Finance

Sotheby’s Definition

Published: January 31, 2024

Learn more about finance with Sotheby's Definition, your comprehensive guide to understanding financial concepts, from budgeting and investing to banking and taxes.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Mastering Your Finances: A Guide to Financial Freedom

Welcome to our Finance category, where we provide you with expert insights and guidance on all things related to managing your finances. Whether you’re looking to save for a dream vacation, navigate the complex world of investing, or simply gain a better understanding of personal finance, you’ve come to the right place. In this blog post, we’ll explore the key principles to help you master your finances and achieve financial freedom.

Key Takeaways:

- Understand the importance of budgeting and tracking your expenses.

- Invest wisely to grow your wealth over time.

Financial freedom is a goal many aspire to achieve. It provides a sense of security, the ability to pursue your dreams, and the freedom to make choices without being hindered by financial constraints. But how exactly do you get there?

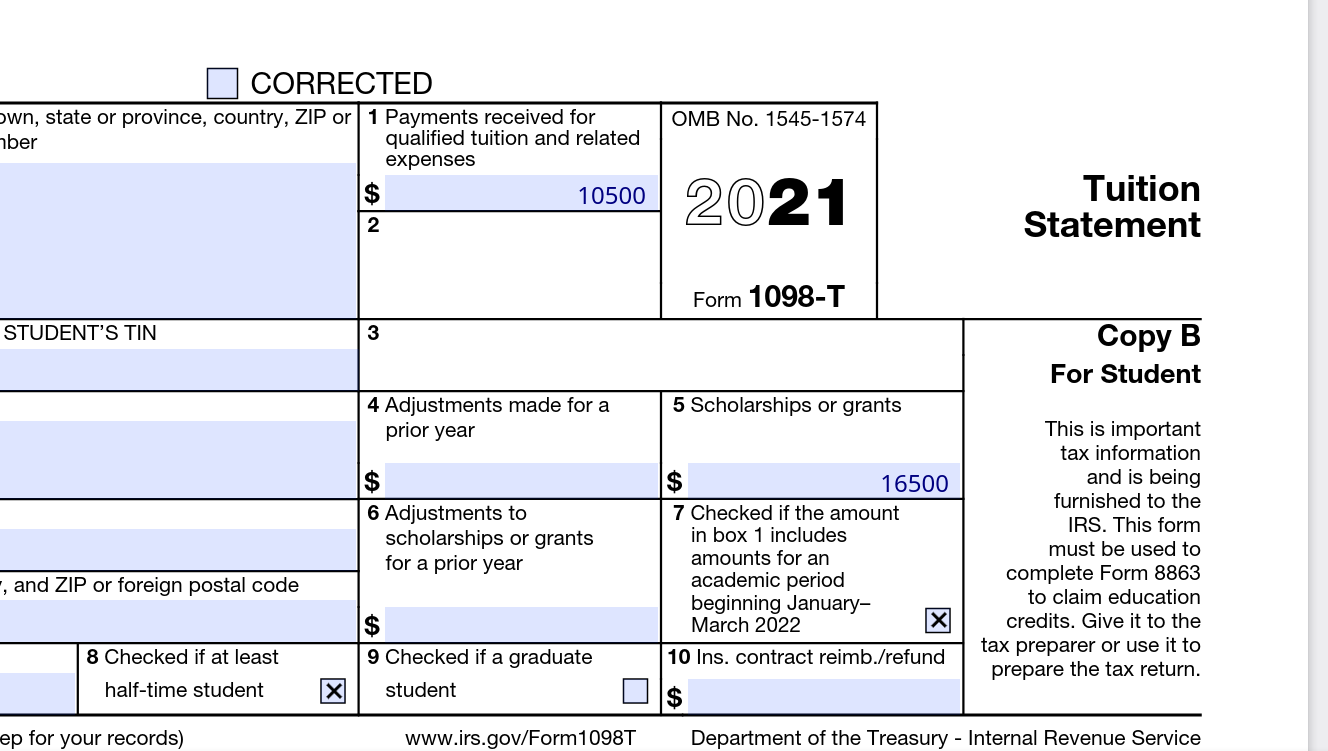

Budgeting is one of the foundational steps towards financial success. By setting clear financial goals and creating a budget that aligns with those goals, you gain control over your money. Start by identifying your income sources and fixed expenses, such as rent or mortgage payments, utilities, and groceries. Then, factor in variable expenses like entertainment and dining out. Tracking your expenses diligently allows you to identify any areas where you may be overspending and make adjustments accordingly. Put simply, budgeting helps you spend less than you earn and avoid going into debt.

Investing is another crucial aspect of achieving financial freedom. By putting your money to work in investment vehicles such as stocks, bonds, or real estate, you can grow your wealth over time. It’s essential to educate yourself about different investment options and their associated risks and returns. Diversifying your investment portfolio can help mitigate risk and maximize potential gains. Consider seeking advice from a financial advisor to develop a sound investment strategy that aligns with your goals and risk tolerance.

To further enhance your financial well-being, consider implementing the following strategies:

- Automate your savings: Set up automatic transfers to a dedicated savings account or retirement fund to ensure consistent saving habits.

- Emergency fund: Build an emergency fund to cover unexpected expenses, such as medical bills or car repairs, and avoid dipping into your long-term savings.

- Insurance coverage: Protect yourself and your assets by having adequate insurance coverage, including health, auto, and homeowner’s or renter’s insurance.

- Debt management: Prioritize paying off high-interest debts to reduce financial burden and free up more funds for savings and investments.

- Continuing education: Stay updated on financial trends, investment strategies, and personal finance best practices to maintain a long-term mindset and make informed decisions.

By understanding the importance of budgeting, investing wisely, and implementing additional financial strategies, you can gain control over your finances and work towards achieving financial freedom. Remember, financial success is a journey – start small, stay consistent, and celebrate milestones along the way.

Stay tuned for more insightful articles as we continue our journey through the world of finance. Don’t forget to explore our other blog categories for additional valuable content tailored to your interests and needs.