Home>Finance>Ratio Spread: Definition, Example, Profit And Loss Calculation

Finance

Ratio Spread: Definition, Example, Profit And Loss Calculation

Published: January 15, 2024

Learn about ratio spread in finance with definition, example, and profit/loss calculation. Understand how this strategy can impact your financial portfolio.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Ratio Spread: Definition, Example, Profit and Loss Calculation

Welcome to the “FINANCE” category on our page! In this blog post, we’re going to dive deep into the concept of ratio spread in options trading. Whether you’re a seasoned trader or just starting out, understanding this strategy can help you make more informed decisions in the stock market. So, let’s get started!

Key Takeaways

- A ratio spread is an options trading strategy that involves buying and selling different numbers of options contracts with the same expiration date.

- Traders use ratio spreads to benefit from potential price movements while minimizing their risk and investment.

What is a Ratio Spread?

Ratio spread is a versatile options strategy that allows traders to take advantage of price volatility while limiting risks. It involves buying and selling options contracts with different quantities but the same expiration date. These contracts usually have the same underlying asset but different strike prices.

This strategy is sometimes also referred to as a vertical spread, and it offers traders multiple ways to profit by leveraging the movement of the underlying asset.

Example of a Ratio Spread

Let’s illustrate the concept with an example. Say you believe that XYZ stock will experience a moderate price increase in the near future. To take advantage of this expected movement, you decide to set up a ratio spread as follows:

- Buy 1 XYZ call option expiring in one month with a strike price of $50.

- Sell 2 XYZ call options expiring in one month with a strike price of $55.

In this scenario, you can profit in two ways:

- If the stock price goes up modestly and stays below the $55 strike price, the sold options will expire worthless, and you’ll keep the premium you received from selling them.

- If the stock price increases significantly and exceeds the $55 strike price, the bought option will start gaining value, and you’ll realize a profit since you control the right to buy the stock at a lower price.

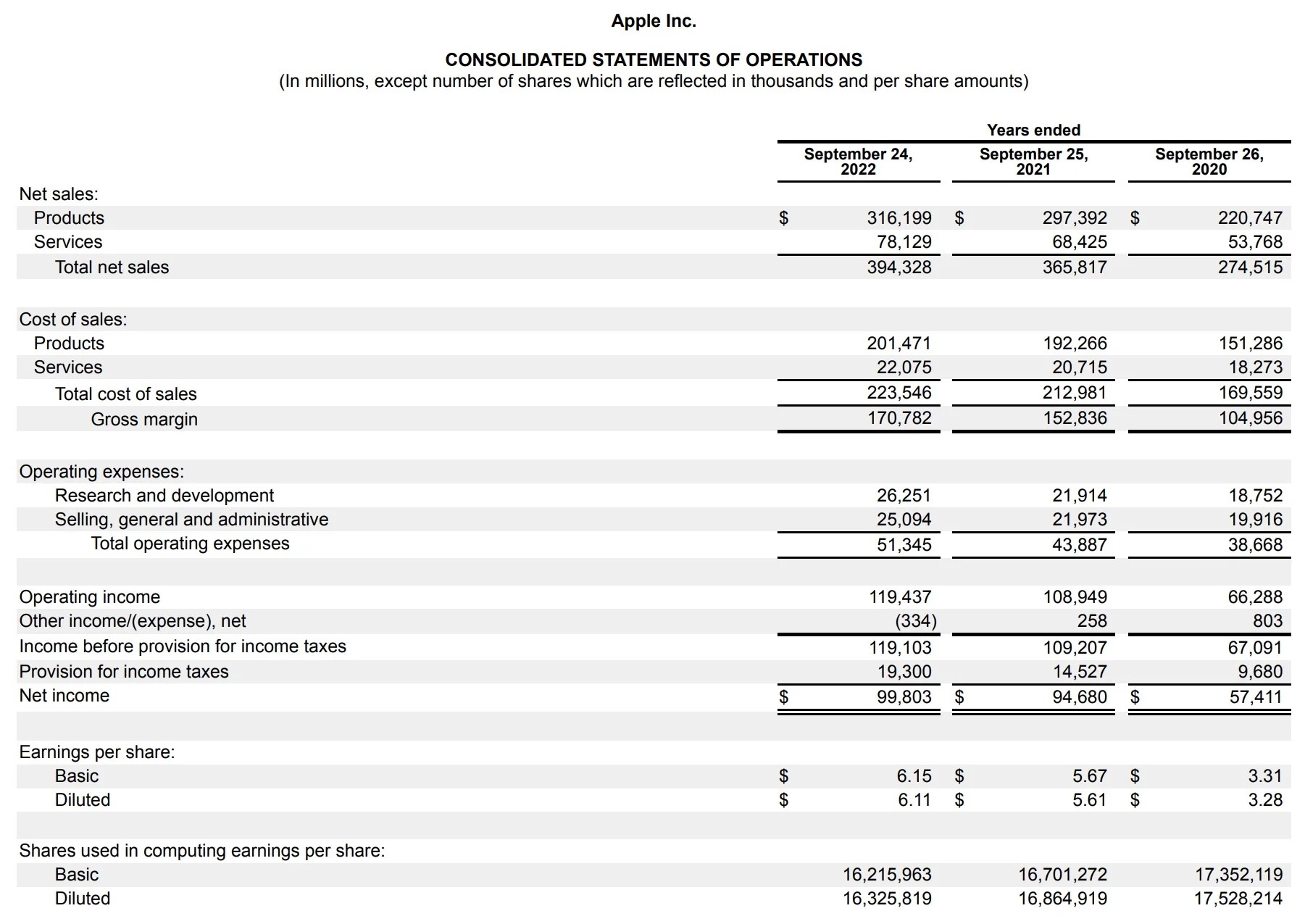

Profit and Loss Calculation

Calculating the potential profit or loss in a ratio spread can be a bit complex due to the combination of bought and sold options. However, it’s crucial to have a clear understanding of the potential outcomes before initiating such a strategy.

The best way to calculate the potential profit or loss is by using an options pricing model or a specialized options trading platform that provides advanced analytics. These tools can help you analyze various scenarios and estimate your potential return based on different stock price levels, expiration dates, and option strike prices.

In Conclusion

The ratio spread is an advanced options trading strategy that offers traders a way to benefit from price movements while managing their risk. By buying and selling options with different quantities and strike prices, traders can optimize their potential return in different market scenarios.

Remember, it’s essential to conduct thorough research, consult with a financial advisor or an experienced options trader, and utilize advanced tools before implementing any complex trading strategy.

Do you have any experience with ratio spread? Let us know in the comments!