Finance

What Is A Credit Week For Pa Unemployment

Published: January 10, 2024

Find out what a credit week for PA unemployment is and how it affects your finances. Explore the details and implications of this important aspect.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Overview

When it comes to filing for unemployment benefits, understanding the intricacies of the process is essential. One important aspect that individuals need to be aware of is the concept of a “credit week.” A credit week plays a significant role in determining eligibility for unemployment benefits and is an important factor considered by unemployment agencies.

A credit week is a specific time period during which an individual must meet certain requirements to qualify for unemployment benefits. It is crucial for individuals to understand how credit weeks work and the impact they have on receiving financial support during times of unemployment.

The purpose of credit weeks is to establish a standardized way of measuring an individual’s eligibility for unemployment benefits. These credit weeks act as milestones, ensuring that applicants have met the necessary criteria to qualify for financial assistance. It is important to note that credit weeks vary depending on the state or country in which the individual resides, as unemployment systems may differ from one jurisdiction to another.

The concept of credit weeks aims to provide a fair and consistent evaluation process, allowing unemployment agencies to assess an individual’s work history and employment status before granting benefits. By setting specific time frames and criteria, credit weeks help to determine who is qualified to receive assistance based on their past contributions to the workforce.

Understanding the workings of credit weeks is essential, as it enables individuals to accurately gauge their eligibility for unemployment benefits. By being aware of the necessary requirements and timelines associated with credit weeks, individuals can better prepare for the application process and navigate the unemployment system more effectively.

Definition of Credit Week

A credit week is a specific period of time used to determine an individual’s eligibility for unemployment benefits. It is a standardized measurement that unemployment agencies use to evaluate an individual’s work history and employment status. The duration of a credit week may vary depending on the specific regulations set by the state or country in which the individual resides.

During a credit week, an individual must meet certain requirements in order to be considered eligible for unemployment benefits. These requirements typically include being actively engaged in a job search, being available and willing to accept suitable employment opportunities, and meeting any additional criteria outlined by the unemployment agency.

Credit weeks serve as a way to quantify an individual’s contributions to the workforce and determine their eligibility for financial assistance in times of unemployment. By establishing specific time frames, credit weeks offer a standardized method for evaluating an individual’s work history and determining their potential entitlement to unemployment benefits.

It is important to note that the criteria for a credit week may differ from one jurisdiction to another. Some states or countries may require individuals to have worked a minimum number of hours or earned a certain amount of income during a credit week, while others may have additional requirements based on individual circumstances.

Regardless of the specific requirements, credit weeks are an integral part of the unemployment benefits system. They provide a framework for evaluating an individual’s eligibility and contribute to the fair and consistent distribution of financial assistance. Understanding the definition and significance of credit weeks is essential for individuals navigating the unemployment system and seeking financial support during periods of unemployment.

Purpose of Credit Week

The purpose of a credit week in the context of unemployment benefits is to establish a standardized measurement to determine an individual’s eligibility for financial assistance. Credit weeks serve as milestones to assess an individual’s work history and contributions to the labor force, ensuring that they meet the necessary requirements to qualify for unemployment benefits.

One of the primary purposes of credit weeks is to provide a fair and consistent evaluation process for determining eligibility. By setting specific time frames and criteria, credit weeks create a standardized measurement that applies to all individuals seeking unemployment benefits. This helps to ensure that everyone is evaluated based on the same standards, regardless of their occupation or industry.

Additionally, credit weeks aim to encourage individuals to actively participate in the workforce and maintain a consistent work history. By considering an individual’s employment status over a specific period of time, credit weeks incentivize a continuous commitment to work. This can help individuals build a sustainable employment record and contribute to their long-term career prospects.

Another purpose of credit weeks is to prevent misuse or abuse of the unemployment benefits system. By requiring individuals to meet specific requirements during credit weeks, such as actively seeking employment and being available for work, the unemployment agency can ensure that benefits are provided to those who genuinely need temporary financial support due to involuntary job loss or other eligible circumstances.

