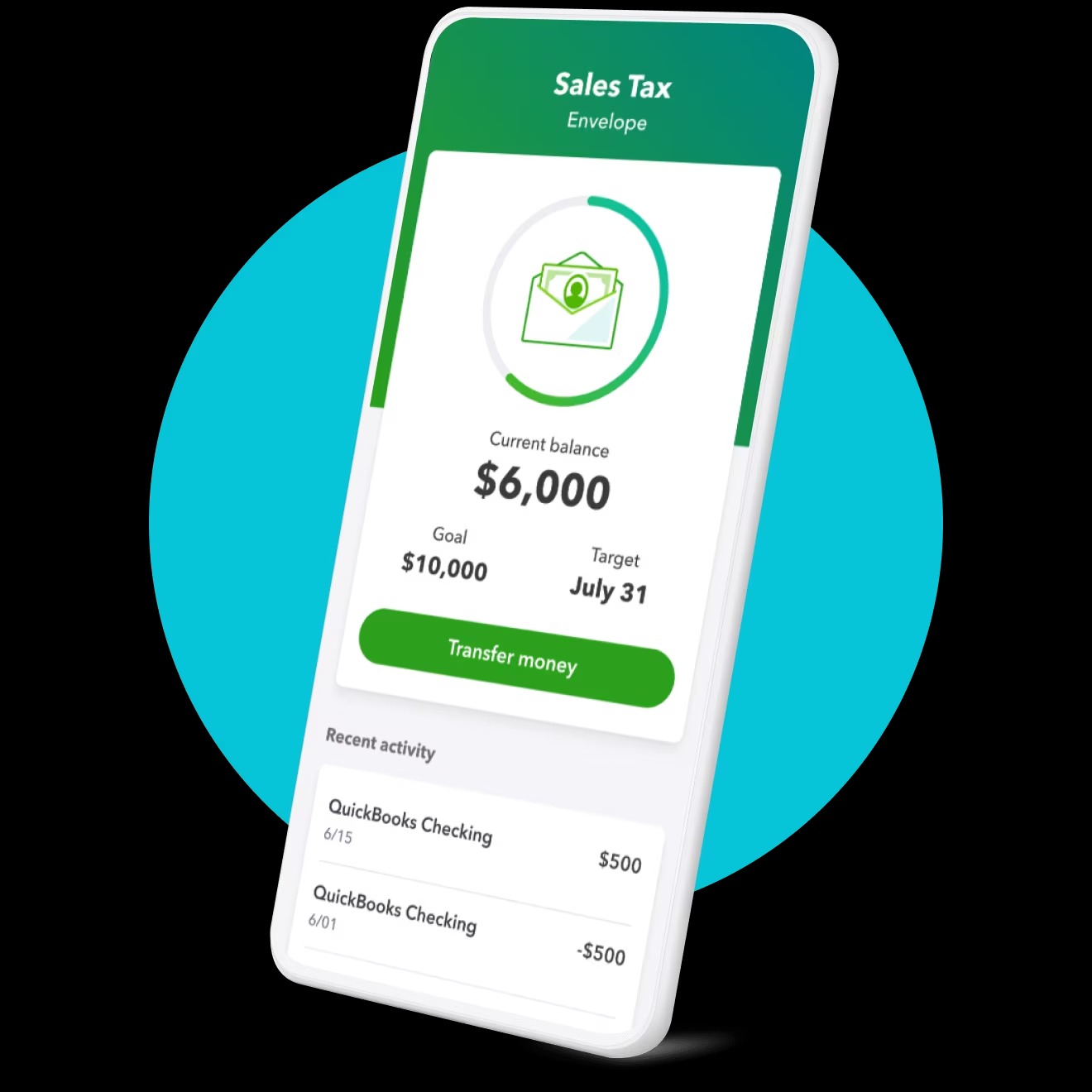

- Deposit Funds: After opening the account, you will be required to make an initial deposit. The minimum deposit amount will depend on the specific requirements set by the financial institution. This deposit will serve as the starting point for your balance in the prime checking account.

- Setup Online and Mobile Banking: Take advantage of the convenience offered by online and mobile banking by setting up these services for your prime checking account. This will allow you to manage your account, track transactions, and access various banking services at your convenience.

It’s important to note that the specific steps and requirements may vary from one bank to another. Some financial institutions may also offer the option to open a prime checking account online, eliminating the need for an in-person appointment.

By following these steps and providing the required documentation, you can successfully open a prime checking account and begin enjoying the exclusive benefits and features that come with it. Remember to carefully review the account terms and conditions and seek clarification on any aspects that you may not fully understand before finalizing the account opening process.

Frequently Asked Questions about Prime Checking Accounts

Here are some commonly asked questions about prime checking accounts:

- What is the minimum balance required for a prime checking account?

- Can I open a joint prime checking account?

- Are there any monthly fees associated with a prime checking account?

- Can I earn interest on the money deposited in my prime checking account?

- What happens if my credit score drops after opening a prime checking account?

- Are prime checking accounts insured by the FDIC?

- Can I switch from a regular checking account to a prime checking account?

The minimum balance required for a prime checking account varies depending on the specific bank or financial institution. It’s important to check with the institution of your choice to determine their minimum balance requirements.

Yes, it is possible to open a joint prime checking account with another individual. This can be a spouse, partner, family member, or business partner. Make sure to provide all required documentation for both account holders during the application process.

While some prime checking accounts may have monthly fees, many institutions offer these accounts with reduced or waived fees. It’s important to review the account details and the fee structure of the specific account you are considering to understand the costs involved.

Yes, prime checking accounts often offer the opportunity to earn interest on the account balance. These accounts typically provide higher interest rates compared to regular checking accounts, allowing you to grow your funds over time.

If your credit score drops after opening a prime checking account, it is unlikely to impact the account itself. However, keep in mind that maintaining a good credit score is essential for accessing other financial products and services in the future.

Yes, prime checking accounts offered by FDIC-insured banks are protected by the Federal Deposit Insurance Corporation (FDIC) up to the maximum limit allowed by law. This means that if the bank fails, your deposits are insured up to the specified amount per depositor.

Yes, it is possible to switch from a regular checking account to a prime checking account. Contact your current bank or the bank offering the prime checking account to inquire about the process and any necessary documentation.

If you have any specific questions about opening or managing a prime checking account, it’s recommended to contact the bank or financial institution directly. They will provide you with the most accurate and up-to-date information based on their account offerings and policies.

Conclusion

Prime checking accounts offer a range of benefits and features that make them an attractive option for individuals with a strong financial standing. These accounts provide higher interest rates, waived fees, enhanced security measures, personalized customer support, and exclusive perks that are not typically available with regular checking accounts.

Opening a prime checking account involves meeting specific eligibility requirements, such as having a good credit score and maintaining a higher account balance. By providing the necessary documentation and completing the application process, individuals can enjoy the advantages of a prime checking account.

While prime checking accounts have several advantages, it’s still important to carefully evaluate your individual financial needs and preferences. Consider factors such as eligibility requirements, fees, benefits, and services offered by different banks and financial institutions before making a decision.

Whether you’re looking to maximize your savings, access personalized support, or take advantage of exclusive perks, a prime checking account can provide a comprehensive and rewarding banking experience. By understanding the features, eligibility requirements, and benefits associated with prime checking accounts, you can make an informed decision that aligns with your financial goals and enhances your banking experience.

Remember to conduct thorough research, compare different options, and consult with financial professionals if needed. Choosing the right prime checking account can provide you with the financial tools and advantages necessary to optimize your banking experience and potentially increase your savings over time.