Finance

What Is A 13-Week Cash Flow

Published: December 21, 2023

Discover the importance of a 13-week cash flow and how it can help manage your finances effectively. Optimize your cash flow management with expert financial guidance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of a 13-Week Cash Flow

- Purpose of a 13-Week Cash Flow

- Benefits of Implementing a 13-Week Cash Flow

- Components of a 13-Week Cash Flow

- Creating a 13-Week Cash Flow Statement

- Monitoring and Analyzing a 13-Week Cash Flow

- Importance of Accuracy in a 13-Week Cash Flow

- Challenges and Limitations of a 13-Week Cash Flow

- Conclusion

Introduction

Managing cash flow is crucial for the financial well-being of any business. It ensures that there is enough cash available to cover expenses, pay employees, and invest in growth opportunities. One effective tool that helps businesses stay on top of their cash flow is the 13-week cash flow forecast.

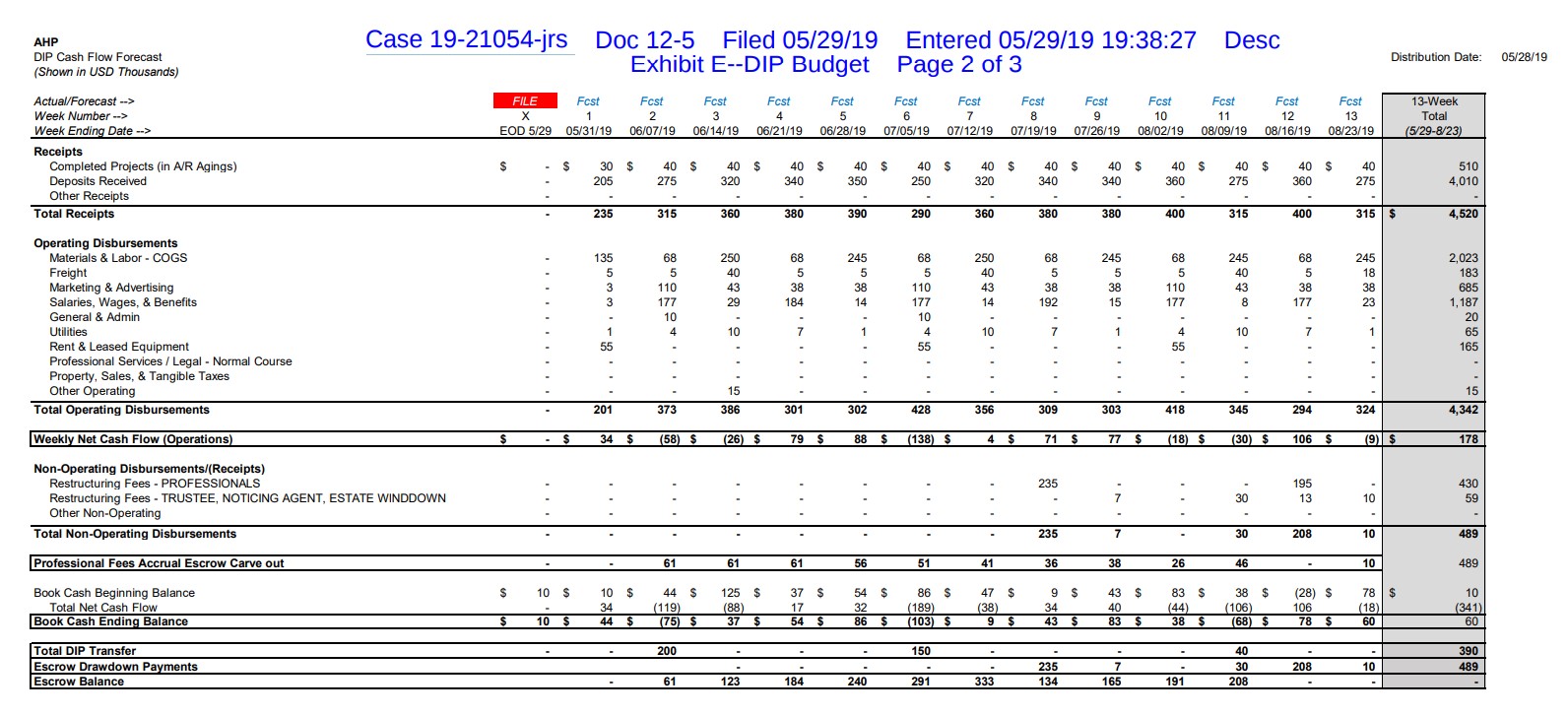

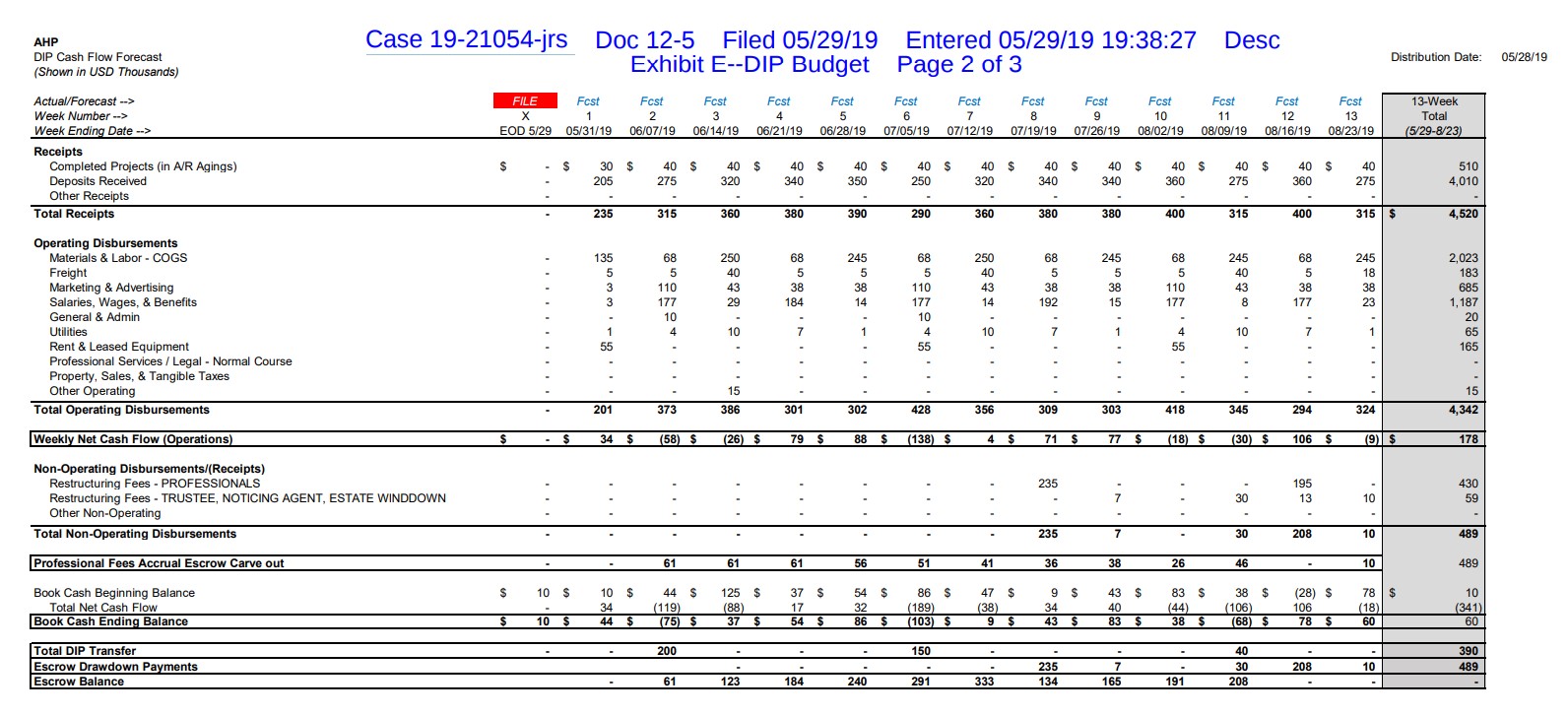

A 13-week cash flow forecast, also known as a 13-week cash flow projection, is a financial management tool that provides a detailed overview of a company’s anticipated cash inflows and outflows over a 13-week period. It helps businesses anticipate cash flow issues, identify potential gaps, and take proactive measures to maintain a healthy financial position.