Credit weeks also help unemployment agencies manage their resources effectively. By implementing credit weeks, agencies can determine the eligibility and entitlement of individuals to receive unemployment benefits. This ensures that funds are distributed to those who have met the necessary criteria, allowing the agency to allocate resources based on a structured and fair evaluation process.

In summary, the purpose of credit weeks is to establish a standardized measurement and evaluation process for determining an individual’s eligibility for unemployment benefits. By providing a fair and consistent framework, credit weeks help prevent misuse of the system, encourage consistent work history, and enable effective allocation of resources by unemployment agencies.

How Credit Week Works

Credit weeks operate by establishing specific time periods during which individuals must meet certain requirements to qualify for unemployment benefits. The process of how credit weeks work may vary depending on the regulations set by the state or country in which the individual resides. However, there are some common factors involved in understanding the workings of credit weeks.

Typically, credit weeks are calculated based on a seven-day period, starting from a specific day of the week. For example, in some jurisdictions, a credit week may start on Sunday and end on Saturday. This establishes a consistent time frame for assessing an individual’s eligibility for benefits.

During a credit week, an individual is required to meet specific requirements set by the unemployment agency. These requirements may include actively seeking employment, being available and willing to accept suitable job offers, and reporting any income earned during the credit week. Additionally, individuals may need to fulfill specific criteria related to their work history, such as having worked a minimum number of hours or earned a certain amount of wages.

Individuals are typically required to document their activities and efforts related to job searching during a credit week. This may involve keeping a record of job applications submitted, interviews attended, or any other relevant job search activities. This documentation is essential for demonstrating compliance with the requirements set by the unemployment agency.

It is important for individuals to accurately report their activities and income during the credit week. Falsifying information or failing to provide accurate details can result in penalties or loss of benefits. Therefore, it is crucial to understand the specific reporting requirements and follow them diligently.

Once an individual meets the requirements of a credit week, they may be eligible to receive unemployment benefits for that period. The exact amount and duration of benefits vary depending on the individual’s work history, earnings, and the regulations of the specific unemployment program.

Overall, credit weeks provide a structured framework for evaluating an individual’s eligibility for unemployment benefits. By adhering to the requirements and accurately documenting their activities during the credit week, individuals can increase their chances of qualifying for financial assistance during periods of unemployment.

Credit Week Eligibility

To be eligible for credit weeks and ultimately qualify for unemployment benefits, individuals must meet certain criteria set by the unemployment agency. The specific eligibility requirements may vary depending on the state or country in which the individual resides, but there are some common factors that determine credit week eligibility.

One of the primary requirements for credit week eligibility is having a qualifying work history. This typically means that individuals must have been employed and paid into the unemployment insurance system for a certain period of time. The duration of this work history requirement can vary, but it is usually within the past 12 to 18 months.

In addition to a qualifying work history, individuals are usually required to have lost their job through no fault of their own. This could include scenarios such as being laid off, having a job contract expire, or experiencing business closures. Generally, individuals who voluntarily leave their job or are terminated due to misconduct may not be eligible for credit weeks or unemployment benefits.

Another important factor in credit week eligibility is actively seeking suitable employment. Individuals are typically required to actively search for work and be available for job opportunities during their credit weeks. This could involve applying for jobs, attending job interviews, or participating in job placement programs as directed by the unemployment agency.

Documentation of job search activities is often required to demonstrate compliance with the active job search requirement. This may include keeping a record of job applications submitted, interview invitations, networking events attended, or any other relevant job search activities. It is important to follow the specific reporting guidelines outlined by the unemployment agency to ensure eligibility for credit weeks and unemployment benefits.

It is crucial to note that eligibility criteria and requirements for credit weeks can vary significantly by jurisdiction. Some states or countries may have additional conditions or restrictions, such as earnings thresholds, specific hours worked, or residence requirements. It is essential for individuals to familiarize themselves with the eligibility criteria specific to their location to ensure they meet all necessary requirements.

