Home>Finance>Spark Spread: Definition, Uses, Calculation Formula

Finance

Spark Spread: Definition, Uses, Calculation Formula

Published: January 31, 2024

Learn about the concept of spark spread in finance, its various applications, and how to calculate it using the formula explained in this comprehensive guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding the Spark Spread: Definition, Uses, Calculation Formula

Welcome to another informative blog post from our Finance category! Today, we will be diving into the world of energy economics and exploring a concept known as the spark spread. Whether you’re a finance enthusiast or just curious about this intriguing term, we’ve got you covered. By the end of this article, you’ll have a clear understanding of what the spark spread is, how it is calculated, and its practical uses. Let’s get started!

Key Takeaways:

- The spark spread is a financial metric used in the energy industry to measure the profitability of operating a power plant.

- It is calculated by subtracting the cost of fuel from the revenue generated by selling electricity.

What is the Spark Spread?

The spark spread refers to the difference between the revenue generated from selling electricity and the cost of fuel required to produce that electricity. Essentially, it measures the profitability of a power plant’s operations. This concept is particularly relevant in the energy industry, where power generation companies need to assess the economic viability of their operations.

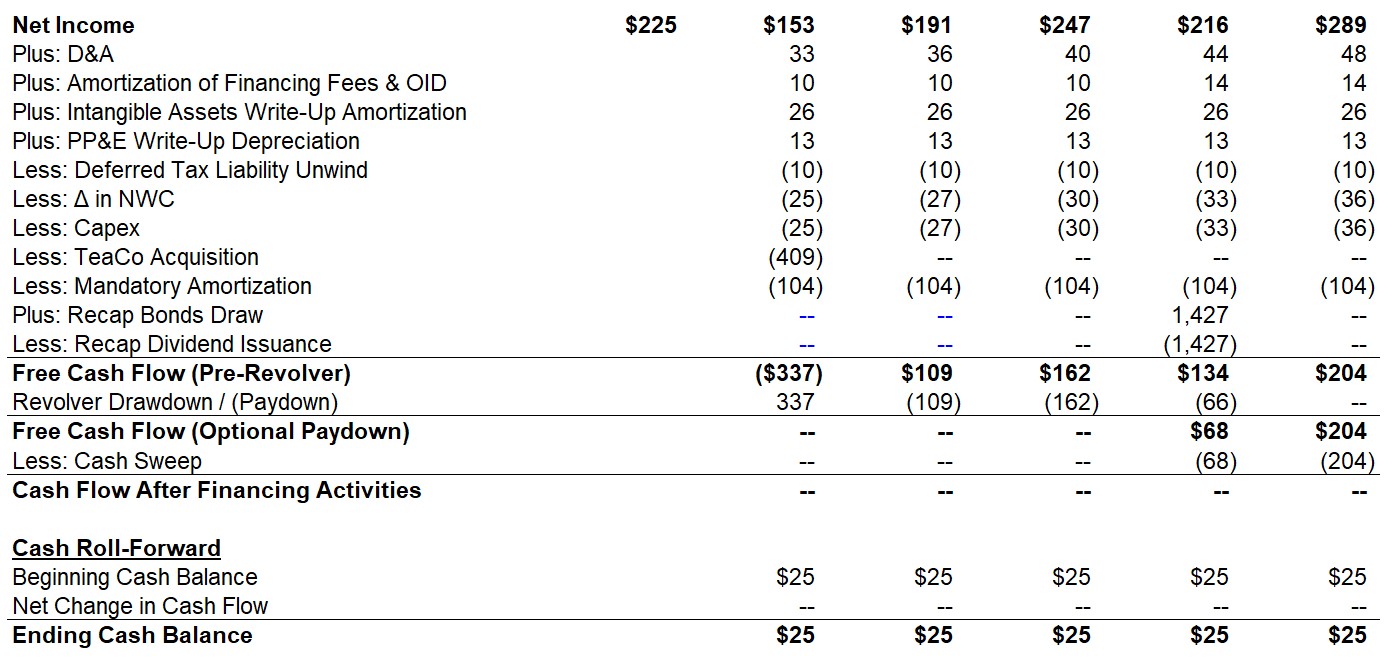

How is the Spark Spread Calculated?

Calculating the spark spread involves a straightforward formula:

Spark Spread = Revenue from Electricity Sales – Cost of Fuel

To determine the revenue from electricity sales, power generation companies look at the market price of electricity, which can vary based on supply and demand dynamics. The cost of fuel, on the other hand, includes expenses associated with the purchase and utilization of resources such as natural gas or coal.

By subtracting the cost of fuel from the revenue generated by selling electricity, companies can assess the financial feasibility of their power generation operations. A positive spark spread indicates profitability, while a negative spark spread suggests potential losses.

Uses of the Spark Spread

The spark spread provides valuable insights for both power generation companies and investors in the energy sector. Here are some common applications:

- Profitability Analysis: Power generation companies utilize the spark spread to evaluate the profitability of their existing power plants or potential investments in new facilities. By comparing the spark spread to operational costs, companies can determine if their power plants are financially viable or if adjustments are required.

- Investment Decision-making: Investors, both individual and institutional, rely on the spark spread as an indicator of the potential returns associated with investing in the energy sector. It can help them assess the profitability of power generation companies and make informed investment decisions.

The spark spread also plays a crucial role in energy market forecasting and planning. It allows policymakers and regulators to understand the economic implications of different energy sources and make informed decisions regarding resource allocation and sustainability.

In Conclusion

The spark spread is a vital financial metric in the energy industry, used to determine the profitability of power generation operations. By calculating the difference between revenue from electricity sales and the cost of fuel, companies and investors can gain valuable insights into the financial viability of power plants. Whether you’re analyzing investments or understanding the economics of energy, the spark spread is a powerful tool.

We hope this article has shed light on the definition, uses, and calculation formula of the spark spread. As always, feel free to explore more articles in our Finance category to expand your knowledge on various financial topics. Stay tuned for more insightful content in the future!