A 13-week cash flow forecast is an invaluable tool, particularly for small businesses and startups that may have limited financial resources and higher cash flow volatility. It allows business owners and financial managers to make informed decisions about spending, borrowing, and adjusting their operations based on cash flow projections.

While a traditional cash flow statement typically covers a longer time frame, such as a year or a quarter, a 13-week cash flow forecast zooms in on a shorter period to provide a more granular view of cash flow fluctuations. This shorter time frame allows businesses to respond quickly to changes in their cash position and take corrective action if necessary.

In the following sections, we will delve deeper into the definition and purpose of a 13-week cash flow forecast, explore its benefits, examine the components of a 13-week cash flow statement, and discuss how businesses can create, monitor, and analyze this financial tool. We will also address the importance of accuracy in a 13-week cash flow forecast and highlight its challenges and limitations.

Overall, a 13-week cash flow forecast is an essential tool to help businesses manage their cash flow effectively and maintain financial stability. By gaining insights into future cash flow, businesses can make strategic decisions to optimize their operations, secure financing when needed, and navigate through challenging times with greater confidence.

Definition of a 13-Week Cash Flow

A 13-week cash flow is a financial management tool that provides a detailed forecast of a company’s expected cash inflows and outflows over a 13-week period. It allows businesses to anticipate and plan for their cash needs, ensuring they have enough liquidity to meet their financial obligations.

Unlike a traditional cash flow statement, which covers a longer period such as a year or a quarter, a 13-week cash flow provides a more short-term perspective. This shorter time frame allows businesses to closely monitor their cash position and make timely adjustments to their operations if needed.

The 13-week cash flow forecast includes all anticipated cash inflows, such as sales revenue, loans, investments, and other sources of cash, as well as all anticipated cash outflows, such as payroll, inventory purchases, operating expenses, loan repayments, and taxes. By examining these inflows and outflows, businesses can project their cash balance at the end of each week and identify potential cash flow gaps before they occur.

A 13-week cash flow forecast takes into account both historical data and future projections. It considers past cash flow patterns, market trends, customer behavior, and any known upcoming events or expenses that may impact cash flow. This comprehensive approach helps businesses make accurate and realistic forecasts, enabling them to make informed decisions regarding cash management.

It is important to note that a 13-week cash flow forecast is not set in stone. It serves as a guideline and should be regularly updated and adjusted as new information becomes available. By continuously monitoring and updating the forecast, businesses can adapt to changes in their cash flow situation and take proactive measures to address any potential shortfalls or surpluses.

Overall, a 13-week cash flow provides businesses with a clear picture of their short-term financial health. It helps them manage cash flow fluctuations, make informed decisions, and maintain financial stability, ultimately contributing to their long-term success.

Purpose of a 13-Week Cash Flow

The purpose of a 13-week cash flow forecast is to provide businesses with a proactive tool to anticipate and manage their cash flow, ensuring they have sufficient liquidity to meet their financial obligations. It serves several key purposes in financial management:

- Identifying potential cash flow gaps: A 13-week cash flow forecast helps businesses identify periods where their cash inflows might not be sufficient to cover their outflows. By pinpointing potential gaps in cash flow, businesses can take proactive measures to address them, such as adjusting spending, pursuing additional sources of financing, or prioritizing payment schedules.

- Forecasting cash needs: By projecting future cash inflows and outflows, a 13-week cash flow forecast allows businesses to forecast their cash needs accurately. This helps them plan and allocate resources effectively, ensuring they have enough cash on hand to cover day-to-day expenses, debt payments, investments, and other financial obligations.

- Supporting financial decision-making: A 13-week cash flow forecast provides businesses with valuable insights to make informed financial decisions. It enables them to evaluate the potential impact of various scenarios, such as changes in pricing, sales volumes, or expenses, helping them determine the most appropriate course of action to achieve their financial goals.

- Managing working capital: Effective working capital management is crucial for maintaining the operational stability of a business. A 13-week cash flow forecast helps businesses assess their working capital needs and make strategic decisions to optimize inventory levels, manage accounts receivable and accounts payable, and allocate resources efficiently.

- Facilitating communication and planning: A 13-week cash flow forecast serves as a communication tool within the organization. It allows stakeholders, including business owners, managers, and lenders, to understand the company’s cash flow position and make collaborative decisions. Additionally, it aids in long-term planning by providing insights into future cash flow trends and guiding strategic initiatives.