By meeting the eligibility criteria for credit weeks, individuals can establish their qualifications for unemployment benefits. It is important to stay informed about the requirements set by the unemployment agency, actively pursue suitable employment opportunities, and provide accurate documentation to ensure eligibility for credit weeks and access to financial support during periods of unemployment.

Filing for Credit Week

Filing for credit weeks is an essential step in the process of applying for unemployment benefits. It involves submitting the necessary documentation and information to the unemployment agency to establish eligibility for financial assistance during periods of unemployment.

The exact process and requirements for filing credit weeks may vary depending on the state or country in which the individual resides. However, there are some common steps involved in filing for credit weeks.

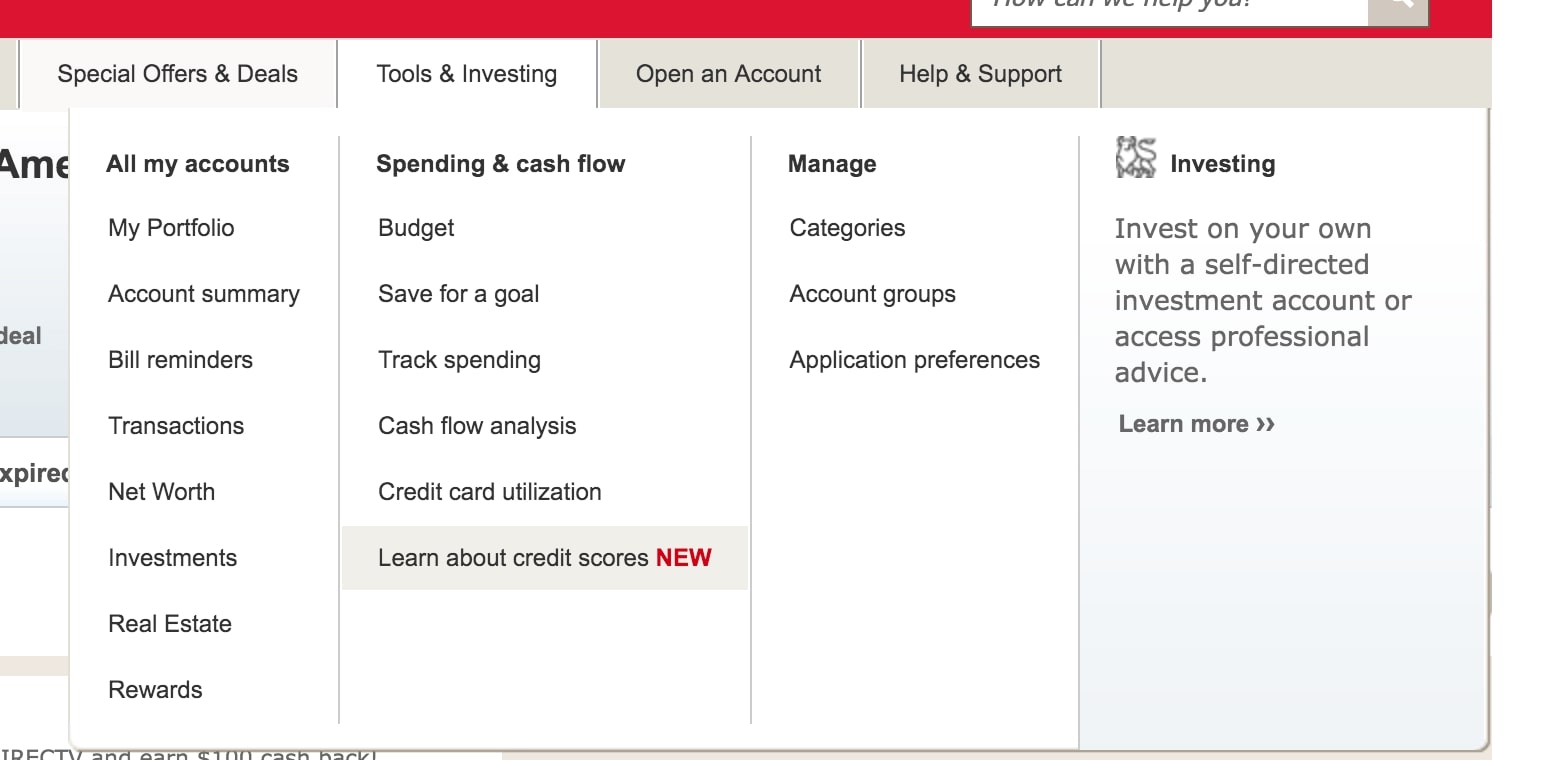

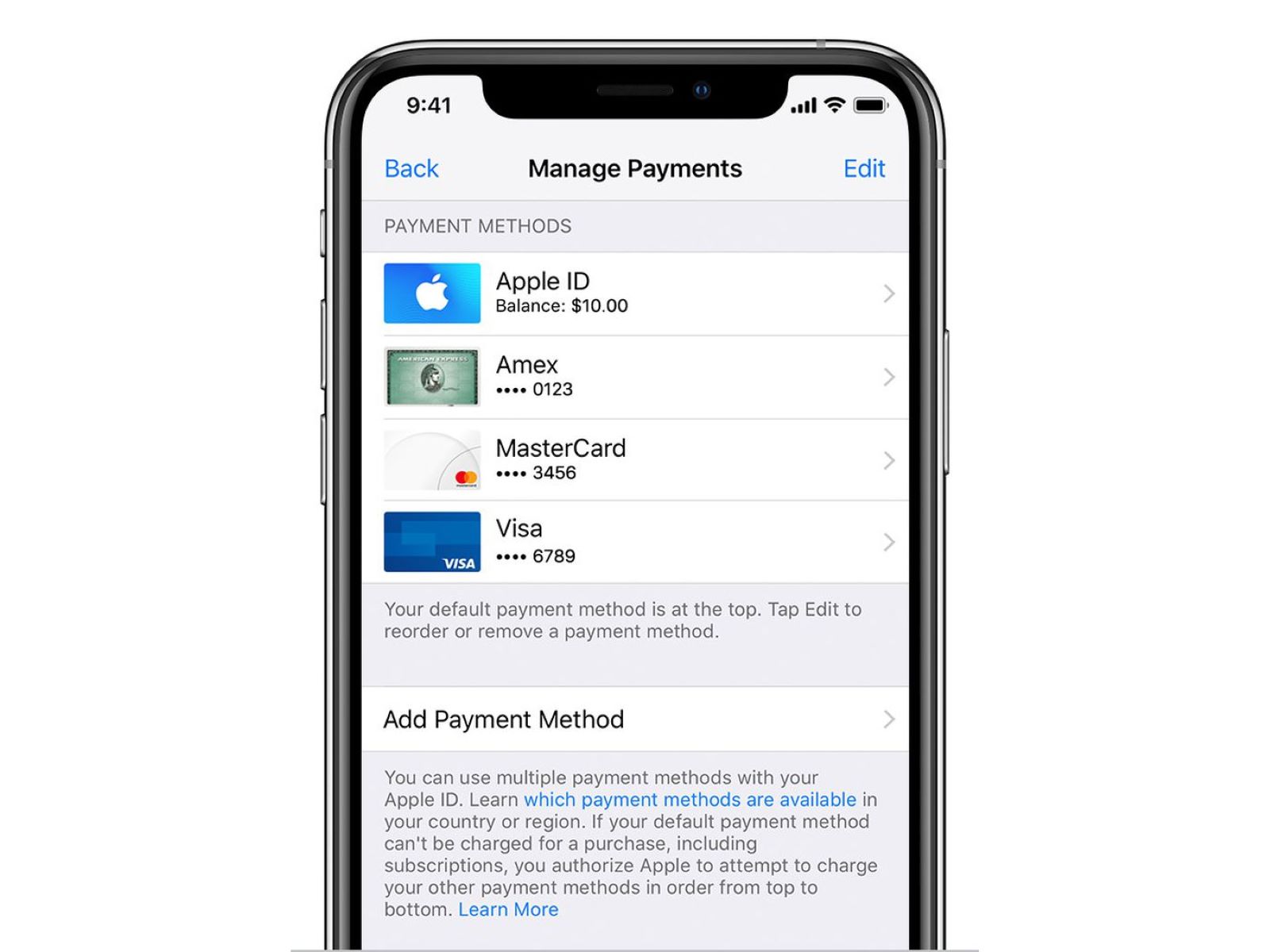

First, individuals typically need to create an account or register with the unemployment agency. This can often be done through an online portal or by visiting a local unemployment office. During the registration process, individuals may be required to provide personal information, such as their name, contact details, and Social Security number.

Once registered, individuals can proceed with filing their credit weeks by submitting the necessary documentation. This usually includes reporting any income earned during the credit week and providing details of job search activities carried out, such as job applications submitted, interviews attended, or networking events attended.

Different unemployment agencies may have specific reporting guidelines and formats for documenting credit weeks. It is important to carefully follow the instructions and provide accurate information to avoid any delays or issues with the application process.

