Finance

Simple Interest Bi-Weekly Mortgage Definition

Published: January 29, 2024

Learn the definition of a bi-weekly mortgage and how it relates to simple interest. Discover key terms in finance and make informed decisions for your home loan.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Simple Interest Bi-Weekly Mortgage – A Financial Game-Changer

When it comes to managing finances, it’s important to explore various options to make the most of your hard-earned money. One such option that has gained popularity among homeowners is the Simple Interest Bi-Weekly Mortgage. But what exactly is it, and how can it benefit you? In this blog post, we’ll delve into the definition and advantages of this innovative financial solution.

Key Takeaways:

- Simple Interest Bi-Weekly Mortgage can help you save on interest payments and shorten the overall term of your mortgage.

- By making bi-weekly payments, you can pay off your mortgage faster and build equity in your home at an accelerated pace.

What is Simple Interest Bi-Weekly Mortgage?

A Simple Interest Bi-Weekly Mortgage is a repayment schedule that allows you to make payments every two weeks, rather than the traditional once-a-month mortgage payment. With this method, a significant portion of each payment goes directly towards reducing the principal balance of your mortgage. This means that you pay less interest over time, allowing you to save money and potentially pay off your mortgage earlier.

Unlike the standard monthly mortgage payment, where interest accrues on a daily basis, with a Simple Interest Bi-Weekly Mortgage, interest accumulates only on the outstanding principal balance. This simple yet effective concept can lead to substantial savings over the life of your mortgage.

The Benefits of Simple Interest Bi-Weekly Mortgage

Now that we understand what a Simple Interest Bi-Weekly Mortgage is, let’s explore some of the advantages it offers:

- Savings on Interest Payments: By making payments every two weeks, you effectively make an extra month’s worth of payments each year. This additional payment reduces the principal faster, resulting in lower overall interest charges. Over time, these savings can add up significantly.

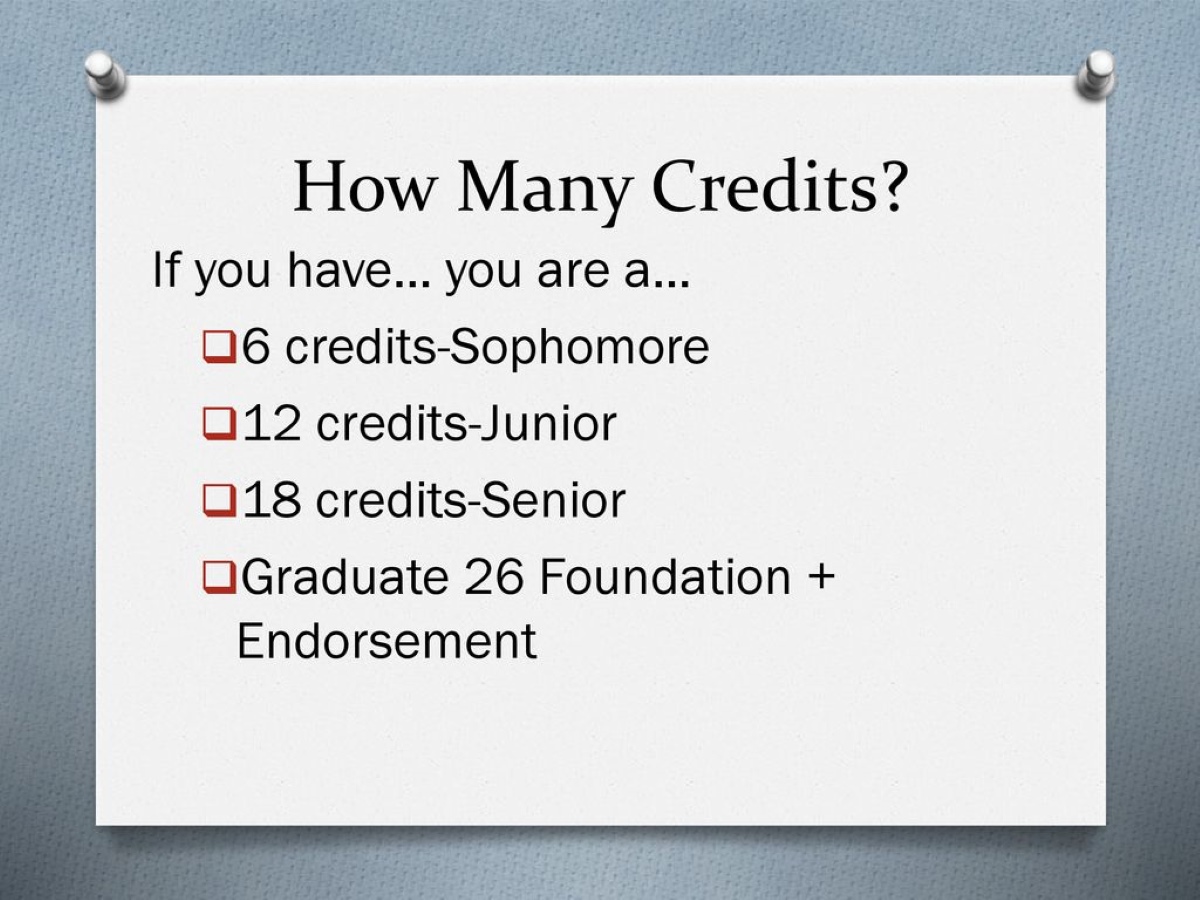

- Accelerated Mortgage Payoff: With a Simple Interest Bi-Weekly Mortgage, you have the opportunity to pay off your mortgage much quicker than with a standard monthly payment plan. By making 26 bi-weekly payments in a year, you effectively make 13 monthly payments. This condensed repayment schedule can help you reach the finish line and become mortgage-free sooner than expected.

- Equity Building: As you pay down your mortgage at an accelerated pace, you’ll be building equity in your home at a faster rate. This increased home equity can provide you with more financial flexibility and opportunities, such as accessing home equity loans or lines of credit in the future.

Ultimately, a Simple Interest Bi-Weekly Mortgage is a financial strategy that allows homeowners to optimize their mortgage repayment plan. It’s important to note that not all lenders offer this option, so it’s crucial to inquire about it when shopping for a mortgage or speaking with your current lender about converting your existing mortgage to this payment structure.

In conclusion, if you’re looking to save on interest payments, pay off your mortgage earlier, and build equity in your home faster, a Simple Interest Bi-Weekly Mortgage could be a game-changer for your financial future.