Overall, the purpose of a 13-week cash flow forecast is to provide businesses with a forward-looking financial tool to effectively manage their cash flow. It helps them navigate through uncertain times, make informed decisions, and maintain financial stability, ultimately contributing to the long-term success and sustainability of the business.

Benefits of Implementing a 13-Week Cash Flow

Implementing a 13-week cash flow forecast offers numerous benefits for businesses of all sizes and industries. It provides valuable insights and helps businesses stay ahead of their financial obligations. Here are some key benefits of implementing a 13-week cash flow forecast:

- Better cash flow management: A 13-week cash flow forecast allows businesses to have a clear understanding of their cash position in the short term. By accurately projecting cash inflows and outflows, businesses can proactively manage their cash flow, ensuring they have enough liquidity to cover expenses and make timely payments.

- Improved decision-making: Having a 13-week cash flow forecast provides businesses with the necessary information to make informed financial decisions. It helps them evaluate the financial impact of different scenarios and choose the most appropriate course of action. Whether it’s investing in growth opportunities, managing expenses, or adjusting pricing strategies, a cash flow forecast serves as a valuable guide.

- Early identification of cash flow issues: A 13-week cash flow forecast enables businesses to identify potential cash flow gaps or shortfalls well in advance. This early detection allows businesses to take proactive measures, such as renegotiating payment terms with suppliers or securing additional financing, to address these issues before they become critical.

- Increased financial stability: By effectively managing cash flow and addressing potential issues, businesses can improve their overall financial stability. Maintaining adequate cash reserves and being prepared for any unexpected expenses or downturns can help businesses weather financial challenges and maintain operations without disruption.

- Better relationships with stakeholders: A 13-week cash flow forecast helps businesses build stronger relationships with stakeholders, including lenders, investors, and suppliers. It demonstrates financial responsibility and transparency, instilling confidence in the organization and fostering trust among external parties.

- Opportunity for strategic planning: With a 13-week cash flow forecast, businesses can plan for the future and make strategic decisions based on a solid financial foundation. By understanding future cash flow trends and patterns, businesses can identify opportunities for growth, assess potential risks, and align their resources and strategies accordingly.

In summary, implementing a 13-week cash flow forecast provides businesses with better cash flow management, improved decision-making capabilities, early identification of potential issues, increased financial stability, stronger stakeholder relationships, and opportunities for strategic planning. By taking a proactive approach to cash flow management, businesses can enhance their financial performance and position themselves for long-term success.

Components of a 13-Week Cash Flow

A 13-week cash flow forecast consists of various components that capture the inflows and outflows of cash over a 13-week period. These components help businesses assess their cash position and make informed financial decisions. Here are the key components of a 13-week cash flow:

- Beginning Cash Balance: The starting point of a 13-week cash flow forecast is the opening balance of cash available at the beginning of the forecast period. This includes cash on hand, in bank accounts, and any other liquid assets.

- Cash Inflows: This component represents all sources of cash that are expected to come into the business during the 13-week period. It includes cash sales, accounts receivable collections, loan proceeds, investment income, and any other sources of cash inflows.

- Cash Outflows: Cash outflows refer to all anticipated cash payments that a business needs to make during the 13-week period. This component includes expenses such as payroll, rent, utilities, inventory purchases, loan repayments, taxes, and any other cash payments.

- Net Cash Flow: Net cash flow is calculated by subtracting the total cash outflows from the total cash inflows. It represents the overall change in cash available to the business during the 13-week period.

- Ending Cash Balance: The ending cash balance is the result of the net cash flow added to the beginning cash balance. It represents the projected cash balance at the end of each week within the 13-week forecast.

- Surplus/Shortfall: The surplus or shortfall is determined by comparing the ending cash balance to the target cash balance. A surplus indicates that the projected cash balance is higher than the desired level, while a shortfall indicates that the projected cash balance is lower than the desired threshold.

- Notes and Assumptions: It is essential to document any significant assumptions or notes that impact the accuracy and validity of the 13-week cash flow forecast. This component ensures transparency and provides context for the forecast’s underlying assumptions.

By examining these components, businesses can gain a comprehensive understanding of their cash flow patterns, identify potential issues, and make informed decisions on how to manage their cash effectively. Regularly updating and monitoring these components allows businesses to adjust their strategies and operations based on the latest cash flow projections.