Many unemployment agencies have embraced online platforms for filing credit weeks to streamline the process and provide a convenient experience for applicants. These online systems often allow individuals to easily input their job search activities and income details directly into the system, eliminating the need for paper forms and manual submissions.

Apart from reporting activities during the credit week, individuals may also need to certify that they are available for work, actively seeking employment, and willing to accept suitable job offers during the credit week. This certification may be done online or by phone, depending on the procedures established by the unemployment agency.

It is important to understand the deadlines for filing credit weeks. Missing the deadline can result in delays or even the loss of benefits. Therefore, individuals should be aware of the specific filing deadlines and submit the necessary documentation promptly.

By filing for credit weeks accurately and on time, individuals can establish their eligibility for unemployment benefits. It is crucial to stay informed about the filing requirements set by the unemployment agency and provide all necessary documentation to ensure a smooth and efficient application process.

Benefits of Credit Week

Credit weeks offer several benefits for both individuals and the unemployment system as a whole. Understanding these advantages can help individuals navigate the unemployment process more effectively and make the most of the resources available to them.

1. Standardized Evaluation: Credit weeks provide a standardized framework for evaluating an individual’s eligibility for unemployment benefits. By setting specific time periods and criteria, credit weeks ensure that everyone is evaluated based on the same standards, promoting fairness and consistency in the system.

2. Milestone for Eligibility: Credit weeks serve as milestones to assess an individual’s work history and contributions to the labor force. They establish a clear timeframe within which an individual must meet certain requirements to qualify for benefits. This helps unemployment agencies determine eligibility based on an individual’s past contributions to the workforce.