It is important to note that the specific components of a 13-week cash flow forecast may vary depending on the nature and complexity of the business. Some businesses may have additional categories or subcategories to capture specific cash flow activities relevant to their industry or operations.

In summary, the components of a 13-week cash flow forecast include the beginning cash balance, cash inflows, cash outflows, net cash flow, ending cash balance, surplus/shortfall, and notes/assumptions. These components collectively provide a detailed snapshot of a business’s cash flow over the designated period, enabling effective cash management and decision-making.

Creating a 13-Week Cash Flow Statement

Creating a 13-week cash flow statement involves several steps to accurately project the cash inflows and outflows over a 13-week period. While the specific approach may vary depending on the business’s needs and industry, here is a general framework to help businesses create a 13-week cash flow statement:

- Gather historical data: Begin by collecting historical financial data, particularly cash flow information, for a similar 13-week period in the past. This historical data will serve as a reference point and help identify any recurring patterns or trends in cash flow.

- Identify cash flow categories: Categorize cash inflows and outflows into specific categories that are relevant to the business. This may include sales revenue, accounts receivable collections, loan proceeds, operating expenses, payroll, loan repayments, taxes, and other relevant categories.

- Estimate future cash inflows: Based on historical data and future business projections, estimate the expected cash inflows for each category over the 13-week period. Consider factors such as sales growth, customer payment behavior, seasonality, and any other relevant variables that may impact cash inflows.

- Forecast cash outflows: Similarly, project the anticipated cash outflows for each category over the 13-week period. This may include expenses such as rent, utilities, inventory purchases, payroll, loan repayments, taxes, and other relevant expenses. Consider any upcoming expenses, changes in vendor terms, or other factors that may affect cash outflows.

- Calculate net cash flow: Subtract the total projected cash outflows from the total projected cash inflows for each week. This will give you the net cash flow for each week within the 13-week forecast.

- Calculate ending cash balance: Start with the beginning cash balance (which can be the actual cash balance at the beginning of the forecast or a projected starting point) and add the net cash flow for each week to calculate the ending cash balance for that week.

- Check for surplus or shortfall: Compare the ending cash balance for each week to the desired target cash balance. Identify any weeks with a surplus or shortfall to determine if adjustments need to be made in cash management or funding activities.

- Review and refine: Regularly review and refine the 13-week cash flow statement as new information becomes available. Adjust projections based on actual cash flow results and update any assumptions or variables that may have changed.

By following these steps and regularly updating the 13-week cash flow statement, businesses can gain a clearer understanding of their cash position, monitor cash flow trends, and make informed financial decisions to better manage their cash flow.

It’s important to note that creating an accurate 13-week cash flow statement requires attention to detail and reliance on historical data and informed projections. In some cases, businesses may seek the assistance of a financial professional or use specialized financial software to streamline the process and ensure accuracy.

In summary, creating a 13-week cash flow statement involves gathering historical data, identifying cash flow categories, estimating future cash inflows and outflows, calculating net cash flow, determining ending cash balances, checking for surpluses or shortfalls, and regularly reviewing and refining the statement. This process helps businesses gain insights into their cash flow and enables effective cash management and decision-making.

Monitoring and Analyzing a 13-Week Cash Flow

Monitoring and analyzing a 13-week cash flow is a critical part of effective cash flow management. By regularly reviewing and evaluating the cash flow statement, businesses can identify potential issues, make informed decisions, and take proactive measures to ensure financial stability. Here are some key steps to monitor and analyze a 13-week cash flow:

- Regular review: Set a schedule to review the 13-week cash flow statement on a regular basis. This can be done weekly or bi-weekly to stay updated on the latest cash flow projections and any changes that may have occurred.

- Compare projections to actuals: Compare the projected cash flow to the actual cash flow. Assess any variances and identify the reasons for the differences. This analysis helps businesses understand the accuracy of their projections and make adjustments if necessary.

- Identify cash flow gaps: Continuously monitor the cash flow statement to identify potential gaps or shortfalls in cash flow. Identify weeks or periods where the projected ending cash balance may fall below the desired threshold. This foresight allows businesses to take proactive measures to address the shortfall, such as adjusting spending or pursuing additional sources of financing.

- Stress testing: Conducting stress tests can help businesses assess the impact of potential financial scenarios on cash flow. Explore various what-if scenarios, such as changes in sales volume, pricing, or payment terms, to understand how these factors would affect cash flow. This analysis enables businesses to make contingency plans and mitigate potential risks.

- Identify trends and patterns: Analyze the cash flow statement to identify trends and patterns in cash inflows and outflows. Look for seasonality or fluctuations in revenue and expenses that may impact cash flow. Understanding these trends allows businesses to anticipate future cash flow fluctuations and adjust their strategies accordingly.

- Continuous improvement: Use the insights gained from the analysis of the 13-week cash flow to continuously refine and improve the accuracy of future projections. Update assumptions, adjust variables, and incorporate lessons learned to enhance the forecasting process.

- Communication and collaboration: Share the 13-week cash flow statement with key stakeholders, such as business owners, managers, and financial team members. Discuss the findings, implications, and potential actions to be taken. Collaboration and input from multiple perspectives can lead to better financial decision-making.

Monitoring and analyzing the 13-week cash flow statement is a dynamic process. It requires regular attention, adaptability, and a willingness to adjust strategies based on the latest insights. By staying proactive and vigilant in monitoring cash flow, businesses can position themselves for financial stability and make informed decisions to achieve their long-term goals.

In summary, monitoring and analyzing a 13-week cash flow involves regular review, comparing projections to actuals, identifying cash flow gaps, stress testing, identifying trends, continuous improvement, and fostering communication and collaboration. These steps help businesses stay on top of their cash flow, identify risks and opportunities, and take appropriate actions to enhance financial performance.

Importance of Accuracy in a 13-Week Cash Flow

Accuracy is paramount when it comes to a 13-week cash flow forecast. The level of accuracy directly impacts a business’s ability to effectively manage its cash flow, make informed financial decisions, and maintain financial stability. Here are some key reasons highlighting the importance of accuracy in a 13-week cash flow:

- Financial decision-making: Accurate cash flow projections enable businesses to make informed financial decisions. Whether it’s allocating funds for investments, managing expenses, or planning for future growth, having accurate cash flow information allows businesses to make strategic and well-informed decisions that align with their financial goals.

- Liquidity management: Cash flow accuracy is crucial for businesses to maintain sufficient liquidity. Knowing the timing and amount of cash inflows and outflows helps businesses ensure they have enough funds available to cover expenses, pay suppliers, and meet financial obligations without facing cash shortages.

- Operational planning: An accurate 13-week cash flow forecast serves as a foundation for operational planning. It helps businesses align their resources, staffing levels, and inventory management with projected cash inflows and outflows. This alignment allows for smoother operations and avoids costly disruptions caused by unexpected cash flow gaps.

- Investor and lender confidence: Accurate cash flow projections demonstrate financial acumen and reliability, which can boost investor and lender confidence. When businesses can accurately portray their cash flow position, it fosters trust and increases the likelihood of securing financing or attracting potential investors.

- Working capital management: Accurate cash flow forecasts aid in efficient working capital management. Businesses can use the forecast to optimize inventory levels, effectively manage accounts receivable and accounts payable, and identify opportunities to reduce costs or improve cash conversion cycles. This improves overall operational efficiency and reduces the risk of cash flow bottlenecks.

- Early identification of cash flow issues: An accurate 13-week cash flow forecast allows businesses to identify potential cash flow issues before they become critical. By reviewing and analyzing the forecast with precision, businesses can take proactive measures to address cash flow gaps, such as renegotiating payment terms, prioritizing collections, or adjusting spending patterns.

- Business resilience and growth: Accurate cash flow projections help businesses maintain financial stability and build resilience to withstand uncertain times. By accurately identifying cash flow trends and patterns, businesses can adapt their strategies, secure financing when necessary, and make informed decisions that promote continued growth and success.

The importance of accuracy in a 13-week cash flow cannot be overstated. It provides crucial information for financial decision-making, liquidity management, operational planning, investor and lender confidence, working capital management, early identification of cash flow issues, and business resilience and growth. By striving for accuracy in cash flow forecasts, businesses can navigate challenges and seize opportunities with confidence, ultimately contributing to their long-term success.