3. Incentive for Continuous Work History: Credit weeks encourage individuals to maintain a consistent work history. By requiring individuals to have a qualifying work history and actively seek suitable employment during credit weeks, the system incentivizes a continuous commitment to work. This can have positive long-term effects on an individual’s career prospects and financial stability.

4. Prevention of Benefit Misuse: Credit weeks help prevent misuse or abuse of the unemployment benefits system. By requiring individuals to meet specific requirements during credit weeks, such as actively seeking employment and being available for work, the system ensures that benefits are provided to those genuinely in need and who meet the established criteria.

5. Efficient Resource Allocation: Credit weeks enable unemployment agencies to allocate their resources effectively. By evaluating an individual’s eligibility based on credit weeks, agencies can determine the entitlement and duration of benefits, allowing for optimized utilization of funds and resources available for unemployment assistance.

6. Financial Support During Unemployment: Perhaps the most crucial benefit of credit weeks is that they allow individuals to access financial support during periods of unemployment. By meeting the requirements of credit weeks, individuals may qualify for unemployment benefits, which can provide temporary financial relief and help cover essential expenses until they secure new employment.

7. Assistance with Job Search: Credit weeks often require individuals to actively seek suitable employment during that time. This requirement can provide additional motivation and focus for individuals to engage in job search activities. Unemployment agencies may also offer job placement services, training programs, or workshops to support individuals in their job search efforts.