Challenges and Limitations of a 13-Week Cash Flow

While a 13-week cash flow forecast is a valuable tool for managing cash flow, it does come with its own set of challenges and limitations. Understanding these challenges can help businesses make more realistic projections and address potential limitations. Here are some common challenges and limitations associated with a 13-week cash flow:

- Uncertainty and unpredictability: The accuracy of a 13-week cash flow forecast heavily relies on assumptions about future cash inflows and outflows. However, predicting the future with complete certainty is impossible. Changes in the economy, market conditions, customer behavior, and other external factors can significantly impact the accuracy of the forecast.

- Limited historical data: A 13-week cash flow forecast may have limited historical data to rely on, especially for new businesses or during periods of significant change. This lack of historical data can make it challenging to accurately project cash flow patterns, leading to increased uncertainty in the forecast.

- Fluctuating cash flow: Some businesses experience cash flow fluctuations that may not fit neatly within a 13-week timeframe. Seasonal businesses, for instance, may have periods of high cash inflows followed by periods of lower activity. These fluctuations can make it difficult to accurately project cash flow over a fixed 13-week period.

- External dependencies: A 13-week cash flow forecast may be influenced by external variables that are beyond a business’s control. For example, changes in interest rates, government regulations, or supplier payment terms can affect cash inflows and outflows. Incorporating these external dependencies accurately into the forecast can be challenging.

- Changing business conditions: Business conditions can change rapidly, introducing potential inaccuracies in the cash flow forecast. Unexpected events, such as a sudden drop in sales or a global pandemic, can significantly impact projected cash inflows and outflows. Staying agile and regularly updating the forecast can help address the challenge of changing business conditions.

- Timing and collection of data: Gathering accurate and up-to-date data for the cash flow forecast can be a challenge. Timely collection of data, such as sales receipts, accounts receivable, and payable information, is crucial for an accurate forecast. Any delays or discrepancies in data collection can affect the accuracy of the cash flow projections.

- Assumption risks: Cash flow forecasts involve various assumptions about future events and business performance. These assumptions may not always align with the actual outcomes. If key assumptions prove to be inaccurate, it can impact the overall accuracy of the cash flow forecast.

Despite these challenges and limitations, a 13-week cash flow forecast remains a valuable tool for businesses to gain insights into their short-term cash flow. While it may not provide absolute certainty, it can help businesses anticipate potential cash flow issues, make informed decisions, and take proactive measures to maintain financial stability. By regularly reviewing and updating the forecast, businesses can adapt to changing conditions and mitigate the impact of these challenges.

In summary, challenges and limitations of a 13-week cash flow include uncertainty and unpredictability, limited historical data, fluctuating cash flow, external dependencies, changing business conditions, timing and data collection challenges, and assumption risks. By acknowledging these limitations and addressing them appropriately, businesses can make more realistic projections and utilize the 13-week cash flow as a valuable tool for cash flow management.

Conclusion

A 13-week cash flow forecast is an essential financial management tool that provides businesses with insights into their short-term cash flow. By projecting cash inflows and outflows over a 13-week period, businesses can make informed decisions, anticipate potential issues, and maintain financial stability.

Throughout this article, we’ve explored the definition of a 13-week cash flow, its purpose, benefits, components, and the process of creating, monitoring, and analyzing it. We’ve also discussed the importance of accuracy in a 13-week cash flow forecast and highlighted the challenges and limitations businesses may encounter when implementing this tool.

Accurate cash flow forecasting is crucial for businesses to effectively manage their financial resources, make informed decisions, and adapt to changing market conditions. It helps businesses anticipate cash flow gaps, manage working capital, and build resilience in the face of uncertainty. By monitoring and analyzing the 13-week cash flow, businesses can identify trends, proactively address cash flow challenges, and align their strategies with their financial goals.

However, it’s important to recognize that a 13-week cash flow forecast has its limitations, including potential inaccuracies due to uncertainty, limited historical data, fluctuating cash flow, external dependencies, and changing business conditions. These challenges emphasize the need for regular review, adjustment, and flexibility in the forecasting process.

In conclusion, a 13-week cash flow forecast is a valuable tool for businesses to manage their cash flow effectively. By striving for accuracy, regularly monitoring and analyzing the forecast, and addressing potential limitations, businesses can enhance financial decision-making, maintain liquidity, and position themselves for long-term success.