Overall, credit weeks play a vital role in the unemployment benefits system by evaluating eligibility, preventing misuse, and providing financial support to individuals during periods of unemployment. By understanding the benefits of credit weeks, individuals can better navigate the unemployment process and access the resources they need during challenging times.

Credit Week Extensions

In certain circumstances, individuals may be eligible for credit week extensions, which allow for an extended period of time to meet the requirements for receiving unemployment benefits. Credit week extensions offer flexibility and support to those who may need additional time to secure suitable employment or meet other eligibility criteria. While the availability and conditions for credit week extensions may vary by jurisdiction, they generally aim to assist individuals in their job search efforts and provide continued financial support.

One common scenario where credit week extensions may be granted is if an individual is actively participating in an approved training or education program. These programs may be designed to enhance an individual’s skills and increase their chances of finding suitable employment. In such cases, credit week extensions allow individuals to focus on their training or education while still maintaining eligibility for unemployment benefits.

Additionally, credit week extensions may be available for individuals who have experienced extenuating circumstances that hindered their ability to actively seek employment during the initial credit week period. Such circumstances may include medical emergencies, personal or family emergencies, or other valid reasons that temporarily limit an individual’s availability for work.

It is important for individuals to carefully review the specific guidelines and requirements set by the unemployment agency in their jurisdiction regarding credit week extensions. This may involve providing documentation or proof of participation in an approved program or demonstrating the extenuating circumstances that warrant an extension.

While credit week extensions can provide much-needed flexibility and support, it is crucial to adhere to any reporting or documentation requirements during the extended period. Individuals should communicate with the unemployment agency and provide any necessary updates or changes in their situation to ensure continued eligibility for benefits.

It’s important to note that credit week extensions are not automatically granted but are typically evaluated on a case-by-case basis. The availability and conditions for credit week extensions may also change over time, depending on the policies and regulations established by the unemployment agency in response to prevailing economic conditions or other factors.

By understanding the possibility of credit week extensions and the criteria for eligibility, individuals can effectively plan their job search efforts and take advantage of the additional time offered to meet the requirements for receiving unemployment benefits. It is recommended to consult the local unemployment agency or review the official guidelines to determine if credit week extensions are available and how to apply for them.

Conclusion

Credit weeks play a significant role in the process of filing for unemployment benefits. They provide a standardized measurement to determine an individual’s eligibility for financial assistance, based on their work history and employment status during specific time periods. Understanding the concept and workings of credit weeks is crucial for individuals navigating the unemployment system and seeking financial support during periods of unemployment.

By adhering to the requirements of credit weeks, individuals can establish their eligibility for unemployment benefits and gain access to essential financial support. The standardized evaluation process ensures fairness and consistency in determining who qualifies for benefits, preventing misuse or abuse of the system.

Credit weeks also encourage individuals to maintain a consistent work history and actively seek suitable employment, promoting long-term career prospects and financial stability. They provide a structured framework for job search activities and documentation, fostering accountability and motivating individuals to actively engage in their job search efforts.

Furthermore, credit weeks help unemployment agencies effectively allocate resources by ensuring benefits are provided to those who meet the established criteria. By efficiently evaluating eligibility based on credit weeks, agencies can make informed decisions on the distribution of funds and support individuals in their time of need.

It is essential for individuals to stay informed about the specific requirements and guidelines set by their local unemployment agency regarding credit weeks. This includes accurately reporting job search activities, income earned, and meeting any additional criteria that may be in place. By understanding and following the processes and deadlines for filing credit weeks, individuals can maximize their chances of qualifying for unemployment benefits and accessing the financial support needed during periods of unemployment.

In conclusion, credit weeks serve as an integral part of the unemployment benefits system, providing a standardized and fair evaluation process. They incentivize active job search efforts while ensuring proper resource allocation. By understanding and fulfilling the requirements of credit weeks, individuals can navigate the unemployment system more effectively and receive the financial assistance they need during challenging times.